Get the free 2024 Foreign Profit Corporation Annual Report

Get, Create, Make and Sign 2024 foreign profit corporation

How to edit 2024 foreign profit corporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 foreign profit corporation

How to fill out 2024 foreign profit corporation

Who needs 2024 foreign profit corporation?

A Comprehensive Guide to the 2024 Foreign Profit Corporation Form

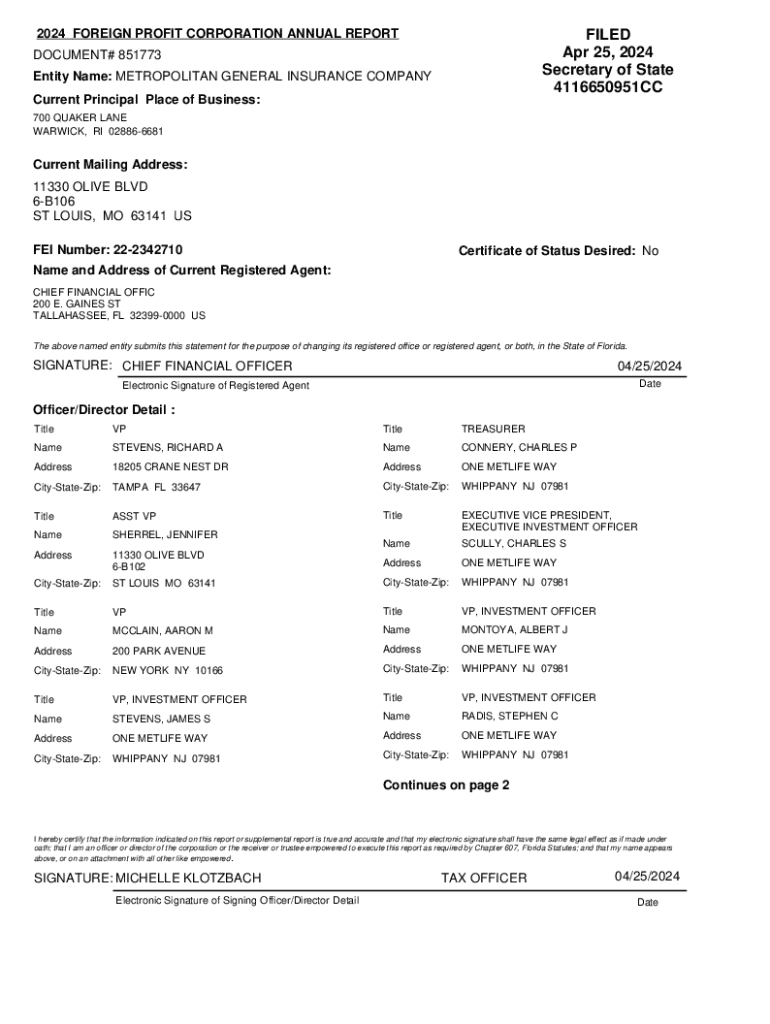

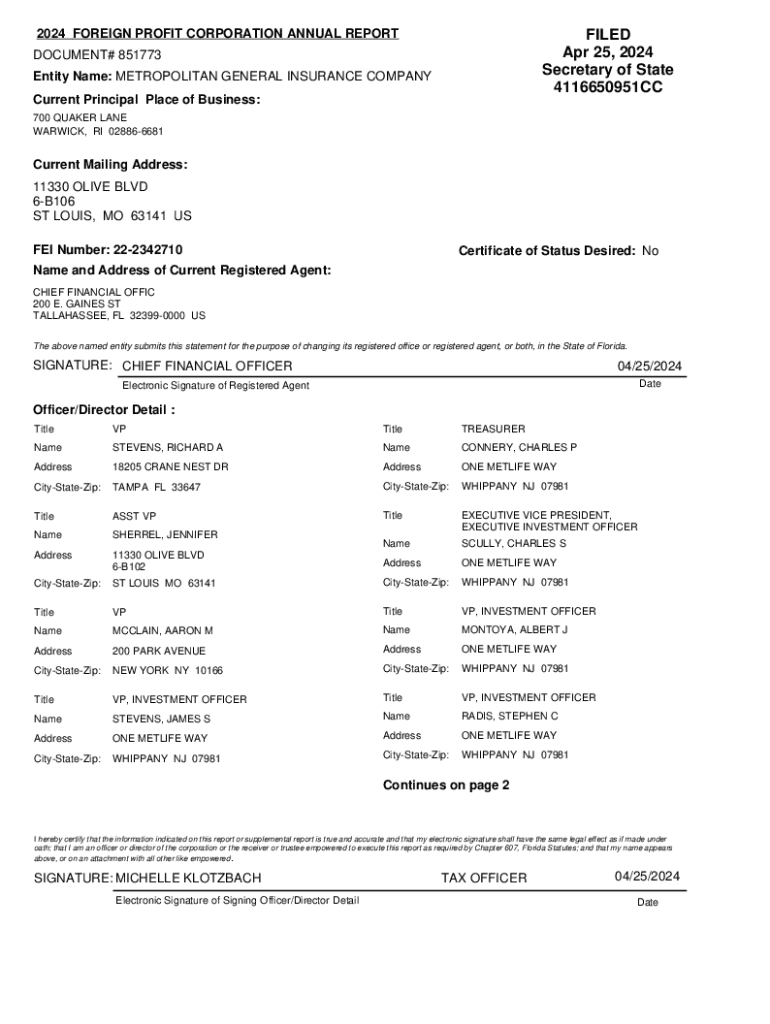

Understanding foreign profit corporations

A foreign profit corporation is defined as a company that is incorporated in one jurisdiction but operates in another. Essentially, if your corporation is established in one country and begins business activities in the United States, it is classified as a foreign profit corporation in the U.S. Recognizing the essential differences between domestic and foreign corporations is vital, particularly regarding taxation, legal obligations, and shareholder rights.

