Get the free Notice of Short Sale

Get, Create, Make and Sign notice of short sale

How to edit notice of short sale online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of short sale

How to fill out notice of short sale

Who needs notice of short sale?

The Complete Guide to the Notice of Short Sale Form

Understanding the Notice of Short Sale Form

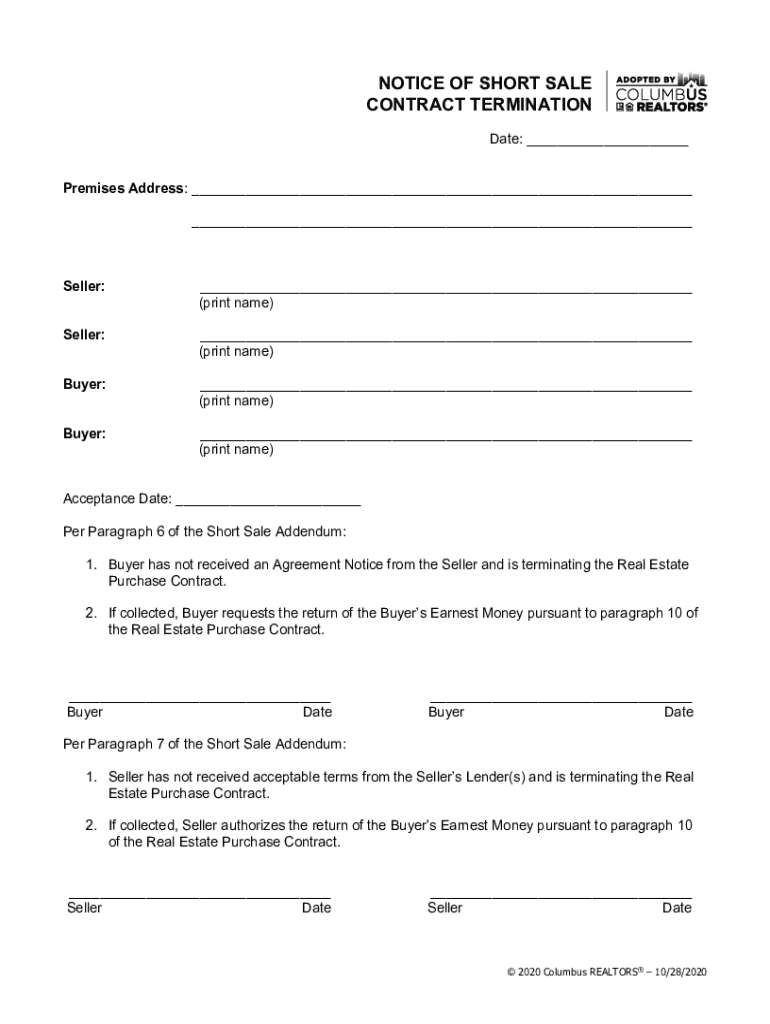

A Notice of Short Sale Form is a critical legal document used during real estate transactions where the sale price of a property is less than the outstanding balance on the mortgage. This form plays a vital role in communicating the intention to sell the property as a short sale to all relevant parties, including lenders, real estate agents, and potential buyers. For homeowners who are facing financial difficulties, completing and submitting this form can provide a path to avoiding foreclosure, while also benefiting lenders by allowing them to recover part of the investment.

The importance of this form cannot be overstated. It formalizes the short sale process and is necessary for lenders to evaluate whether they will approve the sale, generally resulting in less financial loss than foreclosure proceedings. Understanding how the form works is essential for anyone involved in real estate transactions, especially homeowners in distress.

Key components of the form

The Notice of Short Sale Form consists of several key components that need to be accurately completed to avoid delays or denials during the short sale process. The essential sections include:

Who needs to fill out this form?

Filling out the Notice of Short Sale Form is essential primarily for homeowners facing the possibility of foreclosure. However, it is also important for real estate agents who are assisting in the sale and lenders or mortgage companies that must process the transaction. These parties must understand the requirements for completing the form accurately and efficiently.

Preparing to complete the Notice of Short Sale Form

Before you start filling out the Notice of Short Sale Form, it is crucial to gather all necessary documents that will support your case. This includes items like recent mortgage statements, tax returns, a hardship letter explaining your financial difficulties, proof of income, and any other financial documents that may be relevant. Having this information organized and readily available will make the process smoother.

