Get the free 2024 Florida Profit Corporation Annual Report

Get, Create, Make and Sign 2024 florida profit corporation

Editing 2024 florida profit corporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida profit corporation

How to fill out 2024 florida profit corporation

Who needs 2024 florida profit corporation?

2024 Florida Profit Corporation Form: A Comprehensive Guide

Overview of Florida profit corporations

A Florida profit corporation is a legal entity created to conduct business for profit in the state of Florida. This structure provides liability protection to its shareholders, separating personal assets from business debts and obligations. By incorporating as a profit corporation, business owners can enhance credibility, secure funding, and attract investors.

Compliance with state laws is essential for maintaining good standing and avoiding penalties. Florida profit corporations must adhere to various regulations, including filing annual reports and ensuring proper governance. Understanding these requirements will aid entrepreneurs in thriving in the dynamic Floridian market.

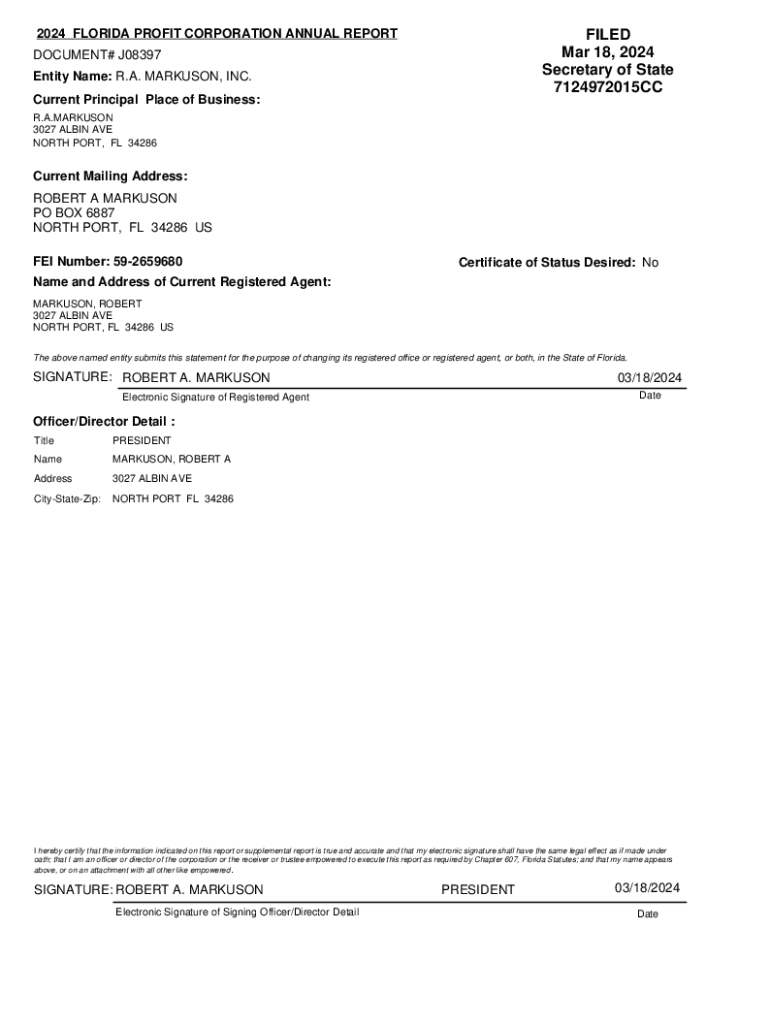

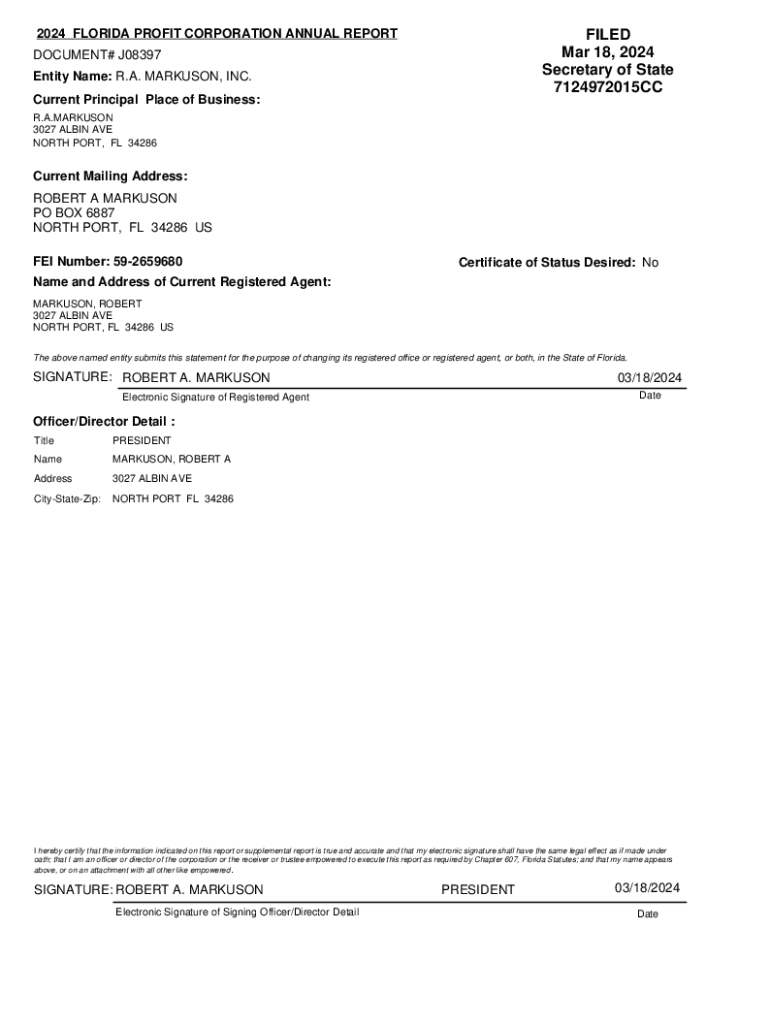

Filing the 2024 Florida profit corporation form

Filing the 2024 Florida profit corporation form involves specific steps to ensure your application is accurate and compliant. Begin by gathering necessary information, including the corporation’s name, principal office address, and details for directors and officers.

