Get the free 2024 Florida Limited Liability Company Annual Report

Get, Create, Make and Sign 2024 florida limited liability

Editing 2024 florida limited liability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida limited liability

How to fill out 2024 florida limited liability

Who needs 2024 florida limited liability?

2024 Florida Limited Liability Form: Your Comprehensive Guide

Understanding Florida limited liability companies (LLCs)

A Limited Liability Company (LLC) is a flexible business structure that combines the benefits of both corporations and sole proprietorships. In Florida, forming an LLC allows for the protection of personal assets from business liabilities while offering tax benefits and operational flexibility. LLCs can be owned by one or multiple members, making them an attractive choice for individuals and small businesses.

Among the several advantages of establishing an LLC in Florida are the minimal compliance requirements, pass-through taxation, and enhanced credibility with clients and suppliers. Additionally, Florida’s LLC laws provide a considerable amount of operational freedom and protection from personal liability. This structure contrasts significantly with corporations, which are subject to more rigid requirements and formalities.

Key considerations before filing

Before initiating the filing process for your Florida LLC, there are key considerations to address. Selecting a unique name for your LLC is crucial as it sets the foundation of your brand identity and ensures compliance with state regulations. Florida requires that LLC names include 'Limited Liability Company' or its abbreviations (LLC or L.L.C.).

To check name availability, you can utilize the Florida Division of Corporations’ online database. This step is vital as competing entities may have similar names, which could lead to future legal issues. Furthermore, choosing between a member-managed or manager-managed structure will affect how your LLC operates day-to-day.

