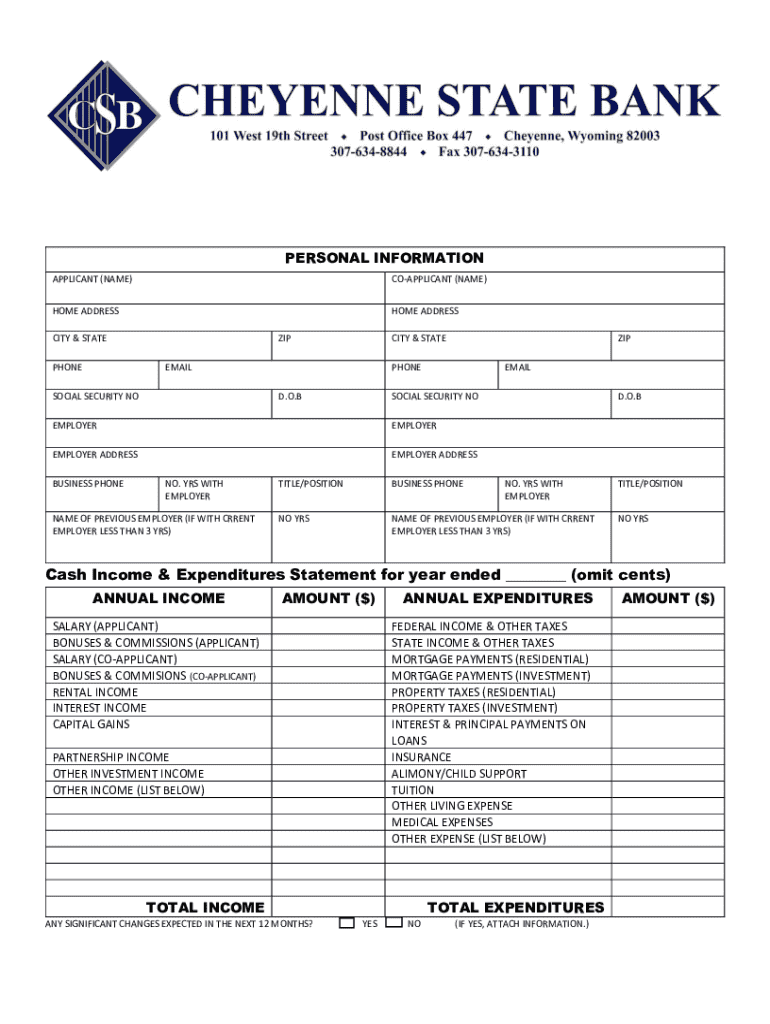

Get the free Cash Income & Expenditures Statement for year ended

Get, Create, Make and Sign cash income amp expenditures

How to edit cash income amp expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash income amp expenditures

How to fill out cash income amp expenditures

Who needs cash income amp expenditures?

Comprehensive Guide to Cash Income and Expenditures Form

Understanding the cash income and expenditures form

The cash income and expenditures form serves as an essential financial tool, allowing individuals and teams to effectively track their financial inflows and outflows. This form is necessary for understanding personal finance, enabling users to gain insights into their financial health.

Accurate documentation is crucial in managing finances. It not only provides a snapshot of one’s current financial situation but also serves as a foundation for future financial planning and decision-making. Keeping thorough records can help avoid unnecessary debt and can assist in maximizing savings.

Components of the cash income and expenditures form

The form consists of two primary sections: income and expenditures. Understanding what to include in each section is essential for accurate financial management.

Income section

The income section is vital as it encompasses all sources of cash inflow. This includes salary and wages, freelance work, and passive income sources like dividends or rental income.

Accurate documentation of income can often be contingent on the type of work one does. It’s imperative to keep all pay stubs, bank statements, and records of earnings organized. For those with variable incomes, developing an estimation strategy is essential.

Expenditures section

In the expenditures section, categorizing expenses accurately is crucial. This typically breaks down into fixed and variable expenses, as well as essential and discretionary spending. Common categories to consider include:

How to fill out the cash income and expenditures form

Filling out the cash income and expenditures form is a structured process that requires organization and attention to detail. Start by gathering necessary documents such as pay stubs, bank statements, and receipts.

Step-by-step instructions

1. **Collecting necessary documents**: Having all financial records at hand simplifies the process. Gather your pay stubs, bank statements, and relevant receipts to ensure accuracy in data entry.

2. **Inputting income data**: When entering income details, be precise. Enter figures as they appear in your documents and double-check for mistakes to ensure accuracy.

3. **Recording expenditures**: Organize expenses by category. Use clear headings for each type of spending to maintain order and facilitate future analysis.

Utilizing pdfFiller tools for filling out the form

pdfFiller offers interactive features that make completing the cash income and expenditures form seamless and efficient. Users can leverage collaboration options for team entries, ensuring that input from all relevant parties is captured accurately.

In addition, pdfFiller’s eSigning capabilities ensure that all entries are secure and verifiable, providing peace of mind for users managing confidential financial information.

Best practices for managing your cash income and expenditures

Managing your cash flow through regular updates is crucial. Establishing a routine for tracking and updating your income and expenditures helps maintain financial clarity.

Regular reviews, whether monthly or quarterly, enable you to track spending habits and adjust your budgets in alignment with your financial goals. Using pdfFiller enhances this process by providing cloud-based access, allowing you to monitor your financial status from anywhere at any time.

Additionally, pdfFiller’s document management features allow for the easy organization and storing of forms, ensuring vital financial records are accessible and well-maintained.

Common mistakes to avoid

Even with the best intentions, users often make errors when managing their cash income and expenditures forms. Some common pitfalls to watch out for include:

Advanced strategies for your cash income and expenditures form

Once you've mastered the basics, consider employing more advanced strategies to enhance your financial management. Analyzing trends over time can provide insightful data that may influence future spending and income decisions.

Additionally, planning for future expenses using historical data can help set realistic savings goals and forecast potential cash flow fluctuations. This foresight is beneficial for effective financial strategy development.

Frequently asked questions (FAQ)

Users often have questions surrounding the cash income and expenditures form. Here are some frequently asked questions that may help clarify any uncertainties:

Conclusion

Maintaining accurate records of cash income and expenditures is critical in achieving financial stability. By utilizing tools like pdfFiller, users can efficiently manage these records and enhance their financial oversight.

With features that streamline documentation, collaboration, and eSigning, pdfFiller empowers users to take control of their financial documentation and planning, paving the way toward financial success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find cash income amp expenditures?

Can I create an electronic signature for signing my cash income amp expenditures in Gmail?

How do I fill out the cash income amp expenditures form on my smartphone?

What is cash income amp expenditures?

Who is required to file cash income amp expenditures?

How to fill out cash income amp expenditures?

What is the purpose of cash income amp expenditures?

What information must be reported on cash income amp expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.