Get the free Application for Installment Payment of Property Taxes

Get, Create, Make and Sign application for installment payment

How to edit application for installment payment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for installment payment

How to fill out application for installment payment

Who needs application for installment payment?

Comprehensive Guide to Application for Installment Payment Form

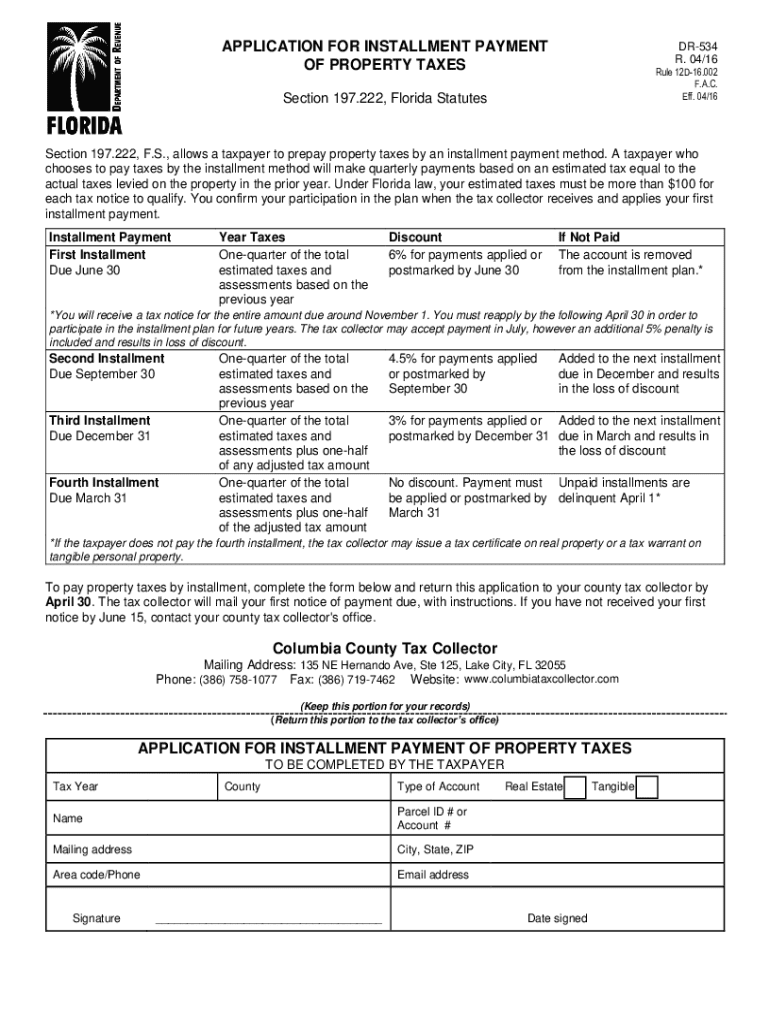

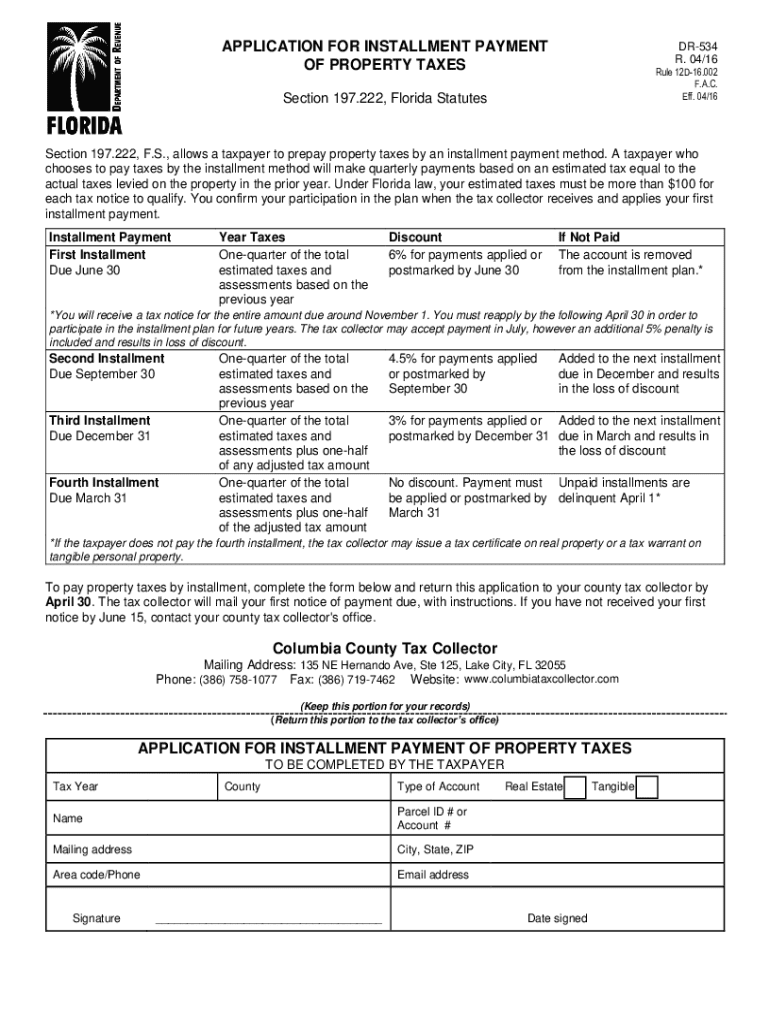

Understanding the installment payment form

An application for installment payment form is a crucial document that allows consumers and businesses to structure payments over a set period instead of a single upfront cost. By utilizing this form, individuals and organizations can manage significant purchases more easily without the burden of immediate full payment. The purpose of the form is to provide a clear and structured agreement that outlines the payment terms, including amounts and timelines involved, ensuring both parties are informed and protected.

Key components of the installment payment form

Various elements must be included in the application for installment payment form to ensure clarity and legality. The personal information section collects essential data required for identification and processing, like name, address, and Social Security number for individuals or Tax ID for businesses. This formal identification ensures that lenders can verify the identity of the person applying for credit.

The payment plan details section typically outlines the amount financed, the interest rate, payment frequency, and terms of agreement. Furthermore, the authorization section requires the applicant's signature and the date of signing, which serves as a legal agreement, binding both parties to the terms specified in the document.

Step-by-step guide to filling out the form

Filling out the application for installment payment form can be simplified into manageable steps to ensure accuracy and completeness. First, prepare your information by gathering necessary documents such as proof of income, recent credit history, and any other financial documentation that might support your application. Understanding your financial situation will help you accurately fill out payment details and agree to terms you can manage.

Next, completing the form itself involves filling in your personal information accurately, specifying the payment details like amounts and interest rates, and providing any additional information if required by the lender. It’s crucial to review your completed sections thoroughly to ensure accuracy before submitting, as mistakes can lead to delays or denials.

An important tool to consider is pdfFiller for editing your form. Users can upload the application for installment payment form to pdfFiller, which provides editing tools to make necessary corrections easily. This ensures that all information is precise, making the application process smoother.

Signing and submitting the installment payment form

Once the form is completed, you'll need to sign and submit it for processing. Electronic signatures have become increasingly popular due to their convenience. Using pdfFiller's eSignature functionality allows users to sign forms digitally, offering several advantages such as enhanced security and ease of use.

