Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

A Comprehensive Guide to Form 8-K

Understanding Form 8-K

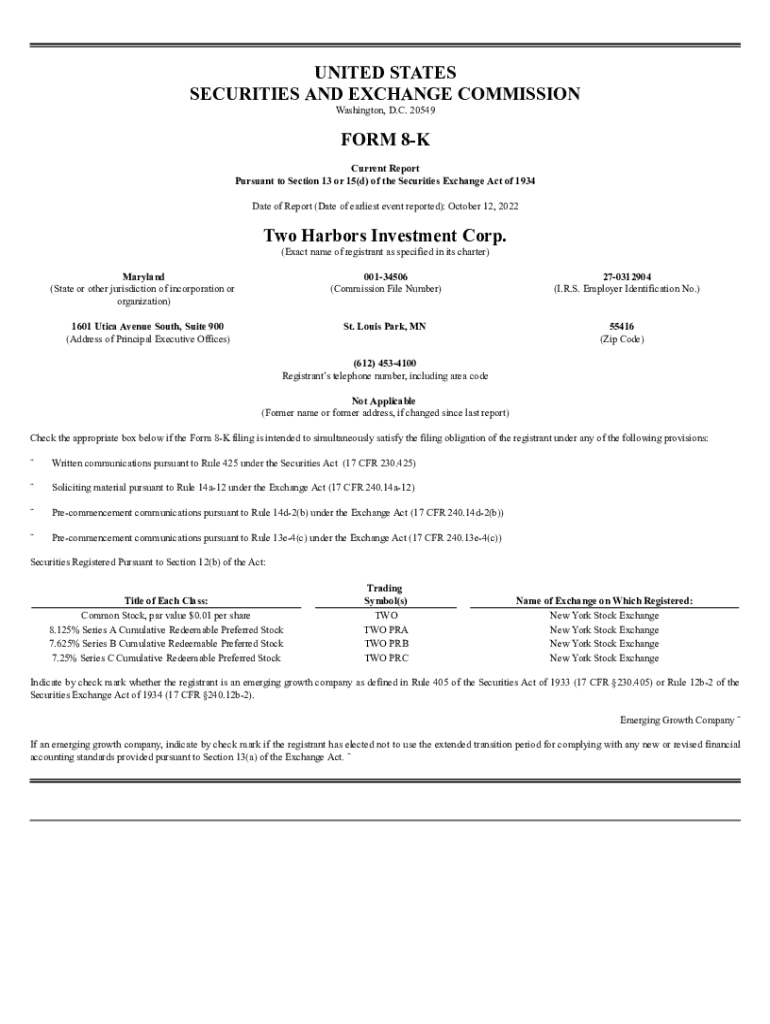

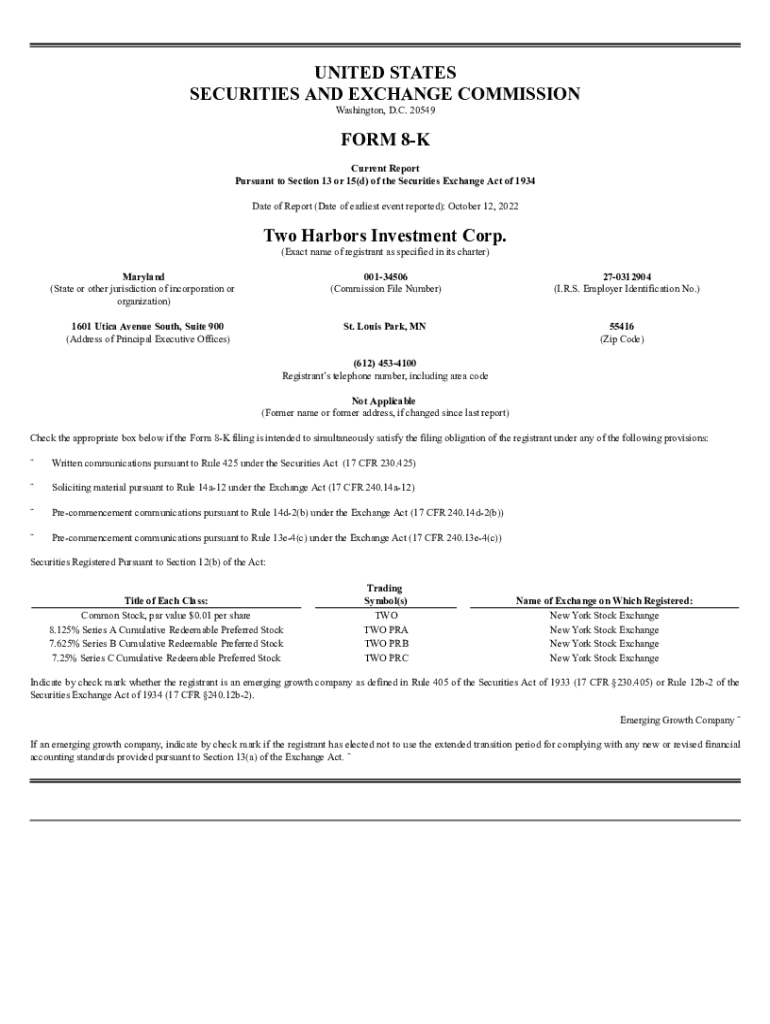

Form 8-K serves as a crucial document for publicly traded companies, functioning as a current report that captures significant events affecting the company. Unlike annual reports such as Form 10-K or quarterly reports like Form 10-Q, which provide regular updates on a company's financial condition, Form 8-K is utilized for immediate reporting of essential occurrences. Its significance lies in ensuring that investors and the public are promptly informed of events that may influence their decisions regarding the company's stock.

The purpose of Form 8-K extends beyond mere compliance; it's about transparency and maintaining trust in the marketplace. Companies are legally obligated to file Form 8-K when substantial developments occur, thereby safeguarding the interests of their investors. This requirement enhances the overall credibility of the business and contributes to a fairer, more transparent financial environment.

When is Form 8-K required?

Several events trigger the requirement to file Form 8-K. These include changes in company control, departure of executive officers, significant acquisitions, and amendments to the company's bylaws. Each of these scenarios carries implications that could affect stakeholder decisions, making timely reporting imperative.

Timeliness is critical when it comes to filing Form 8-K. Companies have a four-business-day window to submit the form from the date of the event. Failure to comply can lead to penalties, including fines and reputational damage. Therefore, companies should have streamlined processes in place to ensure that these filings are made on time.

Detailed breakdown of Form 8-K structure

