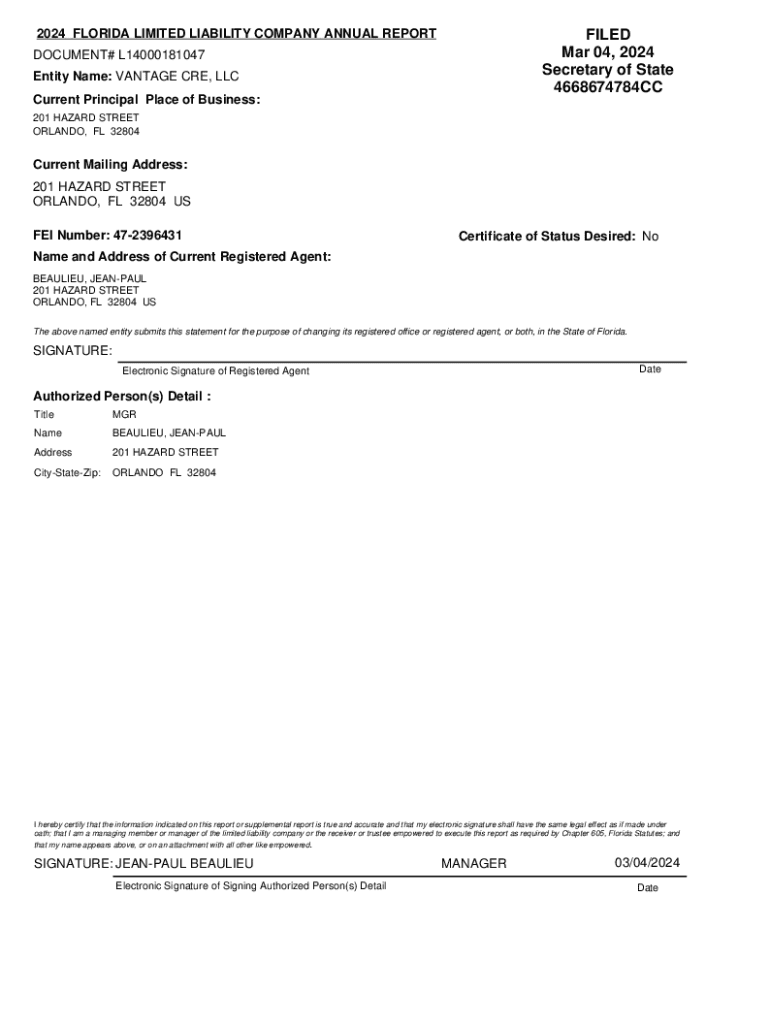

Get the free 2024 Florida Limited Liability Company Annual Report

Get, Create, Make and Sign 2024 florida limited liability

Editing 2024 florida limited liability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida limited liability

How to fill out 2024 florida limited liability

Who needs 2024 florida limited liability?

Your Comprehensive Guide to the 2024 Florida Limited Liability Form

Understanding limited liability companies (LLCs) in Florida

A Limited Liability Company (LLC) offers business owners a unique blend of liability protection and flexibility. By forming an LLC in Florida, entrepreneurs can protect their personal assets from business liabilities while enjoying the pass-through taxation typically associated with sole proprietorships and partnerships.

One of the primary benefits of forming an LLC in Florida is the state's business-friendly environment, which includes no state income tax for LLCs. This financial advantage, coupled with limited liability protection, makes LLCs an attractive choice for many business owners.

LLCs differ from other business entities, such as corporations, primarily in their structure and tax treatment. For instance, corporations face double taxation, while LLCs do not. Understanding these distinctions can help business owners choose the right entity for their needs.

