Get the free 2024 Florida Profit Corporation Annual Report

Get, Create, Make and Sign 2024 florida profit corporation

Editing 2024 florida profit corporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida profit corporation

How to fill out 2024 florida profit corporation

Who needs 2024 florida profit corporation?

2024 Florida Profit Corporation Form: A Comprehensive Guide

Understanding the Florida profit corporation

A Florida profit corporation is a legal entity established under Florida law for the purpose of conducting business and generating profits. Unlike non-profit organizations, profit corporations prioritize earning income for their shareholders. This type of corporation is commonly used by businesses seeking to limit the personal liability of its owners while benefiting from certain tax advantages.

The benefits of forming a profit corporation in Florida are significant. Firstly, liability protection is a primary advantage, as it shields personal assets from business debts and legal actions. Additionally, Florida offers tax advantages for corporations, including the potential for lower tax rates compared to personal income tax. Forming a profit corporation also enhances credibility with customers and suppliers, as it signals a stable and professional business structure.

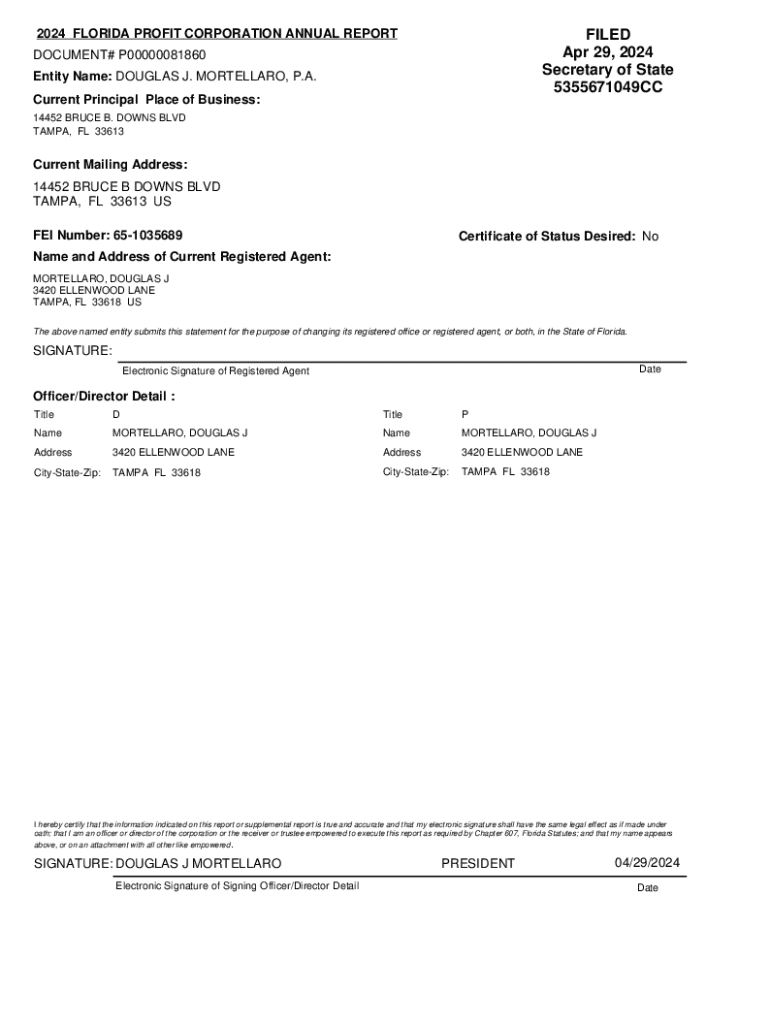

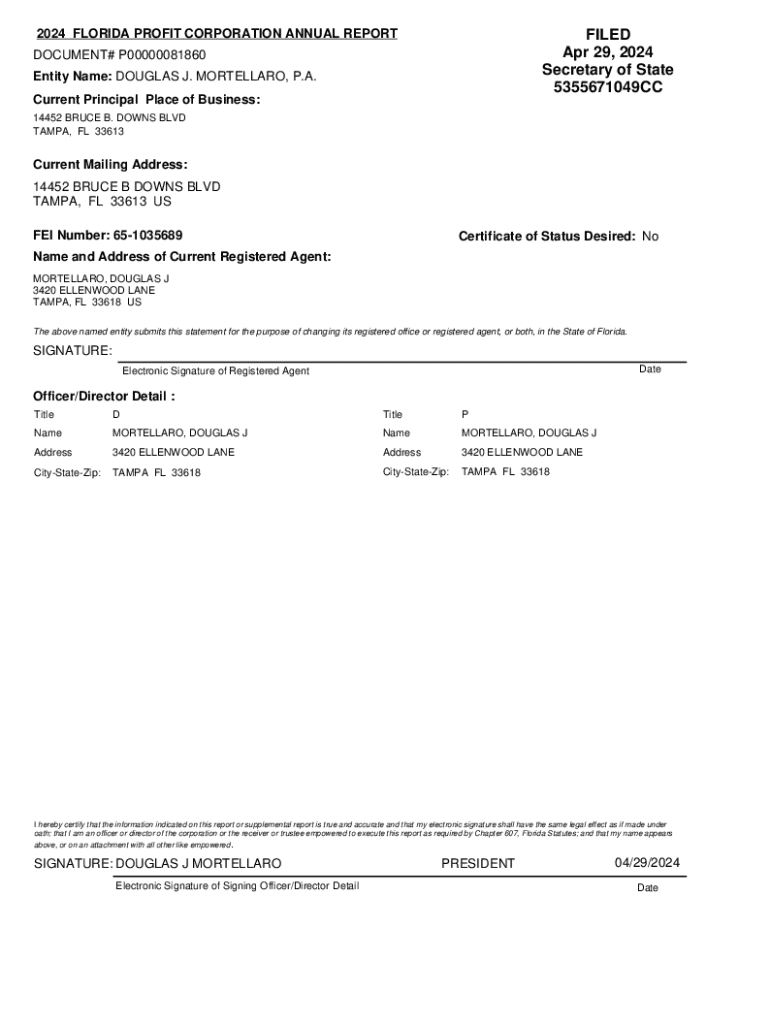

Key requirements for filing the 2024 Florida profit corporation form

To file the 2024 Florida profit corporation form, certain key requirements must be met. First, the incorporators, who file the paperwork to establish the corporation, must be at least 18 years old. There are no restrictions on residency, meaning both residents and non-residents can serve as incorporators.

