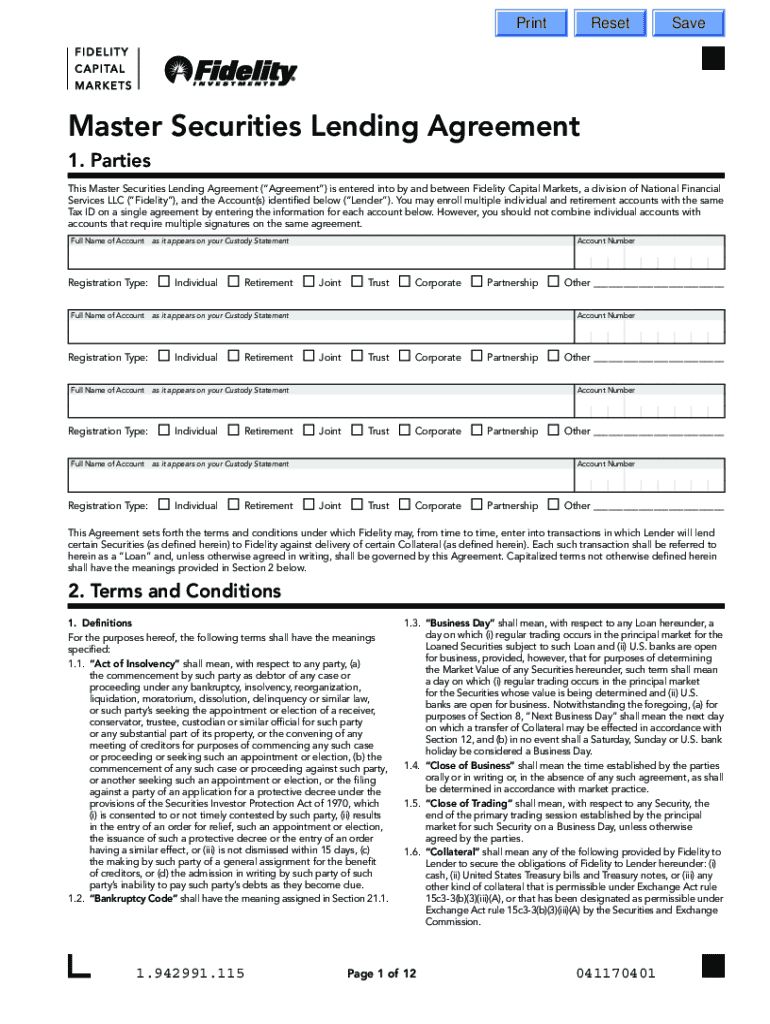

Get the free Master Securities Lending Agreement

Get, Create, Make and Sign master securities lending agreement

Editing master securities lending agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out master securities lending agreement

How to fill out master securities lending agreement

Who needs master securities lending agreement?

Master Securities Lending Agreement Form: A Comprehensive How-to Guide

Understanding the master securities lending agreement (MSLA)

A Master Securities Lending Agreement (MSLA) serves as a foundational legal contract between parties involved in securities lending transactions. This agreement outlines the terms under which securities are lent, establishing the rights and obligations of both the lender and the borrower. Its importance in the securities lending landscape cannot be overstated, as it defines critical parameters that govern the relationship between financial institutions, hedge funds, and institutional investors.

The MSLA is essential not just for regulatory compliance but also for risk management in securities lending. By providing a standardized framework, it helps parties mitigate potential disputes and fosters trust. Typical use cases include arrangements wherein institutional investors lend securities to other financial entities that need to cover short positions or engage in arbitrage.

Key components of the master securities lending agreement

The MSLA comprises several essential components that need careful consideration. These components outline the responsibilities and rights of both parties involved, ensuring clarity and minimizing misunderstandings.

How to fill out the master securities lending agreement form

Filling out the MSLA form requires attention to detail and an understanding of the various components outlined previously. A structured approach helps ensure accuracy and completeness.

It’s vital to avoid common mistakes, such as overlooking collateral definitions or miscalculating interest rates, which can complicate future transactions.

