Get the free 2024 Florida Profit Corporation Annual Report

Get, Create, Make and Sign 2024 florida profit corporation

Editing 2024 florida profit corporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida profit corporation

How to fill out 2024 florida profit corporation

Who needs 2024 florida profit corporation?

2024 Florida profit corporation form: A comprehensive guide

Overview of Florida profit corporations

A profit corporation in Florida is a legal entity created to generate profit for its shareholders. Unlike non-profit organizations, profit corporations aim to reinvest earnings back into the company or distribute dividends to shareholders. This business structure provides limited liability protection, meaning owners are not personally liable for the debts or obligations incurred by the corporation. Florida's favorable business climate, including no state income tax on corporations, attracts entrepreneurs looking to establish a profit corporation.

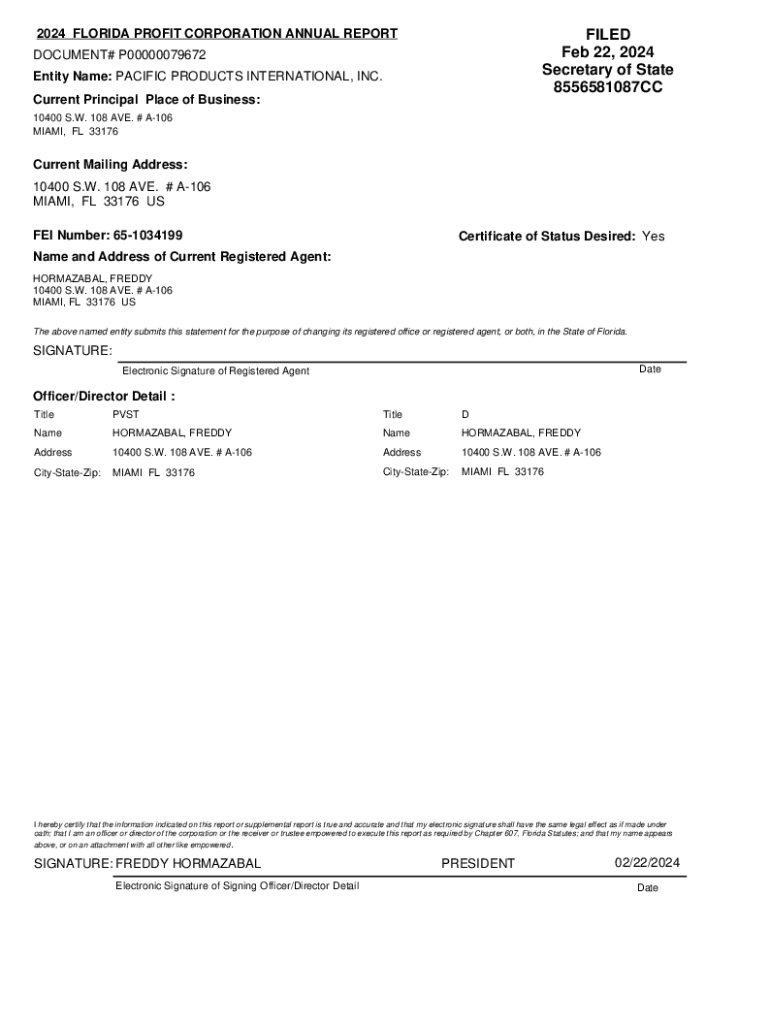

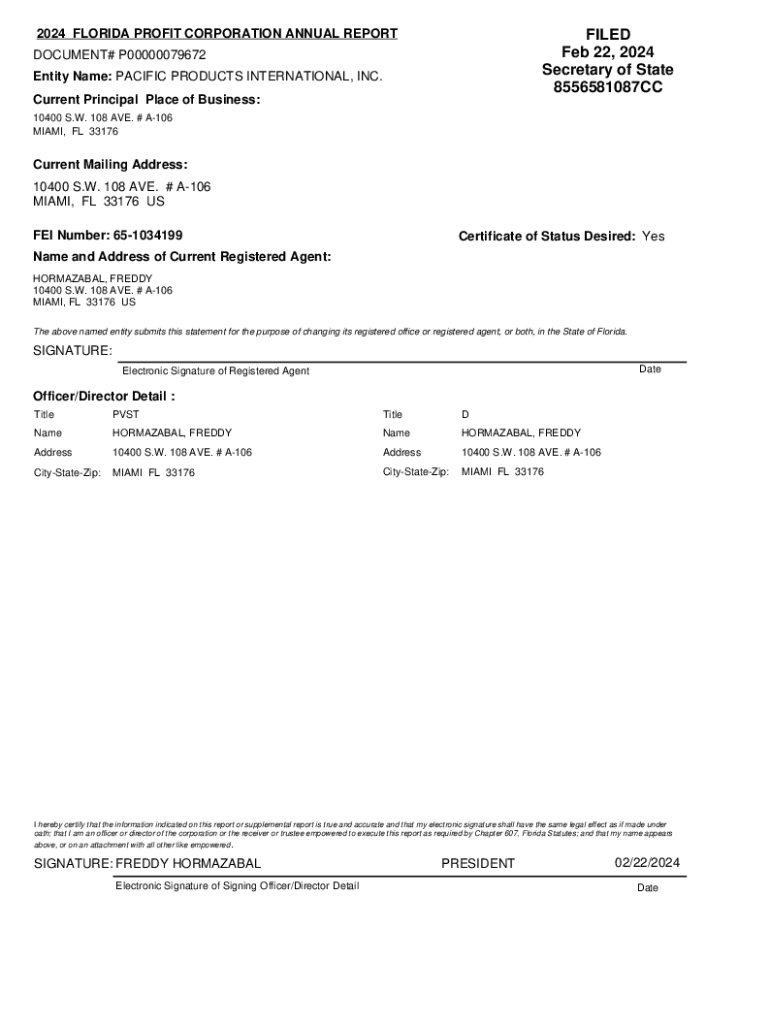

Filing information for the 2024 Florida profit corporation form

Filing a profit corporation involves several steps and must be done correctly to comply with state regulations. The filing process for the 2024 Florida profit corporation form begins with submitting Articles of Incorporation to the Florida Department of State. This documentation is vital as it officially establishes your business. Key filing deadlines for 2024 include January 1 for annual report submissions as well as any required amendments to your file. It's essential to gather the necessary documentation to avoid any processing delays.

Step-by-step instructions to complete the 2024 Florida profit corporation form

Completing the 2024 Florida profit corporation form requires careful attention to detail. Start by gathering necessary information, including the names and addresses of the incorporators, the defined purpose of the corporation, and stock issuance information. Access the online form through the Florida Department of State’s website or platforms like pdfFiller, which simplifies document management.

Once you have collected the necessary details, you can fill out the form online via pdfFiller. This platform offers user-friendly navigation that ensures a smooth process. When you are done, review your entries for accuracy using pdfFiller’s handy editing tools, which can help highlight common errors. This careful review step is crucial to prevent any processing issues down the line.

Payment options for filing the articles of incorporation

When you're ready to submit your Articles of Incorporation, it's important to know the payment options available to you. The Florida Department of State accepts various payment methods for filing fees, including credit and debit cards, as well as electronic checks. The fee structure for 2024 includes a base filing fee, along with additional fees depending on the specific requirements of your corporation.

E-filing process for the 2024 Florida profit corporation form

E-filing the 2024 Florida profit corporation form offers several advantages, including convenience and speed. To complete the e-filing process, navigate to the appropriate section of the Florida Department of State’s website or use pdfFiller. Once you have filled out your Articles of Incorporation, submit them electronically. After submission, you will receive a confirmation of your filing, which you can track through the state’s online system.

Alternative: Paper filing process

If you prefer the traditional method, paper filing is still an option for establishing your profit corporation. Begin by downloading the Florida profit corporation form from the state website. Carefully read the instructions for manual completion, gathering all necessary information beforehand. Once your form is complete, send it via mail to the appropriate address provided on the form. Keep in mind that paper submissions may take longer to process compared to e-filing.

