Get the free Notice of Dissolution of Co-partnership or Business Under Assumed Name

Get, Create, Make and Sign notice of dissolution of

How to edit notice of dissolution of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of dissolution of

How to fill out notice of dissolution of

Who needs notice of dissolution of?

A Comprehensive Guide to the Notice of Dissolution of Form

Understanding the notice of dissolution

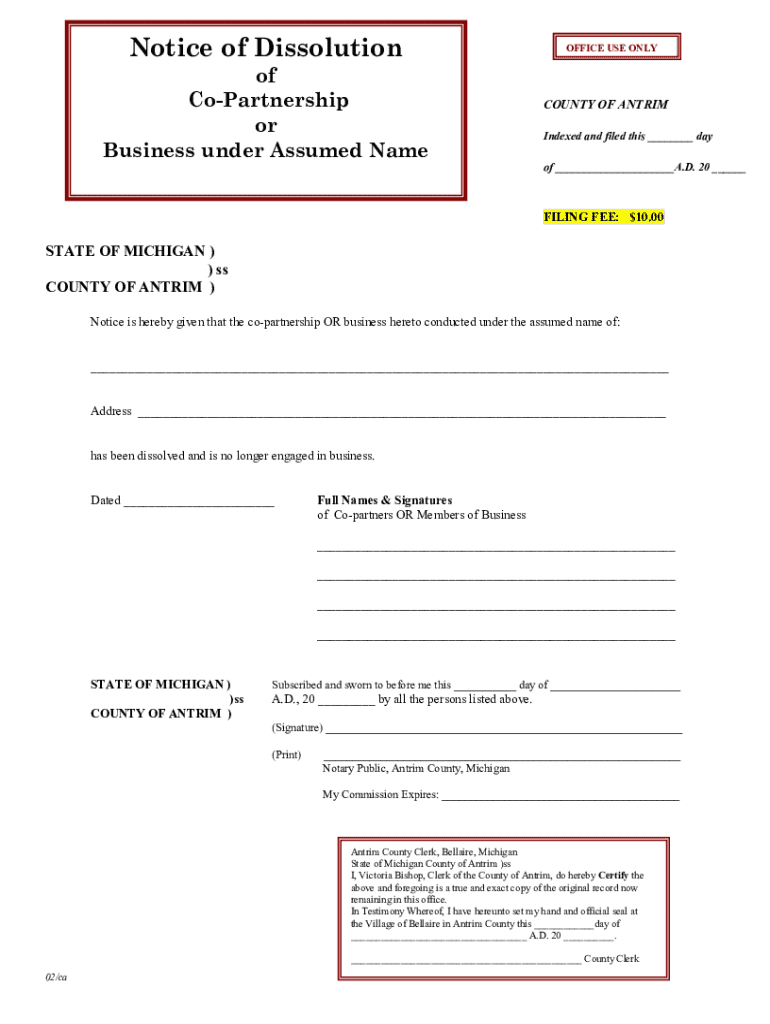

A Notice of Dissolution is a legal document that signals the end of a business entity's existence. It formally informs the state and other stakeholders that a business is ceasing operations and handling its affairs. Filing a Notice of Dissolution is crucial as it helps protect the business owners from any continued liabilities after the business is officially closed. Additionally, it serves to legally dissolve any partnerships or corporations, ensuring that all obligations have been met.

Many business owners hold misconceptions about this process. For instance, some believe that simply closing the doors is enough, while others might think that the dissolution can be ignored until necessary. In reality, failing to file the Notice of Dissolution can lead to unforeseen penalties and debts lingering well beyond the company's operational end.

Types of business entities requiring a notice of dissolution

Different business structures require a Notice of Dissolution to legally cease operations. Understanding which entities need to file is essential for compliance and legal accuracy. Primarily, the following types of business entities are involved:

The legal framework surrounding dissolution

Dissolution is governed by state-specific laws and regulations, which vary significantly across jurisdictions. Generally, there are established steps to follow and forms to submit, all regulated under business entity statutes within each state. It's important to note that each state has different requirements and timelines for dissolution, often influenced by the business's type and structure.

Failing to file a Notice of Dissolution can have severe repercussions, such as ongoing tax obligations, the inability to legally close the business, and potential personal liability for debts incurred after the business has ceased to exist. Therefore, understanding and navigating the legal framework is imperative for a smooth cessation process.

