Get the free 2024 Florida Limited Liability Company Annual Report

Get, Create, Make and Sign 2024 florida limited liability

Editing 2024 florida limited liability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida limited liability

How to fill out 2024 florida limited liability

Who needs 2024 florida limited liability?

2024 Florida Limited Liability Form - How-to Guide

Understanding Florida limited liability companies (LLCs)

A Limited Liability Company (LLC) is a popular business structure in Florida that combines the flexibility of a partnership with the liability protection of a corporation. LLCs offer owners flexibility in management and a pass-through taxation system, which simplifies tax obligations. The Florida LLC law is designed to facilitate business growth and investment by providing owners with personal liability protections against business debts and lawsuits.

Forming an LLC in Florida brings several benefits, including limited liability for members, which protects personal assets from business liabilities. Additionally, Florida has a favorable tax environment, with no state income tax on LLCs, making it an attractive state for entrepreneurs. Unlike corporations, LLCs have fewer formalities and can be managed flexibly, appealing to both new and experienced business owners.

Preparing to file the 2024 Florida limited liability form

Before filing your 2024 Florida Limited Liability Form, gather the essential documents, such as identification and any pre-existing business information that may be necessary. One of the first steps in the formation process is to choose a unique name for your LLC. The name must comply with Florida's naming requirements, which can be checked through the Florida Division of Corporations’ online database.

Additionally, designating a registered agent is crucial. The registered agent is responsible for receiving legal documents and service of process on behalf of the LLC. This agent must have a physical address in Florida and be available during business hours. It's vital to ensure your registered agent executes their responsibilities diligently to maintain good standing for your LLC.

