Get the free 2024 Florida Profit Corporation Annual Report

Get, Create, Make and Sign 2024 florida profit corporation

Editing 2024 florida profit corporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida profit corporation

How to fill out 2024 florida profit corporation

Who needs 2024 florida profit corporation?

2024 Florida Profit Corporation Form: A Comprehensive Guide

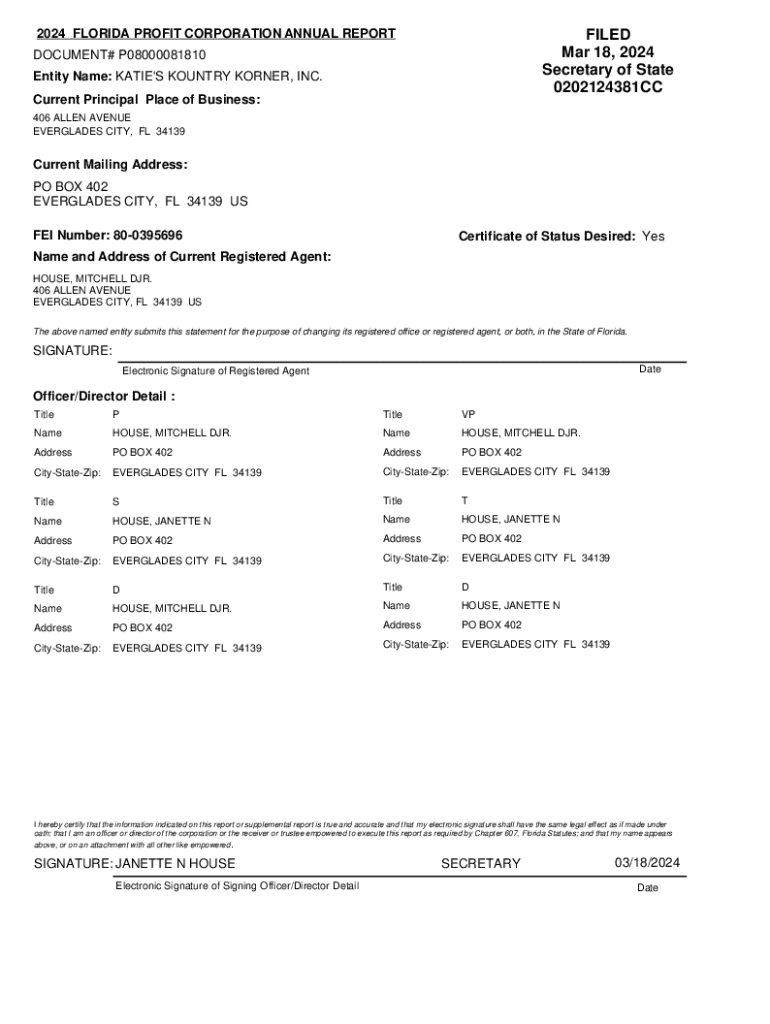

Overview of the 2024 Florida Profit Corporation Form

The 2024 Florida Profit Corporation Form is a crucial document that enables individuals and business teams to establish a profit corporation in the state of Florida. It serves as the official Articles of Incorporation, declaring the intention to form a corporation under Florida’s business regulations. By filing this form, businesses can gain various legal protections, credibility, and access to funding.

Filing Articles of Incorporation in Florida is not just a bureaucratic requirement; it is a strategic move that protects business owners from personal liability, establishes a clear structure for management, and enables tax benefits. The 2024 form has introduced key changes, streamlining some process requirements, and enhancing clarity which will simplify incorporation for new businesses.

Filing information

The 2024 Florida Profit Corporation Form must be completed and filed by any individual or group intending to form a corporation that will conduct profit-driven activities in Florida. This includes local entrepreneurs and established businesses aiming to expand operations in the state. Additionally, non-profit organizations and professional corporations may need a different route, necessitating attention to specific requirements.

Before filing, applicants should ensure they meet several prerequisites including selecting a unique business name, identifying a registered agent, and preparing information about the initial directors and officers. Florida Statutes, specifically Title XXXVI, Chapter 607, regulate incorporation and provide the legal framework under which corporations operate, making understanding these statutes crucial for compliance.

Step-by-step guide to completing the form

Completing the 2024 Florida Profit Corporation Form requires careful attention to detail. This section will break down the steps involved to ensure accuracy throughout the filing process.

