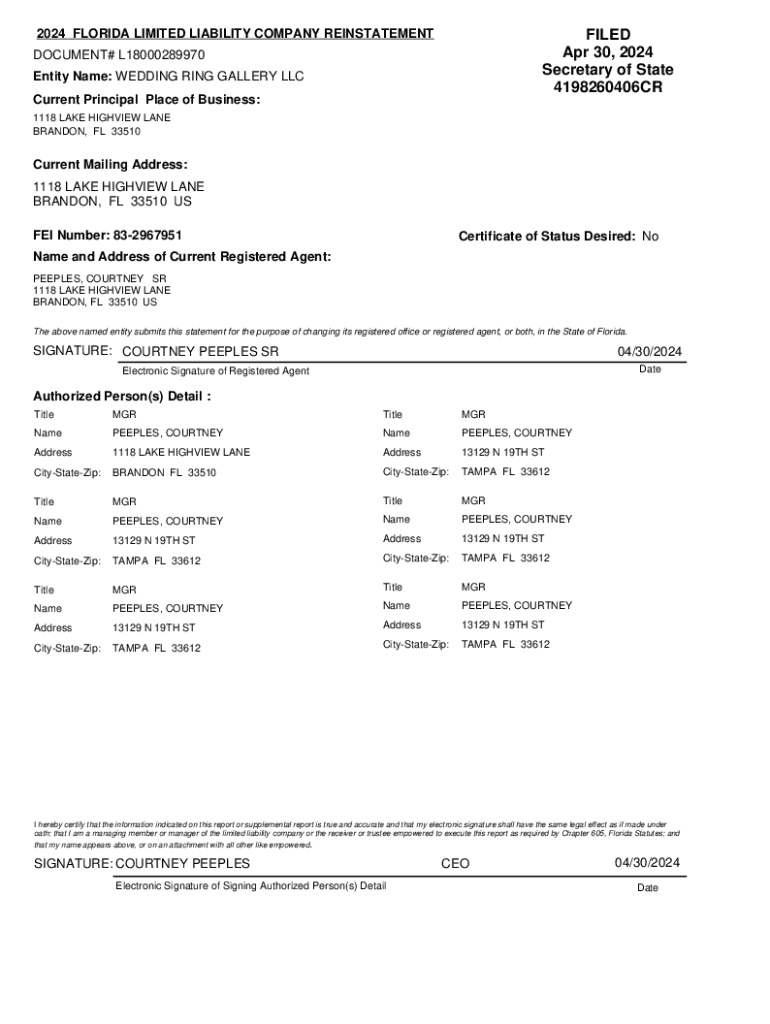

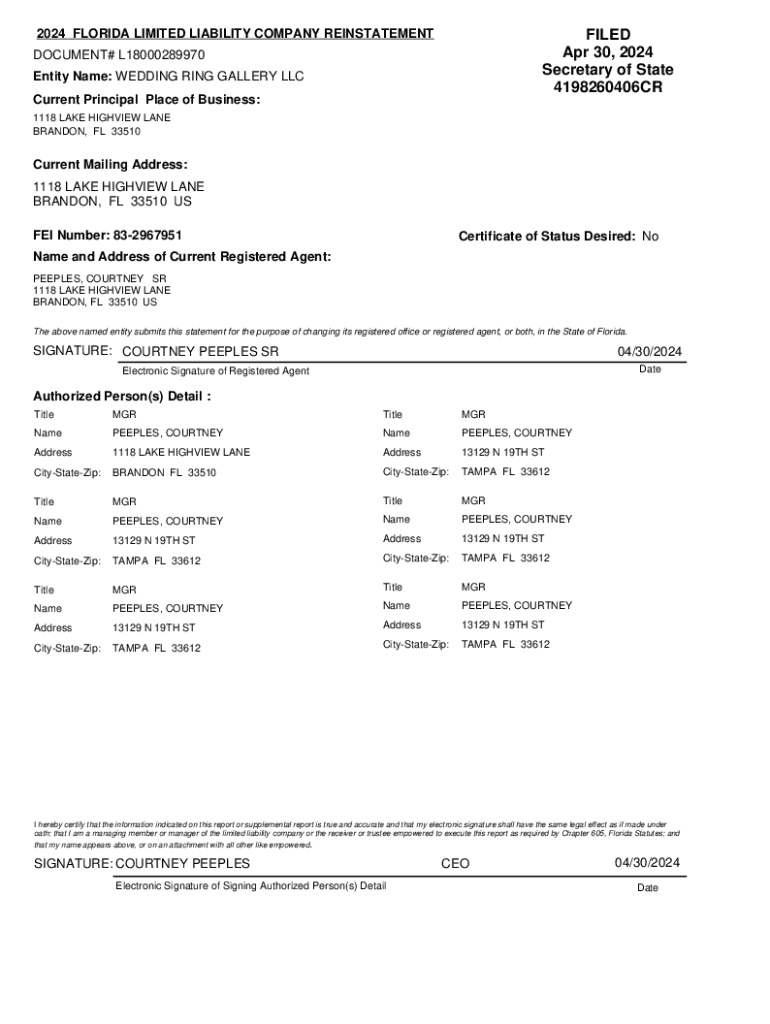

Get the free 2024 Florida Limited Liability Company Reinstatement

Get, Create, Make and Sign 2024 florida limited liability

Editing 2024 florida limited liability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida limited liability

How to fill out 2024 florida limited liability

Who needs 2024 florida limited liability?

2024 Florida Limited Liability Form: Your Comprehensive Guide

Understanding the Florida Limited Liability Company () Structure

A Limited Liability Company (LLC) in Florida is a unique business structure that combines elements of both corporations and partnerships. Its primary purpose is to provide owners, known as members, with limited personal liability for business debts, meaning that their personal assets are generally protected from business creditors. With an LLC, you have the freedom to manage your business without the rigid formalities required of a corporation.

Forming an LLC in Florida comes with a plethora of benefits. One of the most significant advantages is the pass-through taxation treatment, where business profits are only taxed at the individual owners’ tax rates, avoiding double taxation. Additionally, LLCs offer flexible management structures, ongoing compliance simplicity, and heightened credibility when interacting with third parties.

2024 updates to Florida formation requirements

In 2024, there are crucial updates to Florida LLC formation requirements that all prospective business owners must be aware of. One key change is the emphasis on electronic filings, streamlining the process and enhancing efficiency. Additionally, legislative amendments have introduced new compliance standards for reporting beneficial ownership information, thereby increasing transparency in LLC operations.

These changes mean it's more important than ever to stay compliant with regulations. Failing to adapt to these updates can lead to filing errors or issues that may hinder your business operations. Ensuring you understand the latest requirements will facilitate a smoother formation process, allowing your LLC to thrive.

Essential steps to complete the Florida Limited Liability Form

Completing the Florida limited liability form involves several essential steps. Adhering to these will ensure your LLC is properly registered with the Florida Division of Corporations, thereby qualifying you for the advantages of this business structure.

Step 1: Choose a name for your

Your LLC's name must adhere to Florida’s naming guidelines. The name should include 'Limited Liability Company' or its abbreviations (LLC or L.L.C.). It must also be distinguishable from other entities registered in Florida.

Before committing to a name, check its availability through the Florida Division of Corporations’ online database. This crucial step ensures that there will be no conflicts when registering your business.

Step 2: Designating your registered agent

Every LLC in Florida must designate a registered agent who will act as the official point of contact for legal documents. The registered agent must be a Florida resident or a business entity authorized to do business in Florida.

When selecting a registered agent, consider their reliability and responsiveness. This role is crucial because they handle essential documents, including lawsuits and summons, impacting your LLC's legal standing.

