Get the free the hartford hospital indemnity

Get, Create, Make and Sign hospital indemnity claim form

How to edit form hartford hospital indemnity online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form hartford hospital indemnity

How to fill out group accident critical illnessspecified

Who needs group accident critical illnessspecified?

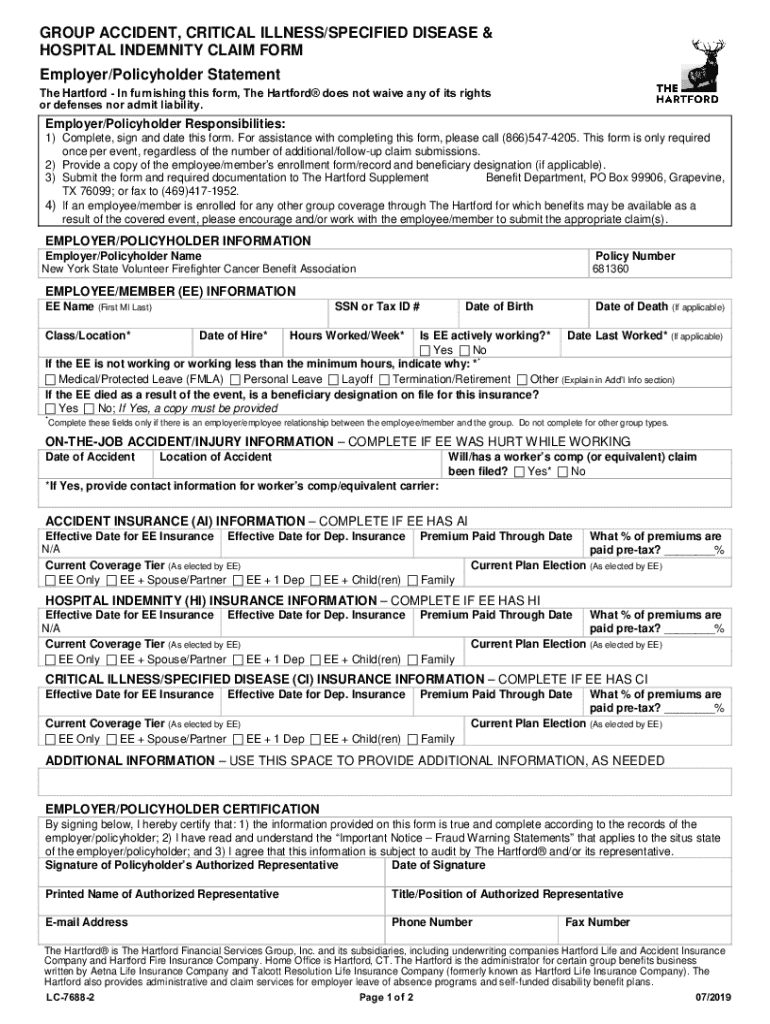

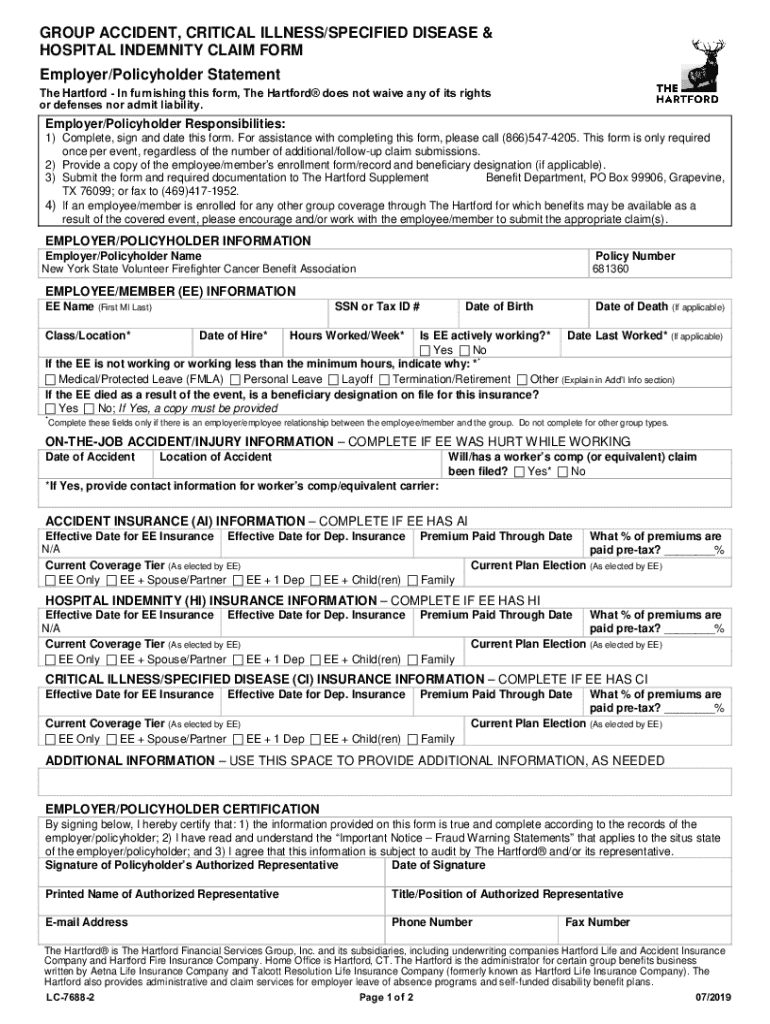

Understanding the Group Accident Critical Illness Specified Form

Understanding group accident and critical illness insurance

Group accident insurance is designed to provide financial assistance in the event of an unintentional injury. This type of insurance covers various types of accidents, including falls, vehicle accidents, and sports-related injuries. Unlike standard health insurance that focuses on a broad array of medical services, group accident insurance zeroes in specifically on the consequences stemming from accidents.

