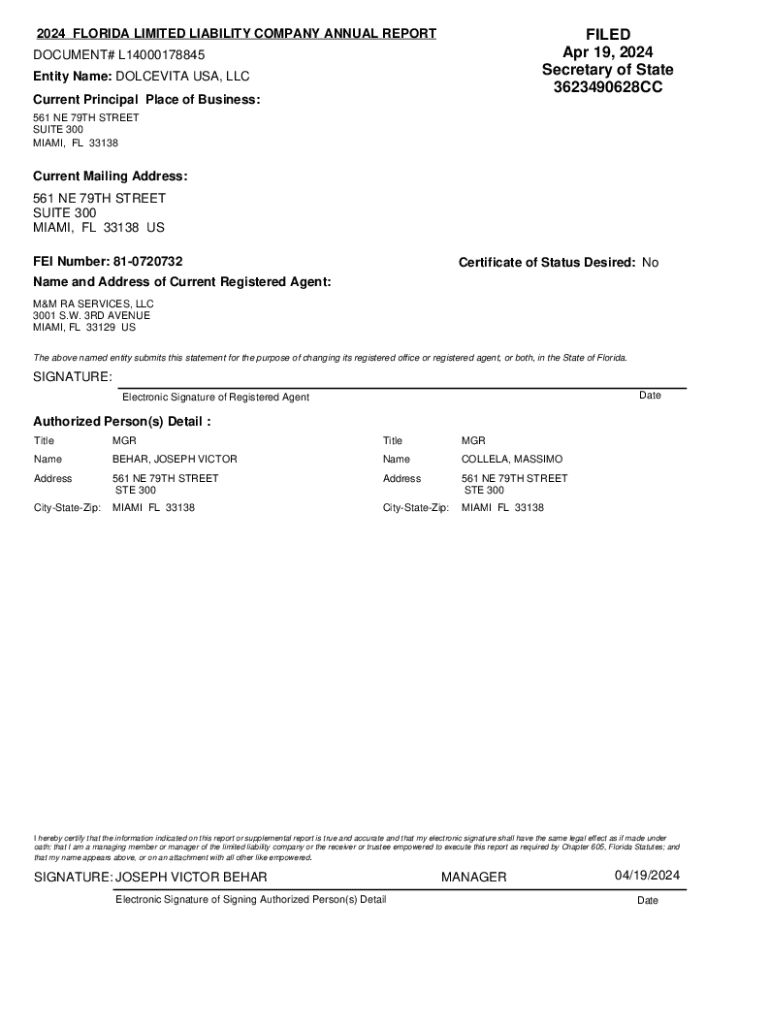

Get the free 2024 Florida Limited Liability Company Annual Report

Get, Create, Make and Sign 2024 florida limited liability

How to edit 2024 florida limited liability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida limited liability

How to fill out 2024 florida limited liability

Who needs 2024 florida limited liability?

2024 Florida Limited Liability Form: A Comprehensive Guide

Understanding Florida Limited Liability Companies (LLCs)

A Limited Liability Company (LLC) is a popular business structure that combines the benefits of both a corporation and a partnership or sole proprietorship. In Florida, LLCs are widely used due to their flexibility and liability protection. The personal assets of the owners, known as members, are protected from the liabilities of the business, which means that if your LLC faces lawsuits or debts, your personal finances typically remain unaffected.

There are several key benefits to forming an LLC in Florida, including limited liability protection, which safeguards personal assets from business debts, and a flexible management structure that can adapt to the needs of its members. Additionally, LLCs enjoy pass-through taxation, meaning the income is taxed at the individual level rather than at the corporate level.

When compared to other business structures like corporations or sole proprietorships, LLCs offer a unique balance of benefits that appeal to many business owners in Florida.

Essential requirements for forming an in Florida

To form an LLC in Florida, several essential requirements must be met. First, you need at least one member—an individual or another legal entity. Importantly, Florida does not impose a maximum limit on the number of members, making it flexible for various business arrangements.

Another significant factor is the choice of management structure. LLCs in Florida can be member-managed, where members actively participate in operating the business, or manager-managed, where members designate one or more managers to handle operations.

Naming your LLC also comes with specific requirements. The name must be unique and distinguishable from existing businesses registered in Florida, and it must include the words 'Limited Liability Company' or the abbreviation 'LLC' or 'L.L.C.'.

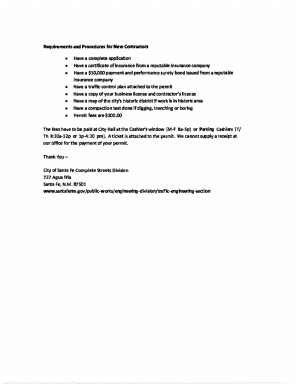

Preparing to fill out the 2024 Florida Limited Liability Form

The Articles of Organization form is the primary document required to establish your LLC. Before you fill it out, gather essential information such as your desired business name, the principal office address where the LLC will conduct its activities, and registered agent details, who is responsible for receiving legal documents on behalf of the LLC.

When preparing the form, you should also clarify the management structure of your LLC, indicating whether it will be managed by its members or by a designated manager. It's crucial to avoid common mistakes while completing the form, such as providing incorrect or incomplete information, which can lead to delays or rejections in your filing.

Step-by-step instructions to complete the Florida formation form

Below is a step-by-step guide to help you seamlessly navigate the completion of the 2024 Florida Limited Liability Form.