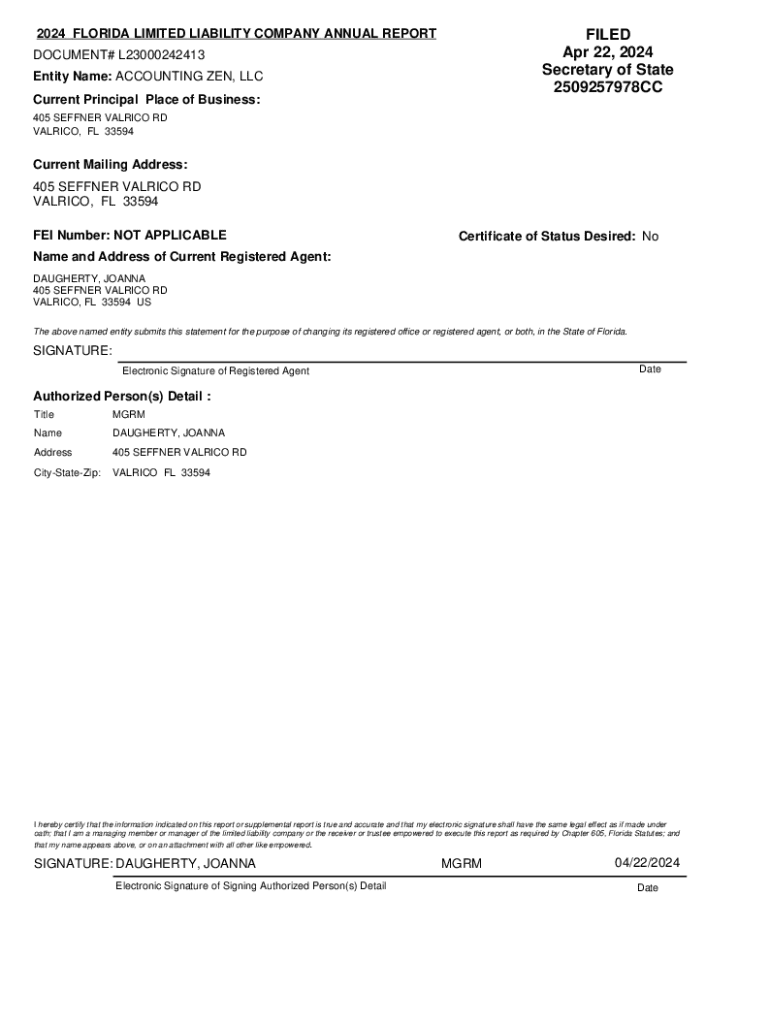

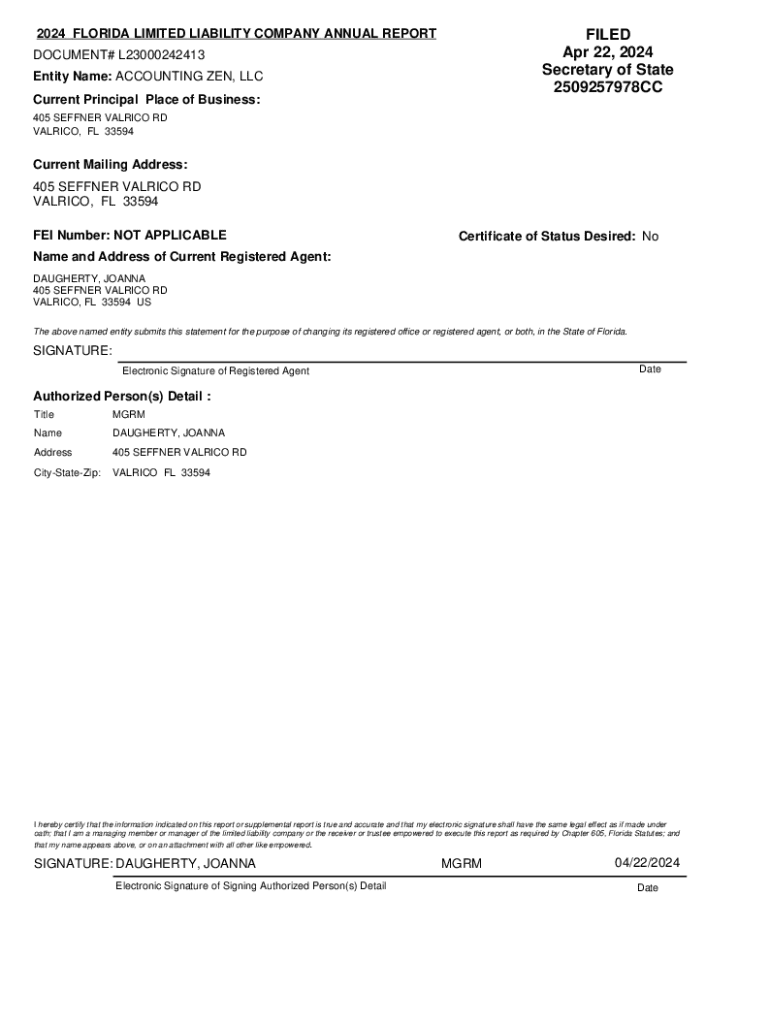

Step-by-step guide to filling out the 2024 Florida limited liability form

Access the 2024 Florida Limited Liability Form through the Florida Division of Corporations' website. The form is available for both online and offline filling. If opting for the online method, ensure your web browser is supported, as not all browsers are compatible with the online filing system.

Completing the form involves multiple sections. You will need to input information such as the name of the LLC, its principal office address, details of your registered agent, and management structure preferences — either member-managed or manager-managed. Don't forget to specify the LLC's effective date and duration, as these details are foundational to the formation process.

Reviewing your completed form is imperative to ensure accuracy and completeness. Common mistakes to avoid include typos in the LLC name, incorrect agent information, or omitting required signatures. Double-checking your work minimizes the risk of delays or rejection in processing.

Submitting the 2024 Florida limited liability form

The submission of the 2024 Florida Limited Liability Form can be conveniently completed online through the Florida Division of Corporations portal. Make sure your web browser meets the system's requirements for a smooth submission process. If you prefer traditional methods, you can also file via mail or in person.

