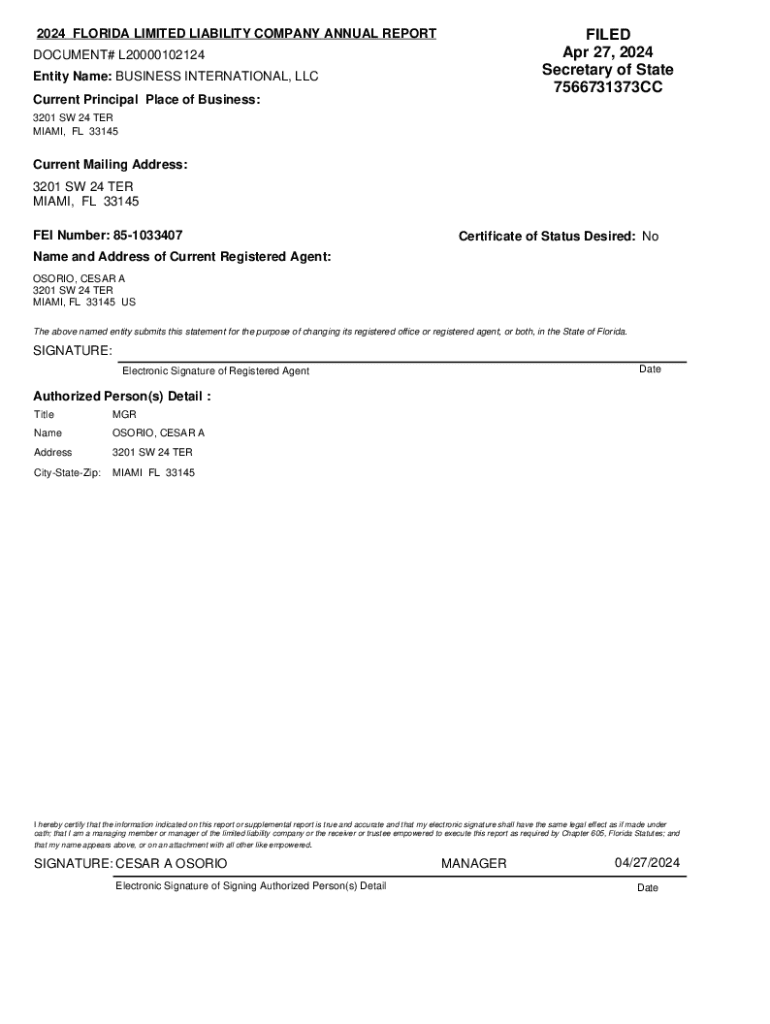

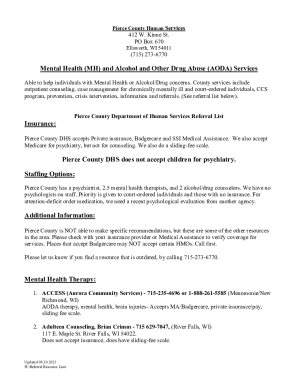

Get the free 2024 Florida Limited Liability Company Annual Report

Get, Create, Make and Sign 2024 florida limited liability

Editing 2024 florida limited liability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida limited liability

How to fill out 2024 florida limited liability

Who needs 2024 florida limited liability?

2024 Florida Limited Liability Form: Your Comprehensive Guide

Overview of Florida Limited Liability Companies (LLCs)

A Florida Limited Liability Company (LLC) is a business structure that combines the limited liability protection of a corporation with the tax efficiency and operational flexibility of a partnership. This makes it a favored choice for entrepreneurs and small business owners looking to mitigate personal risk while enjoying the benefits of a straightforward organizational model.

The primary advantages of forming a Florida LLC include: 1. **Limited Liability Protection**: LLCs safeguard personal assets from business debts and claims. 2. **Pass-Through Taxation**: LLCs typically do not pay federal income tax; instead, profits and losses are reported on members' personal tax returns. 3. **Flexibility in Management Structure**: Unlike corporations, LLCs can be managed by members or appointed managers, providing various options depending on business needs.

As of 2024, there have been several regulatory updates aimed at ensuring better compliance and safeguarding business interests. Understanding these changes can aid in making well-informed decisions when forming an LLC.

Preparing to file the 2024 Florida Limited Liability Form

Before diving into the filing process for the 2024 Florida Limited Liability Form, it’s crucial to prepare adequately. Following a structured approach will not only save time but also diminish the likelihood of filing errors.

