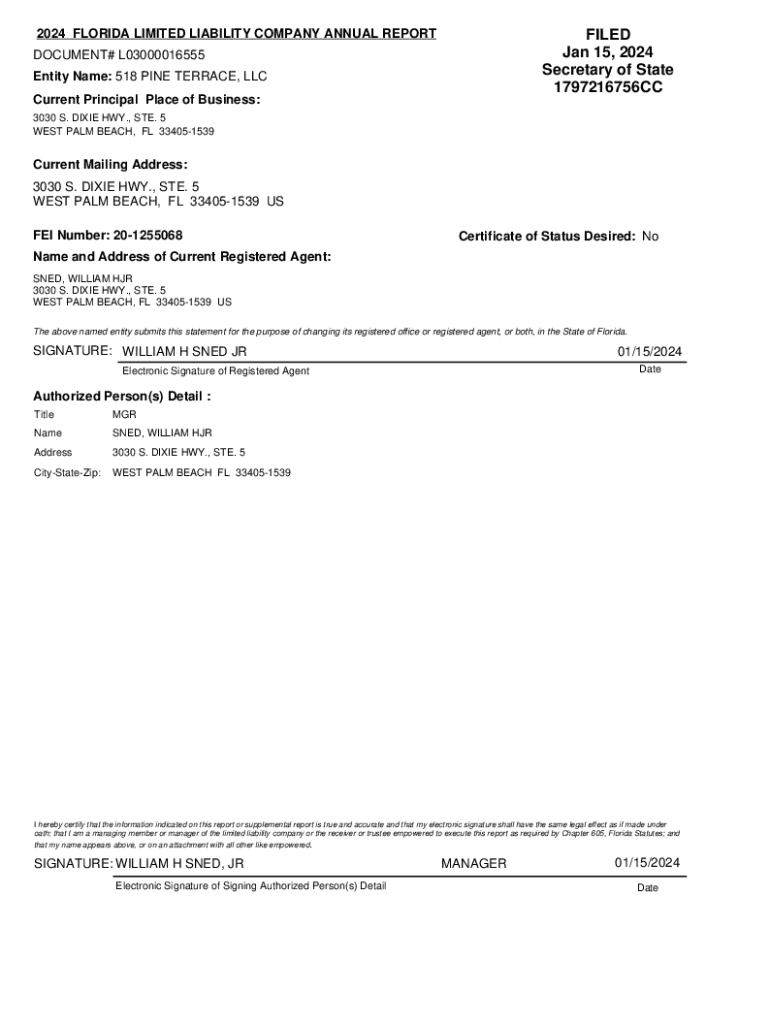

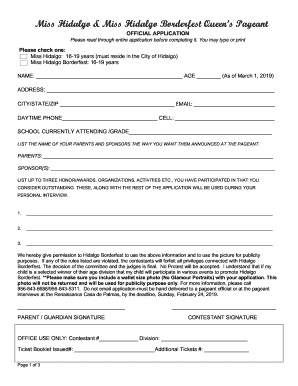

Get the free 2024 Florida Limited Liability Company Annual Report

Get, Create, Make and Sign 2024 florida limited liability

How to edit 2024 florida limited liability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida limited liability

How to fill out 2024 florida limited liability

Who needs 2024 florida limited liability?

2024 Florida Limited Liability Form: A Comprehensive Guide

Understanding the Florida Limited Liability Company ()

A Florida Limited Liability Company (LLC) is a unique business structure that combines the flexibility of a partnership with the liability protections of a corporation. LLCs are designed to shield their owners (known as members) from personal liability for business debts, making them a safe option for entrepreneurs.

Key characteristics of a Florida LLC include limited personal liability, flexible management capabilities, and relatively simple tax structures. Members can choose how they want to be taxed: either as a sole proprietor or as a corporation, allowing for unique financial strategies.

The benefits of forming an LLC in Florida are numerous. Not only does it protect personal assets, but Florida also boasts a favorable business climate. With no personal income tax and a straightforward formation process, entrepreneurs can focus on growing their business without worrying about excessive state regulations.

Why choose an in Florida?

Choosing an LLC over other business structures, such as a sole proprietorship or a corporation, offers several advantages. For instance, LLC members are typically only liable for the amount of their investment in the company, protecting personal assets from business debts and lawsuits. This limitation is an essential consideration for risk-averse individuals.

Furthermore, Florida’s business climate is conducive to entrepreneurship. With a growing economy and an influx of new residents, many businesses thrive in this sunny state. Additionally, Florida's LLCs require fewer formalities and ongoing compliance than corporations, making them easier to maintain.

Prerequisites for filing the 2024 Florida Limited Liability Form

Step 1: Decide on a name for your

The first step in forming your LLC is selecting a suitable name. It must be distinguishable from other registered entities in Florida and must include "Limited Liability Company," or abbreviations such as "LLC" or "L.L.C." This requirement helps differentiate LLCs from other business structures.

Conducting a name availability search on Florida's Division of Corporations website is critical to ensure your chosen name is not already in use. This will save you time and potential legal issues down the line.

Step 2: Determine your management structure

Next, establish the management structure of your LLC. You can opt for a member-managed or a manager-managed LLC. In a member-managed LLC, all members participate in the daily business operations, while a manager-managed LLC designates one or more managers to handle these tasks, relieving members from day-to-day responsibilities. This decision impacts how decisions are made and how operational tasks are performed.

