Get the free Billing Statement - Monthly

Get, Create, Make and Sign billing statement - monthly

Editing billing statement - monthly online

Uncompromising security for your PDF editing and eSignature needs

How to fill out billing statement - monthly

How to fill out billing statement - monthly

Who needs billing statement - monthly?

Billing statement - monthly form: A comprehensive guide

Understanding billing statements

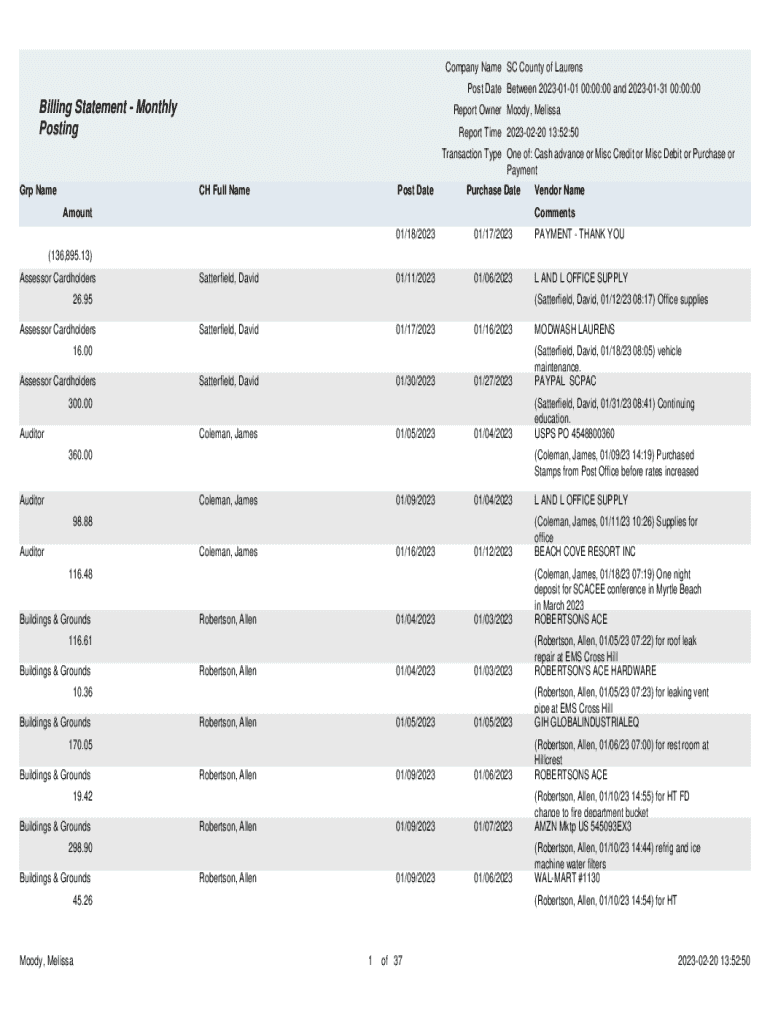

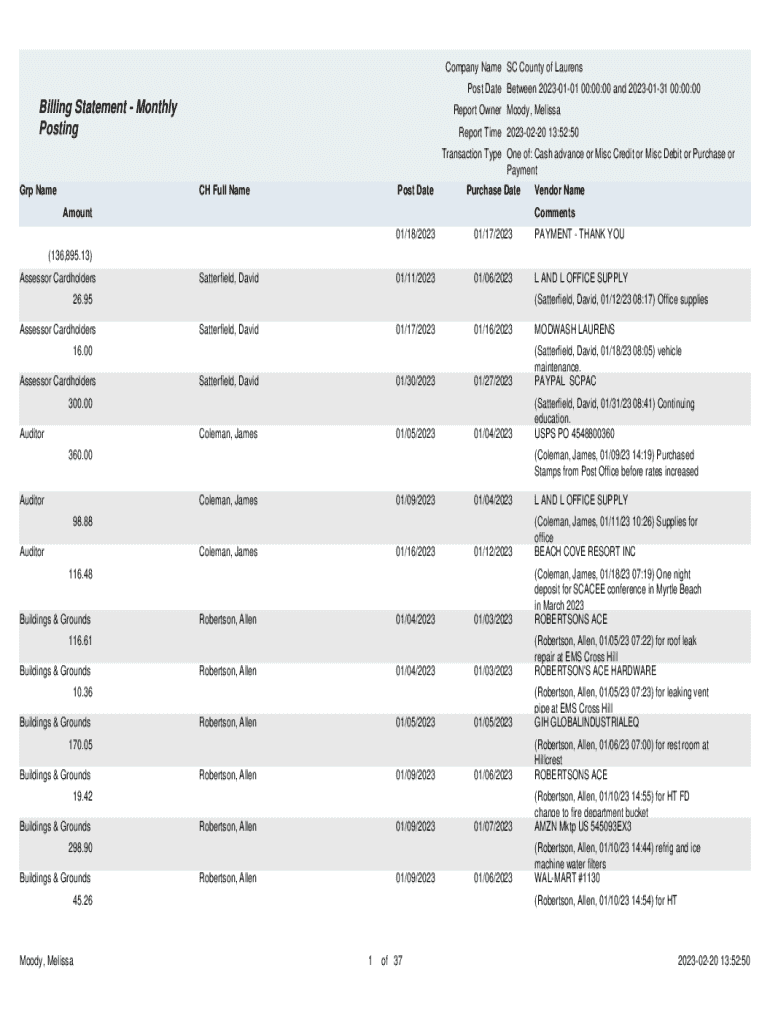

A billing statement is a crucial document that consolidates all financial transactions over a specific period, usually a month. It serves as a detailed account of charges incurred and payments made, allowing both individuals and businesses to track financial activities effectively. The significance of billing statements extends beyond simple record-keeping; they foster transparency between service providers and clients, offer clarity in financial obligations, and facilitate more structured financial planning.

