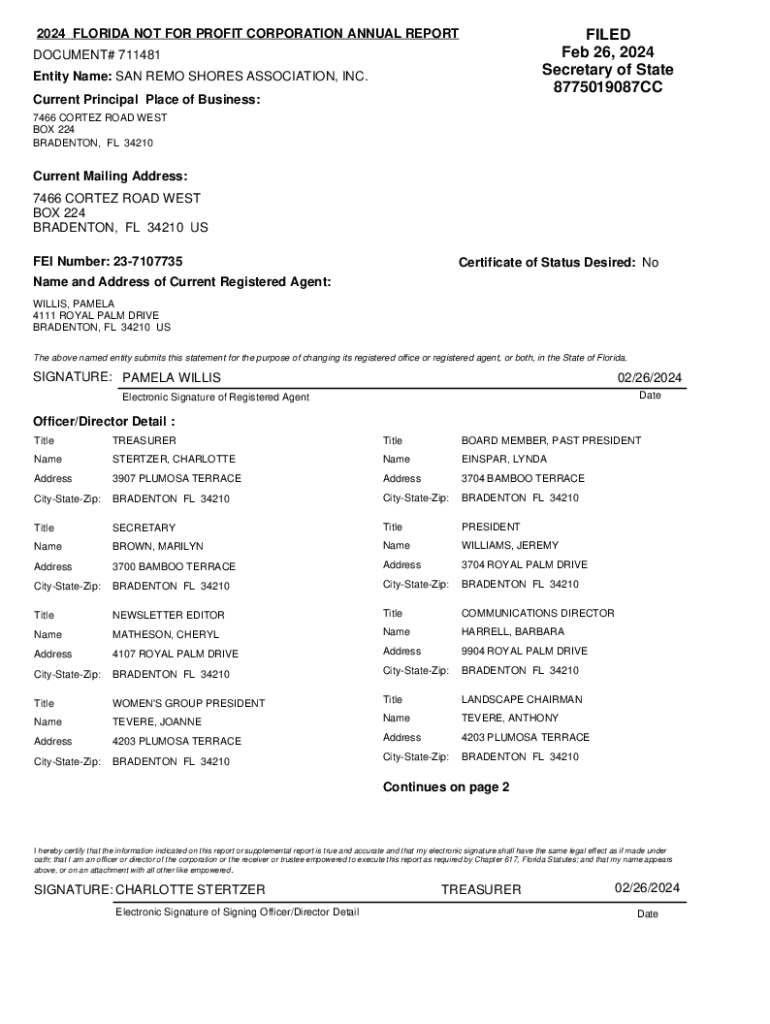

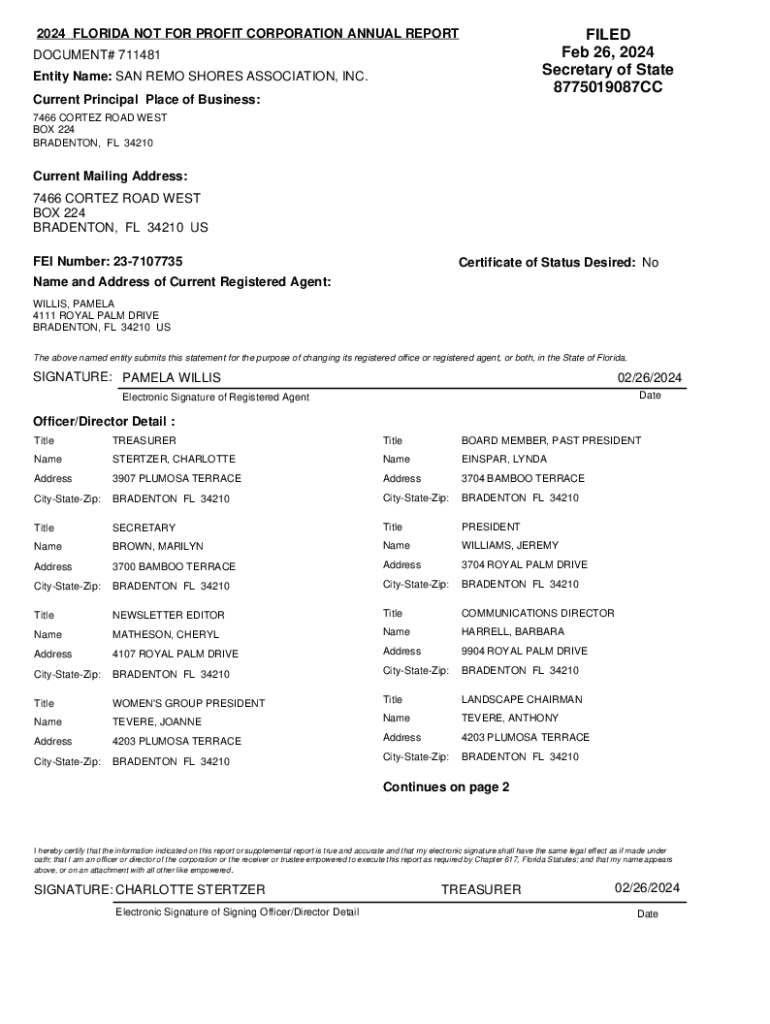

Get the free 2024 Florida Not for Profit Corporation Annual Report

Get, Create, Make and Sign 2024 florida not for

How to edit 2024 florida not for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida not for

How to fill out 2024 florida not for

Who needs 2024 florida not for?

