Get the free Form 990-pf

Get, Create, Make and Sign form 990-pf

Editing form 990-pf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-pf

How to fill out form 990-pf

Who needs form 990-pf?

Form 990-PF Form: A Comprehensive How-to Guide

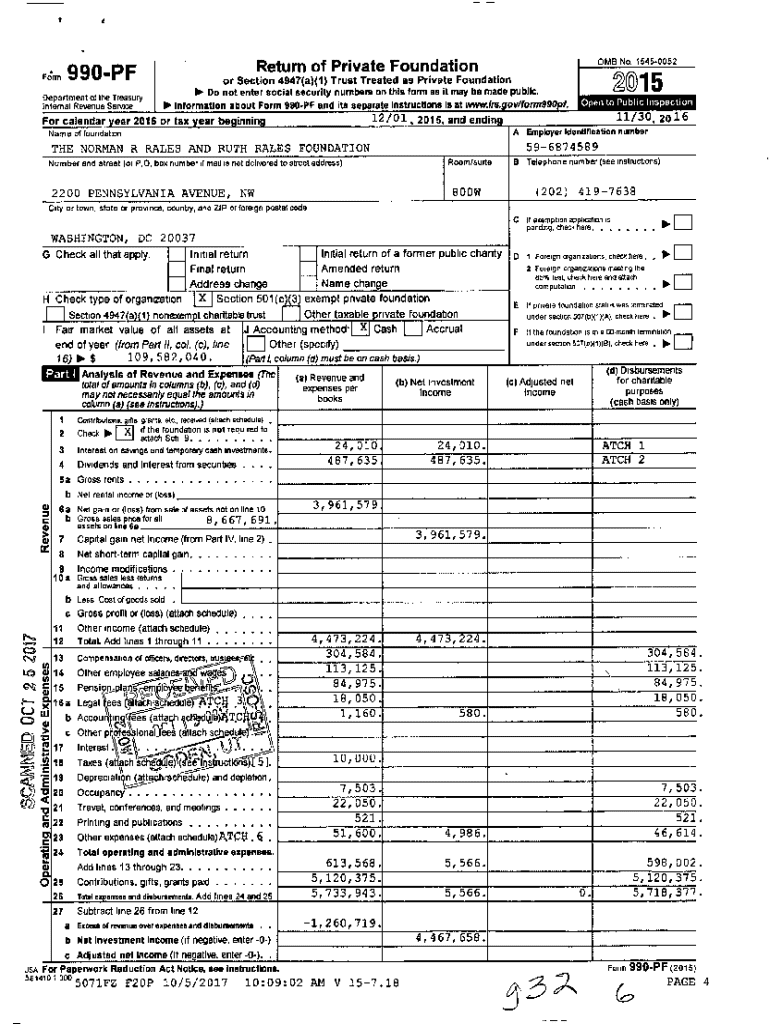

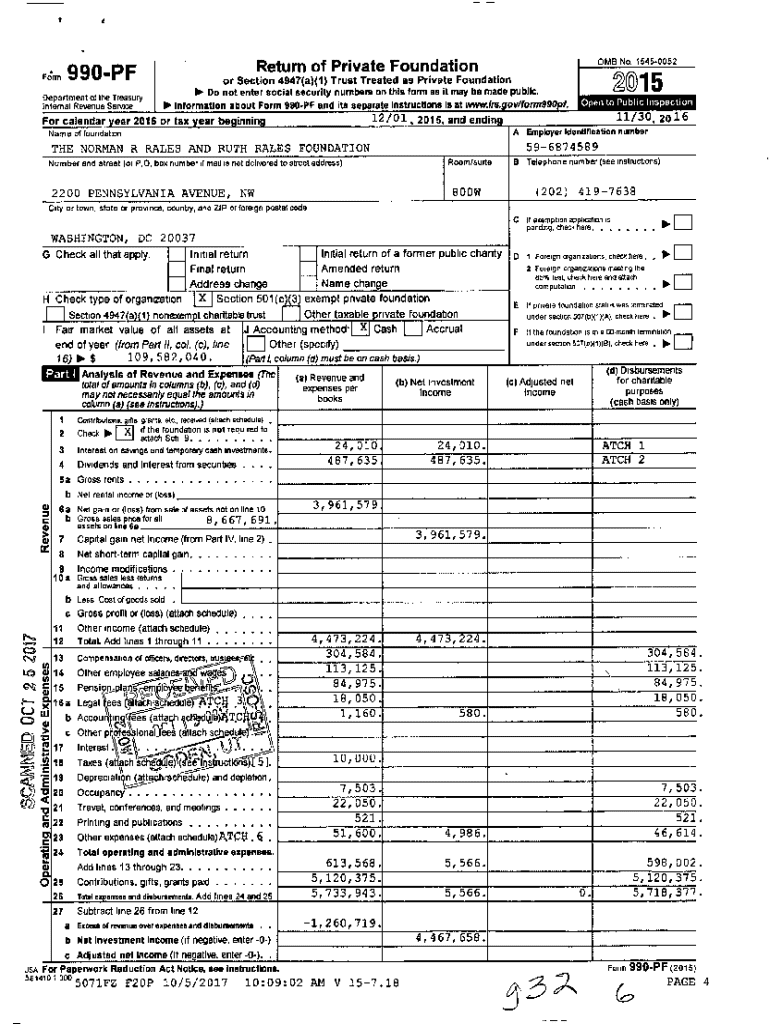

Understanding Form 990-PF

Form 990-PF serves as the annual tax return for private foundations, a unique subset of charitable organizations in the U.S. Designed by the IRS, this form ensures transparency and accountability in the operations and finances of private foundations. Understanding its intricacies is crucial for any organization under this classification, as it aims to provide a comprehensive financial picture and substantiate charitable distributions.

Private foundations must navigate specific IRS regulations and requirements outlined in Form 990-PF. This form not only reports financial activity but also highlights the foundation's program service accomplishments, governance structure, and compliance with federal regulations. By requiring detailed information about a foundation's operations, the IRS aims to uphold the integrity of charitable giving.

Who must file Form 990-PF?

Private foundations are generally required to file Form 990-PF annually. To qualify as a private foundation, an organization must primarily operate for charitable, educational, or religious purposes and typically derive its funding from a single source, such as an individual or family.

Here are the criteria that define qualifying organizations:

Certain exceptions exist, such as organizations that are temporarily inactive or those whose gross receipts are below specific thresholds. Understanding these exceptions is vital to ensure compliance with IRS mandates and avoid unnecessary penalties.

When is Form 990-PF due?

Form 990-PF must be submitted on or before the 15th day of the 5th month after the end of the foundation’s fiscal year. For most organizations that operate on a calendar year, this translates to a May 15 deadline.

Each state may also have specific submission requirements; therefore, consulting local regulations is essential to avoid discrepancies. Late filings can lead to financial penalties and complications regarding the foundation's tax-exempt status.

Breakdown of Form 990-PF sections

Form 990-PF comprises several critical sections that provide detailed insights into the foundation's operations and finances. The main components include identification information, financial statements, program service accomplishments, and governance details. Each section serves a specific purpose in outlining essential information to the IRS and the public.

Here’s an overview of the key sections:

In addition to the primary sections, various schedules complement the form, including Schedule A, which addresses public charity status, Schedule B for contributions, and Schedule C for political campaign activities. Properly completing these schedules is critical for compliance and transparency.

Additional requirements for Form 990-PF filing

Filing Form 990-PF involves certain attachments and documentation that must accompany the submission to the IRS. These may include detailed financial statements, minutes from board meetings, and IRS determination letters. Additionally, some states impose their own reporting requirements, making it vital for organizations to stay informed about local laws.

