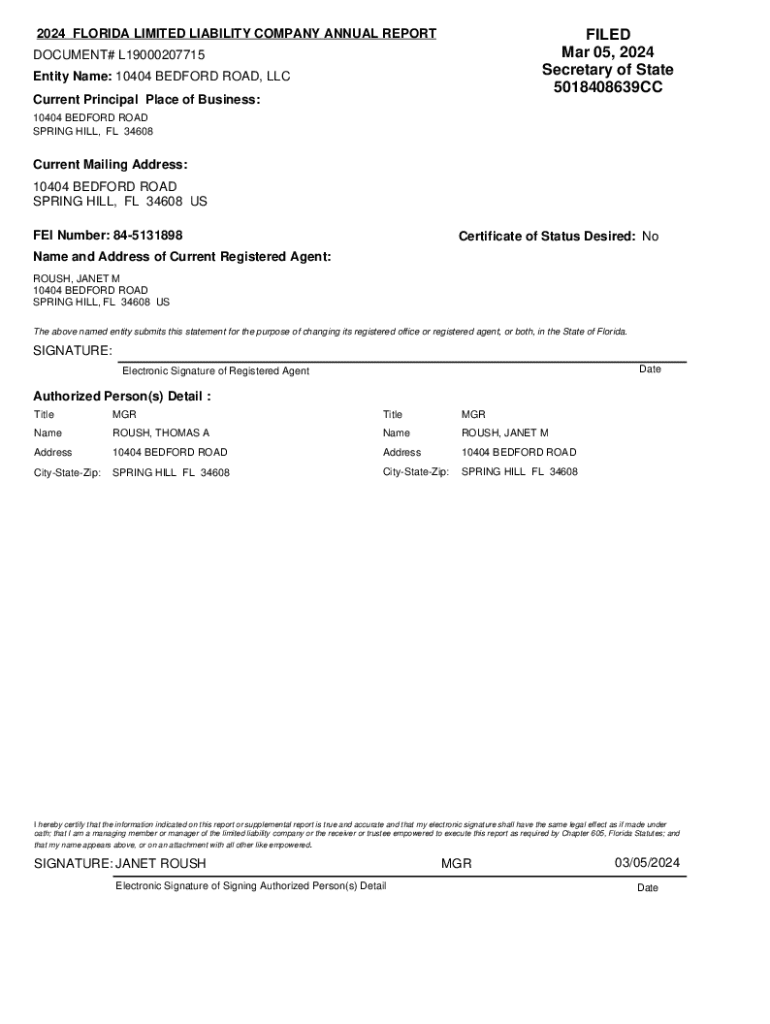

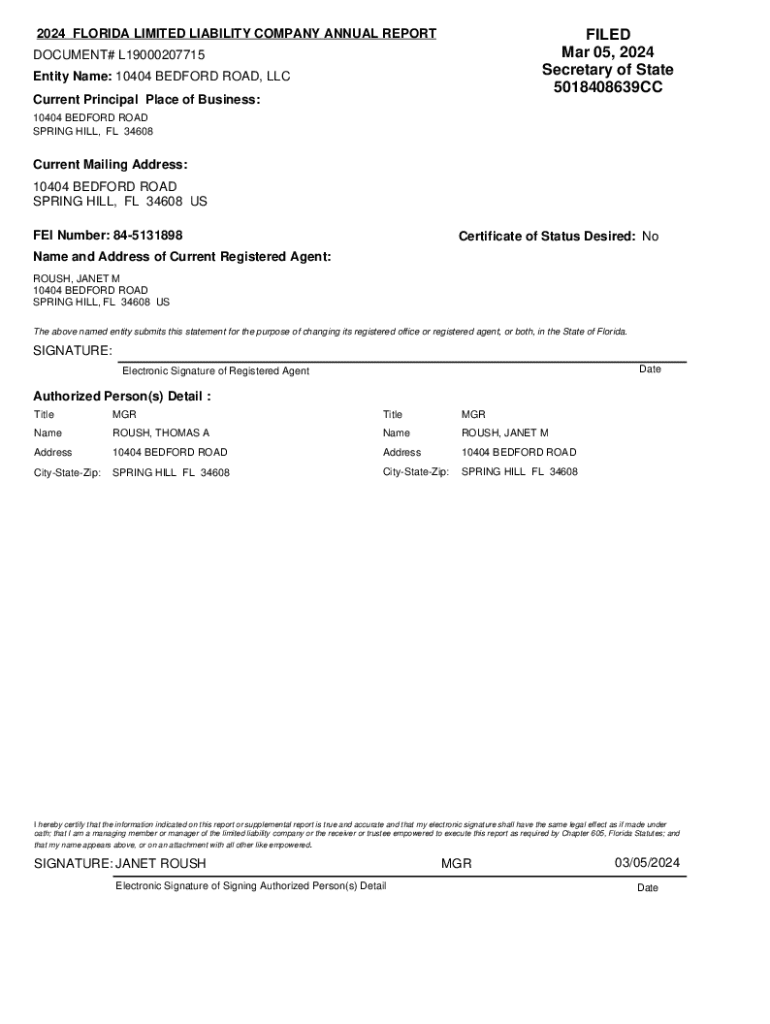

Get the free 2024 Florida Limited Liability Company Annual Report

Get, Create, Make and Sign 2024 florida limited liability

Editing 2024 florida limited liability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida limited liability

How to fill out 2024 florida limited liability

Who needs 2024 florida limited liability?

2024 Florida limited liability form: A complete guide to forming your

Understanding the Florida limited liability company ()

A Limited Liability Company (LLC) in Florida is a popular business structure that combines the benefits of both corporations and partnerships. An LLC provides its owners, known as members, with limited liability protection, ensuring that personal assets are safeguarded against the company's debts and liabilities.

One of the primary benefits of forming an LLC in Florida is the limited liability protection it offers. Unlike sole proprietorships and partnerships, an LLC protects the personal assets of its members from business-related lawsuits or debt. Additionally, LLCs enjoy pass-through taxation, meaning that profits and losses can be reported on the personal tax returns of the members, avoiding the double taxation typical of corporations.

Another advantage is the flexible management structure. Members can choose to manage the LLC themselves or appoint managers to handle daily operations. This allows for a customizable approach to management that suits the individual needs of the business.

Key terminology when discussing LLCs includes 'members' who are the owners of the LLC and 'managers' who may or may not be members and run the operations of the LLC. Understanding these terms is critical in navigating the formation and management of your LLC in Florida.

Preparing to form your in Florida

The journey to forming your LLC in Florida begins with careful preparation. This includes several key steps that will help you ensure that your company is set up for success.

Choosing a unique name for your

Start by selecting a name for your LLC that is unique and reflective of your business. Florida law requires that your LLC name includes 'Limited Liability Company' or an abbreviation like 'LLC'. It's best practice to check the name availability through the Florida Division of Corporations website to ensure your chosen name is not already in use.

Determining your management structure

Your LLC can be member-managed, where all members participate in running the business, or manager-managed, where specific members or outside individuals are designated to manage daily operations. Choose the structure that best fits your business goals and operational style.

Selecting a registered agent

A registered agent is an individual or business entity designated to receive official documents and legal papers on behalf of your LLC. In Florida, your registered agent must have a physical address within the state and be available during standard business hours. Ensure that your registered agent is reliable and responsible for handling critical communications.

Completing the Florida Articles of Organization

The Articles of Organization is a vital document that officially establishes your LLC in Florida. It outlines essential information about your business and must be filed with the Florida Division of Corporations.

Filling out the Articles of Organization involves several key sections, including your LLC name and address, registered agent information, and chosen management structure. Accuracy is critical: any errors can delay your application.