2024 Florida Not For Form: A Comprehensive Guide

Understanding the 2024 Florida Not For Form

The 2024 Florida Not For Form serves a crucial role in various financial and legal processes across the state. This document is specifically designed to certify that a business or individual does not need to register for sales tax, in situations where they are not engaging in taxable activities. Whether you are a small business owner or an individual operating in a specific industry, understanding this form can help you navigate state regulations effectively.

Its importance cannot be overstated: failure to file this form may result in unnecessary tax obligations. Thus, knowing who needs to utilize the 2024 Florida Not For Form is vital.

Key features of the 2024 Florida Not For Form

The structure of the 2024 Florida Not For Form is tailored to ensure users can provide all necessary information clearly and efficiently. Each section of the form contains required fields that collect essential data such as the business name, nature of the services provided, and certification of non-taxable activities. A complete overview of these sections is crucial for effective completion.

Additionally, the interactive features of this form—especially when utilizing pdfFiller—allow you to edit the document easily. You can collaborate with your team seamlessly, ensuring that everyone involved in the filing process can stay updated on changes in real-time.

Step-by-step instructions for filling out the 2024 Florida Not For Form

Before you begin filling out the 2024 Florida Not For Form, gather all relevant documents and information necessary for accurate completion. This includes your business identification number, personal identification, and any records related to the nature of your business activities. Keeping these documents handy will streamline the process.

As you fill out the form, follow these detailed instructions section by section:

How to edit and sign the 2024 Florida Not For Form

Using pdfFiller’s editing tools, modifying the 2024 Florida Not For Form is straightforward. To begin editing, open the document in pdfFiller and select the sections you wish to adjust. The user-friendly interface allows you to insert text, images, and make various adjustments without hassle.

Once your edits are complete, signing the form electronically is just a few clicks away. Florida law recognizes electronic signatures as legally valid, streamlining the process and eliminating the need for physical paperwork.

Uploading and storing your form

After completing the 2024 Florida Not For Form, it’s essential to save your work properly. pdfFiller offers several cloud storage options that allow you to keep your documents secure and accessible from anywhere. You can save your progress at any time, ensuring that you don’t lose valuable information.

To keep track of document versions easily, use pdfFiller's version management tools that allow you to revert to previous versions if needed, facilitating better organization and clarity.

Frequently asked questions (FAQs)

Navigating the 2024 Florida Not For Form can bring up various questions. Common queries include what to do if a mistake is made on the form after submission and whether it is possible to amend the form once filed. It is critical to understand that minor errors can often be corrected through amendments or resubmissions, so staying informed is key.

Additionally, if you encounter technical difficulties while using pdfFiller, their support team is ready to assist with troubleshooting common issues and offering guidance.

Payment options for filing

Understanding filing fees associated with the 2024 Florida Not For Form is important for individuals and businesses alike. Generally, fees can vary based on the type of submission; hence, familiarity with these costs ensures no unexpected financial surprises arise.

If you miss the filing deadline, there may be consequences, including late fees or penalties. It’s essential to address late submissions promptly by contacting the relevant state government offices to learn about options available to you.

Monitoring your form status

After submitting the 2024 Florida Not For Form, keeping track of its status is vital. Follow specific steps within the state’s online systems to verify your form’s processing status. Timelines may vary, but generally, updates should be available within a few weeks.

Once your submission is confirmed, you will want to obtain a filed copy of the form. Keep these confirmation documents safe, as they may be required for future reference.

When and how to make changes to the filed form

Realizing an error after filing doesn’t have to be daunting. The process of correcting mistakes via an amendment is typically straightforward. You can file an amendment with the same office where you submitted your original form.

For subsequent amendments or updates, understand that while some adjustments may come with associated fees, addressing these changes timely will keep your filings accurate and in compliance with Florida regulations.

Related forms and documentation

Florida residents may encounter several other forms relevant to their tax and legal obligations beyond the 2024 Florida Not For Form. Familiarizing yourself with these forms, such as applications specific to business licenses or local tax exemptions, can streamline overall compliance.

In addition to the primary form, other documentation may be required to accompany your submission, ensuring that you meet all necessary criteria set out by the state.

Tips for successful form management

To maximize your efficiency with the 2024 Florida Not For Form, employing best practices for document management is essential. Organize your forms on pdfFiller to allow for easy access and tracking. Setting reminders for important filing deadlines can help you stay proactive and avoid last-minute scrambles.

Consider integrating pdfFiller with other productivity tools you use to enhance your workflow. This integration will support the seamless management of your documents across various platforms, reducing the risk of oversight.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2024 florida not for online?

How can I edit 2024 florida not for on a smartphone?

How do I edit 2024 florida not for on an Android device?

What is 2024 florida not for?

Who is required to file 2024 florida not for?

How to fill out 2024 florida not for?

What is the purpose of 2024 florida not for?

What information must be reported on 2024 florida not for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.