Domestic corporations are those formed under the laws of the state where they are incorporated, typically enjoying a clearer legal framework for operations. In contrast, foreign profit corporations may face numerous complexities stemming from their overseas origins, such as varying rules on liability, taxation, and operational permits. This is why proper registration through the 2024 foreign profit corporation form is essential for compliance and successful business operations in the U.S.

Why you need the 2024 foreign profit corporation form

Filing the 2024 foreign profit corporation form is critical for several reasons, primarily compliance with state laws governing foreign entities. Each state has its regulations requiring foreign profit corporations to register before conducting business. Failing to do so may lead to penalties, including fines or restrictions on business operations.

Moreover, compliance ensures smoother business operations. By officially recognizing your business, you can engage in legal contracts, open bank accounts, and access local resources. Without proper registration, companies may find it challenging to fully integrate into the local economy and could face unpredictable legal challenges.

Eligibility criteria for foreign profit corporations

To be eligible for registration as a foreign profit corporation in the U.S., certain requirements must be met. These include having a valid business incorporated outside of the United States and appropriate documentation demonstrating your corporate existence and compliance with your home country’s laws. This often involves documents such as a certificate of good standing and articles of incorporation.

Essentially, businesses involved in lawful activities can typically apply to register as foreign profit corporations. However, jurisdictions may have specific requirements based on the nature of the business, such as type of business activity and state-specific regulations.

Steps to complete the 2024 foreign profit corporation form

Completing the 2024 foreign profit corporation form may seem daunting, but breaking it into manageable steps can simplify the process.

Common mistakes to avoid when filing

Filings can be rejected or delayed due to common mistakes. One prevalent error is providing inaccurate information, which can raise red flags during the review process. Ensure all business names, financial details, and addresses are correct and match officially issued documents.

Additionally, missing required attachments often leads to delays in processing your application. Always check your checklist before submission. Finally, be aware that improper submission methods can result in loss of documentation or delays. Adhering to the specified submission guidelines is crucial to avoid complications.

Additional forms and filings related to foreign profit corporations

Post-registration, foreign profit corporations must fulfill ongoing requirements, including filing annual reports. These reports typically provide updates on your corporation's financial status and must comply with specific state regulations.

Furthermore, depending on your business operations, obtaining local business licenses and permits may be necessary to operate legally. Additionally, foreign entities must comply with tax regulations specific to international businesses, including understanding applicable state and federal tax obligations.

Managing your foreign profit corporation post-filing

Once your 2024 foreign profit corporation form has been filed and approved, it’s essential to manage your documents efficiently. pdfFiller offers tools to keep your documentation organized and accessible. With their platform, you can save and edit all relevant documents in one place, ensuring you remain compliant with state requirements.

Additionally, tracking submission statuses and deadlines is crucial. pdfFiller provides reminders and tracking features to assist you in staying organized. Regular updates and amendments, especially regarding changes in business structure or significant corporate changes, must be documented to maintain your status as a compliant entity.

Frequently asked questions about the foreign profit corporation form

Many questions arise during the registration process, especially regarding refusals. If your application is rejected, reviewing the provided feedback carefully is essential. Common reasons might include inaccuracies or missing documentation.

The length of the filing process can vary by state. Generally, expect a processing time of 2-4 weeks if all documents are correctly submitted. Regarding fees, anticipate costs associated with form submission and possible background check fees, which can differ from state to state.

Expert insights on the future of foreign profit corporations in 2024

As 2024 progresses, emerging trends indicate that more foreign profit corporations are eyeing opportunities in the U.S. market. Regulatory changes may emerge, impacting tax obligations and compliance requirements. Businesses should stay informed about these trends to strategically plan for financial success.

Choosing to work with experts familiar with the U.S. legal landscape can offer foreign corporations a competitive edge, helping navigate potential challenges swiftly and ensuring operations align with local laws and practices.

Leveraging pdfFiller for your document management needs

Using pdfFiller for managing the 2024 foreign profit corporation form simplifies the process of document collaboration, editing, and eSignatures. With its cloud-based platform, you can access your documents from anywhere, making it easy to collaborate with team members across the globe.

Moreover, pdfFiller integrates seamlessly with other platforms, enhancing your workflow. This holistic approach supports your international business operations, allowing you to focus on growth rather than bureaucracy.

Related services on pdfFiller

pdfFiller not only assists with the 2024 foreign profit corporation form but also offers an array of document templates for other business entities. From sole proprietorships to LLCs, a diverse selection caters to various business needs.

In addition, services like notary options and document storage ensure that all your essential records remain organized and securely stored. The comprehensive support resources available help users maximize their experience with document management.

Connecting with our support team

If you encounter any issues or questions while using pdfFiller, connecting with our support team is effortless. Accessing help is easy; whether through live chat, email support, or community forums, assistance is always available for users.

Being proactive about seeking guidance can enhance your experience and ensure you're correctly handling your foreign profit corporation filing and other associated requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2024 foreign profit corporation directly from Gmail?

How do I edit 2024 foreign profit corporation straight from my smartphone?

How do I fill out 2024 foreign profit corporation using my mobile device?

What is 2024 foreign profit corporation?

Who is required to file 2024 foreign profit corporation?

How to fill out 2024 foreign profit corporation?

What is the purpose of 2024 foreign profit corporation?

What information must be reported on 2024 foreign profit corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.