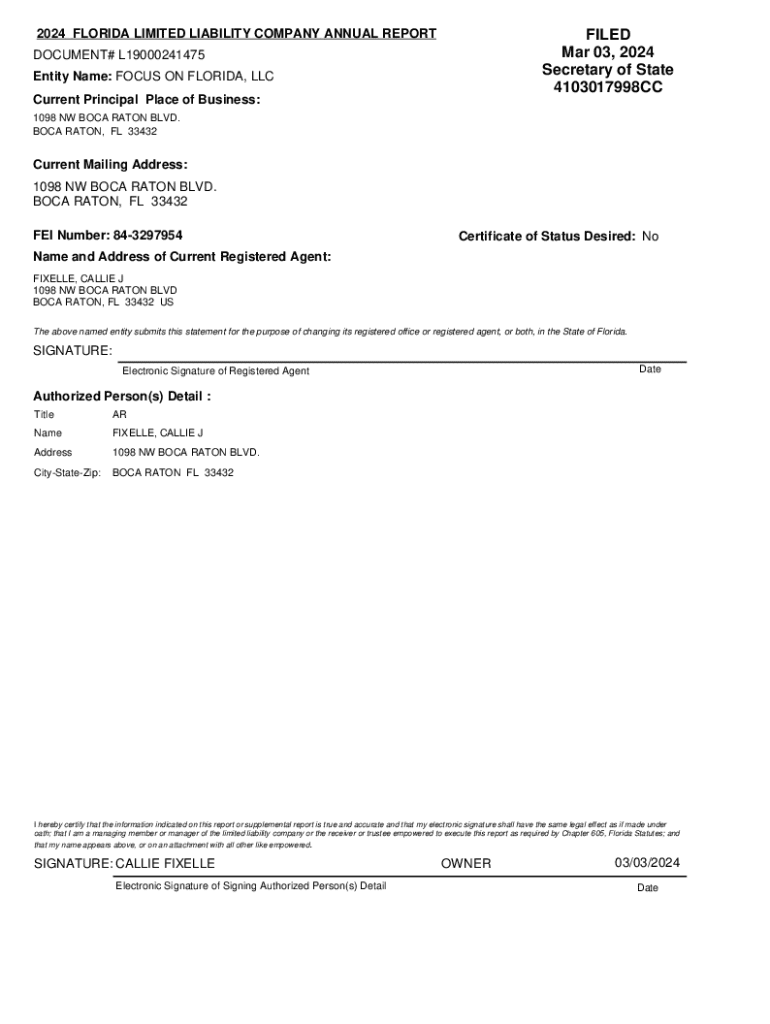

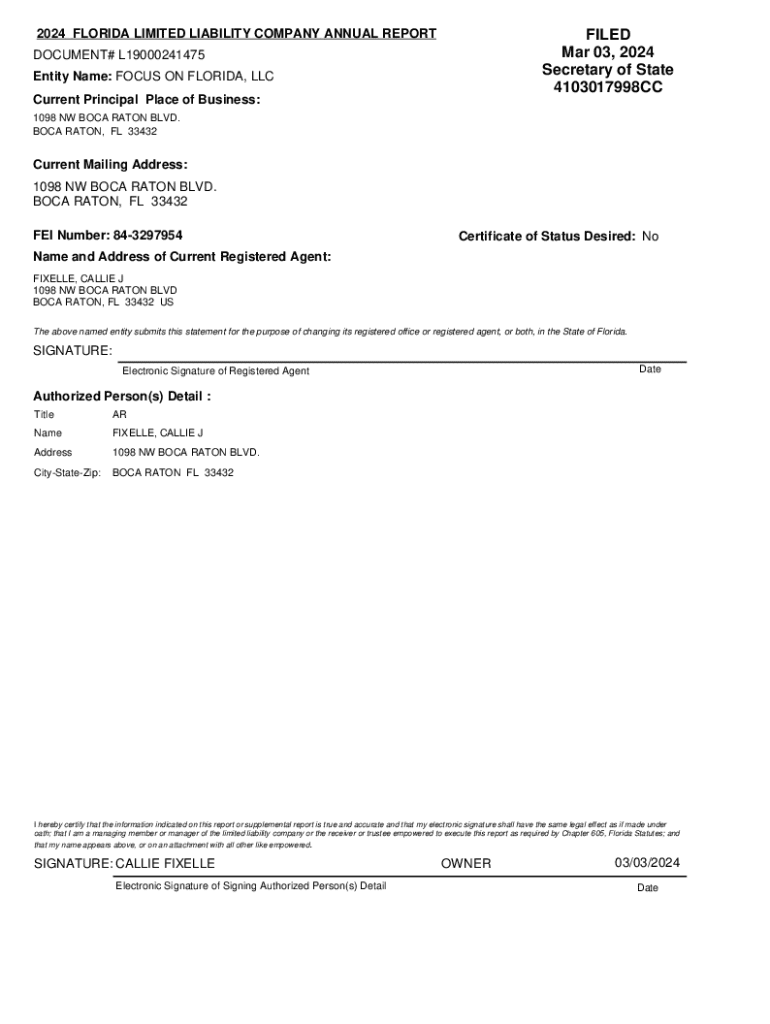

The 2024 Florida limited liability form explained

The cornerstone document for forming an LLC in Florida is the Articles of Organization. This form outlines fundamental details about your LLC and must be filed with the Florida Division of Corporations. The 2024 Florida limited liability form includes essential sections such as the entity name, principal office address, registered agent designation, and management structure.

Completing the form accurately is critical. Common mistakes include providing inaccurate registered agent information or neglecting to meet the naming requirements. Each section must be reviewed thoroughly to avoid delays or rejections during processing.

Step-by-step guide to filing your online

Filing your 2024 Florida limited liability form online is a straightforward process. Here’s a step-by-step guide to assist you. Start by accessing the 2024 Florida Limited Liability Form through pdfFiller, which facilitates easy document management and ensures all information is current and compliant.

Utilize pdfFiller’s interactive tools to fill out your Articles of Organization with precision. After completing the form, you can easily eSign the document directly through the platform, streamlining the submission process. Submit your application online, and you'll receive a confirmation once it is processed.