Understanding the structure of Form 8-K is vital for both companies filing the report and investors reviewing it. The form consists of a cover page that provides basic information about the company, including its name, address, and SEC file number. Following that, the form specifies the item number related to the event being reported, along with a detailed description of the event.

Form 8-K encompasses various items (from 1.01 to 9.03) that cover different events. Common items relevant for reporting include Item 1.01 (Entry into a Material Definitive Agreement), Item 5.02 (Departure of Directors or Certain Officers), and Item 8.01 (Other Events). Each item aims to provide clarity about material changes affecting the company's business operations and financial health.

Reading and interpreting Form 8-K

Navigating Form 8-K documents can seem daunting due to their technical language and format. Investors looking to understand the implications of a filing should focus on key dates and descriptors that highlight the nature of the event. The summary at the top often provides a succinct overview, while more detailed sections elaborate on the implications.

When analyzing the key information, it's essential to spot critical dates, such as the occurrence of the event and the filing date. Additionally, look for any statements regarding potential impacts on financial performance or operations. Parsing through this information can yield valuable insights that are pivotal for making informed investment decisions.

Historical context and trends

Historically, the use of Form 8-K has evolved significantly, particularly in response to regulatory changes and shifts in corporate governance practices. Notable examples include filings related to major scandals or emergent technological transitions, which have often impacted stock markets drastically. For instance, high-profile resignations like that of former CEOs or financial restatements have led to immediate investor reactions, showcasing the power of timely disclosures.

