Get the free Rental Property Tax Organizer

Get, Create, Make and Sign rental property tax organizer

Editing rental property tax organizer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out rental property tax organizer

How to fill out rental property tax organizer

Who needs rental property tax organizer?

Comprehensive Guide to the Rental Property Tax Organizer Form

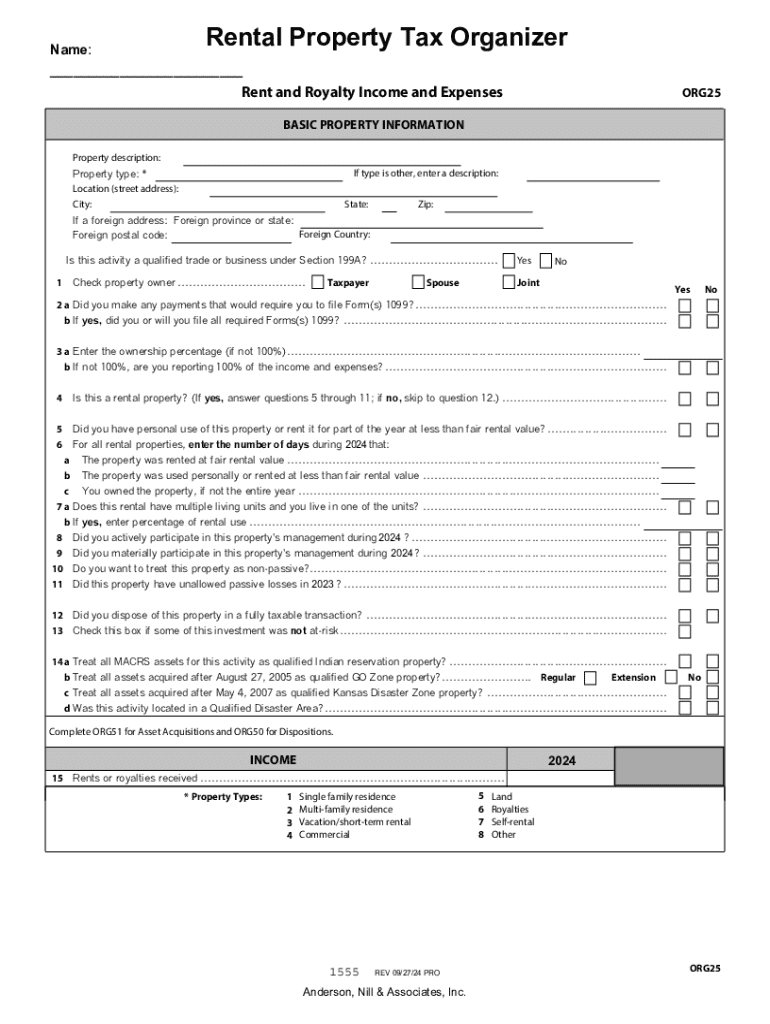

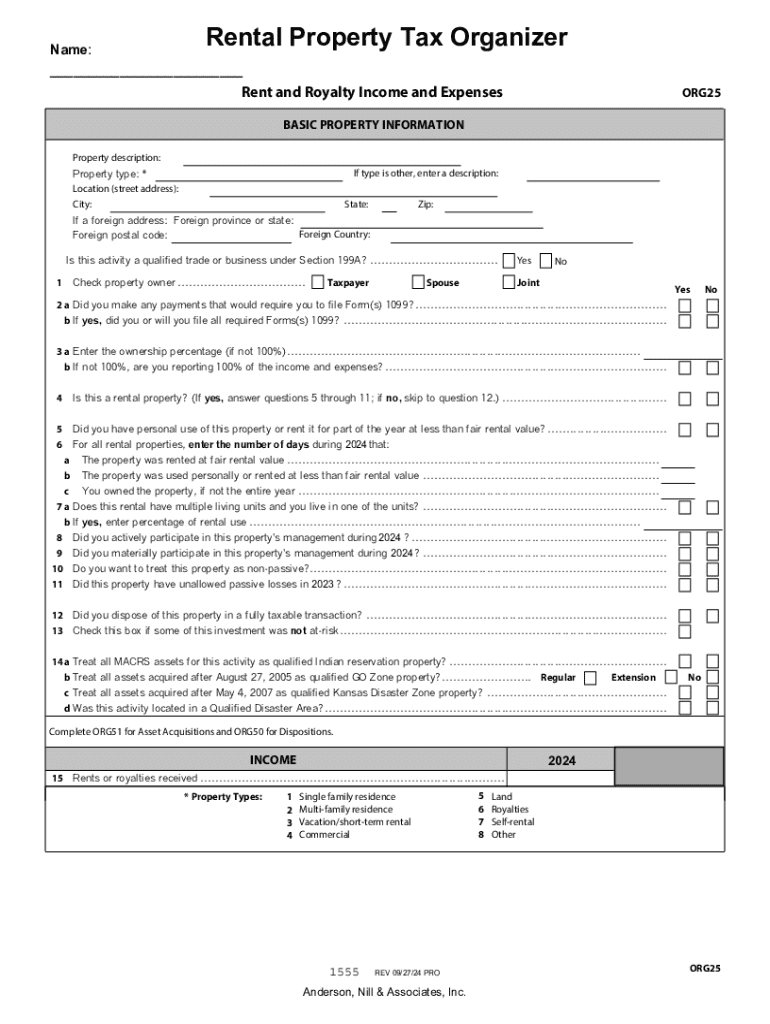

Understanding the rental property tax organizer form

The rental property tax organizer form is a vital tool designed to streamline the tax filing process for property owners and managers. This form serves to collect, organize, and present all relevant rental income and expense data to ensure compliance with tax regulations. Providing a clear structure, it helps identify and categorize the necessary information for accurate reporting.