Step 3: Prepare your articles of organization

The Articles of Organization is the main form that establishes your LLC. You must provide key information such as the LLC name, principal office address, the registered agent’s name and address, and the members’ details.

While filling out this form, avoid common mistakes like listing an unavailable name or incorrect addresses. Attention to detail here can save you time and prevent potential rejections from the state.

Step 4: File the Articles of Organization

Once your Articles of Organization are prepared, it’s time to file them with the Florida Division of Corporations. You can choose between e-filing, which is generally quicker, or mail submission.

E-filing streamlines the process and provides immediate confirmation of your submission. Here’s a step-by-step guide to e-filing: log onto the Florida Division of Corporations’ website, navigate to the LLC filing section, and follow prompts to upload your form and pay the required fees.

Step 5: Obtain your Federal Employer Identification Number (FEIN)

After successfully filing your Articles of Organization, the next step is obtaining a Federal Employer Identification Number (FEIN) from the IRS. This number is necessary for numerous business activities, including hiring employees and opening a business bank account.

You can apply for your FEIN online through the IRS website; the process is free and usually takes about 10 minutes if you have all your information ready.

Detailed insights on completing the 2024 Florida Limited Liability Form

Completing the 2024 Florida limited liability form requires careful attention to accuracy and detail. Utilize interactive tools, such as fillable templates, to guide you through the form and ensure you don’t overlook any necessary information.

When managing your LLC documents, make sure to edit, sign, and keep track of every document related to your LLC efficiently. Consider using platforms like pdfFiller, which offers tools for easy management and signing of documentation. Address frequently asked questions on form submission and processing to optimize your filing experience.

Additional compliance requirements for Florida LLCs

Apart from filing your Articles of Organization, Florida LLCs must comply with various state licenses, permits, and registrations. Depending on your business type, you may need to obtain special permits or licenses to legally operate in Florida.

Furthermore, 2024 has brought significant changes in reporting beneficial ownership information, which aims to enhance LLC transparency. Failure to comply with these requirements could impact your LLC’s good standing.

Common questions regarding the Florida formation process

How to utilize pdfFiller for your Florida documentation

pdfFiller offers powerful tools that greatly enhance the LLC filing process. From fillable forms that guide you through each requirement to eSignature capabilities, pdfFiller simplifies documentation management immensely.

Utilizing collaboration features within pdfFiller allows teams to work together seamlessly, ensuring that every step of the LLC formation is accounted for and approved. This feature is particularly beneficial for those embarking on the LLC formation journey with partners or multiple members.

Getting help: Resources and support for Florida formation

Starting an LLC can be daunting, but ample resources are available. Connecting with legal experts can provide clarity on questions regarding your LLC's formation and compliance requirements.

You can also tap into online forums and community support for insights from fellow LLC owners who have navigated similar challenges. For direct assistance, bookmark the Florida Division of Corporations' website, and keep vital contact information handy.

Best practices for managing your Florida post-formation

Once your LLC is established, ongoing compliance is crucial. Annual reports and fees must be filed with the state to maintain your LLC’s active status. Keeping track of these deadlines is vital for sustaining good standing.

An operating agreement, though not required by Florida law, is highly recommended. It outlines the management structure and operational guidelines, setting clear expectations among members. As your business evolves, be prepared for future changes such as merging or converting your LLC, and maintain flexibility in your business strategies.

Interactive FAQs for 2024 Florida Limited Liability Form

To streamline your learning process, access a dynamic FAQ section tailored to address common concerns regarding the 2024 Florida limited liability form. This interactive tool helps keep questions updated with the latest changes and ensures that you have quick internet access to the information you need.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2024 florida limited liability from Google Drive?

How do I edit 2024 florida limited liability in Chrome?

How do I fill out the 2024 florida limited liability form on my smartphone?

What is 2024 Florida limited liability?

Who is required to file 2024 Florida limited liability?

How to fill out 2024 Florida limited liability?

What is the purpose of 2024 Florida limited liability?

What information must be reported on 2024 Florida limited liability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.