Get the free Voluntary Cover Application

Get, Create, Make and Sign voluntary cover application

Editing voluntary cover application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out voluntary cover application

How to fill out voluntary cover application

Who needs voluntary cover application?

Your Complete Guide to the Voluntary Cover Application Form

Understanding the voluntary cover application form

A voluntary cover application form is a document designed to allow individuals or organizations to apply for additional coverage beyond mandatory insurance policies. This type of coverage often includes health insurance, dental, life insurance, and other supplementary benefits. The purpose of this form is to streamline the process of securing this vital protection, ensuring that applicants can easily express their preferences and needs.

The necessity of this application form lies in its role as an official record of the individual's interest in extending their insurance coverage. Without this document, insurance providers cannot fulfill requests for voluntary cover options, which can lead to gaps in essential protection.

Eligibility criteria for voluntary coverage

Eligibility for voluntary coverage varies widely based on the provider and the specific type of insurance. Generally, individuals and groups who meet certain criteria can apply for this additional coverage. Criteria may include employment status, age, and health considerations.

It's essential to review these requirements carefully. Some employers, for example, may offer this coverage only to full-time employees, while others may extend it to part-time staff as well. Specific age limits may also apply, particularly for life insurance and other age-sensitive policies.

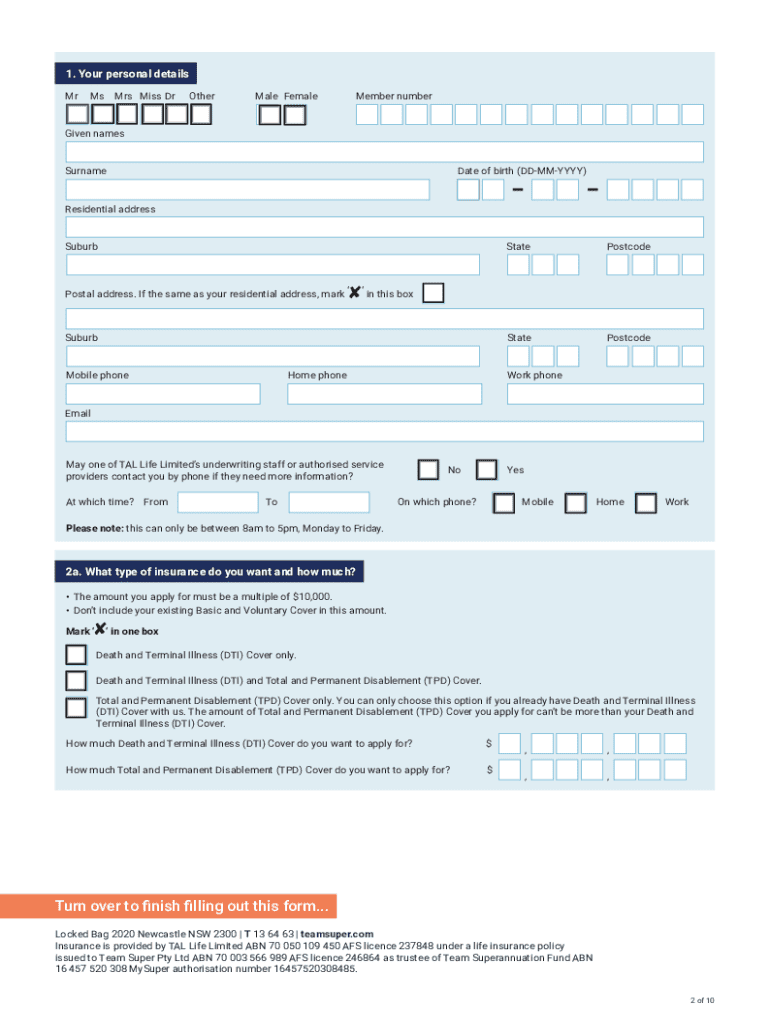

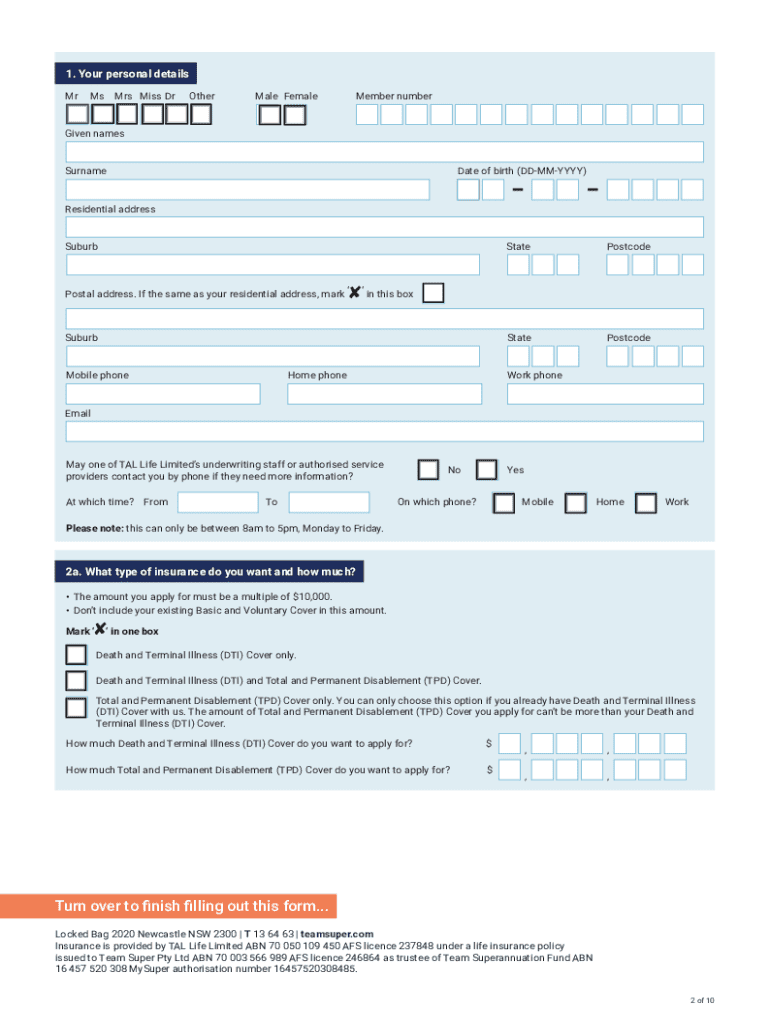

Preparing to fill out the voluntary cover application form

Before diving into filling out the voluntary cover application form, it's crucial to gather the necessary documentation. This typically includes a valid identification, proof of eligibility, and sometimes financial documentation depending on the type of coverage being requested.

To ensure a smooth experience, consider preparing collected information in advance. Understanding technical terms used within the form can also save time and prevent confusion, ultimately leading to a more efficient application process.

Step-by-step guide to completing the form

Completing the voluntary cover application form requires attention to detail and systematic input of information. Start with the personal information section, ensuring accuracy with your name, address, and contact details. Mistakes here can cause delays in processing.

Next, you'll move to the coverage selection. Evaluate the options available, considering what best fits your needs. Once completed, you must provide your signature and the date, whether electronically or via print, ensuring that it's legible and accurate.

Editing and finalizing your application form

Once you've filled out the voluntary cover application form, reviewing and editing it for accuracy is essential. Utilizing tools such as pdfFiller can significantly assist in this process. With pdfFiller, you can edit fields, correct mistakes made during initial entry, and even add notes or explanations where necessary.

These features not only facilitate smooth document management but also allow for seamless collaboration. You can share your application with team members for feedback or utilize annotation tools to clarify points before final submission.

Submitting your application

