Get the free Ns Form 15

Get, Create, Make and Sign ns form 15

How to edit ns form 15 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ns form 15

How to fill out ns form 15

Who needs ns form 15?

NS Form 15 Form: A Comprehensive How-To Guide

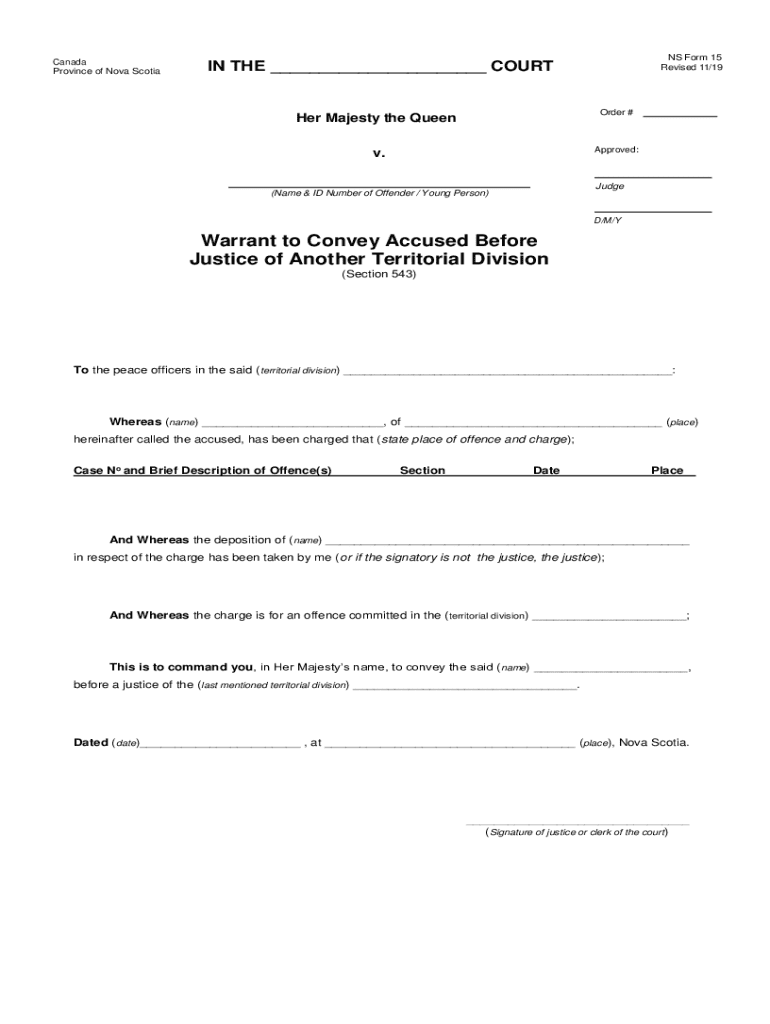

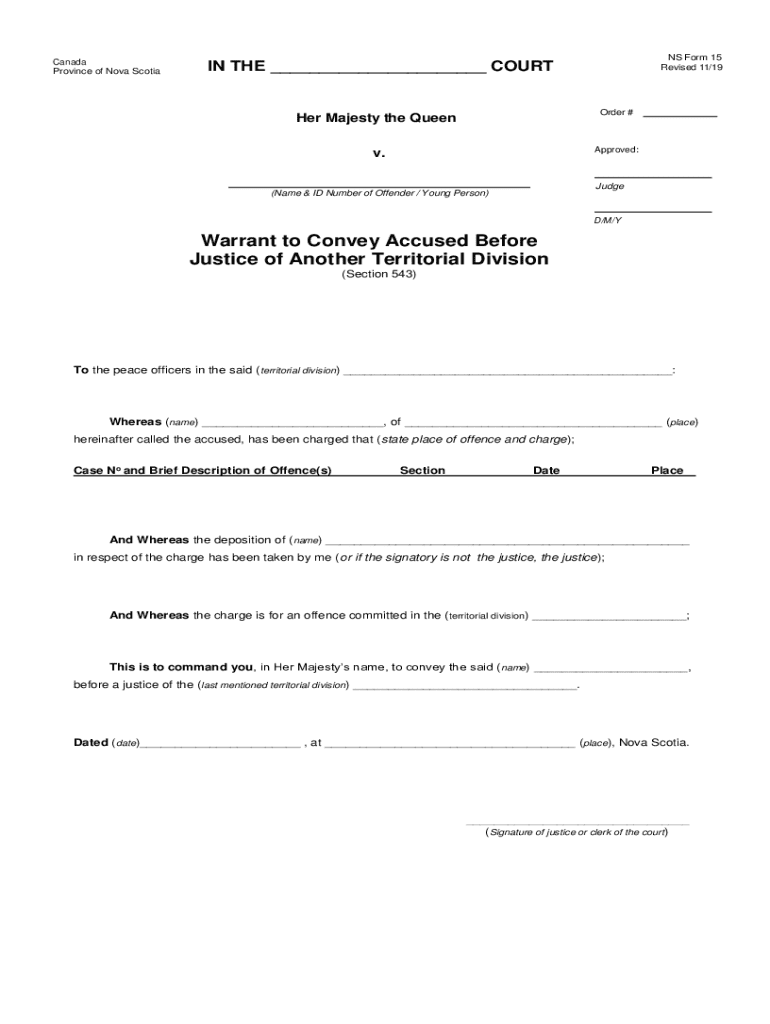

Overview of NS Form 15

NS Form 15 is a vital document used in the corporate sector, specifically designed for businesses to declare certain information related to their corporate structure, function, and compliance with local laws and regulations. The form primarily serves the purpose of representing the corporation's identity and its operational interests to relevant authorities.