Necessary documentation includes the Articles of Incorporation, which outline essential details about the corporation, such as its name, purpose, and registered office address. Along with this, the corporation needs to draft bylaws that govern its internal operations, as well as an Initial Report, which is typically filed within the first year of incorporation.

Detailed steps for completing the Florida profit corporation form

Filing the 2024 Florida profit corporation form involves several steps to ensure compliance and accuracy. The first step is to gather all required information, including the business name and address, the purpose of the corporation, and the names and addresses of all incorporators. Choosing an appropriate name is crucial; it should be unique and comply with Florida naming regulations.

Next, you will fill out the 2024 Florida profit corporation form, which includes several sections that require specific details. Each section should be thoroughly reviewed to ensure accuracy before submission. Finally, the submitted form should be carefully proofread. Mistakes or overlooked information can result in delays or rejections, so take time to ensure it meets all requirements.

Filing options: Online vs. paper submission

When deciding how to submit the 2024 Florida profit corporation form, there are two primary options: online filing or paper submission. E-filing offers distinct advantages, such as instant submission and processing that can reduce the potential for errors. Furthermore, electronic submissions typically receive quicker confirmations, allowing you to begin operating your corporation sooner.

For those preferring traditional methods, paper filing is also available. This option requires mailing the completed form and any necessary attachments to the appropriate Florida Division of Corporations office. When opting for paper filing, it’s important to check for the correct postal information and ensure that payment options are clearly understood, as various methods may be available.

Payment options for filing

Filing the 2024 Florida profit corporation form incurs certain costs, which can vary based on how you choose to complete the process. For online filings, there are several accepted payment methods, including credit and debit cards and electronic check payments. Understanding these options is essential for a smooth filing experience.

The costs associated with filing typically include a basic filing fee, which can change from year to year. Moreover, there may be additional expenses if you choose to reserve a corporate name in advance or if you seek expedited processing services to accelerate confirmation of incorporation.

Frequently asked questions

As you navigate the process of filing the 2024 Florida profit corporation form, you may encounter several common questions. Is the corporation name available for use? Conducting a name search through the Florida Division of Corporations can provide clarity on name availability before filing your application.

How do you correct errors on a submitted application? If networking and paperwork culminate in issues, there are steps to amend the filed form, typically involving submitting correction requests and possibly additional fees. Understanding processing times is also crucial; confirmation can take varying periods depending on how the form is filed, whether online or via paper.

Maintaining compliance after filing

Once your Florida profit corporation is officially established, it's crucial to maintain compliance with state regulations. Annual reporting is a requirement for Florida profit corporations, necessitating submission of the Annual Report and associated fees. This must be done by May 1st each year to remain in good standing and avoid penalties.

Updating corporate information is equally important. Whenever there are changes, such as a shift in business address or changes in corporate officers, timely updates should be made to the state. This not only keeps your records accurate but also ensures you continue to meet legal requirements.

Utilizing pdfFiller for document management

Managing the necessary documents for your Florida profit corporation becomes straightforward with pdfFiller. This cloud-based solution enables users to edit PDFs seamlessly, eSign, collaborate, and effectively manage a variety of documents from any location. Using pdfFiller ensures you have your corporate documents organized and easily accessible.

To effectively manage your Florida profit corporation documents on pdfFiller, follow these steps: First, create an account on pdfFiller’s platform. Then, access the relevant templates for the Florida profit corporation form and any other related documents you need to manage. Use pdfFiller's editing tools to fill out, sign, and save these important forms, ensuring compliance and proper filing.

Troubleshooting common filing issues

Despite careful preparation, filing errors can occur. Understanding common reasons for rejected applications is critical. Some of the typical pitfalls include submitting forms with incomplete information, failing to pay the required fees, or using an unavailable corporation name. By being aware of these issues, you can take proactive steps to ensure that your filing proceeds smoothly.

Should your application be rejected, specific steps must be taken to rectify the situation. Most often, this involves revisiting the submitted form to identify errors, correcting them, and resubmitting your application, possibly incurring additional costs depending on what went wrong. Keeping good records and maintaining meticulous attention to detail can drastically help mitigate these issues.

Conclusion of filing process and additional considerations

Filing the 2024 Florida profit corporation form is a vital step in establishing your business legally and effectively. It’s essential to ensure timely filing and compliance with state regulations to avoid penalties that could hinder your business operations. Once filed, consider next steps such as obtaining an Employer Identification Number (EIN) and opening a business bank account.

Additionally, staying informed about further legal obligations and requirements will be crucial in your journey as a business owner in Florida. Utilizing services like pdfFiller enables a smoother document management process and helps maintain organization, ensuring you remain compliant while focusing on growing your business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 2024 florida profit corporation?

How do I make changes in 2024 florida profit corporation?

How do I edit 2024 florida profit corporation straight from my smartphone?

What is 2024 florida profit corporation?

Who is required to file 2024 florida profit corporation?

How to fill out 2024 florida profit corporation?

What is the purpose of 2024 florida profit corporation?

What information must be reported on 2024 florida profit corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.