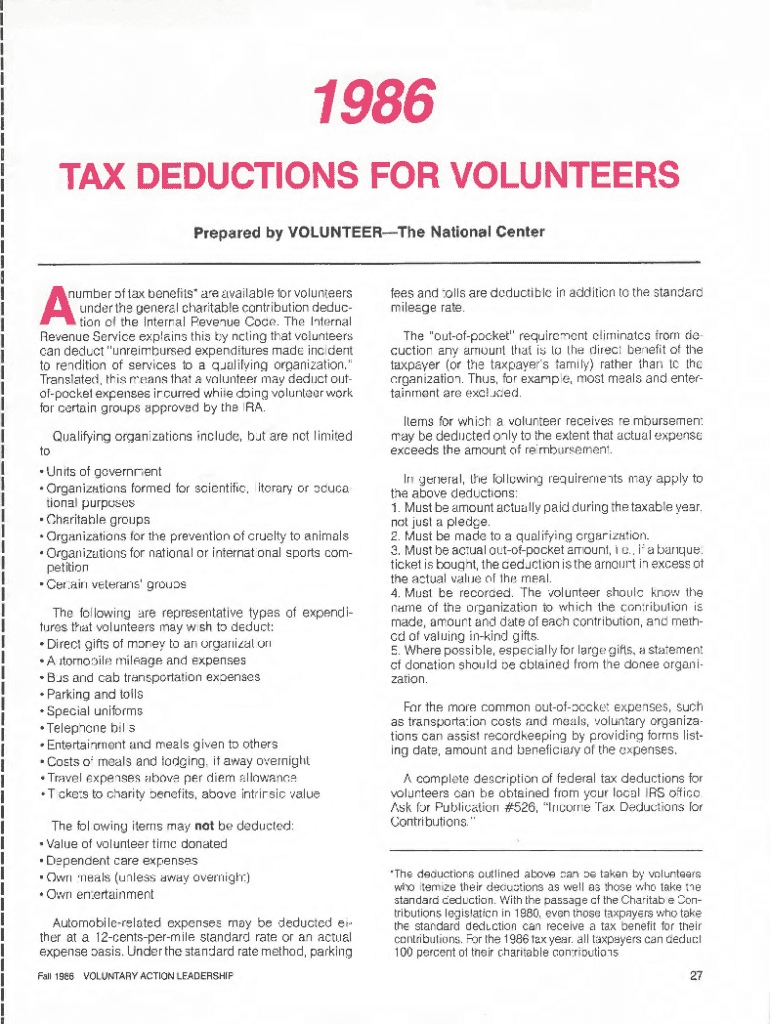

Get the free How to Get Tax Breaks for Volunteer Work

Get, Create, Make and Sign how to get tax

Editing how to get tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out how to get tax

How to fill out how to get tax

Who needs how to get tax?

How to get tax form: A comprehensive guide to accessing your essential tax documents

