Get the free Section 408 Statement of No Objection

Get, Create, Make and Sign section 408 statement of

Editing section 408 statement of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out section 408 statement of

How to fill out section 408 statement of

Who needs section 408 statement of?

A Comprehensive Guide to the Section 408 Statement of Form

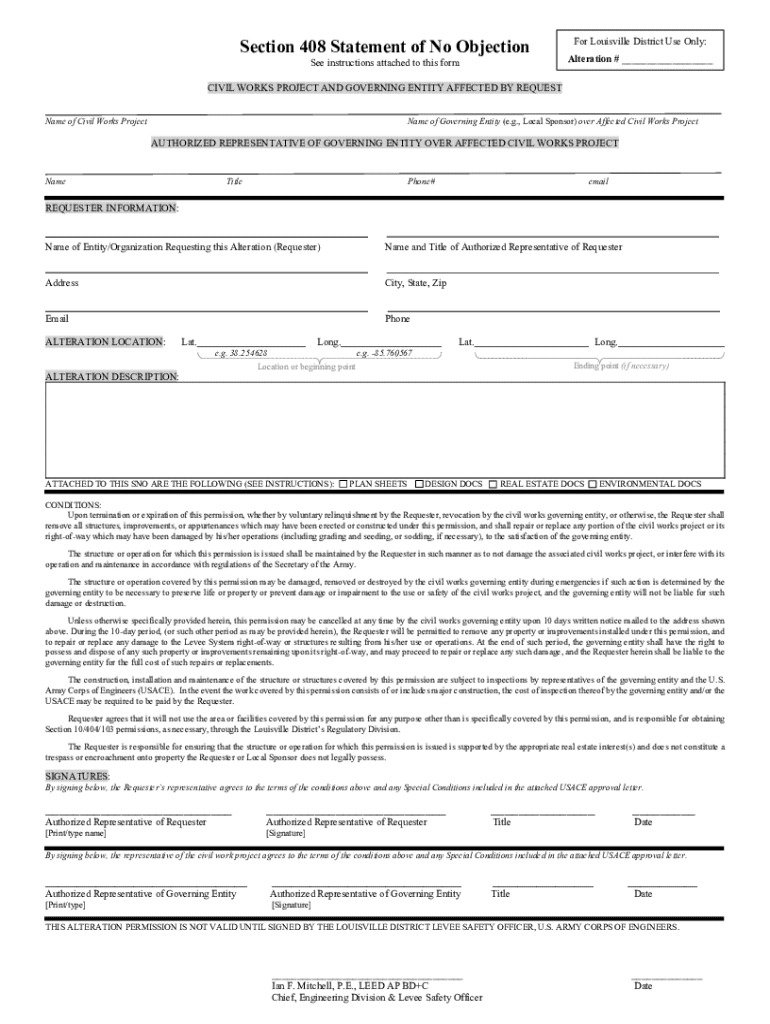

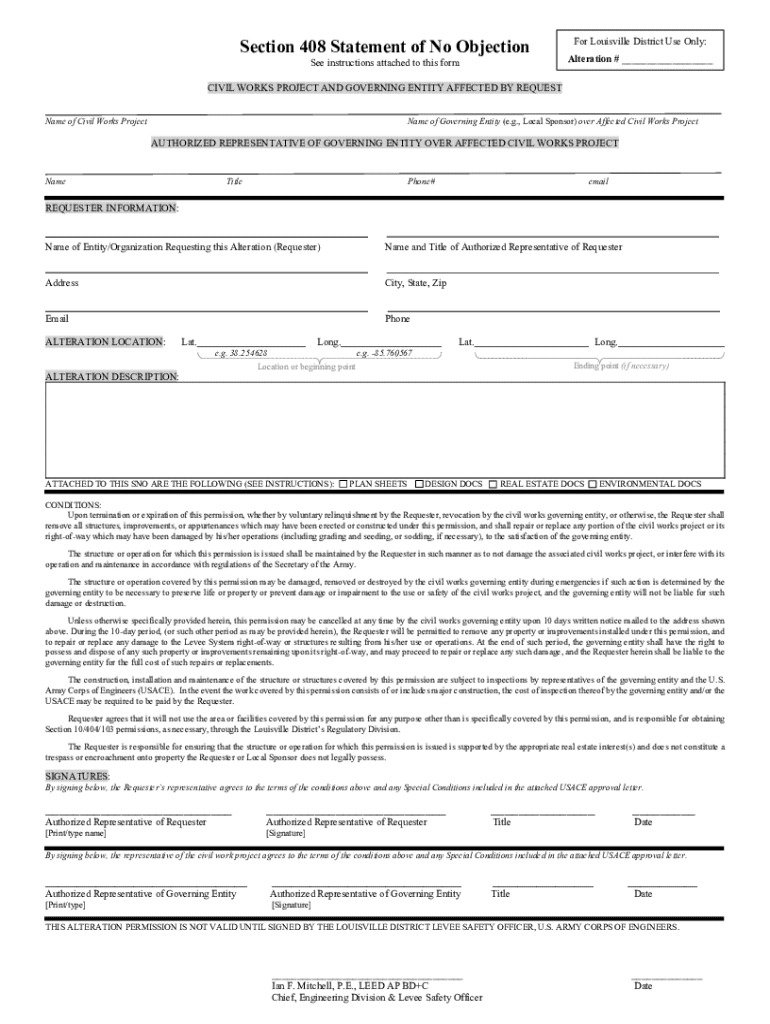

Understanding the Section 408 Statement of Form

The Section 408 Statement is an essential financial document that plays a pivotal role in ensuring compliance and transparency in financial reporting. Designed to capture key financial information, this form serves the dual purpose of providing a snapshot of an individual's or organization's financial health while fulfilling legal requirements set forth by regulatory bodies.

For many, the importance of the Section 408 Statement extends beyond mere compliance; it is also a tool that fosters trust among stakeholders by promoting accountability. Whether you are a small business owner or a large corporation, understanding this form is crucial in navigating the complex landscape of financial reporting.

Who needs to file?

The requirement to file a Section 408 Statement typically falls on a variety of individuals and organizations, including but not limited to:

Understanding the contexts in which the Section 408 Statement is applicable can help users ensure compliance and avoid potential penalties.

Key components of the Section 408 Statement

A well-prepared Section 408 Statement requires specific, detailed information. Key components include:

Understanding each section of the form can significantly ease the filing process, allowing for a more accurate representation of financial data and decreasing the likelihood of errors.

How to prepare for filing the Section 408 Statement

Preparation is key when filing the Section 408 Statement. Gather all required documents beforehand to facilitate accurate completion. Essential documents include:

Common mistakes include providing inaccurate or incomplete data, overlooking signature requirements, and failing to keep track of submission deadlines. Avoiding these pitfalls can save time and prevent complications.

Step-by-step instructions to complete the Section 408 Statement

Step 1: Personal information section

Start by entering your personal details accurately. Ensure your name matches your identification documents, and double-check contact information for errors.

Step 2: Financial information section

When reporting financial data, prepare a summary of income and expenses. Ensure all figures are accurate and reflect your financial reality.

Step 3: Affirmations and signatures

After filling out the form, read through it carefully to confirm that all information provided is true. Your signature at the bottom of the form certifies the completeness and accuracy of the information.

Interactive tips for digital completion