Critical illness insurance, on the other hand, serves as a safeguard against severe health conditions such as cancer, heart attack, or stroke. It pays out a lump sum upon diagnosis, helping individuals manage high medical expenses. The distinction from standard health insurance lies in its focus: while health insurance will cover ongoing treatments, critical illness policies ensure financial support during critical times without needing to demonstrate how funds will be used.

Importance of having a specified form

Specified forms play a critical role in the insurance claims process. These forms ensure clarity, providing both the claimant and the insurer a structured way to convey necessary information related to the claim. A well-articulated form boosts the accuracy of submissions, significantly lowering the likelihood of confusion or misinterpretation during processing.

Additionally, specified forms aid in expediting claims processing by minimizing errors. When all required fields are filled out correctly, it shortens the time from submission to approval, allowing claimants to receive funds sooner. This is particularly beneficial in urgent medical situations where timely assistance is paramount.

Overview of the group accident critical illness specified form

The group accident critical illness specified form is fundamental in processing claims related to both accidents and critical illnesses. This form typically consists of several key sections, including personal information that establishes the identity of the insured, coverage details that define what the insurance policy covers, and medical history sections that provide context for any claims being filed.

In addition to these sections, commonly required documentation includes copies of identification, insurance cards, and relevant medical records. Properly completing the specified form and providing comprehensive documentation lays a solid foundation for a successful claim process.

Step-by-step guide to completing the specified form

Completing the specified form can be straightforward if you're adequately prepared. Start by gathering all necessary information and documents, such as personal identification, insurance details, medical records, and any supporting documentation. Clarity on your coverage needs is essential to provide accurate information on the form.

Next, follow detailed instructions to ensure each section is filled out correctly. For instance, include accurate personal information such as full name and address in the personal information section. Specify coverage details by referencing your insurance policy, making sure to indicate whether the claim relates to an accident or a critical illness. When documenting medical history, list any relevant treatments or past conditions that relate to the claim.

After completing the form, reviewing it for accuracy is crucial. Double-checking ensures that all information is correct, significantly increasing the chance of a swift claim approval. Highlight any inconsistencies or areas that could be easily misunderstood and amend those before submission.

Utilizing pdfFiller for effective document management

pdfFiller offers an ideal solution for managing the group accident critical illness specified form and similar documents. Its cloud-based platform allows users to access, edit, and share forms from anywhere, making it extremely convenient for both individuals and teams. This flexibility is invaluable, especially when you're dealing with sensitive timeframes in health-related claims.

The platform's eSignature functionalities enable faster approvals by allowing electronically signed documents to be submitted quickly. With interactive tools, users can collaborate in real time, ensuring that multiple stakeholders can contribute to the completion of a form without unnecessary delay. The step-by-step guidance available on the platform also ensures that every user, regardless of their experience level, can navigate the form easily.

Troubleshooting common issues with the specified form

Common pitfalls arise when filling out the specified form. Missing out on key information or required documentation can result in delays or even rejections of claims. It’s essential to thoroughly review the form and check for any overlooked sections. Misunderstanding the coverage limits can also lead to complications, underscoring the importance of reading the terms of your insurance policy carefully.

If a claim is denied, the next steps include reviewing the denial letter and understanding the reasons behind it. Often, open communication with the insurance provider can clarify the situation and help resolve outstanding issues. When re-submitting, ensure to address all concerns highlighted in the denial to increase the likelihood of a successful outcome.

Best practices for managing your group accident and critical illness insurance

Maintaining organized records related to your group accident and critical illness insurance is essential. Establishing a systematic filing system assists in tracking all required documents like policy statements, claim forms, and medical records. Regularly updating your personal and medical information can also greatly benefit claim processing, ensuring all data is current and accurate.

Periodic reviews of your coverage are advisable to ensure that your policy meets your current needs. Insurance needs can change based on health status, lifestyle changes, or family dynamics. Using tools such as those offered by pdfFiller allows for efficient updates to your documents, keeping your information up-to-date with minimal hassle.

Frequently asked questions (FAQs)

Having a few key questions answered can provide clarity on dealing with the group accident critical illness specified form. For instance, if you lose your specified form, contacting your provider promptly to request a replacement is essential. Typically, insurance providers can issue a new form quickly. Regular updates of your insurance details are advised, especially following significant life changes or every few years.

Additionally, many insurance companies now allow forms to be submitted online. Using a platform like pdfFiller Streamlines this process, enabling users to submit forms electronically, thereby improving the efficiency of handling claims much more than traditional methods.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form hartford hospital indemnity?

Can I create an eSignature for the form hartford hospital indemnity in Gmail?

Can I edit form hartford hospital indemnity on an iOS device?

What is group accident critical illnessspecified?

Who is required to file group accident critical illnessspecified?

How to fill out group accident critical illnessspecified?

What is the purpose of group accident critical illnessspecified?

What information must be reported on group accident critical illnessspecified?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.