Get the free 2016 Foreign Profit Corporation Annual Report

Get, Create, Make and Sign 2016 foreign profit corporation

How to edit 2016 foreign profit corporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2016 foreign profit corporation

How to fill out 2016 foreign profit corporation

Who needs 2016 foreign profit corporation?

2016 Foreign Profit Corporation Form How-to Guide

Overview of the 2016 foreign profit corporation form

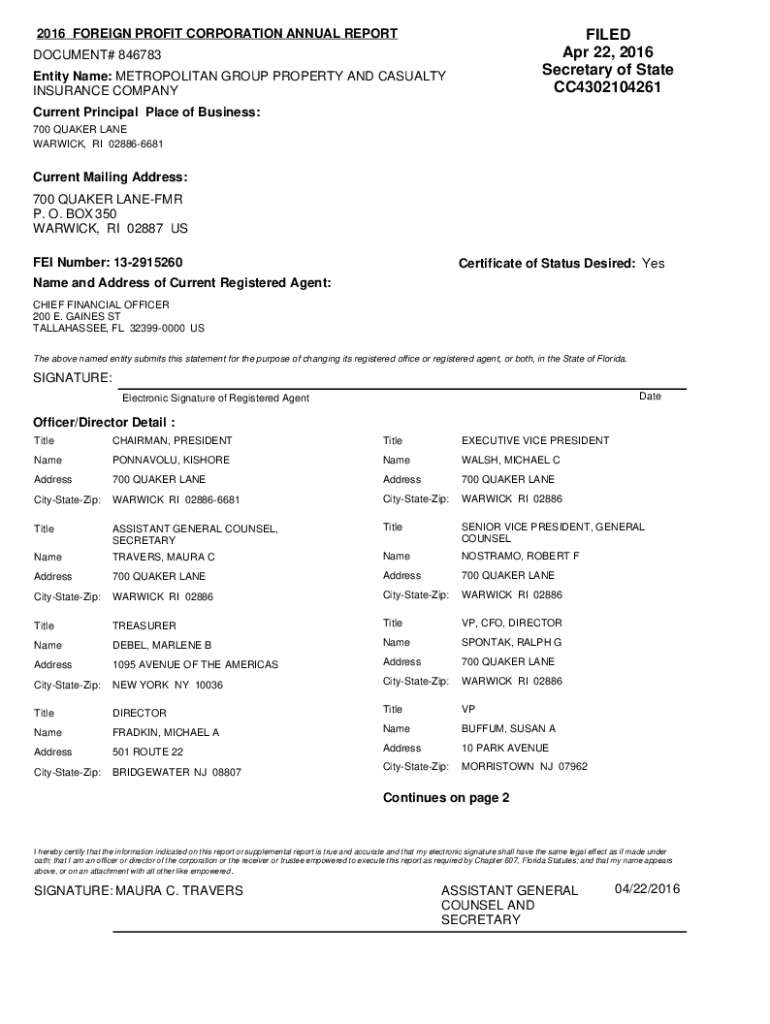

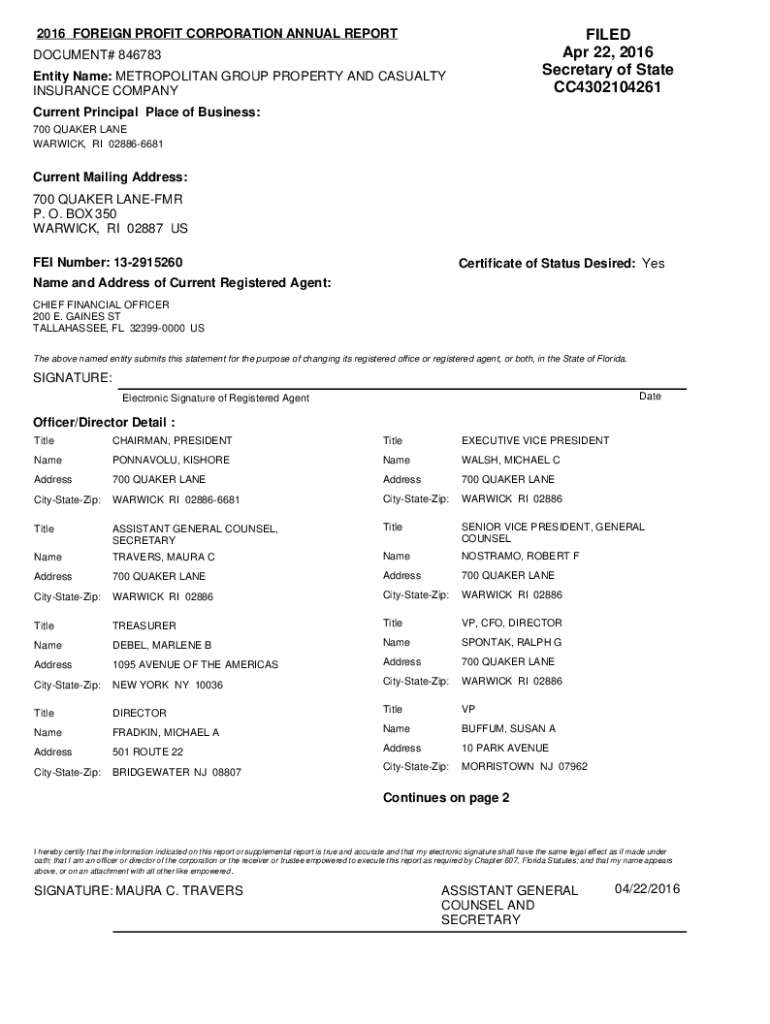

The 2016 Foreign Profit Corporation Form serves as a critical document for corporations that operate in jurisdictions outside their state of incorporation. This form officially registers a foreign corporation to conduct business within a new state, aligning with local laws and regulations. Its purpose is not only to notify state authorities of the corporation's presence but also to ensure compliance with tax obligations and legal requirements in the new jurisdiction.