**Step 1: Choose a unique business name**. This must be distinctive and not already in use by another registered entity. Conducting a name check via Sunbiz (the official Florida Department of State website) is recommended to confirm availability and avoid rejections due to name conflicts.

**Step 2: Designate a registered agent**. This individual or entity is responsible for receiving legal documents on behalf of your LLC. In Florida, a registered agent must have a physical address in the state and be available during regular business hours. Look for an agent with credibility and reliability, as they play a critical role in ensuring your business can respond timely to legal issues.

Finally, **Step 3: Understand Florida LLC management structure options**. Choose between a member-managed structure, where all members can participate in the business’s day-to-day operations, or a manager-managed structure when a few designated individuals will handle operations. The right choice depends on your business’s size, scale, and operational preferences.

The 2024 Florida Limited Liability Form: Step-by-step instructions

Now that you are prepared to file, the next step involves completing the Articles of Organization, which constitutes the official formation document for your LLC.

**Step 4: Complete the Articles of Organization**. This involves providing required information such as your LLC's name, the principal office address, registered agent's name and address, and the management structure. It's essential to avoid common mistakes like leaving fields blank or misspelling the business name, as these can lead to rejection of your application.

**Step 5: File the form online or by mail**. Filing online through Sunbiz is efficient, allowing for immediate processing of your application. To file online: - Create an account on Sunbiz. - Fill in the Articles of Organization using the platform’s guided interface. - Submit the form along with the appropriate filing fee, currently set at $125. If you prefer filing by mail, print the completed form and submit it to the Florida Department of State, Division of Corporations, along with a check for the filing fee. Ensure any required documentation is included to avoid delays.

After filing: What to expect

Once you have submitted your Articles of Organization, you’ll receive confirmation of your filing. This may come in the form of a receipt if filed online or an acknowledgment when you file by mail. It's advisable to keep this documentation for your records.

To check the status of your filing, visit the Sunbiz website and access their LLC search feature. Standard processing times can vary; however, you can typically expect confirmation within 1 to 2 business days for online filings. Delays may occur depending on volume or if additional information is required.

After your LLC is formed, there are essential next steps to consider: - **Obtaining an Employer Identification Number (EIN)**: Required for tax purposes and hiring employees. - **Drafting an operating agreement**: Although not mandatory in Florida, this document outlines the management framework and operating procedures. - **Understanding ongoing compliance requirements**: This includes filing annual reports and maintaining a registered agent to ensure your LLC remains in good standing.

Frequently asked questions about the 2024 formation

Navigating the LLC formation process can raise questions. Here are some of the most frequently asked questions to clarify common concerns.

Utilizing pdfFiller for a seamless document experience

pdfFiller is designed to eliminate the hassle of paperwork involved in filing your 2024 Florida Limited Liability Form. Users can easily fill out, edit, and sign their PDF documents from any device with internet access.

**How to use pdfFiller to fill out the 2024 Florida Limited Liability Form**: To begin, simply upload your form to the pdfFiller platform, where you can fill in the necessary details conveniently. The user-friendly interface guides you through each section for a complete and accurate submission.

The platform also offers collaboration features, allowing teams to engage in real-time editing and decision-making. This can greatly improve efficiency when multiple stakeholders are involved in the business formation process.

Security is a top priority for pdfFiller, as it securely stores documents in the cloud, meaning users can access and manage critical documents from anywhere without the worry of physical storage issues.

Unique considerations for 2024 filings

As you prepare to file your 2024 Florida Limited Liability Form, it's essential to be aware of recent legislative changes that may impact LLC operations. Updated regulations focused on enhancing transparency and compliance are now in effect, and they could require modifications in how LLCs report certain activities.

Additionally, trends towards sustainability in business practices are becoming increasingly prominent. The push for ESG (Environmental, Social, and Governance) reporting can affect how you position your LLC in the market. Awareness of these factors now will better equip you to address future regulatory challenges as they arise.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2024 florida limited liability directly from Gmail?

How can I send 2024 florida limited liability for eSignature?

Can I create an electronic signature for signing my 2024 florida limited liability in Gmail?

What is 2024 florida limited liability?

Who is required to file 2024 florida limited liability?

How to fill out 2024 florida limited liability?

What is the purpose of 2024 florida limited liability?

What information must be reported on 2024 florida limited liability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.