Get the free 2024 Florida Profit Corporation Annual Report

Get, Create, Make and Sign 2024 florida profit corporation

Editing 2024 florida profit corporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida profit corporation

How to fill out 2024 florida profit corporation

Who needs 2024 florida profit corporation?

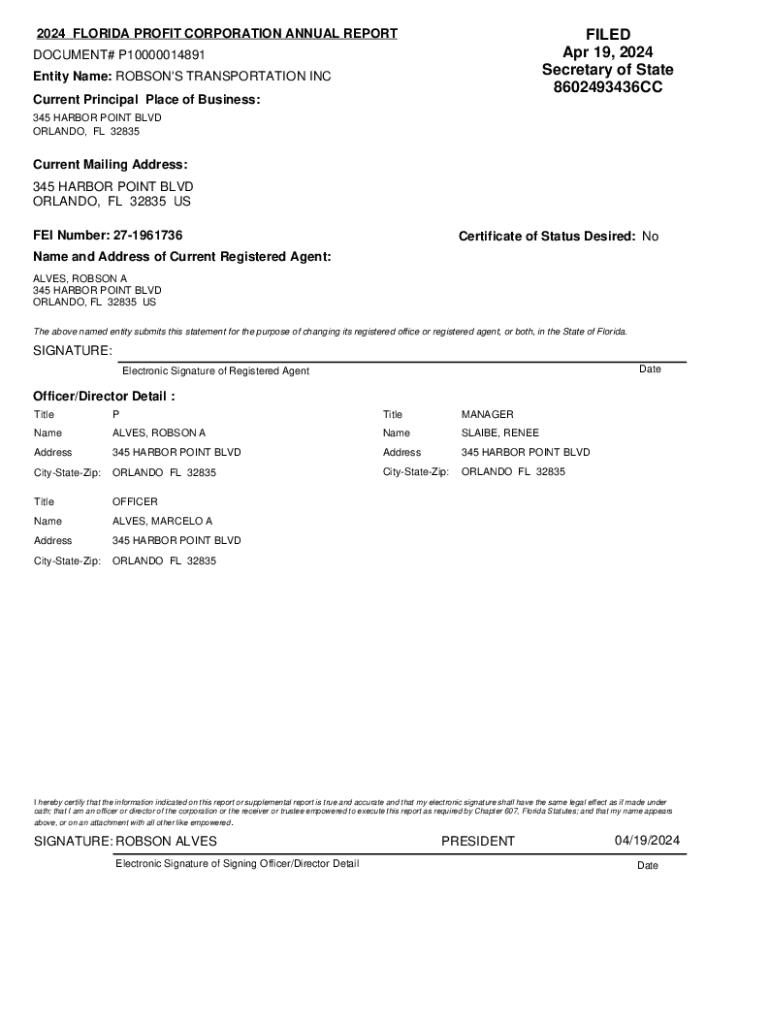

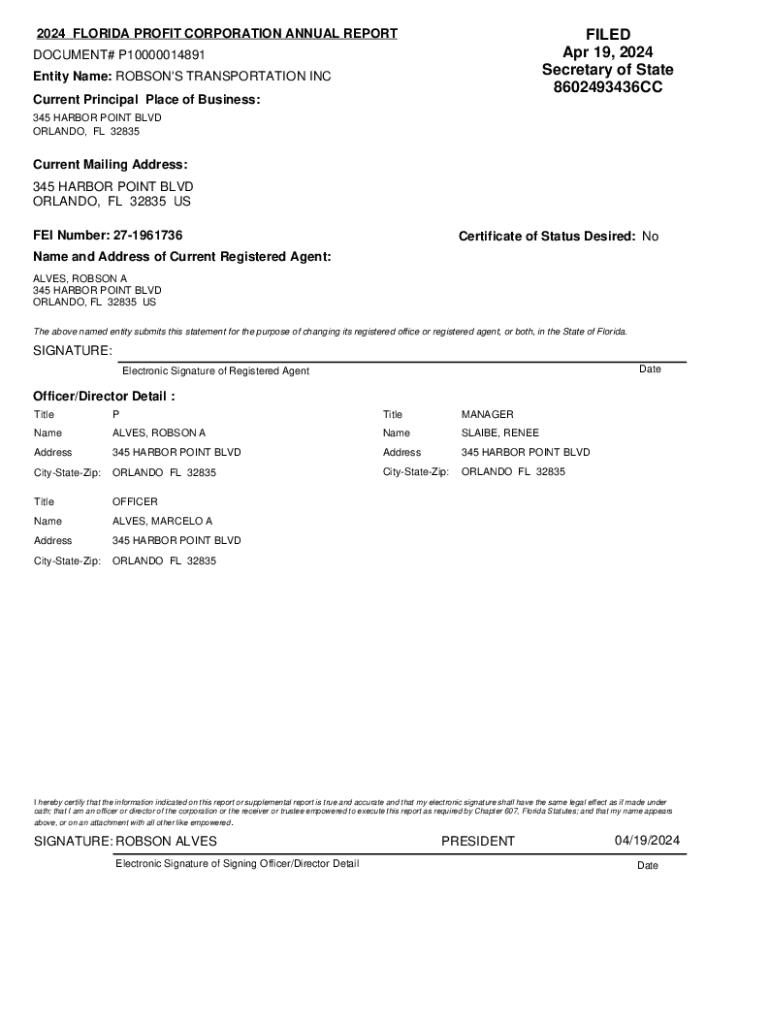

Understanding the 2024 Florida Profit Corporation Form

Understanding Florida profit corporations

A Florida profit corporation is a distinguished legal entity formed by individuals to conduct business aimed at generating a profit. The structure allows the corporation to own assets, incur liabilities, and enjoy certain legal protections separate from its owners, known as shareholders. In Florida, the profit corporation is the most commonly chosen legal structure among business owners seeking limited liability and enhanced credibility.