For property owners and managers, this organizer is indispensable, simplifying what could otherwise be a complex process into manageable sections. It not only aids in maintaining thorough records but also highlights tax obligations, ensuring that individuals meet their legal responsibilities and optimize potential deductions.

Essential components of the rental property tax organizer form

The rental property tax organizer form consists of several key sections that play a crucial role in the accurate reporting of both income and expenses. Each section is designed to capture specific data points necessary for tax filing.

Key sections typically include personal information, where property owners can detail their identity; property details that catalog information about the rental unit; rental income reporting that captures all forms of income generated; and expense documentation that lists all relevant deductions.

Interactive tools for data entry can enhance the user experience, simplifying the task of filling out these forms accurately. Keeping track of receipts and financial records meticulously is essential for providing substantiated claims during tax season.

Rental income: Reporting requirements and best practices

When it comes to rental income, proper reporting practices are paramount to avoid potential audits or penalties. Rental income can be categorized into two main types: residential and commercial properties, each with its specific reporting requirements. Additionally, transient rentals like Airbnb or vacation rentals are also included.

To ensure accuracy, all forms of rental income should be aggregated and reported on the appropriate tax returns. One common mistake is underreporting income, which can lead to severe consequences. Ensuring that all revenue is documented, including any late fees or services offered, is crucial.

Detailed breakdown of allowable tax deductions

Understanding the various categories of rental property expenses is vital for maximizing tax deductions. Landlords can deduct several types of expenses, which can significantly reduce taxable income. Operating expenses such as repairs and maintenance, utility bills, and property taxes fall under this category.

Depreciation allows property owners to recover the cost of the property over time, while interest on mortgages is another substantial deduction. Documenting these deductions accurately is crucial; keeping thorough records will support your claims during audits and ensure compliance with IRS guidelines.

Property information: Essential data for tax filing

When filling out the rental property tax organizer form, specific property identification details are required. This includes the address, property type, and identification number. If managing multiple properties, it’s essential to keep this organized to avoid confusion during reporting.

Organizing your property documentation efficiently allows for quick access to necessary information, whether it's for personal use or in case of an audit. Tagging electronic files or maintaining a property management spreadsheet may facilitate this process significantly.

Step-by-step guide to filling out the rental property tax organizer form

Filling out the rental property tax organizer form can be simplified by following a methodical approach. Begin by gathering all relevant documentation, such as tax statements, bank records, and any notices related to rental income and expenses. Having everything in one place will make data entry more streamlined.

As you proceed, complete each section meticulously, starting with your personal information. Next, input property-specific data before moving on to rental income and expenses. With solutions like pdfFiller's interactive features, editing and signing become more accessible, which will enhance the user experience.

Managing your completed rental property tax organizer form

After completing the rental property tax organizer form, it’s essential to manage this document efficiently. Take time to review and edit your form, ensuring that no information is overlooked or misreported. Utilizing electronic signature options makes it easier to finalize and validate your document.

Storage solutions such as cloud-based systems allow for easy access and sharing capabilities, making it simple to collaborate with tax professionals or team members. Secure storage will also safeguard against unforeseen data loss.

Collaboration and sharing features on pdfFiller

pdfFiller supports collaboration and sharing features that are immensely beneficial, especially for teams managing rental properties. Users can work on tax documents simultaneously, ensuring efficient processes and accuracy. The real-time change tracking allows each participant to see updates instantly.

Utilizing interactive feedback tools within pdfFiller further enhances document quality as users can leave comments and suggestions directly on the form. This collaborative approach minimizes errors and fosters accountability among team members.

FAQs about the rental property tax organizer form

Tax season often brings questions about the rental property tax organizer form, making it crucial to address common inquiries effectively. Many users worry about what to include in their forms or how to best document their expenses. Concise, actionable answers can ease these concerns.

Troubleshooting tips can assist users in navigating form completion challenges, and providing resources for further assistance can empower individuals to take control of their tax responsibilities confidently.

Navigating changes in tax laws affecting rental properties

Staying updated with local tax regulations is vital for property owners to ensure that their rental property tax organizer form reflects any recent changes. Tax laws can shift annually, and understanding what adjustments are required will help maintain compliance.

Utilizing tools for ongoing education, whether through webinars, workshops, or online resources, helps property owners adapt their forms and practices according to current requirements. This proactive approach not only keeps owners informed but also maximizes their potential for tax benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my rental property tax organizer in Gmail?

How can I send rental property tax organizer to be eSigned by others?

Can I create an electronic signature for the rental property tax organizer in Chrome?

What is rental property tax organizer?

Who is required to file rental property tax organizer?

How to fill out rental property tax organizer?

What is the purpose of rental property tax organizer?

What information must be reported on rental property tax organizer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.