Get the free 2024 Florida Profit Corporation Annual Report

Get, Create, Make and Sign 2024 florida profit corporation

Editing 2024 florida profit corporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida profit corporation

How to fill out 2024 florida profit corporation

Who needs 2024 florida profit corporation?

Everything You Need to Know About the 2024 Florida Profit Corporation Form

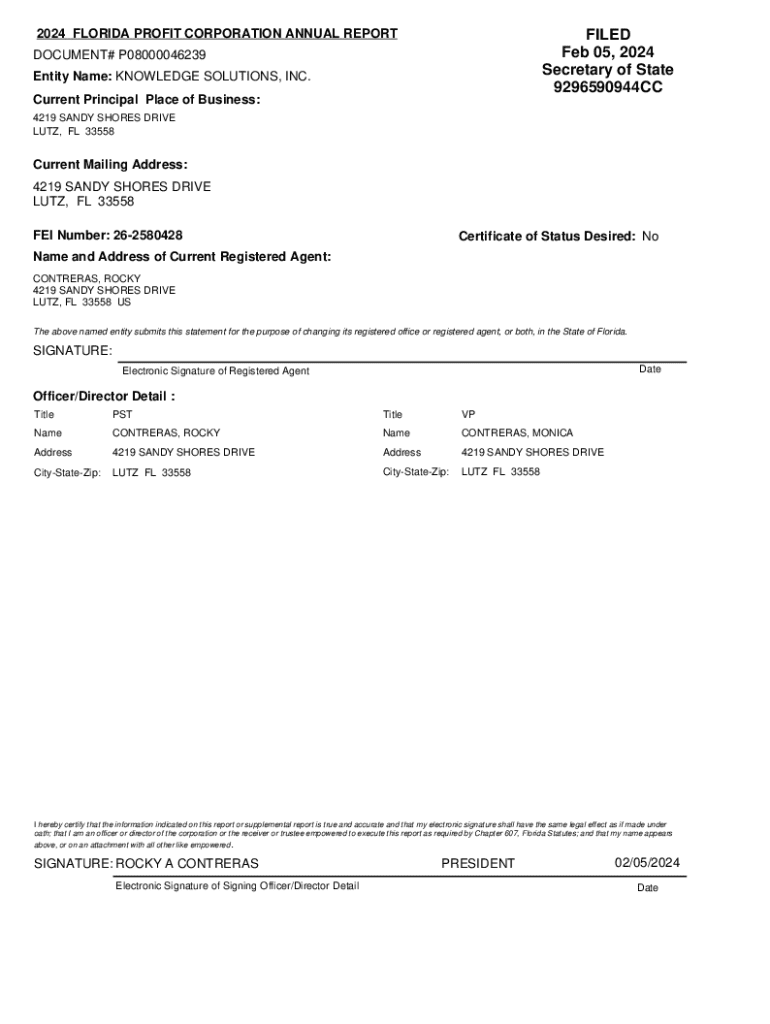

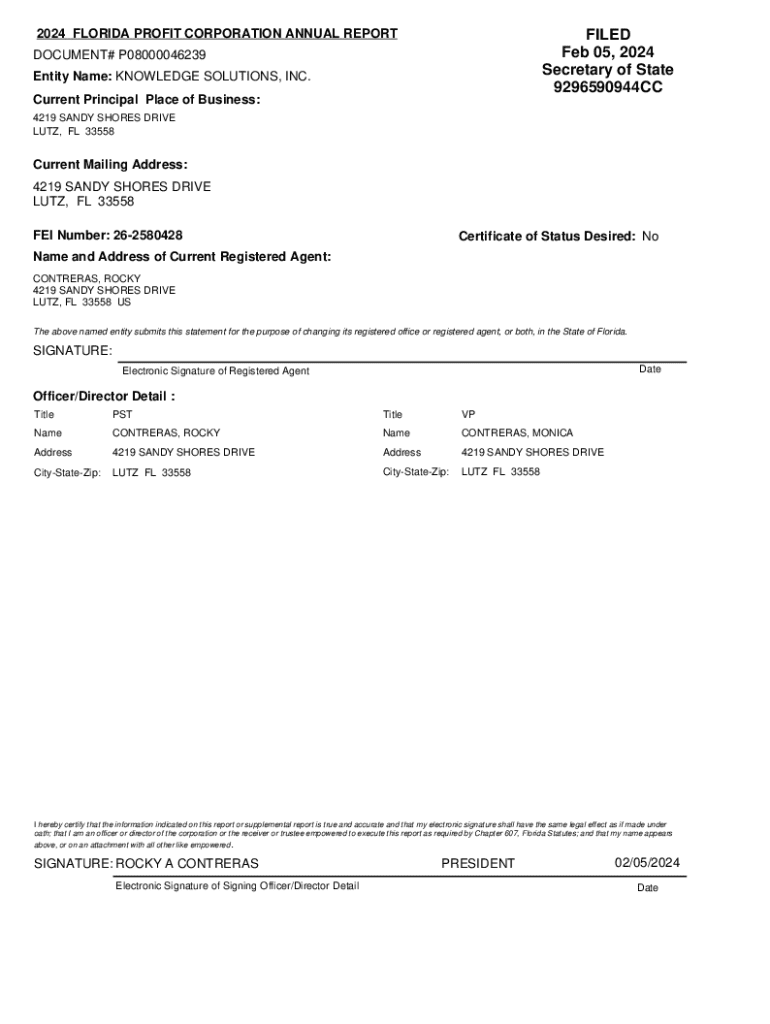

Overview of the 2024 Florida Profit Corporation Form

The 2024 Florida Profit Corporation Form is a critical document for individuals or groups looking to establish a profit-driven corporation in Florida. It serves as the foundation for formalizing a business entity, distinct from its owners, allowing for legal recognition, liability protection, and potential tax benefits. This year introduces several key updates designed to streamline the filing process and enhance accessibility for new corporations.

Notable updates for 2024 include revisions that clarify various requirements, potentially reducing filing errors. Enhanced online resources have also been introduced, making it easier than ever to navigate the filing process effectively.

Filing information

Before diving into the filing process, it’s essential to understand eligibility requirements for the 2024 Florida Profit Corporation Form. Generally, any individual or group wishing to start a business in Florida can file. This includes both residents and non-residents, provided they meet certain stipulations.

Specific restrictions may apply, particularly to entities holding certain licenses or permits in Florida, such as banking or insurance entities, which need to meet additional regulatory criteria.

Regarding document requirements, filers need to prepare the following basic documents:

Getting started with the Florida Profit Corporation Form

To begin your journey towards establishing a profit corporation, first access the 2024 Florida Profit Corporation Form via pdfFiller. The platform offers user-friendly access and streamlined processes to facilitate filing.

Here's a step-by-step process to guide you through:

pdfFiller also provides interactive tools to ensure accuracy, including editing tools and features that allow seamless e-signing directly within the form.

E-filing the Florida Profit Corporation Form

E-filing has become the preferred method for many due to its efficiency. To start e-filing the 2024 Florida Profit Corporation Form, ensure you have all documents ready and follow these steps:

E-filing offers advantages such as faster processing times and automated notifications, substantially reducing paperwork hassles.

Payment options for filing articles of incorporation online

When it comes to filing the 2024 Florida Profit Corporation Form, understanding payment methods is vital. Accepted payment methods include credit cards, bank transfers, and other secure online payment options.

The fee structure for filing usually consists of base filing fees coupled with any additional service charges. Here’s a quick breakdown of what to expect:

