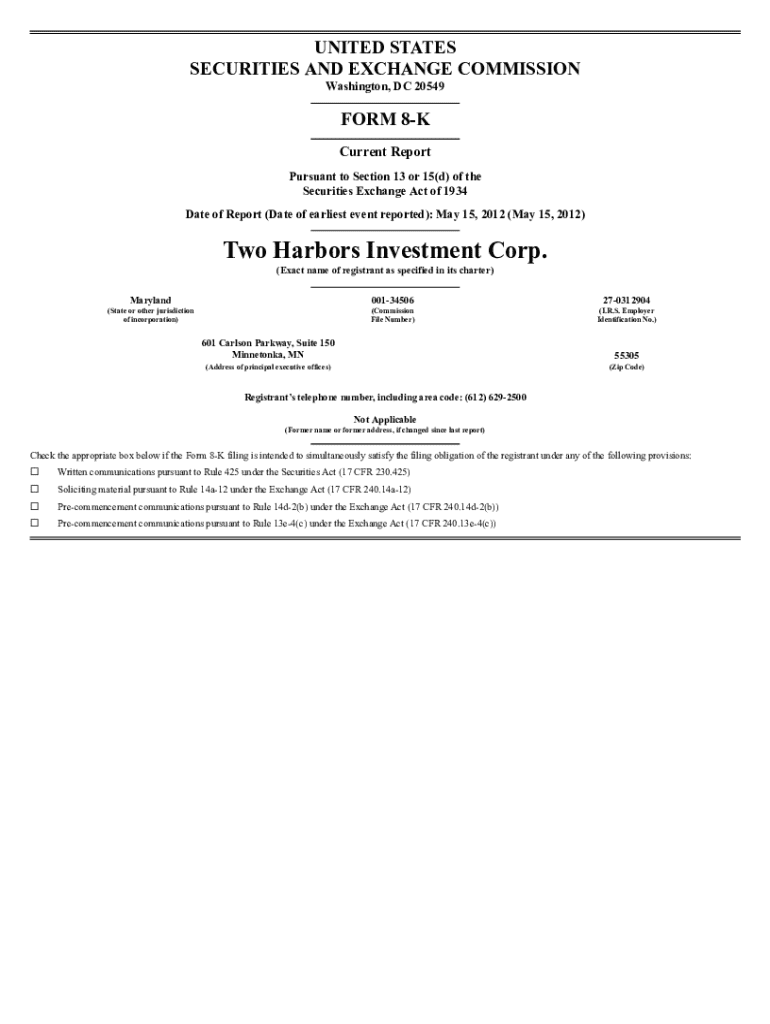

Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Form 8-K: Comprehensive Guide to Understanding and Managing Your Filing

