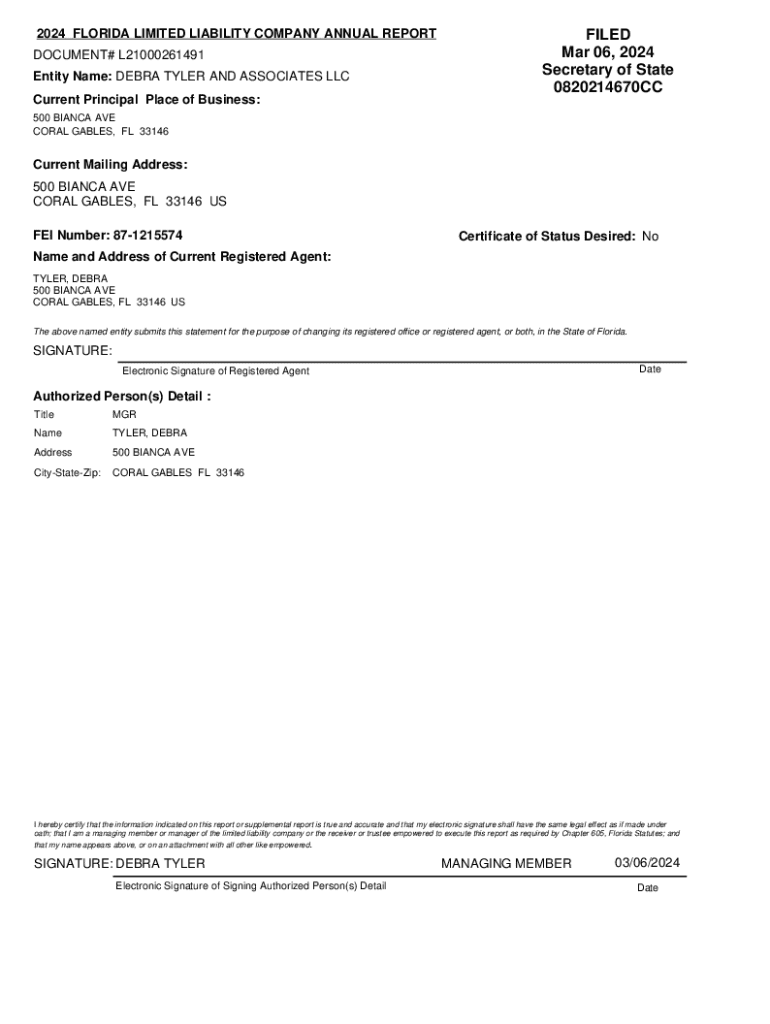

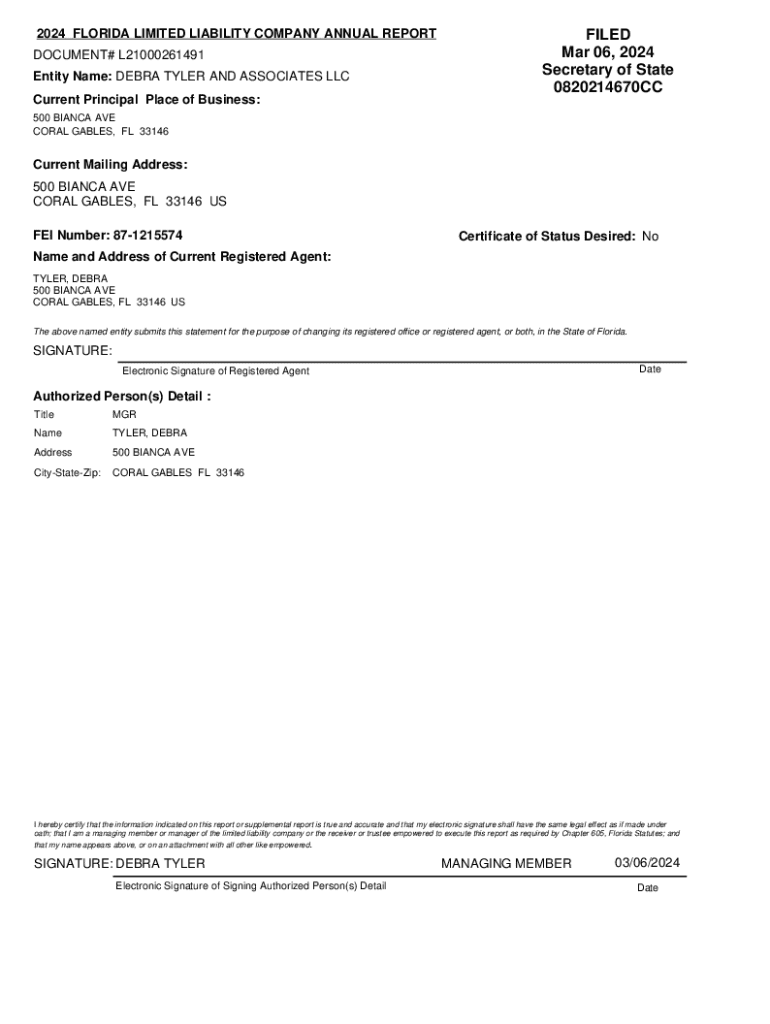

Get the free 2024 Florida Limited Liability Company Annual Report

Get, Create, Make and Sign 2024 florida limited liability

Editing 2024 florida limited liability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida limited liability

How to fill out 2024 florida limited liability

Who needs 2024 florida limited liability?

2024 Florida Limited Liability Form: A Comprehensive How-to Guide

Overview of Florida Limited Liability Companies (LLCs)

A Florida Limited Liability Company (LLC) is a popular legal structure that combines elements of both corporations and partnerships. By forming an LLC, business owners can protect their personal assets while enjoying the flexibility of management and tax benefits. Unlike sole proprietorships or partnerships, an LLC provides liability protection, meaning members are typically not personally liable for business debts.

One significant advantage of forming an LLC in Florida is the state's favorable business climate, which includes no state income tax on individuals. Additionally, Florida allows for a single-member LLC, making it accessible for solopreneurs. Unlike corporations, LLCs are less formal and do not require extensive record-keeping, enhancing their appeal.

Key requirements for forming a Florida

To form a Florida LLC, certain eligibility criteria must be met. Primarily, the company cannot be a bank or an insurance company, and members must be at least 18 years old. Additionally, the LLC must choose a unique name that is distinguishable from existing businesses and complies with Florida naming regulations.