Overview of the 2024 Florida Limited Liability Form

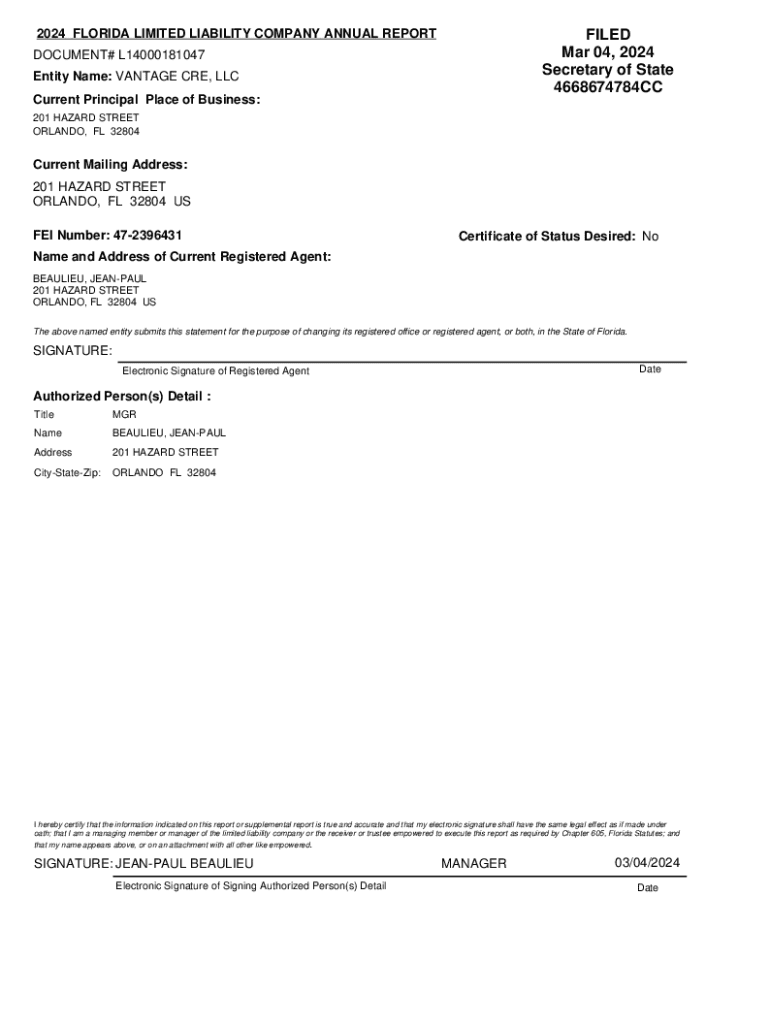

The 2024 Florida Limited Liability Form, also known as the Articles of Organization, is essential for formally establishing an LLC in Florida. This document serves as a declaration of the formation of the LLC and outlines critical information about the business.

Filing this form is crucial as it officially registers the LLC with the state, providing legal recognition and protection. Any individual or entity interested in forming a new LLC in Florida must complete and file this form.

Type of business entities and eligibility

To be eligible for LLC status in Florida, a business must meet specific characteristics, including a legal purpose and at least one member, who can be an individual, corporation, or another LLC. Florida differentiates between domestic LLCs, formed under Florida law, and foreign LLCs, which are formed under the laws of another state or country but wish to operate in Florida.

Common misconceptions about LLCs include the belief that they are only for small businesses. In reality, LLCs can accommodate businesses of all sizes and structures, making them a versatile option for various entrepreneurs.

Step-by-step guide to filing the 2024 Florida Limited Liability Form

Filing the 2024 Florida Limited Liability Form involves several essential steps that ensure proper registration and comply with state regulations.

Here’s a detailed guide on the necessary steps:

Cost breakdown for forming an in Florida

The cost to form an LLC in Florida includes various fees that can vary depending on the filing method and additional requirements for your business.

Certain businesses may qualify for discounts or fee waivers, especially non-profits or veteran-owned businesses. Various payment options are available, including credit card or check.

Common FAQs about the 2024 Florida Limited Liability Form

Many first-time LLC filers have questions about the process and requirements surrounding the 2024 Florida Limited Liability Form.

Troubleshooting and corrections

For those who encounter issues during the filing process, knowing how to troubleshoot and correct errors is vital.

Additional forms and filing options

In addition to the Articles of Organization, Florida has several related forms for LLCs, including forms for amendments, business dissolution, and transferring ownership.

For those interested in using filing services, a comparison of these can help you choose the best options based on features like speed, affordability, and support.

Using pdfFiller for your document management

pdfFiller provides an intuitive platform for editing, signing, and managing the Florida Limited Liability Form efficiently. Users can seamlessly navigate the digital environment to generate accurate documents ready for submission.

Engage with the process: interactive tools

pdfFiller offers several tools to aid in completing and submitting the Florida Limited Liability Form. These tools simplify the complex process into easy, step-by-step actions.

Success stories: entrepreneurs who formed LLCs in Florida

Many entrepreneurs have successfully navigated the Florida LLC formation process with pdfFiller's support. Stories of these business owners serve as inspiration to potential LLC members.

For instance, a retail startup was able to complete the entire registration process in under a week using pdfFiller’s tools, finding the platform both user-friendly and efficient.

Key takeaways and next steps

Filing the 2024 Florida Limited Liability Form is a significant step toward establishing a legally recognized business entity. It's essential to follow the outlined steps carefully to ensure smooth processing.

Encouragement remains to start the filing process today. Utilize pdfFiller’s resources for efficient document management, allowing you to focus on the growth and success of your new LLC.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2024 florida limited liability for eSignature?

Can I create an eSignature for the 2024 florida limited liability in Gmail?

How do I edit 2024 florida limited liability on an Android device?

What is 2024 florida limited liability?

Who is required to file 2024 florida limited liability?

How to fill out 2024 florida limited liability?

What is the purpose of 2024 florida limited liability?

What information must be reported on 2024 florida limited liability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.