Additionally, understanding the implications of a short sale is vital. This option might help you sell your home for less than what you owe but can have a significant impact on your credit score. Generally, a short sale damages your credit less than a foreclosure, but it's essential to maintain open communication with your lender to navigate this process effectively.

Step-by-step guide to filling out the form

Filling out property information

The first section requires detailed property information, including the complete address and the type of property you are selling. It’s important to ensure that this information is accurate as it will be used by all parties involved in the transaction.

Owner information section

Next, provide personal details such as your name, contact information, and any co-owners' names. Common pitfalls include miswriting names or contact information, which could lead to communication issues later.

Lender details

This section requires you to include the name of the lender and associated account numbers. If you're unsure about any information, reach out to your lender directly. This information is critical as the lender must approve the short sale.

Sale details

Here, document the sale process, including the proposed sale price and the expected closing timeline. Being realistic with your sale price helps prevent rejection from the lender due to inadequate offers.

Signing and finalizing the form

Finally, ensure all required parties sign and date the document. The importance of having correct signatures cannot be overstated. For those who prefer electronic documentation, pdfFiller offers easy-to-use tools for electronic signatures, ensuring a smooth conclusion to this step.

Editing and managing the Notice of Short Sale Form

Using pdfFiller to edit your form

Once your form is filled out, utilizing pdfFiller’s editing tools can significantly streamline the process. This platform allows users to easily make changes as necessary, only requiring a few clicks to modify any section of the form. The ability to edit helps you keep information current, ensuring all parties have the most accurate data.

Collaborating with stakeholders

Collaboration is key in a short sale. pdfFiller enables seamless sharing of documents with real estate agents or lenders, ensuring that everyone stays on the same page. You can also benefit from features such as version control and comments to increase clarity and understanding among all parties involved.

Storing and accessing the form

Opting for cloud storage via pdfFiller means your documents are easily accessible from anywhere. Keeping your forms secure and organized is imperative, as this ensures that you can retrieve any necessary documents when needed without hassle.

Tips for successful submission of the form

Checklist before submission

Before hitting send on your Notice of Short Sale Form, perform the following checks to ensure complete submission:

Common mistakes to avoid

When filling out the Notice of Short Sale Form, users often make frequent errors that can hinder the approval process. For example, not providing complete information or submitting incorrect lender details can result in delays. Always take your time to review and ensure that everything is in order before submission.

Frequently asked questions (FAQs)

What happens after submit the form?

After submission, your lender will review the Notice of Short Sale Form along with your financial documentation. They may require additional information or clarification before making their decision. Typically, the lender will either approve or deny the request, and this process usually takes a few weeks.

How long does the short sale process take?

The timeline for a short sale can vary significantly, generally taking anywhere from three to six months. This variation depends on factors such as lender responsiveness, market conditions, and the amount of paperwork involved.

Can rescind my short sale notice?

Yes, you can rescind your short sale notice prior to receiving a final acceptance from your lender. If your circumstances change or you decide to explore other options, notifying your lender immediately is essential.

What should do if my lender denies my short sale request?

If your request is denied, reviewing the reason for denial is critical. You may have the option to appeal the decision, or you might consider alternative strategies such as loan modifications or working with a housing counselor to explore other possibilities.

Additional insights and best practices

Long-term impacts of a short sale

Opting for a short sale does have long-term consequences, particularly on future home buying opportunities. Generally, it's easier to secure a new mortgage after a short sale compared to a foreclosure, but it will still affect your credit score. Educating yourself about these impacts helps you make informed decisions regarding your financial future.

Resources for homeowners in distress

Should you find yourself in distress, numerous resources are available to assist you. Connecting with real estate professionals can provide valuable insight into your options. Additionally, financial counseling services can help you better understand your situation and create a plan moving forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send notice of short sale for eSignature?

Can I create an eSignature for the notice of short sale in Gmail?

How do I edit notice of short sale on an Android device?

What is notice of short sale?

Who is required to file notice of short sale?

How to fill out notice of short sale?

What is the purpose of notice of short sale?

What information must be reported on notice of short sale?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.