Understanding tax forms

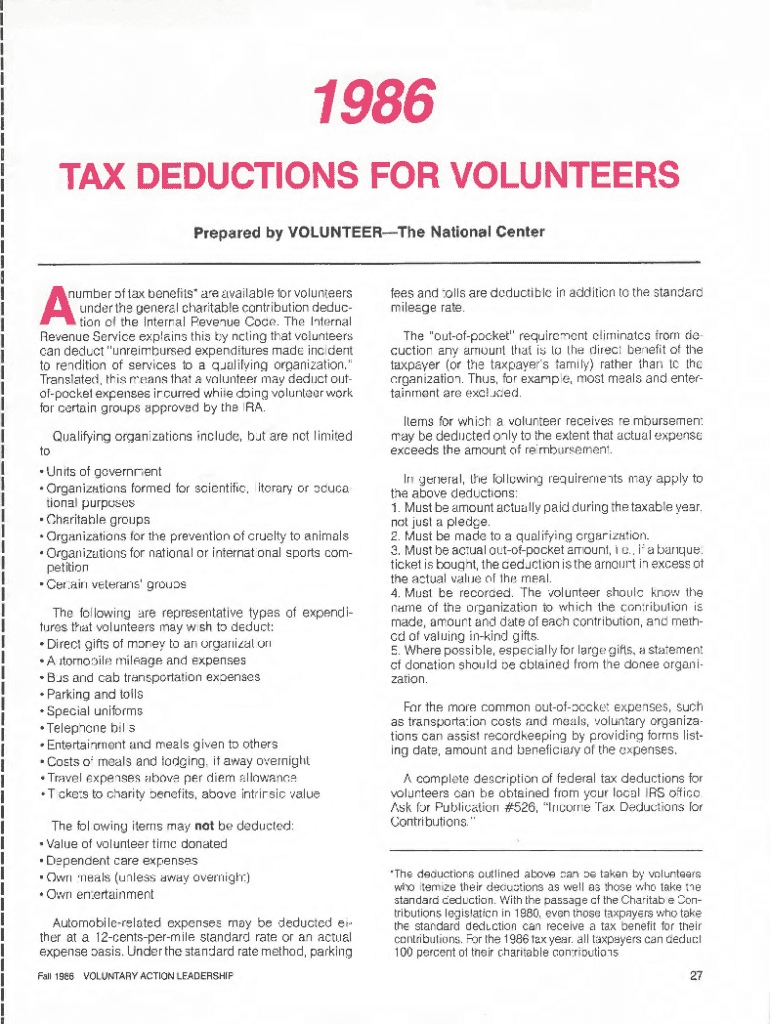

Tax forms are essential documents required by the Internal Revenue Service (IRS) for filing income taxes. They serve myriad purposes, ranging from reporting income and taxes withheld to claiming deductions and credits. Knowing the common types of tax forms helps individuals and businesses navigate their tax obligations effectively. Obtaining these forms in a timely manner is crucial not only to ensure compliance but also to avoid any last-minute issues during tax season.

Identifying the required tax form

Different situations require different tax forms. Recognizing which form you need is critical to ensure accurate filing. For instance, if you are an employee, you would typically receive a Form W-2 from your employer. In contrast, if you are a retiree receiving pension or annuity payments, you might need a Form 1099-R. If you had health insurance coverage through your employer, the Form 1095-C will be instrumental in your tax filing.

Accessing your tax form online

With the rise of digital services, accessing your tax forms online has become more straightforward. Most tax-related entities, including the IRS and various employers, allow for online access to these critical documents. Here's how you can navigate this process:

Start by signing into your online tax account. If you don't have one, you will need to create an account using your personal identification details, such as your Social Security number, date of birth, and filing status. Once logged in, you should navigate to the tax form section of the website.

Requesting your tax form by mail

If online access isn't an option, you'll need to request your tax forms by mail. This process involves providing specific information to validate your request. Most tax organizations require you to provide your account details and identity verification.

Follow this step-by-step guide to successfully request a tax form via mail:

Additional methods to obtain your tax form

Aside from online and mail requests, there are various other methods to receive your tax forms. If you encounter any obstacles or require personalized help, contacting customer support is another option. Many tax organizations, including the IRS, offer assistance through different channels.

Editing and managing tax forms with pdfFiller

Once you have your tax forms, you may need to edit or manage them. pdfFiller offers a seamless solution to easily edit PDFs, fill out tax forms, and prepare them for submission. You can import your tax form into the pdfFiller platform, where it’s easy to modify key information and even eSign the document for timely submission.

Troubleshooting tax form issues

It can be frustrating if you run into issues while trying to access your tax forms. If you can’t access your form online or have trouble with a mail request, knowing how to troubleshoot is essential. Many common issues can be resolved with a few simple actions.

Understanding related tax topics

To effectively navigate the tax landscape, it’s beneficial to be aware of key dates and additional forms related to your tax situation. Tax filing deadlines are crucial, as failure to file on time can result in penalties. Understanding which other related forms might apply to you can further simplify the process and ensure accurate filing.

Feedback and support options

Providing feedback on your experience with obtaining tax forms can be valuable for improving services. Know that support centers offer immediate assistance for those facing difficulties. Navigating the support upon the first interaction can be crucial for resolving queries swiftly.

Utilizing interactive tools

Interactive tools have revolutionized tax preparation, making it more accessible and accurate. Utilizing online calculators and estimators before filing can result in savings and quicker processing times. The benefit of these tools is that they guide you with real-time data, ensuring you capture all possible credits and deductions relevant to your situation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get how to get tax?

How do I edit how to get tax in Chrome?

How do I complete how to get tax on an iOS device?

What is how to get tax?

Who is required to file how to get tax?

How to fill out how to get tax?

What is the purpose of how to get tax?

What information must be reported on how to get tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.