Over the years, the paradigm of Form 8-K reporting has seen changes with increased regulatory scrutiny aimed at enhancing transparency. Companies now tend to file more frequently, adapting their communication strategies to ensure they meet stakeholder expectations and legal requirements. This trend emphasizes the importance of maintaining a proactive approach to investor relations.

Benefits of utilizing Form 8-K

For investors, Form 8-K serves as a vital source of information, offering timely updates that could directly impact their investment decisions. By staying informed about significant events affecting a company they have invested in, investors can make better-informed choices, which can lead to improved portfolio management. Regular updates help mitigate risk and foster confidence among investors.

For companies, the advantages are equally compelling. Regularly filing Form 8-K demonstrates a commitment to transparency, fostering trust with investors. This transparency can help build long-term shareholder relationships and improve overall company reputation. Furthermore, proactive communication can mitigate potential backlash during adverse events.

Best practices for filing Form 8-K

Filing Form 8-K requires meticulous preparation to ensure compliance and accuracy. Companies should begin by gathering all necessary documentation, including details about the event and any relevant communications that need to accompany the filing. To streamline the process, it’s advisable to establish clear internal protocols for prompt reporting in response to significant events.

Having a dedicated team responsible for monitoring events and ensuring compliance with Form 8-K requirements can significantly enhance the efficiency of filings. Regularly assessing internal processes will help maintain compliance standards and improve reporting accuracy.

Frequently asked questions about Form 8-K

Many misconceptions surround Form 8-K, particularly regarding what needs to be disclosed. Companies need not report every minor event; only significant occurrences deemed material to investors are required. For example, routine operational changes or minor management shifts do not necessitate a Form 8-K filing.

Understanding the submission and review process is vital for companies looking to navigate regulatory oversight effectively. Familiarity with SEC guidelines will help firms avoid pitfalls related to incomplete submissions.

Related forms and their use

Understanding Form 8-K is further enriched by its comparative relationship with other SEC filings, such as Form 10-K and Form 10-Q. While Form 10-K is an annual comprehensive report discussing the company’s performance over the previous year and Form 10-Q provides quarterly updates, Form 8-K is essential for immediate and current reporting of material events.

When to utilize each form largely depends on the nature and timing of the information being reported. For immediate disclosures, Form 8-K should be utilized, while Form 10-Q and 10-K are suited for scheduled reporting.

Keeping up-to-date with Form 8-K regulations

Staying informed about the latest updates and changes to Form 8-K regulations is vital for companies and investors alike. Regulatory bodies frequently revise rules to enhance transparency and accountability. Recent updates might include alterations to the categories of events requiring reporting or specific compliance requirements. Companies should pay careful attention to these changes to ensure their disclosures remain compliant.

Engaging with resources such as the SEC website, educational institutions, and financial news outlets can provide valuable insights into evolving regulations and best practices.

Community insights and experiences

Real-life accounts of Form 8-K filings provide rich illustrations of its practical significance. Various companies have effectively communicated critical events through Form 8-K, ensuring that stakeholders are informed promptly. For instance, following the abrupt departure of a high-ranking executive, a prudent company's 8-K filing not only outlined the events but also provided insights into succession plans and reassurances to investors.

Feedback from stakeholders often mirrors the quality of communication surrounding these filings. When companies are transparent and timely in their 8-K disclosures, investors express greater confidence and appreciation, viewing the company as diligent and considerate of their interests.

Interactive tools and resources

pdfFiller provides invaluable resources for individuals and teams navigating the complexities of form management. With our fillable template for Form 8-K, users can simplify the reporting process by utilizing an interactive platform to draft, edit, and file the document seamlessly.

These features not only streamline the filing process but also enhance overall productivity for companies managing numerous SEC forms, solidifying pdfFiller’s position as a go-to solution for document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 8-k online?

How do I fill out form 8-k using my mobile device?

How do I complete form 8-k on an Android device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.