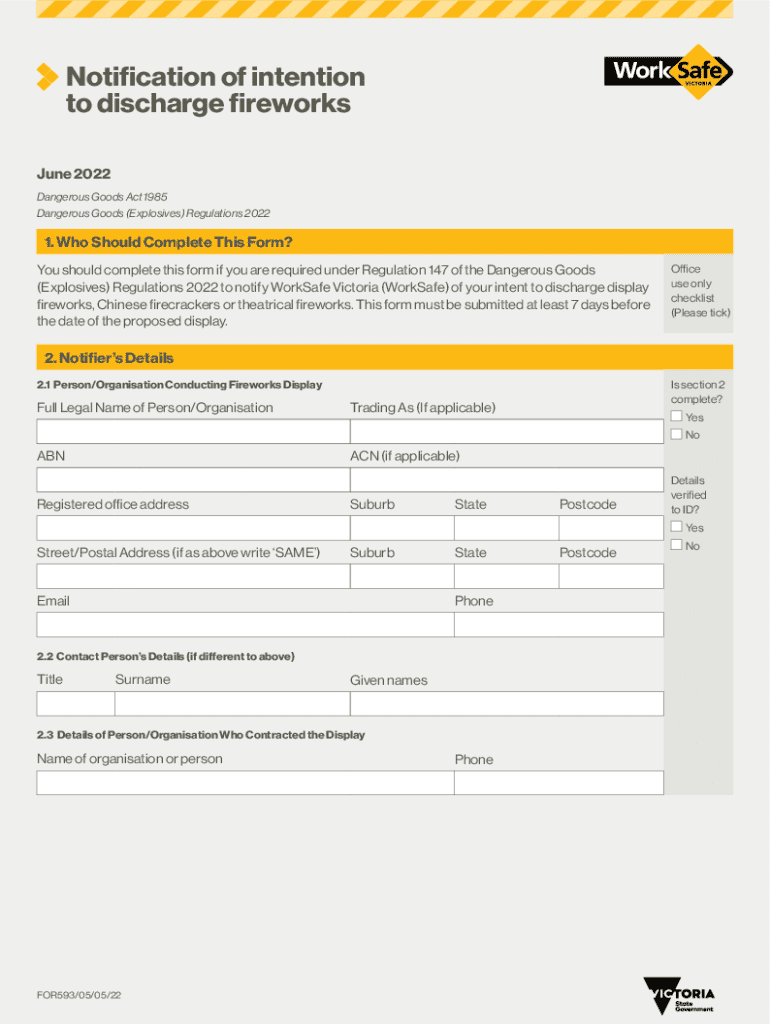

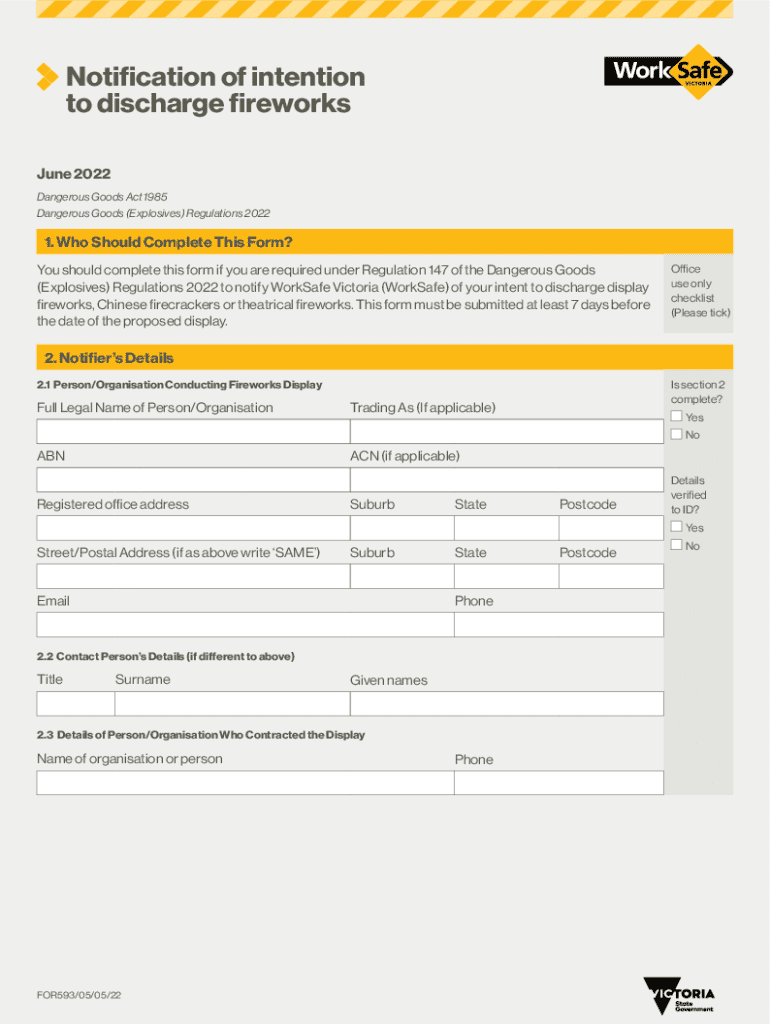

Get the free Notification of Intention to Discharge Fireworks

Get, Create, Make and Sign notification of intention to

How to edit notification of intention to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notification of intention to

How to fill out notification of intention to

Who needs notification of intention to?