Preparing to file the notice of dissolution

Preparation is key prior to filing the Notice of Dissolution. This involves gathering all necessary information and documentation that details the business's closure and confirming that all obligations have been fulfilled. Essential documents may include tax records, partnership agreements, and meeting minutes authorizing dissolution.

The required forms may differ based on the business type and state regulations. It is advisable to check with the local Secretary of State's office to understand which forms need to be completed. Variations can exist even within similar business structures, so ensure you’re using the correct document specific to your entity type.

Completing the notice of dissolution form

Filling out the Notice of Dissolution form can seem daunting, but a methodical approach can simplify the process. Begin the form by filling out your business's legal name, entity number, and the primary business address. Ensure accuracy with every entry, as discrepancies can complicate the dissolution process.

Common mistakes to avoid include neglecting to include member/partner signatures, omitting the date of dissolution, or failing to provide required documentation. To ensure accuracy, double-check all entries and consider having a colleague review the form before submission.

Reviewing and signing the notice of dissolution

After completing the form, thorough review is essential. This not only catches errors but ensures compliance with all state laws. Depending on the structure of the business, required signatures may vary. For corporations, typically, the president and secretary must sign; for LLCs, generally, all members need to sign off on the dissolution.

In today’s digital age, it's also possible to use platforms like pdfFiller to facilitate the signing process. Electronic signatures are valid in many jurisdictions, streamlining the approval process and making it much more efficient.

Filing the notice of dissolution

Once the Notice of Dissolution form is completed and signed, the next step is to file it with the appropriate state agency, usually the Secretary of State's office. It’s crucial to understand the filing fees associated with your specific state, as they can vary significantly.

You can often submit the documentation online, by mail, or in person. When filing online, you may find the process quicker, but ensure you follow all electronic processes as mandated by the state authorities.

Post-filing considerations

After filing the Notice of Dissolution, you should monitor the status. Confirmation from the state that dissolution is approved may take time, and it’s recommended to retain copies of all submitted documents. Handling creditors is another critical post-dissolution task; resolving outstanding debts and notifying all creditors of the business closure is essential.

Document retention is also vital during this phase. Retain all documents related to the business's dissolution for a minimum of seven years, as they may be required for future tax or litigation purposes.

Common issues and recommendations

Many businesses face hurdles during the dissolution process, ranging from incomplete documentation to unresolved liabilities. Feedback from users highlights the importance of starting the dissolution process early and seeking professional help when uncertainties arise.

Frequently asked questions often address who should file the notice, what information is necessary, and how to resolve disputes among partners. Resources for assistance, including legal advice or accounting support, can help clarify these issues and provide actionable insights.

Interactive tools for enhanced management

Utilizing tools like pdfFiller can significantly streamline the management of your Notice of Dissolution forms. This platform allows users to create, edit, eSign, and collaborate on documents all from one convenient location. The cloud-based solution ensures that you can access important documents anytime and anywhere.

pdfFiller's collaborative editing tools enable teams to work together on the forms seamlessly. Sharing documents for review and obtaining necessary signatures has never been easier, ensuring compliance while reducing turnaround time on essential business filings.

Case studies: successful dissolutions

Business owners can benefit greatly from case studies about successful dissolutions. Many entrepreneurs have shared their experiences, illustrating effective strategies and the importance of meticulous documentation. Testimonials from users of pdfFiller highlight how easy the platform made their filing process, resulting in timely and compliant dissolutions.

These case studies not only serve as motivation but also as practical guides for others facing similar challenges, reinforcing the importance of following through with all necessary procedures to ensure a swift closure of business matters.

Keeping up-to-date with business regulations

Staying informed about changes in business compliance regulations is critical for ongoing and future operations. Business owners should subscribe to alerts from state regulatory agencies or relevant newsletters that provide updates regarding business filings and requirements. This proactive approach ensures that you remain compliant and can adapt to any new laws that may impact your operations.

Knowing the specifics surrounding the Notice of Dissolution of form not only helps in ensuring compliance during dissolution but also plays a role in maintaining an organized approach to handling all business affairs, ultimately supporting future undertakings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute notice of dissolution of online?

How do I edit notice of dissolution of online?

How can I fill out notice of dissolution of on an iOS device?

What is notice of dissolution of?

Who is required to file notice of dissolution of?

How to fill out notice of dissolution of?

What is the purpose of notice of dissolution of?

What information must be reported on notice of dissolution of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.