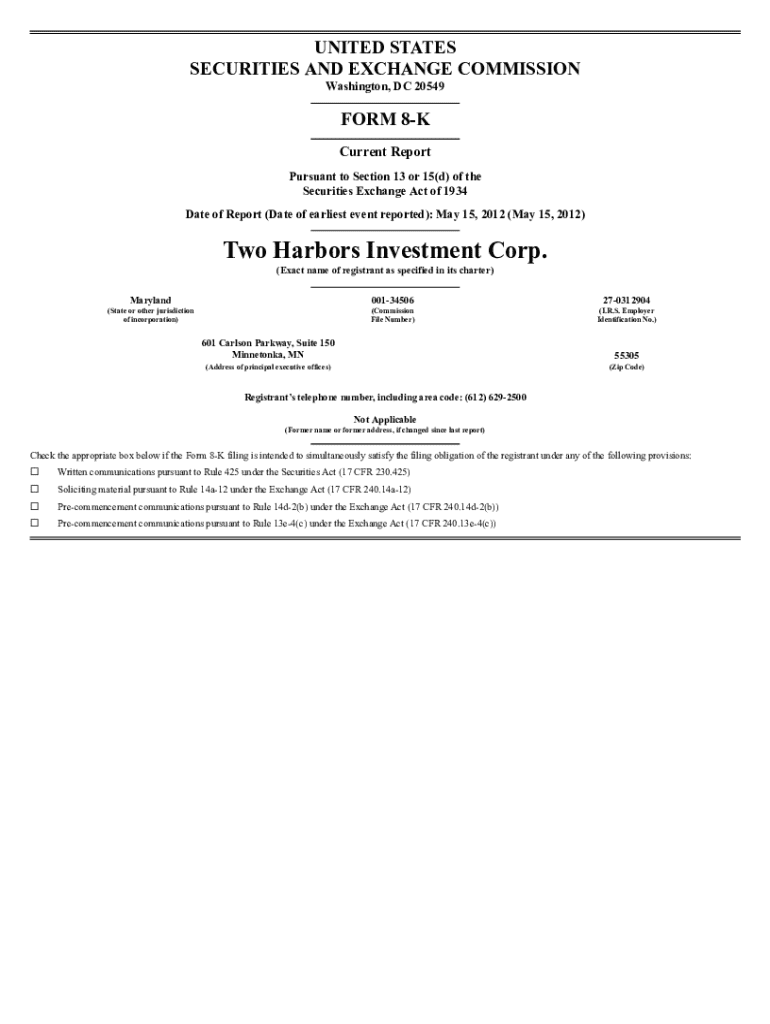

Overview of Form 8-K

Form 8-K is a critical document mandated by the U.S. Securities and Exchange Commission (SEC) that allows publicly traded companies to report significant events that may affect their shareholders' interests. Commonly referred to as the 'current report,' this form ensures that investors are kept informed about developments that could influence the company's financial standing or stock price.

The purpose of Form 8-K is to enhance transparency between companies and the investing public, promoting informed decision-making and maintaining investor trust. Key stakeholders involved in Form 8-K filings include company executives, legal counsel, and regulatory professionals who understand complex disclosure requirements.

When is Form 8-K required?

Certain events necessitate the filing of a Form 8-K, particularly those that can significantly impact a company's financial health or operational status. These include, but are not limited to, mergers and acquisitions, changes in executive leadership, bankruptcy, or substantial asset sales. Unlike other forms like the 10-K or 10-Q, which provide periodic summaries of financial performance, Form 8-K is filed in real-time when a material event occurs.

Timeliness is critical for Form 8-K filings; companies are required to submit the form within four business days following the triggering event. This swift reporting ensures that investors receive up-to-date information and can react accordingly. Notably, timing discrepancies can lead to regulatory scrutiny and negatively impact the company’s reputation.

Structure of Form 8-K

The structure of Form 8-K is designed to organize critical information logically and concisely. The form begins with header information, including the company name, SEC file number, and the date of the report. This is followed by itemized disclosures that detail the specific events being reported.

Key sections include standard items such as 'Item 1.01: Entry into a Material Definitive Agreement' and 'Item 5.02: Departure of Directors or Certain Officers.' Some items require detailed reporting, and companies often attach exhibits, such as contracts or official statements, to clarify the significance of the reported events.

Reading and interpreting Form 8-K

Interpreting a Form 8-K effectively begins with familiarizing oneself with its structure. Readers should focus on the itemized sections to identify the critical information pertinent to their interests. Start by looking for disclosures that may indicate financial implications, such as company acquisitions or shifts in leadership, which can signal potential impacts on stock value.

For those who may not have a financial background, simplifying the jargon is essential. Utilizing plain language or summarizing complex terms can demystify the information. For example, a 'definitive agreement' denotes a formal contract, and understanding these terms can help interpret the consequence of events reported on the form.

Items of interest in Form 8-K

Several items frequently appear in Form 8-K filings, and recognizing these can aid in understanding a company's dynamics. 'Item 1.01: Entry into a Material Definitive Agreement' marks essential contractual commitments that could alter the business trajectory. 'Item 5.02: Departure of Directors or Certain Officers' highlights changes in leadership that may impact strategic direction.