Status updates and confirmation of your filing

Once you have filed your Articles of Incorporation, it’s important to stay informed on the status of your filing. The Florida Department of State provides online tools that enable you to check the status of your submission. Typically, processing times vary based on the method of submission. E-filings are generally processed faster than paper submissions. Expect to receive confirmation by email once your filing is accepted, which serves as proof of the official establishment of your corporation.

Dealing with common issues in filing

Filing issues can occur, resulting in the rejection of your Articles of Incorporation. Common reasons include errors in the information provided, discrepancies in the corporation name, or missing signatures. To avoid these problems, double-check your entries against the guidelines. If your filing is rejected, you will need to correct the errors and resubmit your application promptly. The Florida Department of State offers resources and customer support to assist you in resolving these issues efficiently.

Post-filing requirements for Florida profit corporations

Once you have successfully filed the Articles of Incorporation, your responsibilities are not complete. Florida profit corporations must file an annual report with the state to maintain good standing and avoid penalties. This report is due every year by May 1, and it’s crucial for keeping your corporation in compliance with state regulations. Additionally, any changes in business ownership or structure must be reported, including beneficial ownership information, which enhances transparency.

Resources for Florida profit corporations

Managing your corporation’s documents requires efficient tools. pdfFiller offers a variety of features, including access to templates for important documents, eSignature capabilities, and robust document management tools. These resources make it easier for business professionals to collaborate and manage key documents related to their corporations, enhancing productivity and compliance with regulations.

FAQs regarding the 2024 Florida profit corporation form

As you navigate the process of filing the 2024 Florida profit corporation form, common questions may arise. For instance, if your desired corporation name is already in use, you will need to select an alternative that complies with state naming requirements. If you prefer not to file online, assistance is available through various resources, including legal professionals. To obtain copies of your filed Articles of Incorporation, you can request them directly from the Florida Department of State.

Expanding your business: Beyond profit corporations

While profit corporations are a popular choice for many business owners, it’s worthwhile to consider other structures such as Limited Liability Companies (LLCs) or partnerships. These alternatives offer different benefits, like flexible management options and varying tax implications that can suit your specific needs as your business grows. Regularly evaluating your business structure is essential, especially as your company’s goals evolve.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2024 florida profit corporation for eSignature?

Can I create an eSignature for the 2024 florida profit corporation in Gmail?

How do I fill out 2024 florida profit corporation using my mobile device?

What is 2024 florida profit corporation?

Who is required to file 2024 florida profit corporation?

How to fill out 2024 florida profit corporation?

What is the purpose of 2024 florida profit corporation?

What information must be reported on 2024 florida profit corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.