The name must include 'Limited Liability Company' or an abbreviation like 'LLC' or 'L.L.C.' Members should also decide on a management structure, which can be member-managed, where all members participate in daily operations, or manager-managed, where specific members are designated to handle management duties.

Essential documentation for 2024 Florida limited liability form

The pivotal document for forming an LLC in Florida is the Articles of Organization. This form officially registers your LLC with the state. When filling out the Articles, you'll need to provide essential information such as the business name, principal address, registered agent's name and address, and details regarding the management structure.

Along with the Articles of Organization, you may also need additional documents such as an Operating Agreement, which outlines the management structure and operational guidelines for the LLC. While this is not required by the state, it's highly recommended to safeguard your rights and obligations as a member.

Step-by-step guide to filing the 2024 Florida limited liability form

Filing the 2024 Florida limited liability form involves several steps that require careful preparation. Start by gathering all necessary information related to your LLC, including addresses, management structure, and registered agent details.

Next, navigate to the Florida Division of Corporations website, where you’ll find the filing options available. Choose between online filing or the traditional mail submission. Online filing is typically faster and allows you to receive immediate confirmation. Ensure you fill out the form correctly, paying close attention to each section.

Common mistakes include incorrect name spelling or missing information about the registered agent. A thorough review ensures a smooth submission process.