Step 3: Designate a registered agent

A registered agent is an individual or entity designated to receive legal documents on behalf of your LLC. In Florida, a registered agent must have a physical address in the state and be available during regular business hours. They serve as the official point of contact for legal matters and government correspondence.

Choosing a reliable registered agent is crucial for ensuring that your LLC remains in good standing with the state.

The 2024 Florida Limited Liability Form process

Step 4: Preparing your Articles of Organization

After deciding on your LLC's name, management structure, and registered agent, you will need to prepare your Articles of Organization. This document includes essential information, such as your LLC's name, address, registered agent's information, and management structure. It's critical to ensure that all information is accurate and conforms to state guidelines.

You can find available templates and resources on pdfFiller that simplify the process of drafting and customizing your Articles of Organization, helping you to avoid common mistakes.

Step 5: Filing your Articles with the State of Florida

Once your Articles of Organization are ready, it's time to file them with the Florida Division of Corporations. You have the option to file electronically or via traditional mail. E-filing is recommended for its speed and ease. To e-file, visit the Florida Division of Corporations' website, create an account, and follow the prompts to submit your documents.

pdfFiller offers interactive tools that guide you through the e-filing process, allowing for seamless submission of your LLC formation paperwork.

Step 6: Obtaining your Federal Employer Identification Number (EIN)

An Employer Identification Number (EIN) is crucial for your LLC, as it's used for tax purposes and to open a business bank account. To obtain an EIN, visit the IRS's website and complete Form SS-4. The process can be done online, and you'll receive your EIN immediately upon completion.

Step 7: Complying with Florida's licensing and permit requirements

Following the filing of your Articles of Organization, you must ensure compliance with Florida's specific licensing and permit requirements. Depending on your business type, you'll need to research and secure the necessary licenses at the state and local levels. Consulting with local chambers of commerce or the Florida Small Business Development Center can help in identifying what is required.

Important considerations after filing

Confirming your filing status

Once you have filed your LLC formation documents, it’s essential to confirm your filing status. You can check the status of your LLC formation on Florida's Division of Corporations' official site. Expect to receive confirmation that your LLC has been officially registered. Processing times can vary, but it generally takes a few days.

Maintaining your

After your Florida LLC is formed, it’s vital to adhere to ongoing requirements. Florida requires annual reporting and related fees to maintain good standing. Keeping your business compliant ensures it continues to operate smoothly and avoids penalties or dissolution.

Common actions and FAQs related to the 2024 Florida Limited Liability Form

Changing your name post-formation

If you find the need to change your LLC's name after formation, you'll need to file an amendment with the Florida Division of Corporations. Ensure that the new name follows the same guidelines as your initial name selection. Changing the name may impact existing contracts and agreements, so it's wise to consult with legal professionals as needed.

How to handle rejected filings

Should your filing be rejected, it's typically due to incomplete or incorrect information. Common reasons include improperly formatted names or errors in addresses. Review the rejection notice carefully, correct the issues, and resubmit your application promptly to avoid delays.

Filing for foreign LLCs in Florida

If your LLC is already formed in another state and wishes to operate in Florida, you must file an Application for Certificate of Authority to transact business in Florida. This process involves providing documentation from your home state and aligning with Florida's regulations for foreign entities.

Utilizing pdfFiller for your needs

pdfFiller is designed to enhance your LLC formation experience, providing interactive tools for efficient document management. Whether you're preparing Articles of Organization or modifying existing documents, pdfFiller enables seamless editing, signing, and collaboration—all in one cloud-based platform.

With access-from-anywhere convenience, teams and individuals alike find that pdfFiller simplifies the process of managing extensive documentation related to establishing and maintaining a Florida LLC.

Navigating the user-friendly features of pdfFiller

Using pdfFiller for the Florida LLC form is straightforward. Step-by-step guidance leads you through creating, editing, and filing your LLC documentation. Its user interface is designed for efficiency, making the management of multiple documents and forms easy and hassle-free.

Benefits of electronic filing through pdfFiller

Additionally, filing electronically through pdfFiller offers speed and convenience. Users receive real-time updates and notifications regarding their filing status, which helps keep the business owner informed throughout the process. This transparency is invaluable for managing formation tasks and staying organized.

Exploring additional resources related to Florida LLCs

Links to official state resources

For more information regarding the necessary forms and FAQs related to Florida LLC formation, it’s beneficial to consult the Florida Division of Corporations' website. Here, you can access documents, guidelines, and resources that further clarify the formation process.

Frequently asked questions (FAQs)

Common queries related to the LLC formation process often revolve around timelines, costs, and compliance requirements. Addressing specific scenarios within LLC management can further empower entrepreneurs to navigate their business journeys with confidence.

Related articles and guides for entrepreneurs

Reading further on topics such as tax implications of LLCs, financial management strategies, and business growth tactics can help entrepreneurs make informed decisions as they embark on their business ventures in Florida. Keeping abreast of ongoing changes and best practices is essential for maintaining a successful LLC.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2024 florida limited liability online?

Can I create an eSignature for the 2024 florida limited liability in Gmail?

How do I complete 2024 florida limited liability on an Android device?

What is 2024 florida limited liability?

Who is required to file 2024 florida limited liability?

How to fill out 2024 florida limited liability?

What is the purpose of 2024 florida limited liability?

What information must be reported on 2024 florida limited liability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.