For individuals, billing statements help in managing budgets and ensuring that payments are made timely. For businesses, they provide essential insights for cash flow management and can be utilized for billing clients or tracking service usage. In essence, a billing statement acts as both a timeline of financial activity and a tool for strategic monetary management.

Key components of a monthly billing statement

The importance of monthly billing statements

Managing monthly billing statements might seem like a mundane task, yet it holds tremendous importance. Tracking these statements allows individuals to identify spending patterns and develop effective budgeting practices. For businesses, maintaining clear billing statements enhances accountability and improves relationships with clients by being transparent about their financial history. They also serve as a critical point of reference for resolving any disputes that might arise regarding the charges or payments.

Using monthly billing statements is not confined just to personal finances or business invoices. They also play a significant role in loan agreements, where borrowers can track payments and remaining balances effectively. The structured nature of these statements ensures that all parties involved have a standardized reference point for transactions, enhancing communication and clarity.

Common scenarios for using a monthly billing statement

How does a monthly billing statement work?

A monthly billing statement operates within a defined billing cycle, usually spanning 30 days, although variations can occur depending on the business or financial institution. Each billing cycle accumulates all applicable transactions, including recurring payments and fees, culminating in a total balance due at the end of the cycle. This cycle not only tracks financial activity but also signals to account holders when their payments are expected, fostering timely responses.

Billing statements differ significantly from invoices, which are typically single requests for payment. While invoices may lack comprehensive transaction histories, billing statements provide a more complete picture of account activity. Recognizing when to utilize each document type can streamline financial communications, making processes smoother and more efficient.

Creating a monthly billing statement

Generating an effective billing statement requires careful attention to detail. Below is a step-by-step guide to create your own monthly billing statement.

Customizing your billing statement

Creating a billing statement tailored to your needs is not only practical but also enhances professionalism. Various templates and formats are available—ranging from static PDF versions to editable formats that allow for customization. Users can easily modify elements such as logos, colors, and even font styles to align with their branding or personal preference.

Using interactive tools can enhance your billing experience. For instance, electronic signatures eliminate the hassles of physical copies, while real-time collaboration features allow multiple stakeholders to review and approve documents efficiently. Options for tracking payment histories and receiving notifications further empower users to manage their billing statements effectively.

Tips for managing monthly billing statements

Implementing proactive strategies can vastly improve the management of monthly billing statements. Setting reminders for payment due dates ensures that accounts remain in good standing, while regularly reviewing billing statements for errors can prevent costly mistakes. Taking these steps allows individuals and businesses to stay ahead of their financial obligations and foster responsible financial behavior.

Technological solutions can provide added convenience. Utilizing cloud-based platforms like pdfFiller not only offers users easy access but also allows for effortless editing and collaboration on documents. Such features enhance efficiency and help maintain accurate records without the chaos of disorganized paperwork.

Frequently asked questions (FAQs)

Addressing common queries can demystify the handling of monthly billing statements for new users. For instance, if an error is detected in a billing statement, account holders should immediately contact the issuing entity to resolve the discrepancy. Disputing a charge requires clear documentation and prompt communication with the service provider.

Moreover, billing statements may or may not be required for tax filings depending on individual circumstances and tax regulations. New users can benefit from understanding best practices for using billing statements, such as maintaining an organized filing system and ensuring that all relevant documents are easily accessible for future reference.

Related documents and templates

In addition to monthly billing statements, several related documents and templates can assist in managing finances. Looking for additional resources? Templates for invoices, payment agreements, and financial summaries are easily accessible on platforms like pdfFiller.

These documents often share similar components with billing statements, creating a cohesive system for tracking financial obligations, whether personal or professional. By linking relevant tools, users can ensure that their financial management strategies are both comprehensive and efficient.

Leveraging pdfFiller for your billing needs

pdfFiller simplifies the process of managing billing statements, offering numerous benefits through its cloud-based platform. Users can seamlessly edit PDFs, eSign documents, and collaborate in real-time, making financial documentation much more accessible and manageable.

Specific features on pdfFiller enhance the user experience significantly, from intuitive templates for billing statements to tools for tracking changes. Such functionality ensures users can create accurate, polished documents that accurately reflect their financial histories.

Conclusion

Understanding and effectively utilizing monthly billing statements is key to building financial awareness, whether for personal use or within a business context. These statements not only document transactions but also empower individuals and teams to take control of their financial health. By leveraging available tools such as pdfFiller, users can streamline their documentation processes, ensuring clarity and accuracy in managing their finances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit billing statement - monthly online?

Can I create an electronic signature for the billing statement - monthly in Chrome?

How do I edit billing statement - monthly on an iOS device?

What is billing statement - monthly?

Who is required to file billing statement - monthly?

How to fill out billing statement - monthly?

What is the purpose of billing statement - monthly?

What information must be reported on billing statement - monthly?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.