Understanding the importance of the NS Form 15 within the business landscape is crucial. It simplifies documentation for businesses, ensuring legal compliance and facilitating smooth operations. For corporations, this form provides a clear delineation of their identity and operational parameters, thereby reinforcing their legitimacy in the eyes of investors and regulators.

Organizations typically need NS Form 15 when establishing a new corporate entity, making amendments to existing corporate structures, or registering their business with local government bodies. The ease of accessing and filling this form digitally via platforms like pdfFiller has transformed document management for many corporations.

Key features of NS Form 15

The NS Form 15 is characterized by several essential components that ensure it serves its intended purpose effectively. Firstly, corporate information sections require details like the company name, registration number, and the address of the corporate headquarters. This information lays the foundation for identifying the corporation within legal frameworks.

Next, applicant statistics are included, outlining who is filling the form—whether it’s a corporate officer, attorney, or authorized representative. Additionally, there are key declaration and signature fields to affirm the accuracy of the information provided, making every submission legally binding.

Related documents typically include business registration affidavits and compliance forms; thus, ensuring all relevant details are previosly gathered before submission is essential. Using a digital format not only simplifies the completion process but also incorporates automated checks and ease of access, streamlining collaboration among team members.

Preparing to fill out NS Form 15

To ensure a smooth completion of the NS Form 15, first assess your eligibility. Review the criteria required to submit the form, such as being a registered representative of the corporation, or having vested interest in the corporation's operations.

Gathering all required information beforehand can significantly ease the filling process. This includes particulars like the Corporate ID, contact details, and any relevant business documents. Organizing this information prior to filling out the form will help create a seamless experience.

Consider tips for document organization, such as creating checklists to track what information is already collected and what additional paperwork you might need. This systematic approach will help prevent errors and omissions which are often the cause of delays.

Step-by-step instructions for completing NS Form 15

Completing the NS Form 15 involves a series of clearly defined steps:

Interactive tools and resources

Leveraging tools such as pdfFiller can profoundly enhance your experience with NS Form 15. This platform allows for easy access to the NS Form 15, along with editing features that can streamline the process. Digital interaction means that documents can be filled out and adjusted on-the-go, eliminating the need for paper prints and manual entries.

Key features of the interactive form-tool include auto-fill capabilities and validation checks, which are instrumental in ensuring accuracy as you complete the form. Additionally, real-time collaboration features enable teams to work together efficiently, even when in different locations, making it an ideal choice for corporate environments.

Common mistakes and how to avoid them

When filling out the NS Form 15, there are common errors that many make, such as incorrect corporation number entry or neglecting to provide complete names. The consequences of these mistakes can lead to delays or denials in processing, emphasizing the importance of vigilantly reviewing the form prior to submission.

To double-check your form effectively, implement a checklist that requires one to verify core details such as names, corporation number, and signatures against your preparatory documents. Frequently asked questions also provide insight into potential issues others have faced when submitting.

Submitting NS Form 15

After completing NS Form 15, you will need to submit it according to your jurisdiction's guidelines. Acceptable submission methods often comprise online processes or traditional mail-in options. It’s important to check specific guidelines and any accompanying documentation that may be required.

Filing fees associated with NS Form 15 can vary based on local regulations; thus, research applicable costs before submission. Tracking your submission status is crucial, as it allows for proactive follow-up if there are any issues or delays in processing.

Post-submission guidelines

After submitting the NS Form 15, you can expect to receive confirmation from the relevant authorities. The waiting period for processing can vary widely based on submission volume and local regulatory practices. Meanwhile, it’s crucial to remain aware of any obligations or responsibilities that emerge post-submission, such as maintaining up-to-date corporate records.

Keeping records of your submission is key. This might involve saving copies of the submitted form, filing receipt confirmations, and maintaining open lines of communication with local regulators for any additional inquiries or requirements.

For more information

If you encounter difficulties while managing the NS Form 15 or require additional clarification, contacting support tailored to corporate regulation issues can offer further assistance. Gathering helpful documentation or guides can ensure you are always prepared for future updates.

Using pdfFiller for document management

pdfFiller stands out as a leading platform for document management, offering comprehensive features designed to simplify the form completion and submission process. Users can edit PDFs seamlessly, eSign documents, and collaborate on forms collaboratively from any device with internet access, ultimately enhancing productivity.

The platform’s intuitive interface allows for streamlined document creation and sharing, ensuring teams work efficiently on corporate documents like the NS Form 15. Real user testimonials highlight the effectiveness of pdfFiller for managing not just NS Form 15 but various other forms and templates necessary for modern business operations.

Enhancing your skills in document management

For individuals and teams looking to enhance their skills in document management, practical tips include systematic document creation processes and proper tagging of documents for easy retrieval. Utilizing platforms like pdfFiller can go beyond just one form; it offers versatile tools for various forms and templates, increasing adaptability within corporate settings.

Expanding your knowledge through pdfFiller’s resources—ranging from webinars to detailed instructional guides—can significantly impact efficiency in form handling. These resources empower users to become more proficient in managing documents and understanding regulatory requirements pertinent to their industry.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ns form 15 for eSignature?

Can I sign the ns form 15 electronically in Chrome?

How do I complete ns form 15 on an iOS device?

What is ns form 15?

Who is required to file ns form 15?

How to fill out ns form 15?

What is the purpose of ns form 15?

What information must be reported on ns form 15?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.