Get the free Ct-1041

Get, Create, Make and Sign ct-1041

Editing ct-1041 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-1041

How to fill out ct-1041

Who needs ct-1041?

CT-1041 Form: A Comprehensive How-to Guide

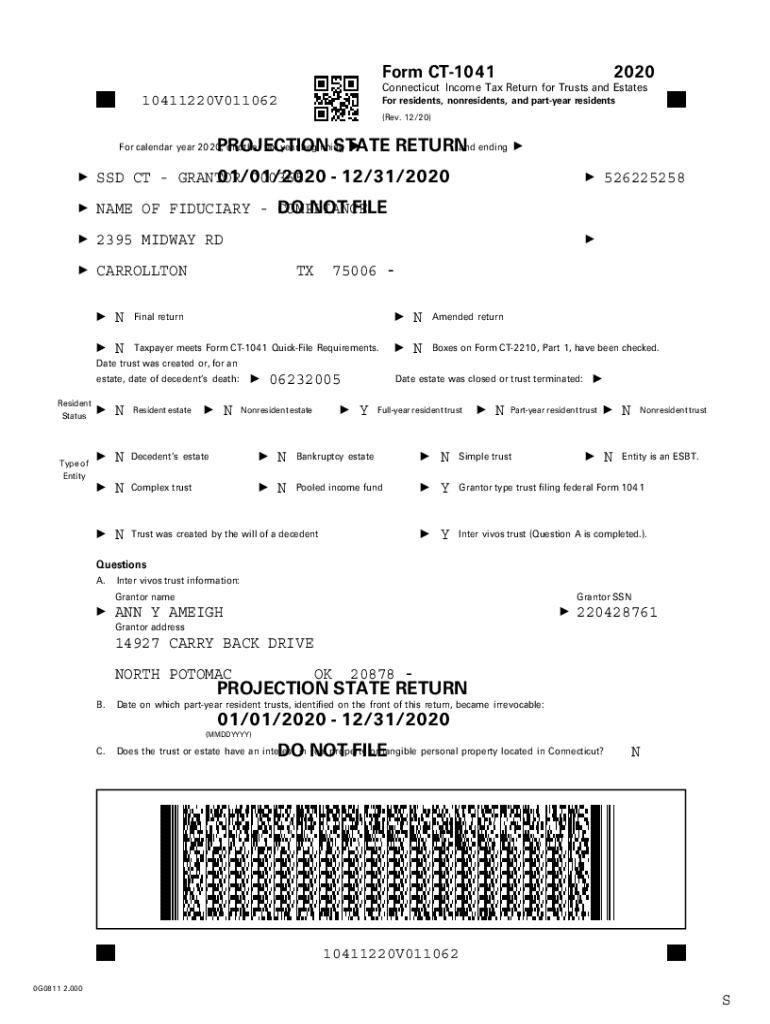

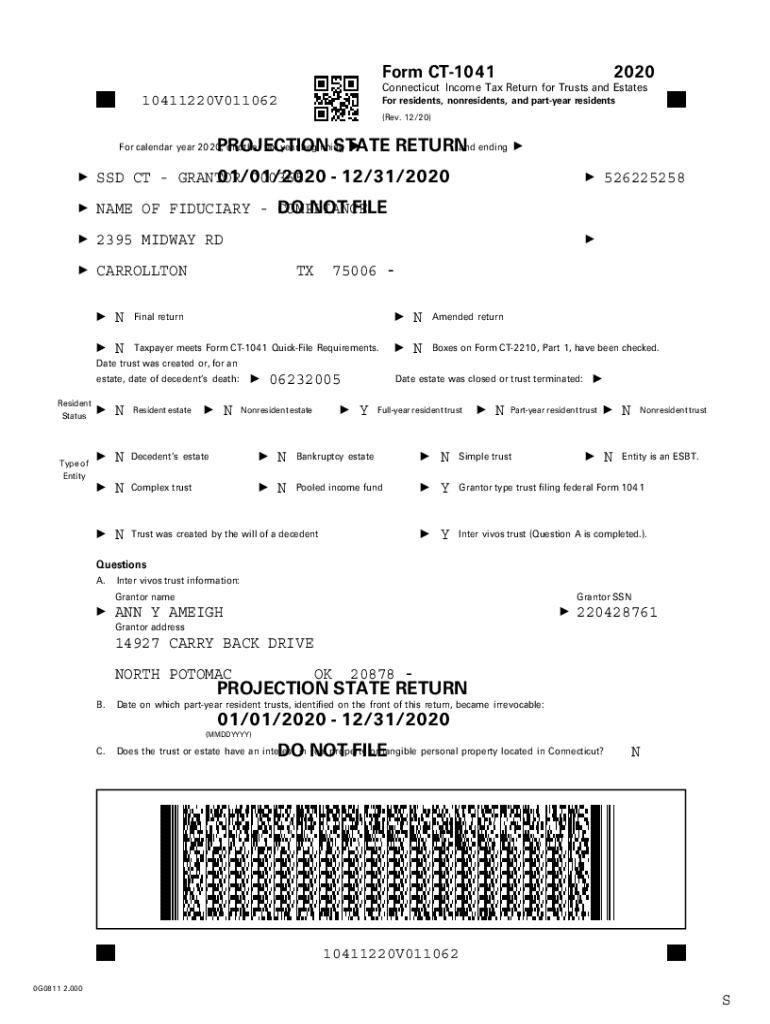

Understanding the CT-1041 form

The CT-1041 form is the Connecticut fiduciary income tax return, specifically designed for reporting the income, deductions, and tax liability for estates and trusts. Filing this form is crucial for managing the tax obligations that arise when managing an estate or trust, ensuring compliance with Connecticut state tax laws.