Notification of intention to form: a comprehensive guide

Understanding the notification of intention to form

A 'notification of intention to form' is a formal declaration made to relevant authorities signifying the intent to establish a new entity, such as a corporation or a non-profit organization. This document typically serves as the initial step in the legal formation process, signaling that the founders are prepared to move forward with the necessary paperwork and processes. Depending on the jurisdiction, the notification may need to be submitted to state agencies, such as the Secretary of State or equivalent. The importance of this notification cannot be overstated, as it lays the groundwork for legal recognition and operational legitimacy. Without it, aspiring entities risk operating outside the bounds of the law.

Organizations and teams, whether startups or established entities branching out, must understand the implications of this notification. For corporations, it signifies a commitment to compliance with state regulations, especially in areas like taxation and liability. In the non-profit sector, the notification is crucial for gaining tax-exempt status and ensuring eligibility for grants and donations. By filing this notification, individuals begin a crucial journey towards establishing a legal entity, and thus, it demands careful consideration and diligence.

Types of notifications of intention to form

Entities that may require a notification of intention to form vary widely, encapsulating various organizational structures. Corporations represent one of the most common types, seeking permission to begin their operations under a particular framework of governance and financial liability. Non-profit organizations also rely heavily on this notification to secure their operational status as tax-exempt institutions. Additionally, LLCs (Limited Liability Companies) and partnerships may also necessitate similar notifications based on state-specific regulations.

It’s important to note that procedures and requirements for submitting these notifications can differ from one state to another. For instance, while some states offer streamlined processes for online submissions, others might require physical documents, detailed statutory references, and more rigorous timelines. Understanding local variations is vital to ensure compliance and avoid unnecessary delays in the formation process.

Key components of the notification

The effectiveness of a notification of intention to form largely hinges on the information it contains. Essential details include the entity's name and address, which must be unique and aligned with state naming regulations. Additionally, outlining the purpose of formation is crucial; it clarifies the nature and operational intent of the entity and gives regulators insight into its expected activities. The notification should also include contact information for the person submitting the notification, ensuring that communication is streamlined.

Legal requirements for these components can be stringent, and incomplete submissions can lead to rejections or delays. For instance, failing to provide a valid business address or neglecting to specify the entity's purpose can prompt state officials to return the notification. It’s vital to meticulously review these components before submission to mitigate risks of procedural setbacks.

Step-by-step instructions for preparing the notification

Preparing the notification of intention to form requires a methodical approach. Here’s a step-by-step guide to ensure you cover all necessary bases:

Common challenges and how to overcome them

While the process of filing a notification of intention to form can seem straightforward, it is not without its challenges. Delays in approval can be frustrating. If you do not receive a response within the expected timeframe, follow up promptly with the appropriate agency to inquire about the status of your submission.

Additionally, avoid common mistakes such as providing information that conflicts with existing state records or failing to complete all parts of the form. To mitigate risks, ensure ongoing consultation with legal advisers or experienced professionals, especially if you are unfamiliar with regulatory frameworks.

Using pdfFiller for efficient document management

pdfFiller is a powerful tool that streamlines the creation and management of notifications of intention to form. The platform allows users to easily generate, edit, and share legally compliant forms from any device, making the process more accessible and efficient.

Some key features include advanced editing functionalities that let you customize templates to meet your entity’s needs, collaboration tools that bring team members together seamlessly for reviews or approvals, and cloud-based access, which means you can retrieve and manage your documents from anywhere, providing unparalleled flexibility for busy professionals.

Additional considerations

After submitting your notification of intention to form, it’s crucial to keep your information updated as necessary. Should there be changes in contact addresses or operational purposes, be proactive in notifying the relevant authorities. Failing to do so may result in complications or legal repercussions.

A common question regarding the notification process is the scope of implications associated with refusal to accept your notification. Understanding the reasons for denial can often reveal insights that help in rectifying the submission for future attempts, ensuring compliance with all necessary standards.

Case studies or success stories

Consider the journey of a startup tech company that successfully utilized their 'notification of intention to form' to shape their foundational policies. By clearly outlining their vision, mission, and structure in the notification, they were able to convey their operational intent, gaining swift approval from state regulators. They found that transparency and thoroughness in their initial documents significantly sped up their timeline to market.

Another success story comes from a non-profit organization that filed their notification detailing their community engagement strategy. This clear purpose helped them not only navigate regulatory channels efficiently but also attract early support from volunteers and donors. Their experience highlights that clarity and purpose in documentation can be powerful tools in both legal compliance and community relations.

Related documents and actions

Filing a notification of intention to form is often just the beginning. Other related forms, such as Bylaws and Articles of Incorporation, will soon follow. Understanding these documents' requirements is crucial as they lay down the operational framework of the company or organization.

After successfully submitting the notification, prepare for vital next steps. Transitioning to operational phases often includes filing additional compliance documents and ensuring that all necessary regulatory obligations are met, paving the way for a smooth start for your entity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send notification of intention to to be eSigned by others?

How do I complete notification of intention to online?

How do I complete notification of intention to on an iOS device?

What is notification of intention to?

Who is required to file notification of intention to?

How to fill out notification of intention to?

What is the purpose of notification of intention to?

What information must be reported on notification of intention to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.