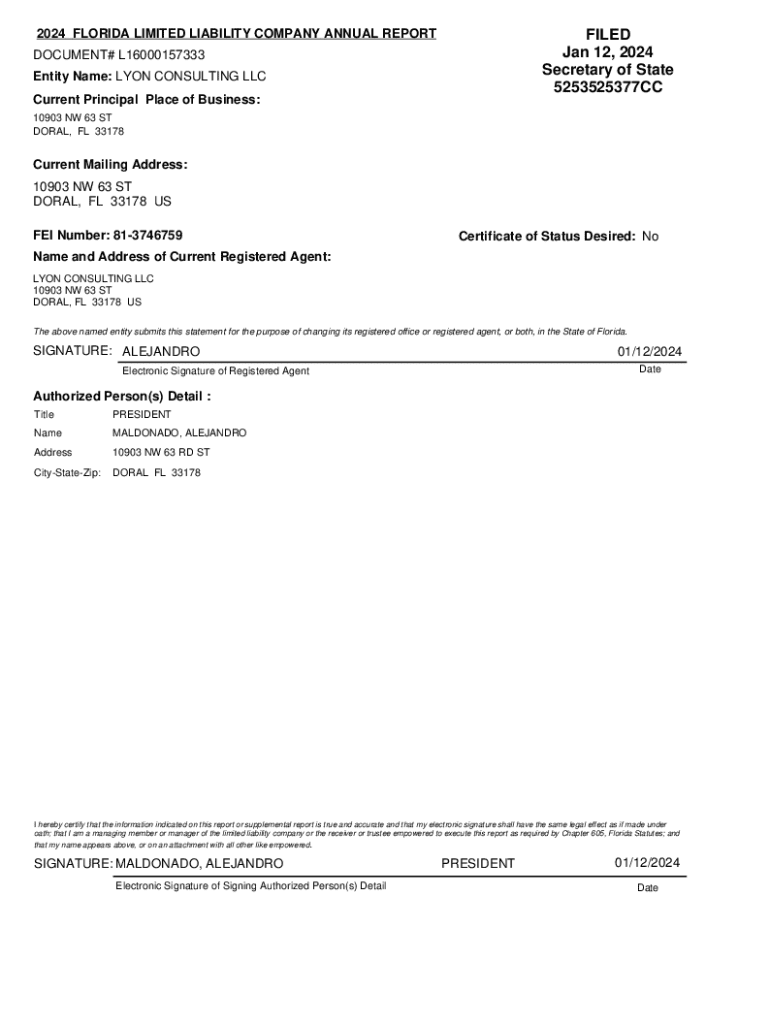

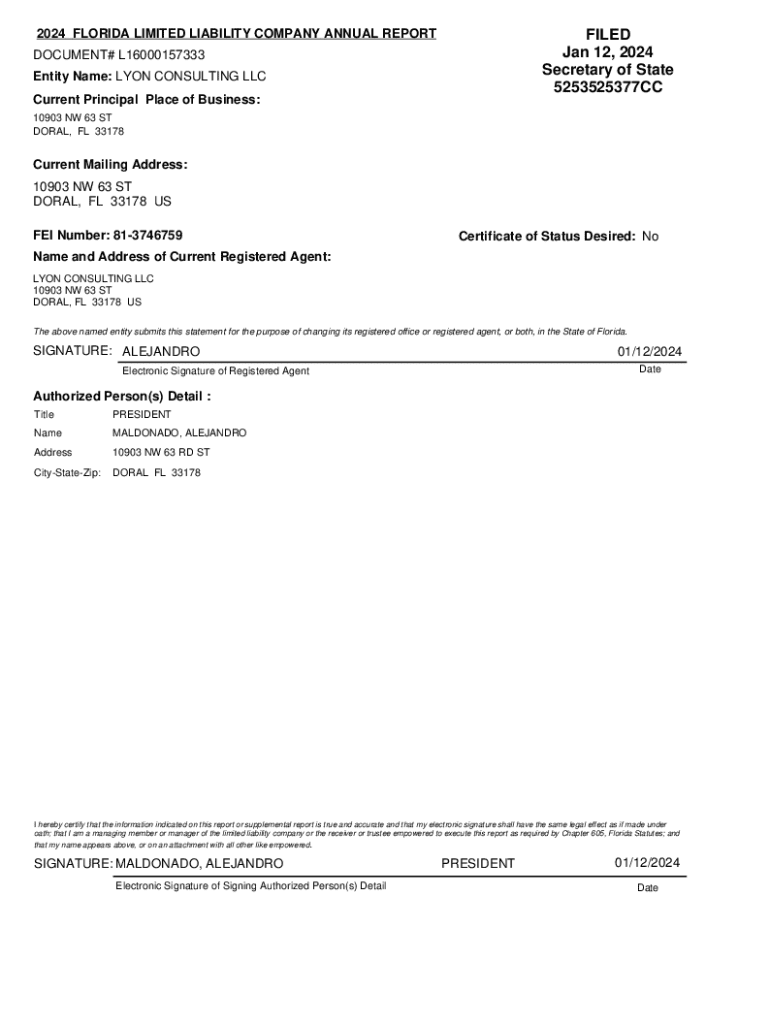

Get the free 2024 Florida Limited Liability Company Annual Report

Get, Create, Make and Sign 2024 florida limited liability

Editing 2024 florida limited liability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida limited liability

How to fill out 2024 florida limited liability

Who needs 2024 florida limited liability?