Key characteristics of Florida profit corporations include the ability to issue stock, which can attract investors, a formal structure that typically requires a board of directors, and compliance with state regulations governing corporate operations. This legal framework ensures that personal assets are protected from company liabilities, providing a safety net in case of financial trouble.

Forming a profit corporation in Florida has several benefits, such as attracting venture capital, gaining access to various tax deductions, and forming a structure that can outlast the individuals who founded it. Businesses can also establish credibility with customers and vendors, enhancing opportunities for growth and collaboration.

Key requirements for filing a Florida profit corporation form

Before filing for a Florida profit corporation, certain eligibility criteria must be met. Typically, any individual who is at least 18 years old can form a corporation, and there are no residency requirements for shareholders or directors. However, a registered agent must reside in Florida to receive legal documents.

The necessary documentation plays a crucial role in the formation process. This includes the Articles of Incorporation, which outlines essential details about the corporation, such as its name, principal office address, and purpose. Bylaws dictate how the corporation will operate and the roles of its officers and directors, while an initial board of directors is required to manage the corporation's affairs.

Choosing a corporate name is another critical step. The name must be unique and distinguishable from existing companies in Florida. To ensure your desired name is available, a name availability check is recommended. If the name is available, you can reserve it for up to 120 days, which can provide peace of mind while preparing the necessary documents.

Filing information

Filing the 2024 Florida profit corporation form can be accomplished through different methods, depending on your preferences. Online filing through the Florida Department of State's website is the most efficient option, allowing for faster processing times and immediate confirmations. For those who prefer traditional methods, paper filing is also available.

Once you decide on your filing method, be sure to be aware of the filing fees applicable in 2024. Currently, the fee for filing Articles of Incorporation is $70. Additional fees may apply for name reservations and expedited processing, and it's essential to check for any updates or changes that may impact your total costs.

E-filing with the Florida Department of State

E-filing offers several benefits, including the ability to submit your documents quickly from anywhere, reduced paperwork, and prompt confirmation of submission. The Florida Department of State has a dedicated portal for e-filing where users can complete and submit their forms efficiently.

Getting started with e-filing requires creating an account on the Florida Division of Corporations website. Once you've set up your account, you can navigate through the forms and select the profit corporation form to fill out. Be sure to review the form for accuracy before submitting and check that your payment is confirmed to avoid any delays.

For those interested in e-filing, it’s essential to use supported web browsers, such as Google Chrome, Firefox, or Microsoft Edge, to ensure compatibility and prevent technical issues during the filing process.

Verification and confirmation of filing

After submitting your Florida profit corporation form, verification and confirmation are crucial steps in ensuring that your application has been accepted. You will receive a confirmation email if your filing is successful, and you should retain this email as proof of filing.

Processing time for filings typically ranges from 1 to 3 business days; however, it can vary based on the volume of submissions at the Department of State. If your filing is rejected, it’s important to understand the common reasons for rejection, which can include issues related to the name of the corporation, missing signatures, or incomplete forms. Checking the submitted information against the requirements can help correct these issues.

Post-filing actions for Florida profit corporations

After successfully filing the 2024 Florida profit corporation form, there are several important actions to take to ensure compliance and maintain the corporation's legal standing. Obtaining a certified copy of the Articles of Incorporation is advisable, as it serves as the official record of your corporation’s existence and can be required for various business transactions.

Another critical step involves reporting beneficial ownership information to the state, which has become mandatory for increased transparency. Furthermore, Florida profit corporations must comply with ongoing requirements, such as filing Annual Reports each year, which come with associated fees. Additional business licenses and permits may also be required depending on your industry and location, and it’s crucial to remain informed about any changes or updates in legislation that could impact your corporation.

Frequently asked questions (FAQs) about Florida profit corporations

When filing the 2024 Florida profit corporation form, you might have some common questions. For instance, can you print and mail your application? Yes, however, online filing tends to be more efficient and quicker. If you prefer not to file online, you can print the forms, complete them, and submit them via mail.

Another question pertains to how the corporation name registration works. After conducting a name availability check and reserving the name, you can proceed with filing the Articles of Incorporation using the chosen name. It's also worth noting that additional forms and fees might be necessary depending on specific business activities, so thorough research before filing is essential.

Interactive tools available on pdfFiller

pdfFiller offers a range of interactive tools designed to streamline the document creation and management experience. Users can harness document creation and editing tools that allow them to easily modify their Florida profit corporation form and other essential documents accurately and efficiently. With the eSignature solutions provided by pdfFiller, signing forms becomes a seamless and legally compliant process.

Collaboration features enable teams to work together from different locations, improving productivity while managing documents in real-time. Furthermore, pdfFiller ensures efficient document management by providing secure cloud storage solutions that allow businesses to access and organize their forms whenever needed.

Conclusion: Empowering your business journey with pdfFiller

Navigating the complexities of filing a 2024 Florida profit corporation form can feel overwhelming, but pdfFiller is positioned to support you throughout your business journey. With an array of features, including document editing tools, eSignature capabilities, and collaborative functionalities, you can streamline the entire process.

Embracing pdfFiller’s platform allows you to manage not just the profit corporation form but any document needs from one accessible, cloud-based solution. Utilizing this platform enables you to focus on growing your business while ensuring compliance and organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2024 florida profit corporation online?

How do I edit 2024 florida profit corporation in Chrome?

How do I edit 2024 florida profit corporation straight from my smartphone?

What is 2024 florida profit corporation?

Who is required to file 2024 florida profit corporation?

How to fill out 2024 florida profit corporation?

What is the purpose of 2024 florida profit corporation?

What information must be reported on 2024 florida profit corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.