Next, complete the Articles of Incorporation, which is a formal document outlining the corporate structure. Review the form for accuracy, as errors could lead to processing delays. Finally, submit the form online through the Sunbiz portal, where tracking and updates are readily available.

E-filing process for Florida profit corporation

The e-filing process for the Florida profit corporation form is designed to be user-friendly. Start by creating an account on the Sunbiz portal. Once your account is set up, navigate the e-filing interface, where you can easily access the necessary forms and resources.

Be mindful of supported web browsers to ensure a smooth filing experience. If you encounter any issues, troubleshooting resources are available on the portal. This digital process not only streamlines submissions but also expedites the overall formation timeline.

Payment options for filing articles of incorporation

When filing the 2024 Florida profit corporation form, understanding the payment process is critical. Acceptable methods include credit cards and electronic checks. Ensure you assess the fee structure and understand how these costs contribute to your overall business budget.

Fees can vary based on various factors, so it’s important to review all potential charges before submission. To ensure successful payment processing, always double-check your payment information and act promptly to avoid delays in the incorporation process.

Naming your corporation

Choosing a name for your Florida profit corporation is a crucial step in the formation process. Check for name availability by searching the Florida Division of Corporations database. It's vital to ensure that the name adheres to the naming requirements set by the state.

If the desired name is unavailable, consider alternatives like adding descriptive terms or rearranging the name. Additionally, taking proactive steps to protect your corporation name through trademarks and registration can safeguard your brand in the competitive marketplace.

Alternatives to online filing

If online filing isn't preferable, Florida allows for paper applications. To print and mail your application, complete the required paper form, ensuring all information is accurately filled out. Be diligent in following the mailing instructions and confirm the correct address to avoid delays.

While paper filing may feel traditional, it comes with both benefits and drawbacks. One advantage is the tangible nature of submitting a physical document, which some may prefer for record-keeping. However, processing times can be significantly longer compared to e-filing, so weigh your options carefully.

Confirmation and processing of your filing

After submitting your Florida profit corporation form, obtaining confirmation is essential. This provides reassurance that your filing is underway. You can access filing confirmation through your Sunbiz account or directly on the portal after processing.

Processing times can vary, so staying informed about expected timelines is beneficial. In case your filing is rejected, common reasons include missing information or discrepancies in the submitted documents. Take note of the issues raised and follow the outlined steps to rectify and resubmit your application.

Post-filing requirements

Once your Florida profit corporation is formed, post-filing requirements come into play. One of the first tasks is obtaining copies of your Articles of Incorporation. This can be easily done through Sunbiz, allowing access to important documentation for your records.

In addition to obtaining necessary copies, reporting beneficial ownership information is mandated to ensure compliance with state regulations. Ongoing compliance obligations include filing annual reports and adhering to corporate governance protocols, which help maintain your corporation's good standing.

Required fees for Florida profit corporations

Understanding the financial commitments for forming a Florida profit corporation is crucial. The initial filing fees for the Articles of Incorporation are set by the state and can vary depending on specific factors related to your corporation. Overviewing this cost will assist you in budgeting appropriately as you start your business.

Apart from initial fees, considering annual reporting fees is essential, as these costs recur yearly. Be sure to keep informed about additional fees for any amendments or special requests after formation to avoid unexpected costs down the line.

Other business structures in Florida

Every business structure has its distinct advantages and disadvantages. While profit corporations provide limited liability and operational flexibility, business owners may also consider Limited Liability Companies (LLCs) or partnerships based on their unique needs. Each structure has different implications on taxation, compliance, and management.

Understanding when to choose a different structure involves assessing personal liability, tax implications, and future growth potential. Research each option thoroughly and consult with a financial advisor if needed, to ensure you select the most suitable structure for your business intentions.

Utilizing pdfFiller for document management

Streamlining the process of managing your Articles of Incorporation is essential, and this is where pdfFiller shines as a crucial tool. With its cloud-based platform, users can easily edit, manage, and securely store documents from anywhere. Use pdfFiller to ensure your forms are completed accurately before submission.

In addition to editing capabilities, pdfFiller offers eSigning functionality, allowing for convenient electronic signatures that can expedite the filing process. Furthermore, collaborating with team members is seamless, enabling multiple users to access and modify documents as needed, ensuring all stakeholders are aligned.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2024 florida profit corporation to be eSigned by others?

Can I create an eSignature for the 2024 florida profit corporation in Gmail?

How do I fill out 2024 florida profit corporation using my mobile device?

What is 2024 florida profit corporation?

Who is required to file 2024 florida profit corporation?

How to fill out 2024 florida profit corporation?

What is the purpose of 2024 florida profit corporation?

What information must be reported on 2024 florida profit corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.