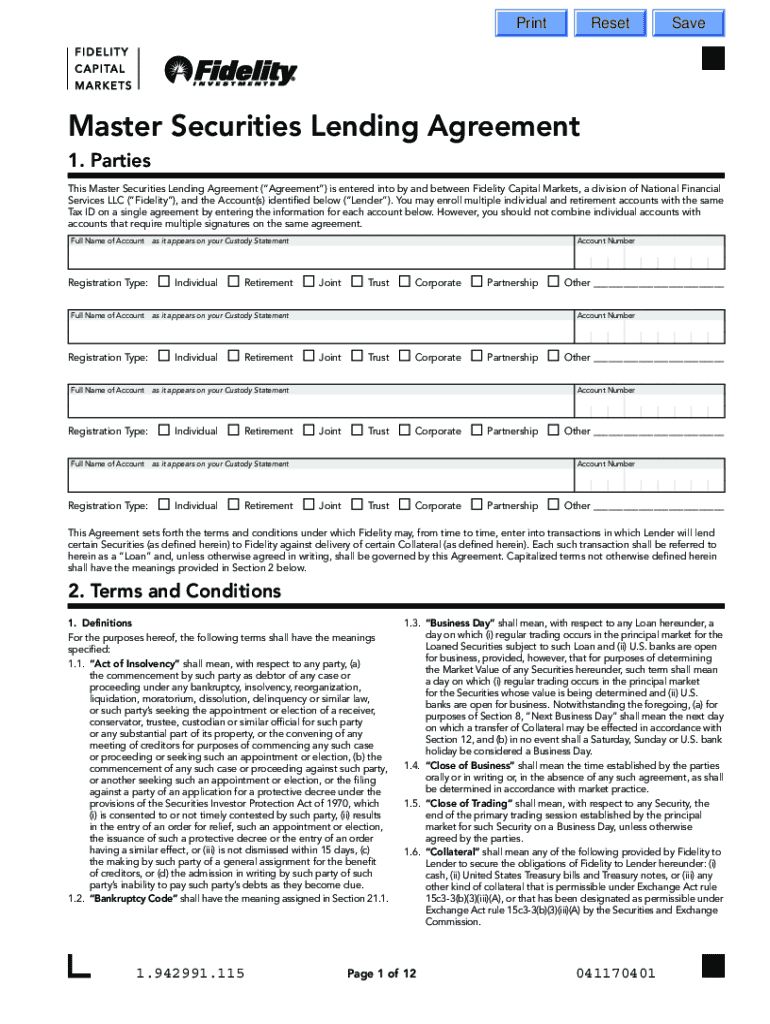

Editing and customizing the master securities lending agreement form

After filling out the form, you may want to refine or adapt it to suit specific needs or scenarios. pdfFiller provides tools for easy document editing, allowing users to customize their MSLA effectively.

Taking advantage of these features can drastically improve teamwork and ensure all parties are aligned on the agreement.

Signing the master securities lending agreement

Once the MSLA is complete and customized, the next step is to finalize the agreement with signatures. pdfFiller’s eSignature options allow for seamless and legally binding signing processes.

These features eliminate the complications of physical signatures while maintaining document integrity and compliance.

Managing and storing your securities lending agreement form

Proper management and storage of your MSLA are crucial for future reference and audits. With pdfFiller’s robust document management features, users can easily organize and retrieve their agreements.

Following these management practices will ensure you are always prepared for reviews or audits.

Interactive tools for effective agreement management

pdfFiller’s interactive features enhance agreement management by allowing users to leverage various tools and analytics.

Utilizing these tools can lead to enhanced efficiency and insight into the document lifecycle.

Common scenarios and faqs related to MSLA

Users often encounter specific situations that generate questions about the MSLA process. Addressing these scenarios through FAQs can serve to further educate users.

These FAQs, when well-structured, can alleviate concerns and build confidence in the securities lending process.

Navigating the regulatory environment around MSLA

The regulatory landscape surrounding securities lending is complex and ever-evolving. Having a well-defined MSLA helps to navigate this environment effectively.

By remaining compliant, parties can ensure smooth operations while minimizing legal risks.

Comparative analysis of MSLA templates

Different MSLA templates cater to various needs and contexts within securities lending. A comparative analysis can assist users in selecting the most suitable template.

This analysis aids users in being strategic with their document choices, ensuring appropriateness for their specific transaction.

Real-life case studies and examples

Exploring real-life scenarios of successful securities lending transactions can provide valuable insights and best practices.

These case studies serve as powerful learning tools that encapsulate practical strategies within the MSLA framework.

Conclusion on the importance of proper documentation in securities lending

Navigating the complex world of securities lending necessitates a deep understanding of the MSLA and its components. Proper documentation ensures that both lending and borrowing parties mitigate risk, comply with regulations, and foster trust.

From drafting to signing and managing agreements, every phase plays a vital role in the success of securities lending transactions. By utilizing platforms like pdfFiller, users can streamline these processes, enhance collaboration, and maintain a robust documentation strategy that stands the test of time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find master securities lending agreement?

How do I make edits in master securities lending agreement without leaving Chrome?

Can I edit master securities lending agreement on an Android device?

What is master securities lending agreement?

Who is required to file master securities lending agreement?

How to fill out master securities lending agreement?

What is the purpose of master securities lending agreement?

What information must be reported on master securities lending agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.