Tracking your filing status

Once you submit your 2024 Florida Profit Corporation Form, monitoring your filing status becomes vital for peace of mind. After filing, a confirmation receipt will be issued, serving as proof of submission.

You can verify the status of your filing through pdfFiller or directly on the Florida Division of Corporations website, where processing times for Articles of Incorporation can vary based on several factors, such as application complexity and the volume of requests.

Handling common issues with the Florida Profit Corporation Form

Filing rejections can be discouraging, but knowing common reasons can help mitigate issues. Here’s a checklist of potential causes for rejection:

If you encounter a rejected filing, follow this step-by-step guide to rectify errors and file accurately:

Additional considerations for new corporations

Forming a Florida Profit Corporation presents numerous benefits, including significant liability protection for owners against business debts and claims. This entity type also offers favorable tax treatment, enhancing business viability.

Owners are required to report beneficial ownership information, which involves disclosure of the entity's principal shareholders. Understanding and complying with these requirements is critical to ensure legal conformity and safeguard the corporation's standing.

Alternative filing methods

For those who prefer traditional filing methods, the Florida Profit Corporation Form can also be submitted by mail. To file by mail, you need to print the form and include all required documents and payments.

Alternatively, in-person filing is available at designated Florida Division of Corporations offices, where you can submit your application directly and receive immediate feedback on your submission.

Frequently asked questions

As you prepare to file the 2024 Florida Profit Corporation Form, you may have questions. Here are some answers to common inquiries:

Interactive resources available on pdfFiller

pdfFiller is committed to empowering users in managing their document needs. The platform offers interactive features designed to assist in completing the 2024 Florida Profit Corporation Form. This includes real-time editing tools and support resources that provide guidance at every step of the filing process.

By leveraging these resources, business owners can navigate the complexities of documentation with confidence, ensuring correct filings and timely submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 2024 florida profit corporation online?

How do I fill out 2024 florida profit corporation using my mobile device?

How can I fill out 2024 florida profit corporation on an iOS device?

What is 2024 florida profit corporation?

Who is required to file 2024 florida profit corporation?

How to fill out 2024 florida profit corporation?

What is the purpose of 2024 florida profit corporation?

What information must be reported on 2024 florida profit corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.