Get the free 2024 Foreign Profit Corporation Annual Report

Get, Create, Make and Sign 2024 foreign profit corporation

Editing 2024 foreign profit corporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 foreign profit corporation

How to fill out 2024 foreign profit corporation

Who needs 2024 foreign profit corporation?

2024 Foreign Profit Corporation Form: A Comprehensive Guide

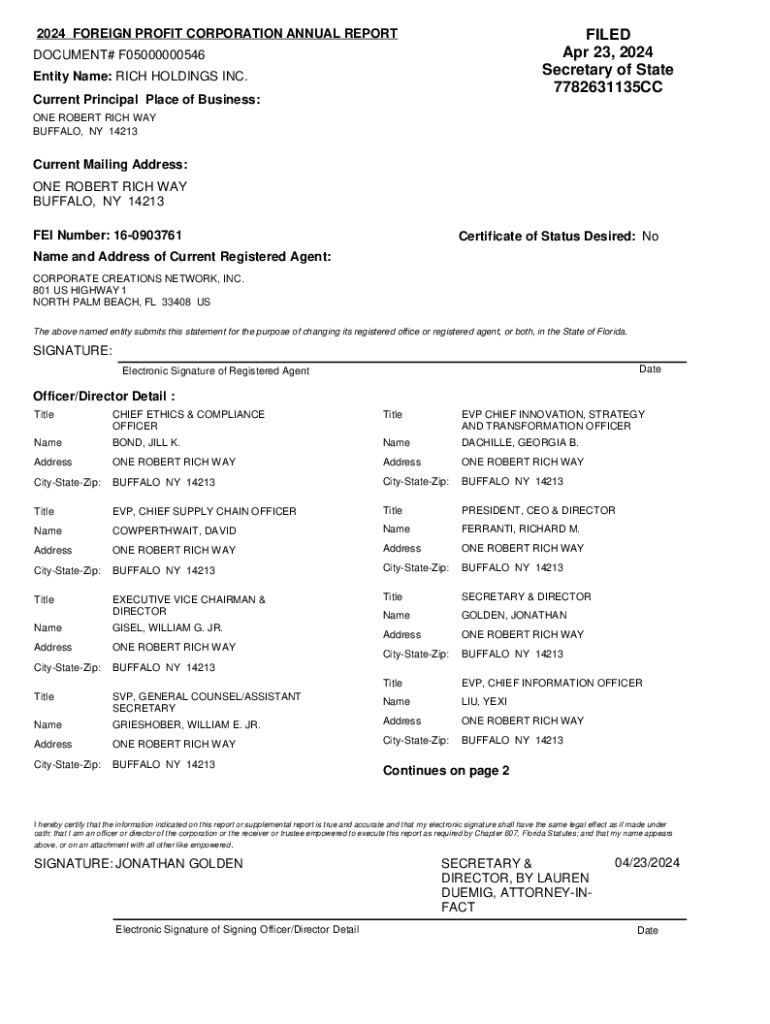

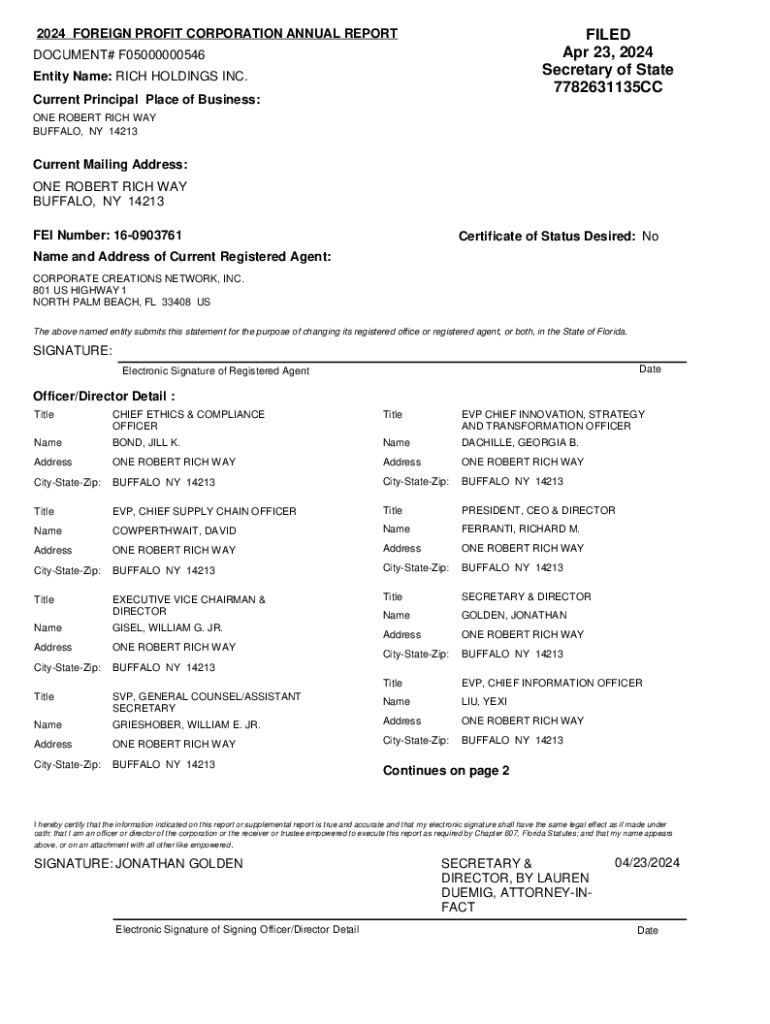

Overview of foreign profit corporations

A foreign profit corporation is a business entity established in one state that operates in another state or jurisdiction. Unlike domestic corporations that are registered in their home state, foreign profit corporations must register to conduct business outside their original state of incorporation. This registration is crucial for maintaining legal compliance and avoiding penalties.

The importance of registration for foreign entities cannot be overstated. Registering as a foreign profit corporation allows businesses to legally operate in multiple states, attract clients, and build trust with local customers. Additionally, it provides some level of protection and credibility when dealing with suppliers, partners, and regulators.

Understanding the 2024 foreign profit corporation form

The 2024 Foreign Profit Corporation Form is a vital document that foreign entities must complete when seeking authorization to operate in a different state. This form serves multiple purposes, such as providing essential information about the corporation's structure and plans, ensuring compliance with state regulations, and aiding in tax assessments.

In 2024, updates to the form may include new requirements for documentation or adjustments to filing fees. It's essential to stay updated with these changes to avoid unnecessary delays or complications. Entities that need to file the form include any corporation that is registered in one state but intends to do business in another, whether through a physical presence or online operations.

Filling out the 2024 foreign profit corporation form

Filling out the 2024 Foreign Profit Corporation Form can seem complex, but by breaking it down into manageable sections, the process becomes straightforward. Here’s a detailed breakdown:

A. Section-by-section breakdown

B. Common mistakes to avoid

Tools and resources for completing the form

Utilizing the right tools can significantly streamline the process of filling out the 2024 Foreign Profit Corporation Form. Interactive fillable PDF options simplify data entry, allowing you to create a cleanly formatted document ready for submission.

Online filing platforms like pdfFiller provide user-friendly interfaces for editing and submitting forms. Tips for effectively using pdfFiller include:

Filing the 2024 foreign profit corporation form

Once you've completed the 2024 Foreign Profit Corporation Form, the next steps involve filing the document with the appropriate state agency. There are generally two submission methods:

A. Submission methods

B. Required fees and payment options

