Get the free 2024 Florida Limited Liability Company Annual Report

Get, Create, Make and Sign 2024 florida limited liability

Editing 2024 florida limited liability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida limited liability

How to fill out 2024 florida limited liability

Who needs 2024 florida limited liability?

2024 Florida Limited Liability Form: Your Comprehensive Guide

Overview of Florida limited liability companies (LLCs)

A limited liability company (LLC) is a popular business structure in Florida, combining the flexibility of a partnership with the liability protection of a corporation. LLCs are designed to provide business owners personal liability protection against debts and legal claims. By operating an LLC, members can shield their personal assets from business liabilities, ensuring that personal belongings like homes and savings accounts are protected in case of business losses.

The benefits of starting an LLC in Florida are significant. These include pass-through taxation, which means profits are taxed on the personal income of the members rather than at the corporate level, and fewer state-imposed formalities compared to corporations. Furthermore, Florida offers a welcoming environment for entrepreneurs, with a growing economy and a diversity of industries.

It's essential to understand the key differences between LLCs and other business structures, such as sole proprietorships and corporations. While sole proprietorships lack liability protection, corporations face more regulatory requirements and double taxation. LLCs bridge the gap by offering flexibility, protection, and tax benefits.

Steps to fill out the Florida limited liability form (Articles of Organization)

Filing the Articles of Organization is the first step to establishing your LLC. This document, known as the Florida limited liability form, requires precise information and adherence to state guidelines.

Step 1: Selecting your name

Choosing a unique name for your LLC is crucial. The name must include 'Limited Liability Company' or its abbreviations 'LLC' or 'L.L.C.'. It's essential to follow the rules set by the Florida Division of Corporations to ensure your selected name is distinguishable from existing businesses.

Step 2: Designating a registered agent

A registered agent acts as the official point of contact for your LLC. This person or entity must have a physical address in Florida and be available during regular business hours. When choosing a registered agent, consider their reliability and ability to handle important correspondence.

Step 3: Understanding the management structure

Decide whether your LLC will be member-managed or manager-managed. In a member-managed LLC, all members participate in day-to-day operations. Alternatively, in a manager-managed LLC, members appoint a manager to handle operations, allowing non-managing members to take a more passive role.