For e-filing, payment can be made using credit or debit cards, while mail-in applications require a check or money order. Always check the fee structure for the current year.

Payment options for filing your articles

As you prepare to file your LLC Articles of Organization, understanding the filing fees for 2024 is crucial. The fee for filing the Articles of Organization in Florida typically ranges from $125, which includes the state’s processing fees.

Payment methods vary depending on your filing choice. For e-filing, you can use a credit or debit card, while mail-in applications generally require payment via check or money order made out to the Florida Department of State.

Once your payment goes through, you can expect to receive confirmation via email or the postal service, notifying you of the system’s processing status.

Confirming your registration

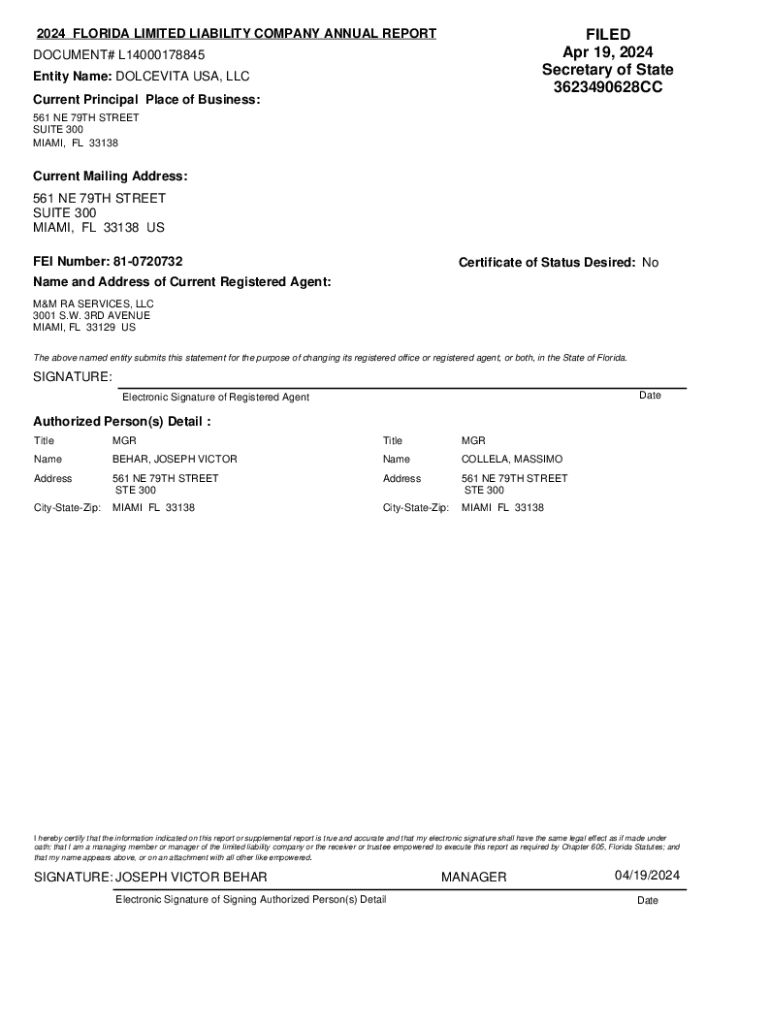

After you have filed your Articles of Organization, you will want to confirm your LLC registration. The Florida Division of Corporations allows you to check the status of your filing online through the Sunbiz website.

This step is essential to ensure you're officially recognized as an LLC and to maintain compliance with Florida state regulations.

Post-formation steps to consider

Once your LLC is officially registered, there are several important steps to consider to ensure smooth operations. First, you should obtain an Employer Identification Number (EIN) from the IRS, which is necessary for tax purposes and may be required to open a business bank account.

Next, drafting an Operating Agreement is recommended even though it is not mandatory in Florida. This document outlines the ownership structure and management procedures of the LLC, helping prevent future disputes among members.

Additionally, ensure that you comply with Florida’s licensing and permit requirements related to your specific business type. Lastly, filing the Beneficial Ownership Information report is also necessary as per federal compliance, which aids in transparency.

Frequently asked questions (FAQs)

As you navigate your LLC formation, here are some answers to common questions that may arise.

Additional tools and resources

To streamline the process of managing your LLC documentation, various tools are available that simplify form filling and document management. Consider utilizing interactive online tools that guide you through each form and allow for easy edits.

Additionally, downloadable templates and other required forms can be found on the Florida Division of Corporations website, helping you stay compliant with state regulations.

For personalized assistance, don't hesitate to reach out to professionals who can support you through the documentation and filing process.

Benefits of using pdfFiller for your documentation

pdfFiller empowers users to manage their LLC documentation efficiently within a cloud-based platform. With its intuitive editing features, you can easily fill out and modify your forms, ensuring that all necessary information is accurate and up-to-date.

Moreover, pdfFiller allows for electronic signatures, which simplifies the authentication process, enabling timely document completion without the hassles of physical paperwork.

Its collaboration features support teams working on LLC documents, allowing multiple users to edit and comment on files. With cloud storage, you can access your critical documents from anywhere, ensuring that your LLC documentation is always at your fingertips.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2024 florida limited liability for eSignature?

How do I execute 2024 florida limited liability online?

How do I complete 2024 florida limited liability on an iOS device?

What is 2024 florida limited liability?

Who is required to file 2024 florida limited liability?

How to fill out 2024 florida limited liability?

What is the purpose of 2024 florida limited liability?

What information must be reported on 2024 florida limited liability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.