In terms of compliance with IRS regulations, organizations must adhere to the various guidelines delineated in the IRS instructions for Form 990-PF. This includes maintaining accurate records and ensuring all financial and operational activities align with the stated charitable purposes.

Consequences of late filing Form 990-PF

Failing to file Form 990-PF by the deadline can lead to significant penalties. The IRS imposes a late filing penalty of $20 per day for each day the return is late, up to a maximum of $10,000 or 5% of the organization's gross receipts, whichever is less. Non-compliance can also affect the foundation’s tax-exempt status, leading to long-term implications for its operations.

Foundations should be proactive to mitigate these risks. Regular monitoring of filing deadlines and establishing a calendar for submissions can help organizations maintain compliance and avoid penalties. Additionally, consulting with tax professionals can provide clarity on reporting obligations and implications.

Extensions for filing Form 990-PF

If additional time is needed to prepare Form 990-PF, organizations can apply for an extension. Foundations can obtain a six-month extension by filing Form 8868, allowing more time to prepare the required documentation accurately.

Organizations eligible for extension must ensure they file Form 8868 by the original due date of Form 990-PF. The approval process is typically straightforward if the request is filed on time, but communication with the IRS should be clear to avoid misunderstandings about filing requirements.

How to file Form 990-PF

Organizations can choose between traditional paper filing or electronic filing for Form 990-PF. E-filing is the recommended method, as it allows for faster processing times, reduced errors, and immediate confirmation of receipt from the IRS. Regardless of the method, organizations must gather all necessary data for submission.

Here’s a step-by-step guide for e-filing Form 990-PF:

Avoid common mistakes during filing, such as incorrect EIN numbers, missing signatures, or errors in financial statements. Thoroughly reviewing the form before submission can significantly reduce the risk of errors.

Frequently asked questions about Form 990-PF

As organizations prepare to file Form 990-PF, several common questions arise. A frequent concern is whether a private foundation can file Form 990 or 990-EZ instead of Form 990-PF; the answer is no—those forms are exclusively for public charities. Another prevalent question pertains to revenue; even if a foundation has zero revenue, it is still required to file Form 990-PF.

Other important FAQs include:

Tools and resources for filing Form 990-PF

Leveraging the right tools can simplify the preparation and filing process for Form 990-PF. pdfFiller offers software solutions designed specifically for nonprofits, allowing organizations to streamline their document management through easy editing, signing, and filing capabilities.

For many organizations, seeking expert assistance is beneficial, particularly when navigating complex tax regulations. Professional advisors can offer tailored guidance, ensuring compliance with specific requirements. Additionally, online resources and training modules provide valuable insights and updates on best practices for filing.

Unpacking the benefits of proper Form 990-PF filing

Properly completing and filing Form 990-PF offers numerous advantages for private foundations. Firstly, it enhances transparency and accountability, which is crucial in maintaining donor trust. By providing a clear picture of financial activities, foundations can demonstrate their commitment to their charitable missions.

Beyond reputation, regular filing ensures compliance with federal and state laws, reducing the risks of penalties. This compliance can lead to more significant support from donors and stakeholders, reinforcing the foundation's mission and impact in the community.

Using pdfFiller: a streamlined approach to Form 990-PF

pdfFiller empowers organizations to effectively navigate the complexities of filing Form 990-PF. With features designed for nonprofits, pdfFiller provides a cloud-based platform that allows users to easily edit, collaborate, and manage documents remotely. This flexibility is especially critical for organizations operating in various geographic locations.

Collaborative document management solutions enable teams to work together seamlessly. This efficiency ensures that data remains accurate and up-to-date, facilitating timely submissions. With pdfFiller, nonprofits can focus on their missions while enjoying the convenience of online document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 990-pf from Google Drive?

How do I edit form 990-pf on an iOS device?

How do I edit form 990-pf on an Android device?

What is form 990-pf?

Who is required to file form 990-pf?

How to fill out form 990-pf?

What is the purpose of form 990-pf?

What information must be reported on form 990-pf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.