For companies aiming to expand their operations nationally or those reconfiguring their business strategy, understanding and accurately completing the 2016 foreign profit corporation form is essential. Filing this form signifies legitimacy and fosters trust among customers, investors, and partners.

Who needs to file the 2016 foreign profit corporation form?

Foreign profit corporations, defined as corporations incorporated outside the state in which they wish to conduct business, are the primary candidates for filing the 2016 foreign profit corporation form. This includes both domestic and foreign companies seeking to expand their operations or increase market reach.

Scenarios warranting this filing include a California-based technology company looking to open a sales office in Texas or a Canadian manufacturing firm entering the U.S. market. Without proper registration through this form, these businesses risk legal and financial penalties.

Eligibility requirements

To file the 2016 foreign profit corporation form, businesses must meet specific eligibility criteria. Primarily, the corporation must be validly incorporated in its original state and have the necessary legal standing to conduct business in its home jurisdiction. Additionally, the business must operate for profit, distinguishing it from non-profit organizations.

Types of businesses that typically qualify as foreign profit corporations include traditional corporations, limited liability companies (LLCs) electing to be taxed as corporations, and joint-stock companies, among others. It's essential that these entities prepare to provide documentation proving their incorporation and compliance within their home state.

Key components of the 2016 foreign profit corporation form

Filling out the 2016 foreign profit corporation form involves multiple sections that collect critical business information necessary for state compliance. Here’s a detailed breakdown of its components:

Step-by-step filing instructions

Filing the 2016 foreign profit corporation form can be a straightforward process if you follow these outlined steps carefully:

A. Preparing your form

Before filing, collect all necessary documents and information, including your corporation's articles of incorporation, bylaws, and details about your registered agent. Ensure accurate data entry into the form to avoid errors.

Double-check that all entries, particularly those related to addresses and shareholder information, are correct to facilitate smooth processing.

B. Filing options

. Tracking your submission

To confirm receipt and check the status of your filing, maintain copies of all submitted documents and related correspondence. Most states provide online tracking systems for easy monitoring.

Common mistakes to avoid in form filing

Error prevention is crucial when completing the 2016 foreign profit corporation form. Common mistakes include incorrect business names, typos in owner details, and failing to designate a registered agent. Each of these errors can lead to significant delays or rejections of your application.

Avoid these pitfalls by conducting a thorough review of your form before submission. It’s advisable to have a second person verify details, ensuring all information aligns with your business’s official records.

Fees and payment information

Filing the 2016 foreign profit corporation form involves associated fees that vary by state. Typically, these fees range from $100 to $500, plus any additional costs related to registered agent services or expedited processing.

Most states accept payments made via credit card, checks, or electronic funds, depending on your filing method. Be sure to check the exact payment process when you file.

Amendments and updates

Understanding when and how to amend the 2016 foreign profit corporation form is key for maintaining compliance. Amending your filing may be necessary due to changes in ownership, business address, or corporate structure.

To file an amendment, complete the designated amendment form and submit it along with any required fees. Each state has specific guidelines, so be sure to follow the procedures outlined by the appropriate state department.

Annual reporting requirements for foreign profit corporations

Once your corporation is registered and operational, it’s critical to understand your ongoing obligations. Many states require foreign profit corporations to submit annual reports detailing business activities, financial information, and any changes in ownership or structure.

Failing to meet annual reporting deadlines can result in penalties or even the dissolution of your corporation, making it essential to remain diligent in maintaining these records and submissions.

Resources and tools for managing corporate documents

pdfFiller offers a suite of tools that support businesses in managing forms like the 2016 foreign profit corporation form efficiently. Users can edit, sign, and collaborate on documents directly within the platform, streamlining the form-filing process and minimizing errors.

Additionally, pdfFiller provides robust storage solutions for your corporate documents, allowing easy access and retrieval of all essential files related to your business filings.

Frequently asked questions (FAQs)

A common inquiry regarding the 2016 foreign profit corporation form is about timelines for processing. Typically, filings are processed within a few weeks, but this can vary by state. It's advisable to file as early as possible to avoid disruptions in business operations.

Another frequent question concerns the necessity of legal counsel. While not mandatory, consulting with an attorney can ensure that your filing is comprehensive and compliant, reducing the risk of future complications.

Related forms and filings for business entities

Several related forms may also be relevant to foreign entities. These can include forms for business licenses, tax registrations, and additional filings based on specific state requirements. Understanding the breadth of necessary documents helps in maintaining compliance across multiple jurisdictions.

For ease of access, pdfFiller has templates available for these forms, ensuring businesses can navigate their obligations without unnecessary stress.

Contact information for assistance

If questions or issues arise while filling out the 2016 foreign profit corporation form, reaching out to the relevant state department can provide valuable guidance. Typically, each state has a designated business services division for this purpose, with contact information available on state government websites.

Ensure to take note of operational hours of these departments to facilitate prompt responses to your inquiries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2016 foreign profit corporation in Gmail?

How do I complete 2016 foreign profit corporation online?

How do I edit 2016 foreign profit corporation in Chrome?

What is 2016 foreign profit corporation?

Who is required to file 2016 foreign profit corporation?

How to fill out 2016 foreign profit corporation?

What is the purpose of 2016 foreign profit corporation?

What information must be reported on 2016 foreign profit corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.