Get the free Third Federal's Retail Lending Products and ...

Get, Create, Make and Sign third federals retail lending

How to edit third federals retail lending online

Uncompromising security for your PDF editing and eSignature needs

How to fill out third federals retail lending

How to fill out third federals retail lending

Who needs third federals retail lending?

Understanding Third Federal's Retail Lending Form

Overview of Third Federal's Retail Lending Form

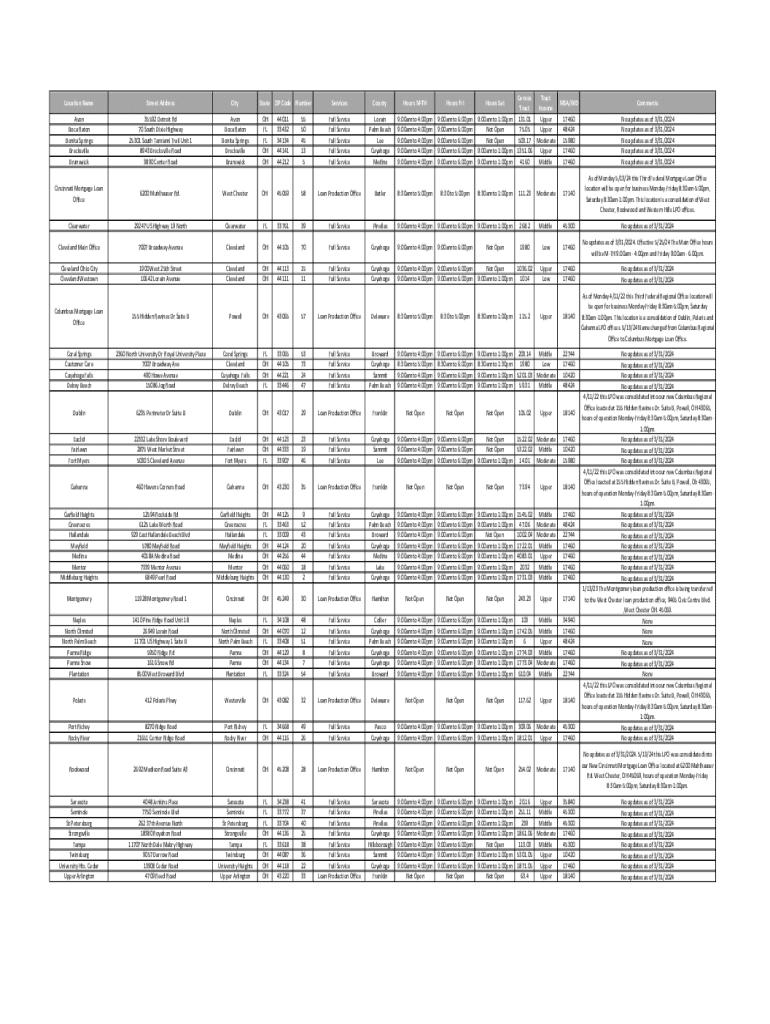

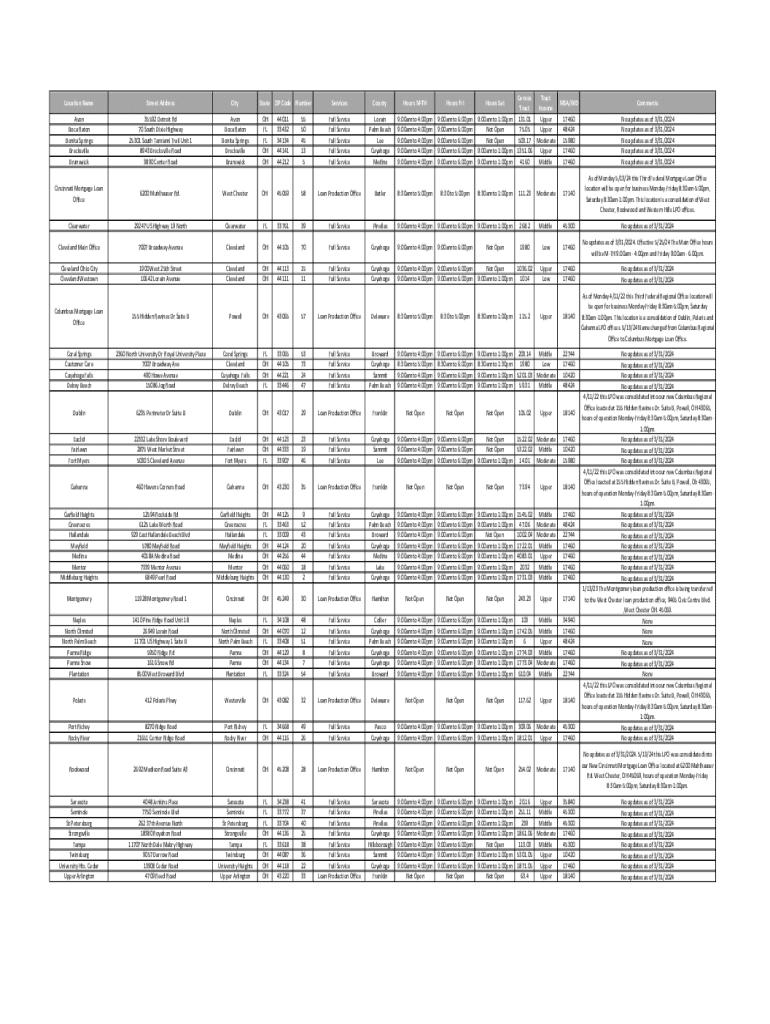

The Third Federal's Retail Lending Form serves as a critical document for individuals seeking loans or financial assistance from Third Federal Savings and Loan. This form captures essential details regarding the borrower's financial situation, lending preferences, and property information, facilitating a smoother lending process.