2024 Florida Limited Liability Form: A Comprehensive Guide

Understanding the Florida Limited Liability Company () Structure

A Florida Limited Liability Company (LLC) offers a unique structure combining the flexibility of a partnership with the liability protection of a corporation. An LLC can have one or more owners, known as members, who enjoy personal liability protection against business debts and claims. This means that personal assets, such as a member's home or bank accounts, are generally safe from any legal actions taken against the business, which is a significant advantage for entrepreneurs.

Choosing to form an LLC in Florida provides additional benefits such as pass-through taxation, which means the LLC itself does not pay taxes on income. Instead, profits and losses are reported on the personal tax returns of the members, potentially leading to substantial tax savings. Furthermore, establishing an LLC can enhance the credibility of the business, as it shows potential customers and partners that it is a formalized organization.

2024 Updates to Florida Formation Requirements

In 2024, several legislative changes have impacted the formation of LLCs in Florida. One of the key updates includes enhanced privacy regulations concerning the reporting of beneficial ownership information. This change requires LLCs to provide detailed information about their owners or controllers, particularly in compliance with federal regulations aimed at preventing money laundering. As a business owner, understanding these updated requirements is crucial to ensure compliance and avoid legal penalties.

Additionally, updates have streamlined the filing process, making it easier for entrepreneurs to establish LLCs without the delay of previous years. The Florida Division of Corporations continues to improve its online systems to offer a more user-friendly experience for filing articles of organization. This efficiency is particularly beneficial for individuals looking to launch their ventures quickly.

Step-by-step guide to forming an in Florida

To successfully form an LLC in Florida, follow this detailed step-by-step guide:

Filing options and submitting your form

When it comes to filing your Articles of Organization, Florida offers multiple options. E-filing is increasingly popular due to its convenience. Through the Florida Division of Corporations’ online portal, you can easily complete and submit the necessary forms from anywhere.

For those who prefer traditional methods, paper filing remains an option. To file by mail, print the completed 2024 Florida Limited Liability Form and send it to the appropriate address provided by the Division of Corporations. While both methods serve the same purpose, e-filing tends to be quicker and allows for immediate confirmation of submission.

Understanding fees and payment options

Establishing an LLC in Florida requires understanding the associated costs. The main fee involves the filing of your Articles of Organization, which is typically around $125, though this amount can vary based on additional services you may require.

In addition to the filing fee, you may encounter optional charges if you choose expedited processing or request certified copies of your documents. Payment for filing can be made conveniently through various methods, including credit card, debit card, or electronic checks when using the e-filing option.

Common FAQs on Florida formation

Establishing an LLC can bring about many questions. Here are some common inquiries:

Resources and tools for managing your

Once your LLC is formed, ongoing management becomes critical. Utilizing interactive tools like those offered by pdfFiller can significantly simplify your document management processes. Through pdfFiller, users can access a suite of tools for creating, editing, and managing essential LLC-related documents.

Additionally, staying compliant with state regulations is crucial. Florida LLC owners must keep track of important compliance deadlines and requirements. Tools available on pdfFiller can assist in maintaining accurate records and timely submissions, safeguarding your LLC from potential legal issues.

Additional considerations

When forming an LLC in Florida, it's important to note the differences for foreign LLCs. If your business is registered in another state but wishes to operate in Florida, you must register as a foreign LLC. The registration process is similar to forming a new LLC, but it requires the provision of additional documents, such as a Certificate of Good Standing from your home state.

Another aspect to consider is the process of converting an existing business to an LLC. Companies already operating as sole proprietorships or corporations can convert to an LLC by filing the appropriate paperwork with the state while carefully adhering to the dissolution requirements of the previous entity.

Navigating the Florida Secretary of State website

The Florida Secretary of State website is a vital resource for entrepreneurs. It provides comprehensive information about LLC formation, including links to essential forms and guidelines. Familiarizing yourself with the site can streamline the process of searching for your LLC name, checking status, and filing necessary paperwork.

Tips for using this site efficiently include utilizing the search feature for articles of organization, exploring FAQs related to LLC formation, and keeping detailed notes of your progress in forming your LLC. This approach will help manage time effectively as you navigate through the requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the 2024 florida limited liability in Chrome?

How do I edit 2024 florida limited liability straight from my smartphone?

Can I edit 2024 florida limited liability on an Android device?

What is 2024 florida limited liability?

Who is required to file 2024 florida limited liability?

How to fill out 2024 florida limited liability?

What is the purpose of 2024 florida limited liability?

What information must be reported on 2024 florida limited liability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.