Common mistakes to avoid

When filing your Articles of Organization, ensure that all information is accurate to avoid common mistakes. Common errors include misspelled names, incorrect addresses, and failure to meet naming requirements. Double-check all details against Florida's naming guidelines to prevent unnecessary complications.

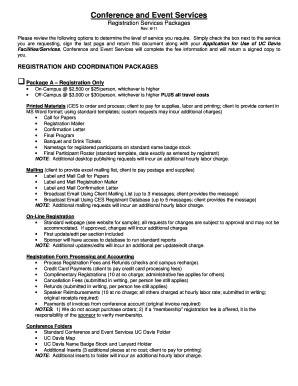

Tips for editing and collaborating on your form with pdfFiller

Utilizing pdfFiller can significantly streamline the editing and collaboration process for your documents. Features like cloud storage, e-signatures, and real-time collaboration facilitate effortless adjustments and ensure accuracy in your filings.

Filing your Articles with the state of Florida

Once your Articles of Organization are complete, it's essential to file them with the Florida Division of Corporations. You have several filing options: online or by mail. Online filing is generally faster and allows you to receive immediate confirmation.

For maximum efficiency, consider using pdfFiller, which enhances the electronic filing experience with easy document management, making it user-friendly and time-efficient.

Payment options for filing fees

When filing your Articles of Organization, be prepared to pay the applicable filing fees. As of 2024, the standard fee is $125 for filing, plus additional costs if you choose expedited services. Payment methods typically include credit/debit cards or electronic checks.

Post-filing requirements and considerations

After submitting your filing, you'll receive confirmation from the Florida Division of Corporations. Verify the acceptance of your filing by checking the status on their website. Processing times for LLC applications can vary, often taking an average of 5 to 10 business days.

Obtaining a federal employer identification number (EIN)

An EIN is necessary for tax purposes and hiring employees. Applying for an EIN is straightforward and can be done for free online through the IRS website. You’ll need this number to open a business bank account and file taxes.

Ongoing requirements for your Florida

Maintaining your Florida LLC requires compliance with ongoing obligations. Annually, LLCs must file a report with the Florida Division of Corporations, updating any changes in the business's structure or registered agent information.

Troubleshooting common issues

While forming your LLC is straightforward, issues can arise. If your filing is rejected, common reasons may include inaccurate details or failure to comply with naming conventions. To rectify a rejected filing, carefully review the feedback provided by the Florida Division of Corporations and resubmit your corrected Articles of Organization.

If you need to change your LLC name after formation, be prepared to file an amendment with the same division. This process involves submitting specific forms and may include additional fees.

Advanced considerations for formation

For professionals, Florida allows the establishment of Professional LLCs (PLLCs), which are specifically designed for licensed professionals such as doctors and lawyers. Additionally, converting an existing business structure into an LLC is feasible by following the state's procedures for conversion.

If you operate in multiple states, registering a foreign LLC in Florida may be necessary. This involves filing additional documents and designating a registered agent within the state. Understanding these advanced considerations will ensure your LLC complies with Florida’s regulations.

Frequently asked questions (FAQs)

Potential LLC owners frequently have several questions when navigating the formation process. Here are answers to some common queries:

Interactive tools and resources

Utilizing pdfFiller offers a seamless experience for filling out your Florida limited liability form. With features like editing, e-signing, and document management, pdfFiller empowers you to manage all your business documents in one platform. The interactive tools allow for easy edits, ensuring that your articles and all related forms are accurate and professionally presented.

As you navigate the LLC formation process in 2024, leverage pdfFiller's solutions to streamline your documentation. This ensures that you meet all requirements efficiently and with the definitive support needed for a successful business launch.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2024 florida limited liability without leaving Google Drive?

How can I get 2024 florida limited liability?

Can I edit 2024 florida limited liability on an Android device?

What is 2024 florida limited liability?

Who is required to file 2024 florida limited liability?

How to fill out 2024 florida limited liability?

What is the purpose of 2024 florida limited liability?

What information must be reported on 2024 florida limited liability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.