For estates and trusts filed in Connecticut, the CT-1041 form serves as an essential tool in maintaining transparency and accountability, allowing the state to assess the tax responsibilities of fiduciaries. Accurately completing this form can help mitigate potential legal issues and ensure that the estate or trust is managed in accordance with the law.

Preparing to fill out the CT-1041 form

Before filling out the CT-1041 form, it is vital to gather all necessary documentation to ensure a smooth filing process. This includes prior tax returns, income statements for the estate or trust, asset valuations, and any relevant financial records. A comprehensive checklist of these documents may include: personal identification, income and expense records, and materials outlining distributions to beneficiaries.

Effective record-keeping is crucial, not only for compliance but also for facilitating accurate tax calculations. Missing documentation can lead to errors in reporting, potentially resulting in penalties or delays in processing. Understanding the tax implications for estates and trusts is also paramount, as the income generated is often taxed differently compared to individual filers. For example, the accumulated income in a trust may not be taxed at the personal income rate but at a fiduciary rate, which can influence the overall tax strategy.

Step-by-step instructions for completing the CT-1041 form

Filling out the CT-1041 form involves a series of steps. Start with the header section, where you will denote the name of the estate or trust, its address, and employer identification number (EIN). This section sets the context for the entire return.

Next, move to the income section, which requires you to categorize various types of income such as dividends, interest, and rental income. Reporting these accurately requires understanding how to differentiate income types and their respective tax treatments. Following the income section, document any deductions and adjustments pertinent to the estate or trust. Common deductions may include trustee fees, attorney fees, and legitimate expenses incurred in managing the estate or trust.

After inputting the income and deductions, compute the tax liability based on the reported figures. Utilize the tax rates and brackets specifically applicable to estates and trusts to determine the owed tax accurately. Finally, don’t forget the signature section, where the fiduciary or authorized individual must sign, thereby attesting to the accuracy of the information provided. Be mindful of filing deadlines and potential penalties for late submissions to avoid complications.

Editing and managing the CT-1041 form

Once you have filled out the CT-1041 form, you may need to edit or manage it further. Using tools like pdfFiller can simplify the editing process. pdfFiller allows for drag-and-drop editing, enabling users to make adjustments quickly. You can easily add text, images, or signatures without hassle, making it highly efficient for tax professionals or individuals managing multiple estates.

Furthermore, the platform provides capabilities for electronically signing the CT-1041 form, which is becoming increasingly important as digital document management becomes the norm. Secure eSigning ensures that the form is legally binding while providing a streamlined process for getting approvals. Collaboration features in pdfFiller also allow you to share the completed form with tax advisors or co-fiduciaries for review. This interactive approach to managing tax documents aids in ensuring accuracy and compliance while enhancing communication.

Frequently asked questions (FAQs) about the CT-1041 form

Filing the CT-1041 form can present various challenges for fiduciaries. One common issue faced by many is understanding the nuances of income categorization. Incorrectly reporting income types can lead to audits or penalties. To mitigate these challenges, thorough research and consultations with tax professionals are recommended. Keeping updated with state tax laws and regulations can also alleviate most filing challenges.

Accuracy is a critical component when completing the CT-1041 form. Common mistakes include incorrect EIN entries, misclassification of income or deductions, and missed deadlines. To ensure accuracy, double-check all figures and consider creating a checklist for the necessary documentation. Consistency in record-keeping and timely filing can prevent many of the issues faced when managing estates and trusts.

Additional insights and tips

For anyone involved in managing an estate or trust, establishing best practices for filing is essential. Organizing financial records and keeping detailed notes on income and expenditures can make future filings significantly easier. Explore digital tools like pdfFiller not only for completing the CT-1041 form but also for ongoing estate management.

Being aware of changes in tax laws that could impact the CT-1041 form is also crucial. Connecticut may amend its tax rates or regulations, which can have immediate effects on both current and future filings. Staying engaged with professional resources or local tax authorities can provide timely updates on such changes, helping fiduciaries remain compliant. Preparation for ongoing management can mitigate the complexities associated with filing subsequent years’ CT-1041 forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ct-1041 without leaving Google Drive?

How can I send ct-1041 for eSignature?

How do I execute ct-1041 online?

What is ct-1041?

Who is required to file ct-1041?

How to fill out ct-1041?

What is the purpose of ct-1041?

What information must be reported on ct-1041?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.