Fees may vary widely between states and are generally non-refundable. Familiarize yourself with:

. Processing times and expectations

Processing times can vary based on the state and their volume of submissions. After submitting your form, you can expect to receive confirmation typically within a few weeks, although some states may take longer. It's wise to monitor the status of your filing by contacting the relevant state agency or through their online tracking tools.

Managing your foreign profit corporation

Once your corporation is officially registered, the next step is managing it effectively to stay compliant with regulations. This involves adhering to ongoing obligations to maintain your foreign status.

A. Rules and regulations after incorporation

B. Using pdfFiller for document management

pdfFiller serves as an excellent tool for managing documents associated with your foreign profit corporation. With features that allow for:

Key considerations for foreign profit corporations in 2024

As you prepare to submit the 2024 Foreign Profit Corporation Form, keep in mind recent legal changes that may impact your operations. For instance, some states have revised laws focusing on foreign entities, which could require renewed compliance efforts.

Moreover, consider economic factors that may be influencing your operations, such as changes in consumer demand or shifts in taxation policies that may affect corporate profitability. Adhering to best practices for maintaining corporate status will help you navigate these changes while ensuring your business remains resilient.

Frequently asked questions (FAQs)

Contact information and support

For additional assistance, pdfFiller provides support for users needing help with the 2024 Foreign Profit Corporation Form. Whether you require guidance on filing or document management, feel free to reach out through their dedicated support channels.

Moreover, contacting state business registries for issues or clarifications can resolve specific inquiries about your filing status or compliance requirements.

Additional tools for foreign corporations

As a foreign profit corporation, streamlining operations is essential. To support your entity, consider leveraging recommended business services that cater specifically to foreign entities. Additionally, utilizing links to state-specific resources and guidelines can provide further insights.

Participating in educational webinars focusing on foreign corporation compliance will help keep you informed about the latest legislative updates and best practices, ensuring your corporation thrives despite regulatory challenges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2024 foreign profit corporation online?

How do I make changes in 2024 foreign profit corporation?

How do I edit 2024 foreign profit corporation straight from my smartphone?

What is 2024 foreign profit corporation?

Who is required to file 2024 foreign profit corporation?

How to fill out 2024 foreign profit corporation?

What is the purpose of 2024 foreign profit corporation?

What information must be reported on 2024 foreign profit corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.