For mail submissions, send your completed form to the Florida Division of Corporations at their designated mailing address. If you decide to submit your form in person, check the location details to ensure you arrive during office hours, as there may be specific protocols in place for walk-in filings.

Important payment and filing information

The filing fees for LLC applications in Florida can vary, so it's essential to check the current rates on the Florida Division of Corporations website. Generally, you can expect to pay a flat fee for filing your 2024 Florida Limited Liability Form, along with any additional fees for expedited processing if desired.

Accepted payment methods include credit cards for online filings and checks or money orders for mailed submissions. Always confirm the total amount due to avoid any errors during the filing process, which could delay your application.

After submission: what to expect

After submitting your 2024 Florida Limited Liability Form, you will receive confirmation from the Florida Division of Corporations. This confirmation usually comes via email or postal mail, so ensure your contact information is accurate on the form. Processing timelines may vary, but you can generally expect to receive your Articles of Organization within a few business days to weeks.

If your application faces rejection, common reasons often include incomplete or inaccurate information. Understanding what went wrong can help you address these issues promptly. Detailed instructions on correcting rejected filings are typically provided by the Division of Corporations, helping you streamline the resubmission process.

Additional requirements after forming your

Once your LLC is formed, the next step is obtaining an Employer Identification Number (EIN) from the IRS, as this number is necessary for tax purposes. You can quickly apply for an EIN online through the IRS website, and in most cases, you will receive it immediately upon successful completion of the application.

Creating an Operating Agreement is also highly recommended. This internal document outlines the ownership structure and operational procedures of your LLC. While Florida does not legally require an Operating Agreement, having one can help prevent misunderstandings among members and provide a clear operational framework. Moreover, ensure compliance with ongoing state requirements like filing annual reports and paying associated fees to maintain your LLC’s good standing.

Leveraging pdfFiller for your documentation

Using pdfFiller simplifies the management of your LLC documentation. From filling out to editing your 2024 Florida Limited Liability Form, pdfFiller provides easy-to-use tools for document creation and management. Whether you need to eSign documents, collaborate with team members, or make necessary adjustments, this cloud-based platform allows access from anywhere, making it ideal for busy entrepreneurs.

With pdfFiller, you can also electronically sign necessary documents, streamlining the filing process. Collaboration features enable teams to work together seamlessly, ensuring that all necessary inputs are included before submission. The interactive tools available help simplify complex tasks, saving time and reducing stress.

FAQs about Florida formation and the 2024 form

Navigating the process of LLC formation can raise several questions. One common inquiry is how to change the name of an existing LLC after formation; this typically requires filing an amendment with the Florida Division of Corporations. For existing businesses looking to convert into an LLC, the process involves filing the appropriate documentation and ensuring compliance with local regulations.

Insurance is another frequently discussed topic. While there are no specific insurance requirements mandated for LLCs, it's prudent to consider general liability insurance to protect your business from potential claims. Additionally, maintaining your LLC’s good standing with the state involves filing your annual reports and paying any associated fees on time to avoid penalties.

Resources for starting your in Florida

Accessing the right resources can significantly ease the LLC formation process. The Florida Division of Corporations offers a wealth of information, including guides and forms necessary for starting your business. Additionally, pdfFiller provides extensive business writing resources that can aid in compliance and documentation.

As you embark on your LLC journey, utilize these resources to equip yourself with the knowledge and tools necessary for a successful business endeavor. Being well-informed helps streamline the process and sets your business up for long-term success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2024 florida limited liability from Google Drive?

How do I execute 2024 florida limited liability online?

How do I complete 2024 florida limited liability on an Android device?

What is 2024 florida limited liability?

Who is required to file 2024 florida limited liability?

How to fill out 2024 florida limited liability?

What is the purpose of 2024 florida limited liability?

What information must be reported on 2024 florida limited liability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.