The purpose of this form is to streamline the loan application process, ensuring that all necessary information is submitted in an organized manner. This not only helps lenders assess applications efficiently but also guides borrowers in presenting their financial profiles accurately.

Purpose and use cases

The Retail Lending Form is vital for anyone looking to secure a loan from Third Federal. Situations that trigger the need for this form include purchasing a new home, refinancing an existing mortgage, or seeking financial assistance for home improvements. By having a standardized form, Third Federal can ensure consistency in the information provided and the evaluation process.

The target audience for this form includes potential homebuyers, homeowners seeking refinancing options, and individuals looking to consolidate debt. It is beneficial for users as it simplifies the application process, reduces the chances of missing essential details, and improves clarity throughout the lending process.

Detailed instructions on filling out the form

Filling out the Retail Lending Form accurately is critical for a successful application. First, gather all necessary documentation which typically includes proof of income, identification verification, and details about the property in question. Organizing these documents prior to starting to fill out the form can save significant time.

As you begin completing each section of the form, it’s essential to pay attention to detail. Fill out personal information such as your name, address, and social security number accurately. When disclosing financial information, ensure that bank statements, pay stubs, and other relevant documents reflect the most current information. Common pitfalls include omission of essential sections and entered data that does not match provided documentation.

Once the form is completed, it’s vital to conduct a thorough review to ensure all entries are correct and verifiable. This extra step can prevent delays in your loan application process.

Interactive tools for enhanced user experience

In today’s digital age, the ability to fill out forms online can greatly simplify tasks. The Retail Lending Form is available in a digital format via pdfFiller, providing users with an accessible way to complete their applications from anywhere. By using an online tool, individuals can avoid common issues associated with paper forms, such as misplacing documents or having incomplete submissions.

Furthermore, integrating eSignature capabilities within pdfFiller allows users to sign the document electronically. This not only expedites the process, but it also ensures that your signatures are secure and legally binding.

Managing and submitting the retail lending form

Once the Retail Lending Form is filled out on pdfFiller, it’s essential to manage your submission effectively. Users can save their completed forms in various formats, including PDF and DOCX, ensuring convenience and compatibility with other systems and devices. This flexibility allows borrowers to maintain records or edit their submissions before finalizing them.

Submitting the form can be done through multiple methods. Depending on preference, users can submit their completed documents online through pdfFiller, in person at a local branch, or by conventional mail. Understanding the including typical processing timelines for each method can aid in planning for when a response can be expected.

Frequently asked questions (FAQs)

Many applicants encounter common issues while filling out or submitting the Retail Lending Form. Some frequently asked questions include clarifications on specific terms, the need for certain documents, and what to do if a mistake is made during completion. Understanding these answers can make the process less daunting and ensure that you are well-prepared.

If issues arise, troubleshooting tips can also be beneficial. For instance, if your application was rejected due to incomplete information, reviewing the specific sections highlighted can provide insights on avoiding similar issues in the future.

Regulatory information

The Retail Lending Form adheres to both state and federal lending laws, ensuring compliance and protection for borrowers. By following established guidelines, Third Federal aims to safeguard against predatory lending practices while providing a fair framework for individuals seeking loans.

The form is subject to oversight and protocols, including the requirement of an OMB Control Number that signifies regulatory accountability. Being aware of these regulations can enhance borrowers' confidence in the lending process.

Connecting with Third Federal

For any personal assistance or inquiries regarding the Retail Lending Form, Third Federal offers various customer support options. Whether you prefer to reach out via phone, email, or live chat, dedicated resources are available to help resolve any uncertainties you may have about the form or the lending process in general.

In addition to the Retail Lending Form, Third Federal provides a host of other lending-related tools. These can aid borrowers in managing their loans effectively and understanding broader financial solutions available through Third Federal, aligning with their needs as individuals or teams.

User feedback and testimonials

Receiving feedback from users who have navigated the Retail Lending Form is invaluable. Real user experiences can provide insights into the effectiveness of the form and highlight areas for improvement. The testimonials can also offer potential users a glimpse of what to expect in terms of process and support.

Moreover, user insights play a critical role in enhancing the form's interface and overall experience. Understanding common experiences, both positive and negative, can help Third Federal refine its processes and better serve future applicants.

Related forms and resources

Besides the Retail Lending Form, borrowers might find other lending applications useful. Examples include forms for personal loans, auto loans, or refinancing options with different lenders. Each form serves specific purposes, guiding users through varying lending contexts.

Additionally, Third Federal and pdfFiller collectively offer numerous financial resources that empower borrowers. From budgeting tools to informative articles about managing loans, these resources equip individuals with knowledge essential for making informed financial decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the third federals retail lending electronically in Chrome?

Can I create an electronic signature for signing my third federals retail lending in Gmail?

How do I edit third federals retail lending on an iOS device?

What is third federals retail lending?

Who is required to file third federals retail lending?

How to fill out third federals retail lending?

What is the purpose of third federals retail lending?

What information must be reported on third federals retail lending?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.