Managing your filing process

After filing your 2024 Florida limited liability form, it's crucial to track the status of your application. You can do this through the Florida Division of Corporations website, which provides a section for checking filing statuses. Understanding the associated fees is equally important. Currently, the cost to file the Articles of Organization in Florida is around $125, but be prepared for additional costs if opting for expedited services.

Typically, the processing time for LLC formation can take up to two weeks, but this might vary based on the volume of applications being processed. If you require faster service, express options are available, which can reduce processing time significantly.

Post-filing steps for your Florida

Once your Florida LLC is established, obtaining a Federal Employer Identification Number (FEIN) is essential. This unique identifier is used for tax purposes and is often required when opening a business bank account or hiring employees. The application for an FEIN can be completed online through the IRS website and is free of charge.

In addition to obtaining a FEIN, ensure you comply with any local licensing or permitting requirements relevant to your specific business. Florida may have industry-specific regulations, and it’s advisable to consult local authorities. Reporting of beneficial ownership information may also be necessary depending on the structure and ownership of your LLC.

Troubleshooting common issues

If your filing was rejected, it's crucial to understand the reason behind it. Common issues can include incomplete information, incorrect fees, or name conflicts. The state provides feedback on why a submission may not meet requirements, which can guide you in making the necessary corrections.

To correct a rejected filing, gather the required information, make the necessary adjustments on the form, and resubmit to the Florida Division of Corporations. If you need to retrieve copies of your filed Articles of Organization, you can request them through the state’s online services.

Understanding ongoing compliance and reporting requirements

Every Florida LLC has annual reporting obligations that require submitting an Annual Report to the state. This report updates the state on changes in the business, such as current addresses and members. The fee for filing this report is approximately $138.75, and it’s typically due each year by May 1.

Maintaining accurate records is vital for operational efficiency and compliance. Ensure that all meetings, decisions, and financial records are documented. Additionally, be aware of when amendments to your Articles of Organization may be necessary, such as changes in management or business activities, to keep your registration accurate.

Frequently asked questions (FAQs)

Prospective business owners often have similar questions regarding LLC formation in Florida. One common question is about the basic costs to form an LLC. The initial filing fee for the Articles of Organization is around $125, and annual fees apply subsequently for ongoing compliance.

Many wonder if it’s possible to change the name of their LLC after formation. Yes, this can be done by filing an amendment. Additionally, selecting a registered agent is another key choice; individuals often ask about the process. You can choose someone local or a registered agent service to fulfill this requirement.

Advanced considerations for LLCs in Florida

When exploring LLCs in Florida, one advanced consideration is the Professional LLC (PLLC), which is specifically for licensed professionals such as doctors and lawyers. This structure provides limited liability while complying with specific regulations applicable to their professions. Additionally, understanding the tax implications of forming an LLC is crucial, as the structure can influence both federal and state taxation.

LLCs can take advantage of Pass-through taxation, where profits and losses can be reported on personal tax returns, avoiding double taxation. Alternatively, LLCs can opt for corporate taxation if it aligns better with their financial strategy.

Interactive tools and resources

Utilizing tools available on pdfFiller can significantly streamline the process of creating and managing your 2024 Florida limited liability form. The platform offers innovative features that allow users to edit PDFs, eSign, collaborate with team members, and manage documents efficiently. You can access templates specifically designed for Florida LLCs to simplify the completion process.

Additionally, pdfFiller provides customer support for assistance in filling out forms and ensuring compliance with state requirements. Whether you're creating, signing, or storing your documents, pdfFiller's cloud-based platform caters to various document needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2024 florida limited liability online?

Can I create an eSignature for the 2024 florida limited liability in Gmail?

How do I edit 2024 florida limited liability on an iOS device?

What is 2024 florida limited liability?

Who is required to file 2024 florida limited liability?

How to fill out 2024 florida limited liability?

What is the purpose of 2024 florida limited liability?

What information must be reported on 2024 florida limited liability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.