Filing options for the Florida Articles of Organization

When filing your Articles of Organization for your LLC in Florida, you have multiple options. E-filing is the most efficient method, allowing for immediate processing. Alternatively, if you prefer a more traditional approach, you may print the form and submit it via mail. Ensure to include the appropriate payment with your application.

If mailing your application, send it to the Florida Division of Corporations and check their website for the latest filing address. Regardless of the method you choose, it’s essential to retain a copy for your records, as this is an important document for your LLC.

Payment information for formation in Florida

When it comes to filing fees, Florida has set specific costs for establishing an LLC. Generally, the filing fee for the Articles of Organization is approximately $125. Payment can be made through various methods, including credit cards, checks, or money orders, which you need to include if filing via mail.

For those choosing to e-file, ensure you have a valid credit or debit card for the transaction. Be aware that additional fees may apply depending on your selected payment method, and it’s wise to check for any updates on the Florida Division of Corporations website to ensure you avoid any surprises.

After filing: What comes next?

After submitting your 2024 Florida limited liability form, you can expect a confirmation notice from the state, confirming the acceptance of your filing. Typically, processing times vary but can take up to two weeks. You may check the status of your filing on the Florida Division of Corporations website to ensure everything is on track.

Once your filing is processed, you will receive a copy of your Articles of Organization, which serves as official proof of your LLC formation. Maintaining this document is crucial, as it will be essential for opening bank accounts, securing funding, and establishing your business credibility.

Common filing questions and troubleshooting

It's not uncommon for applicants to encounter issues during the filing process. If your filing is rejected, the Florida Division of Corporations will typically notify you via the contact information provided. Common reasons for rejection include incorrect information or missing documents.

In such cases, revising the errors promptly is essential to rectify the situation. California has a helpful 24/7 online platform where you can review details and make necessary corrections. Be proactive in seeking answers to frequently asked questions to help simplify the filing experience.

Additional compliance requirements for Florida LLCs

Once your LLC is formed, you must adhere to several compliance requirements to ensure your business operates smoothly. First, obtaining a Federal Employer Identification Number (EIN) from the IRS is essential for tax purposes and hiring employees. This number serves as your business’s unique identifier for federal taxes.

Additionally, depending on the nature of your business, you may need to secure specific state licenses and permits. Conduct thorough research to determine which licenses apply to your LLC. Furthermore, Florida mandates the reporting of beneficial ownership information for certain entities, emphasizing transparency in ownership and control.

Advanced topics for Florida LLCs

For business owners considering transforming their operations, understanding how to convert an existing business into an LLC is crucial. This process involves notifying relevant authorities, adhering to tax regulations, and possibly producing a new operating agreement.

Moreover, maintaining ongoing compliance with state regulations is essential for the longevity of your LLC. Regularly review tax obligations, file necessary annual reports, and stay informed on any legislative changes impacting LLCs in Florida. One valuable option to explore is the benefits of creating a professional LLC, particularly beneficial for licensed professionals such as lawyers, doctors, or architects.

Using pdfFiller for your document management

pdfFiller is an invaluable resource for anyone looking to streamline LLC formation and document management. The platform provides access-from-anywhere features, enabling users to create, edit, and manage their LLC documents efficiently. Collaborative capabilities promote team efficiency, ensuring that multiple stakeholders can contribute easily to the formation process.

With pdfFiller's eSigning capability, users can complete documents in one seamless flow—eliminating the hassle of printing and scanning. As a cloud-based solution, pdfFiller ensures your documents are securely stored and easily accessible whenever needed, making the LLC formation process more manageable and less stressful.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 2024 florida limited liability?

How do I edit 2024 florida limited liability straight from my smartphone?

How do I fill out the 2024 florida limited liability form on my smartphone?

What is 2024 florida limited liability?

Who is required to file 2024 florida limited liability?

How to fill out 2024 florida limited liability?

What is the purpose of 2024 florida limited liability?

What information must be reported on 2024 florida limited liability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.