When it comes to submitting your voluntary cover application form, various methods are usually available. Commonly accepted methods include online submissions through the insurer's website, email submissions, or traditional postal mail. Choose a submission method that is most convenient for you, taking into account the organization's guidelines.

Once submitted, understanding the processing time is crucial. This timeframe can vary significantly based on the insurer's workload and the completeness of your application. Additionally, inquire about how to monitor the status of your application to keep updated.

Managing your voluntary coverage

Effective management of your voluntary coverage is an ongoing process. After obtaining coverage, keep track of all details, including changes in personal circumstances that might affect your coverage status. Insurance providers appreciate timely updates and can often aid in making necessary adjustments.

Renewal is another critical aspect, as voluntary coverage often requires periodic reviews. Be aware of renewal dates and any steps necessary to maintain continuity of coverage, ensuring that you remain protected without interruption.

Interactive tools and resources

The process of managing your voluntary cover application form can be made significantly easier with tools offered by pdfFiller. Interactive features on the platform guide users through each step of the form, providing intuitive suggestions and support. Utilizing FAQs and troubleshooting services can also alleviate uncertainties encountered during the filling process.

Community support plays an equally valuable role; accessing forums can connect you with individuals facing similar situations, offering insights and shared experiences that may prove beneficial. Being part of such a network empowers you with knowledge and diverse perspectives.

Frequently asked questions (FAQs)

As you navigate the voluntary cover application process, you may find yourself encountering common issues and questions. For instance, you might wonder what steps to take in case your application is denied. Understanding the appeals process can help ease your concerns and provide you with a pathway for resolution.

Another common question revolves around changing coverage after enrollment. It's imperative to be familiar with the policies regarding modifications, whether they pertain to increasing, decreasing, or altogether changing coverage types.

Enhancing your understanding of voluntary coverage

Exploring related coverage options helps extend your understanding of voluntary insurance benefits. For example, delving into complementary types of insurance such as accident insurance or short-term disability insurance can provide insights into creating a more robust financial safety net.

Additionally, personal stories and testimonials from individuals who have utilized voluntary coverage can illustrate its benefits and real-world impacts. Their accounts can offer motivation and reassurance for those considering this type of coverage, showcasing how it has effectively aided in unexpected situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my voluntary cover application directly from Gmail?

How do I edit voluntary cover application online?

How do I fill out voluntary cover application using my mobile device?

What is voluntary cover application?

Who is required to file voluntary cover application?

How to fill out voluntary cover application?

What is the purpose of voluntary cover application?

What information must be reported on voluntary cover application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.