Step 1: Gather required information

Verified information aids in minimizing potential delays during processing.

Step 2: Choosing a corporation name

Ensuring your chosen corporation name is available is essential. Use the Florida Division of Corporations' database to check for name availability. This will help you avoid any conflicts or rejections due to name duplication. Names should also adhere to specific Florida naming guidelines that can be found in the business entity index.

Step 3: Filling out the form

Filling out the 2024 Florida Profit Corporation Form involves several sections, including information about the corporation's name, principal office address, and details about the initial directors and officers. Pay attention to ensuring accurate details to avoid rejections. Common mistakes include overlooking the requirement for a registered agent or failing to list all directors.

Start e-filing

E-filing your form is highly recommended for efficiency. Start by accessing pdfFiller’s online platform where you can complete the 2024 Florida Profit Corporation Form conveniently. The e-filing process on pdfFiller guides you through each section, assigns a unique digital identifier, and allows for instant validation of your entries.

Benefits of e-filing through pdfFiller include immediate submission verification, easier editing capabilities, and an overall quicker processing time. Moreover, you can keep an organized digital record of your filings, which simplifies future compliance.

Supported web browsers for e-filing

When e-filing the 2024 Florida Profit Corporation Form, browser compatibility is crucial for a smooth experience. Recommended browsers include the latest versions of Google Chrome, Mozilla Firefox, and Safari. Using an outdated browser can lead to issues with form accessibility, but a few simple troubleshooting steps can mitigate problems.

Payment options for filing fees

Filing the 2024 Florida Profit Corporation Form incurs certain fees that can vary based on the chosen filing method. Understanding these fees is essential. Generally, the initial filing fee for Articles of Incorporation will range around $35 to $125 depending on the specific requirements.

On the pdfFiller platform, you can make payments using credit/debit card payments or PayPal, providing flexibility and convenience. After making payment, ensure you confirm the transaction to avoid processing delays, and keep records of your payment confirmation for your records.

Alternative filing methods

For those who prefer traditional methods, the option to print and mail the 2024 Florida Profit Corporation Form remains available. Start by downloading the form from the Florida Division of Corporations website. After filling it out, ensure you make the appropriate payment, which can be included as a check or money order along with the physical form.

Mail to the address designated in the filing instructions within the form, ensuring you use the correct postage to avoid delays.

Filing confirmation and processing time

After submitting your 2024 Florida Profit Corporation Form, you can expect a confirmation of receipt, typically via email. The state of Florida usually processes these filings within 2-3 business days for e-filed applications, but this may extend to 4-6 weeks during peak periods due to increased volumes.

You will receive an official acknowledgment with your corporation’s formation date and identification number. This confirmation is critical for any further regulatory filings and compliance, so be sure to retain it.

How to sign the online form

Electronic signatures are accepted in Florida for corporate filings. Using pdfFiller, you can easily eSign your completed 2024 Florida Profit Corporation Form. This is crucial as it ensures that you're not required to print, scan, or mail physical copies of your signature, making the filing process much more streamlined.

E-signatures hold the same legal weight as handwritten signatures in Florida, thus providing you with a valid method of confirming your document.

Managing your corporation post-filing

Once the 2024 Florida Profit Corporation Form has been successfully filed, corporations must maintain compliance and robust management. This includes filing annual reports and addressing any amendments as necessary to uphold good standing in Florida.

pdfFiller provides an array of document management tools to assist in this ongoing process, including templates for corporate bylaws, meeting minutes, and additional regulatory forms. Regular checks on compliance status using pdfFiller can save you from potential penalties or loss of corporate status.

Frequently asked questions (FAQs)

Common concerns arise regarding the 2024 Florida Profit Corporation Form and its filing process. Many individuals worry about rejections due to minor mistakes or misunderstandings regarding requirements. Thus, being familiar with the process can alleviate apprehension.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2024 florida profit corporation to be eSigned by others?

How do I complete 2024 florida profit corporation online?

How do I fill out 2024 florida profit corporation using my mobile device?

What is 2024 florida profit corporation?

Who is required to file 2024 florida profit corporation?

How to fill out 2024 florida profit corporation?

What is the purpose of 2024 florida profit corporation?

What information must be reported on 2024 florida profit corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.