For those completing the form online, tools such as pdfFiller can greatly enhance the process, offering interactive features like editable fields that automatically validate data, ensuring you fill out only the required sections correctly.

Reviewing your Section 408 Statement

Before submission, perform final checks. Create a checklist confirming completion of all fields, accuracy of data, and that required signatures are included. Utilize features offered by pdfFiller to collaborate with team members or advisors for a final review.

Collaboration tools allow multiple users to comment and suggest corrections in real-time, thus streamlining the review process.

Submitting the Section 408 Statement

Filing options for the Section 408 Statement include traditional mailing and online submissions, each method offering advantages based on your timing and convenience. However, electronic submissions can provide instant confirmations that are vital for keeping a comprehensive record.

Ensure you are aware of deadlines in relation to your specific context—failure to submit the form in a timely manner can lead to penalties or disqualification from financial programs.

Frequently asked questions (FAQs)

Submitting the Section 408 Statement does not immediately guarantee approval or processing. Typically, expect a timeframe in which you can verify the status of your submission, which varies based on the reviewing authority.

If corrections become necessary after submission, instructions for amending a Section 408 Statement must be strictly followed to ensure compliance. Local regulations often outline these procedures.

For specific inquiries or help related to the Section 408 Statement, resources are available through regulatory body websites or professional advisories that can provide assistance tailored to your needs.

Using pdfFiller for your Section 408 Statement needs

pdfFiller stands out as a comprehensive solution for managing your Section 408 Statement, offering unique features that streamline the process. Intuitive editing tools, easy photo uploads, and signature capabilities centralize your documentation in one platform, enhancing efficiency and productivity.

Accessing your documents at any time and from anywhere is another robust advantage of pdfFiller. The cloud-based storage ensures that your essential files are secure yet accessible, making document creation and revisions more manageable.

With innovative templates and editing functions available at your fingertips, pdfFiller empowers users to be proactive in their document management, truly revolutionizing the way you interact with forms like the Section 408 Statement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in section 408 statement of?

Can I create an eSignature for the section 408 statement of in Gmail?

How do I complete section 408 statement of on an Android device?

What is section 408 statement of?

Who is required to file section 408 statement of?

How to fill out section 408 statement of?

What is the purpose of section 408 statement of?

What information must be reported on section 408 statement of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.