Another item worth noting is 'Item 8.01: Other Events,' which serves as a catch-all for material developments that do not fit into other specific categories. Historical trends often reveal recurring themes in Form 8-K filings, such as reactionary measures to regulatory changes or shifts in company strategy.

Best practices for companies filing Form 8-K

To ensure compliance and accuracy when filing Form 8-K, companies should implement robust internal controls. This may include designating a compliance officer to track significant events and coordinating with legal counsel to ensure all required disclosures are made accurately and timely.

In addition, maintaining comprehensive records and documentation strategies is vital. Companies should document all decisions leading up to the filing and keep copies of all correspondences or agreements related to the reported events. This practice not only supports transparent reporting but also safeguards against potential legal challenges.

Benefits of using pdfFiller for Form 8-K management

pdfFiller provides an efficient solution for managing Form 8-K filings, streamlining the document creation process. Through pdfFiller, companies can quickly edit and finalize forms without cumbersome software, facilitating rapid and accurate submissions.

With integrated eSignature capabilities, pdfFiller allows for quick approvals from necessary stakeholders, reducing delays in filing. Moreover, collaboration tools enable internal teams and legal advisors to work together seamlessly, ensuring all details are in order before submission.

Keeping current with Form 8-K updates

Companies must stay informed about regulatory changes that affect Form 8-K reporting. This vigilance includes keeping track of SEC announcements and any new compliance requirements that may arise. Subscribing to regulatory news feeds can ensure that companies do not miss important updates.

Using pdfFiller can aid in ongoing management of filings, as the platform helps maintain a repository of updated documents that can be accessed at any time. This ease of access is particularly useful as changes occur, allowing for rapid response to any new requirements.

Frequently asked questions about Form 8-K

Many common queries arise surrounding the Form 8-K filing process. For instance, companies often wonder what constitutes a 'material event' that necessitates filing. The answer typically hinges on whether the event could influence an investor’s decisions regarding the stock or financial position.

Additionally, there are misconceptions about the timeframe for filing Form 8-K. Some believe they can delay reporting until quarterly disclosures, but this is erroneous; timely reporting within the specified four days is mandatory. Resources are abundantly available for further assistance, including SEC guidelines and industry-specific legal counsel.

Related documentation and templates

Understanding related documentation can further assist in the successful management of Form 8-K filings. Other forms that may relate include 10-Q, 10-K, and Form S-1, which collectively offer a broader picture of a company’s financial health and reporting obligations. Having ready access to these documents can streamline the filing process.

Additionally, utilizing sample Form 8-K templates can be invaluable for new and existing companies. These templates serve as blueprints for future filings and can be customized to fit the specific scenarios a company might encounter.

Insightful resources and tools

For those seeking an enriched understanding of SEC regulations and Form 8-K, numerous educational articles and resources are available online. These resources often include detailed breakdowns of compliance requirements and best practices.

Moreover, interactive tools for live documentation management can help streamline the filing process. Joining community forums focused on financial reporting can also facilitate discussions with peers, providing additional insights and support.

Share and download options

Once completed, sharing your Form 8-K with stakeholders is straightforward through pdfFiller. The platform allows users to easily send documents directly from the interface, ensuring that all relevant parties are promptly informed.

Additionally, pdfFiller provides various downloading options for distributing the document in preferred formats, whether for archive purposes, meetings, or regulatory review. This versatility ensures you have suitable formats available for any situation.

Explore more solutions

Beyond Form 8-K management, pdfFiller offers a robust suite of capabilities aimed at enhancing document workflows. Whether it is merging documents, creating secure forms or managing compliance across multiple documents, pdfFiller positions itself as an all-in-one solution.

Integrating pdfFiller with other document management and compliance solutions enables seamless operations and enhances efficiency. Companies looking to optimize their reporting processes will find substantial value in leveraging pdfFiller’s comprehensive features.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 8-k directly from Gmail?

How do I fill out the form 8-k form on my smartphone?

Can I edit form 8-k on an iOS device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.