Additionally, submitting the application can typically be done in various ways. An online submission is often quicker and allows for immediate confirmation of receipt, while printing and mailing might be preferred in certain situations. Ensure to confirm that the application has been received by following up with the relevant institution.

Managing your installment payment agreement

After securing your installment payment agreement, it's vital to stay organized and keep track of your payment schedule. Tools available on pdfFiller can aid in monitoring payments through notifications and alerts, so you never miss a due date.

If life circumstances change and you need to modify your installment plan, it's essential to understand the steps involved. Documentation will be crucial when attempting to make changes to your agreement, and maintaining thorough records will facilitate the process.

Common challenges and solutions

Filling out the application for installment payment form can be error-prone if not approached carefully. Typical errors include missing information or providing incorrect financial details, both of which can result in delays in approval or outright denials. Ensuring that all sections are completed accurately is vital.

If you encounter issues, quick resolution is key. Options include contacting support via pdfFiller to rectify problems directly. Utilizing templates within pdfFiller can reduce errors by providing a structured format that's easy to follow, thus ensuring you don’t overlook any critical details.

Advantages of using pdfFiller for your installment payment form

Choosing pdfFiller to manage your application for installment payment form provides several significant benefits. First, the cloud-based nature of the platform allows access from anywhere, meaning that users can fill out, edit, track, and submit forms on-the-go, making it convenient and flexible for busy individuals and teams.

Moreover, pdfFiller’s collaboration features enable sharing with other team members or partners for real-time edits and feedback. Users can work together efficiently while maintaining comprehensive document management, keeping forms organized and tracking changes throughout the process.

Frequently asked questions

When navigating the application for installment payment form process, you may have some common questions. For instance, what happens if my application is denied? It’s essential to review the specifics outlined in the denial letter and understand the reasons provided. Often, these can be rectified by providing additional documentation or addressing concerns raised.

Another common query involves disputing payment terms. If you believe there’s a discrepancy, contacting your lender to clarify or negotiate is crucial. Lastly, pdfFiller offers a variety of resources that can help in filling out specific forms correctly, ensuring that all users are well-informed and supported throughout their document management journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my application for installment payment in Gmail?

Can I create an electronic signature for the application for installment payment in Chrome?

How can I fill out application for installment payment on an iOS device?

What is application for installment payment?

Who is required to file application for installment payment?

How to fill out application for installment payment?

What is the purpose of application for installment payment?

What information must be reported on application for installment payment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.