Step 4: Filling out the Articles of Organization

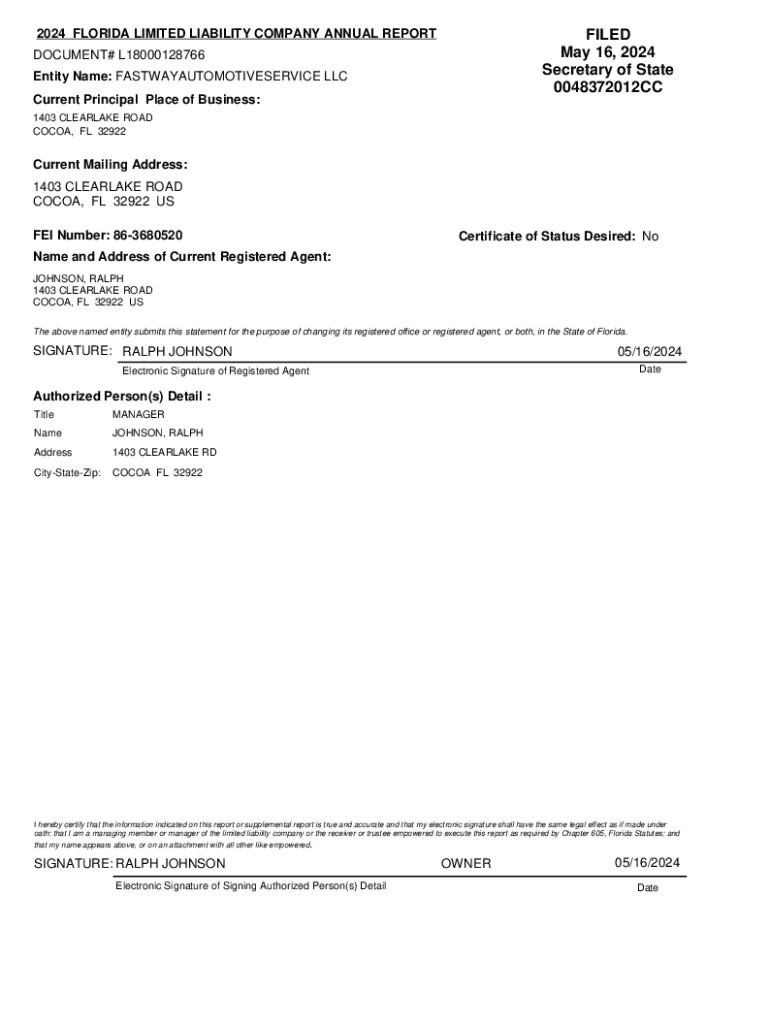

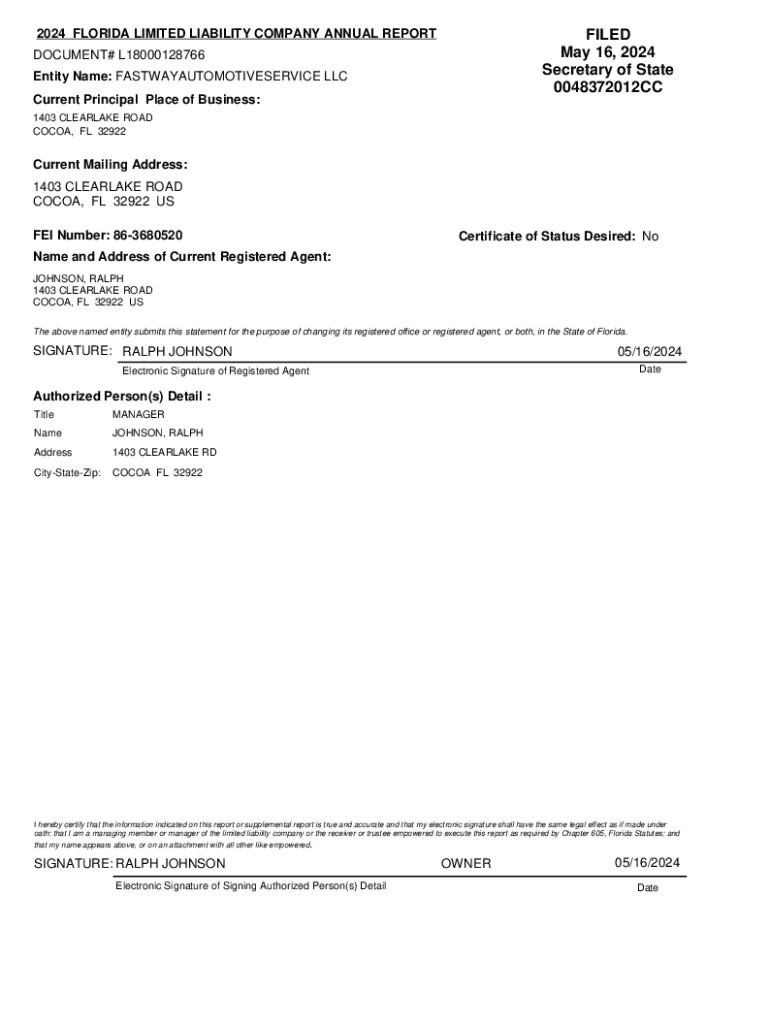

When filling out the limited liability form, ensure you provide the following required information: business name, principal office address, and registered agent information. It's also helpful to include optional information about management structure to clarify operations.

Step 5: Reviewing your form

Before submission, review your form for accuracy. Common errors include typos in the business name and incorrect registered agent details. Ensuring accuracy helps avoid delays in processing your submission.

Step 6: Submitting your form online or via mail

You can file the Florida limited liability form online through the Florida Division of Corporations’ website. If you choose to submit via mail, include the completed form and payment. Acceptable payment methods include credit card or check. You can track your submission online to ensure it has been received.

Processing time and confirmation

After submitting your Articles of Organization, it typically takes around 3 to 10 business days for processing. Once accepted, you will receive a confirmation via email or mail. If your filing is rejected, carefully review the reason for rejection, which might include discrepancies in the provided business name or incorrect format.

To correct errors, carefully review the feedback and resubmit your Articles of Organization. Common reasons for rejection may include failing to adhere to naming guidelines or incomplete information. Prompt action will minimize delays in establishing your LLC.

Costs associated with forming an in Florida

Forming an LLC in Florida involves initial and ongoing costs. The filing fee for the Articles of Organization is currently $125. Other costs to consider include registered agent fees, which can range from $100 to $300 annually, depending on the service chosen, as well as possible business license fees based on local jurisdictions.

Additionally, it's important to account for annual maintenance fees, including filing the mandatory annual report with the state, which incurs a fee of $138.75. Keeping track of these costs helps ensure your LLC remains compliant and operational.

Ongoing compliance requirements

Once your LLC is established, it's vital to adhere to ongoing compliance requirements. An annual report must be filed every year, providing updated information about your LLC's members and registered agent. This report is due each year by May 1, and failing to file can result in the administrative dissolution of your LLC.

Additionally, your LLC may require various business licenses and permits depending on your location and industry, which necessitates a checklist approach to ensuring all necessary licenses are obtained and renewed as required. Staying informed of state fees and taxes related to your LLC is also critical for financial planning.

FAQs about Florida limited liability form

Many people have questions regarding the Florida limited liability form. Here are some frequently asked questions that may clarify your process:

Interactive tools and resources

To aid in your filing process, pdfFiller offers interactive tools that streamline document creation and management. Access our interactive LLC form tool to simplify your filing process. Additional templates can also help further expedite the creation of business documents and submissions.

For those seeking further assistance in the LLC formation process, resources such as local business organizations and legal advisors may also provide support tailored to your specific needs.

Summary of benefits of using pdfFiller for form management

pdfFiller empowers users to efficiently create and manage their LLC documents through a cloud-based platform. With the ability to edit PDFs, eSign, and collaborate in real-time, users can manage their business documents with ease.

Accessing your documents anytime, anywhere ensures that no critical deadlines are missed, providing peace of mind during the LLC formation process and throughout ongoing compliance.

Related forms and services

Aside from the Florida limited liability form, pdfFiller offers a range of additional forms crucial for LLC management and compliance, such as operating agreements and annual report templates. These services facilitate comprehensive business documentation by providing templates and resources tailored to various professional needs.

User insights

Many users have successfully navigated the LLC formation process using pdfFiller. Testimonials highlight how our platform alleviated the complexities associated with filing forms and maintaining compliance. Users appreciate the user-friendly interface and the support that comes with accessing tools designed specifically for LLC management.

Case studies further reveal how pdfFiller helped clients overcome obstacles in the LLC formation process, ensuring they achieved their business goals without unnecessary delays or challenges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2024 florida limited liability from Google Drive?

How do I make changes in 2024 florida limited liability?

How can I fill out 2024 florida limited liability on an iOS device?

What is 2024 florida limited liability?

Who is required to file 2024 florida limited liability?

How to fill out 2024 florida limited liability?

What is the purpose of 2024 florida limited liability?

What information must be reported on 2024 florida limited liability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.