Get the free 2024 Florida Limited Liability Company Annual Report

Get, Create, Make and Sign 2024 florida limited liability

Editing 2024 florida limited liability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida limited liability

How to fill out 2024 florida limited liability

Who needs 2024 florida limited liability?

2024 Florida Limited Liability Form: A Complete Guide

Understanding limited liability companies (LLCs) in Florida

Limited Liability Companies (LLCs) offer a unique blend of flexibility and protection for business owners in Florida. An LLC is a distinct legal entity that is separate from its owners, providing the potential for limited personal liability for business debts, meaning creditors typically cannot pursue the owners' personal assets.

The advantages of forming an LLC in Florida are substantial. First, there is the crucial aspect of **limited liability protection**; owners, known as members, usually are not personally responsible for business debts beyond their investments. This feature shields personal assets like homes and savings from business creditors.

Typically, business owners considering an LLC include freelancers, small business startups, and those wanting a flexible management structure while limiting personal risk. Therefore, understanding the structure and requirements of an LLC is crucial for any aspiring Florida entrepreneur.

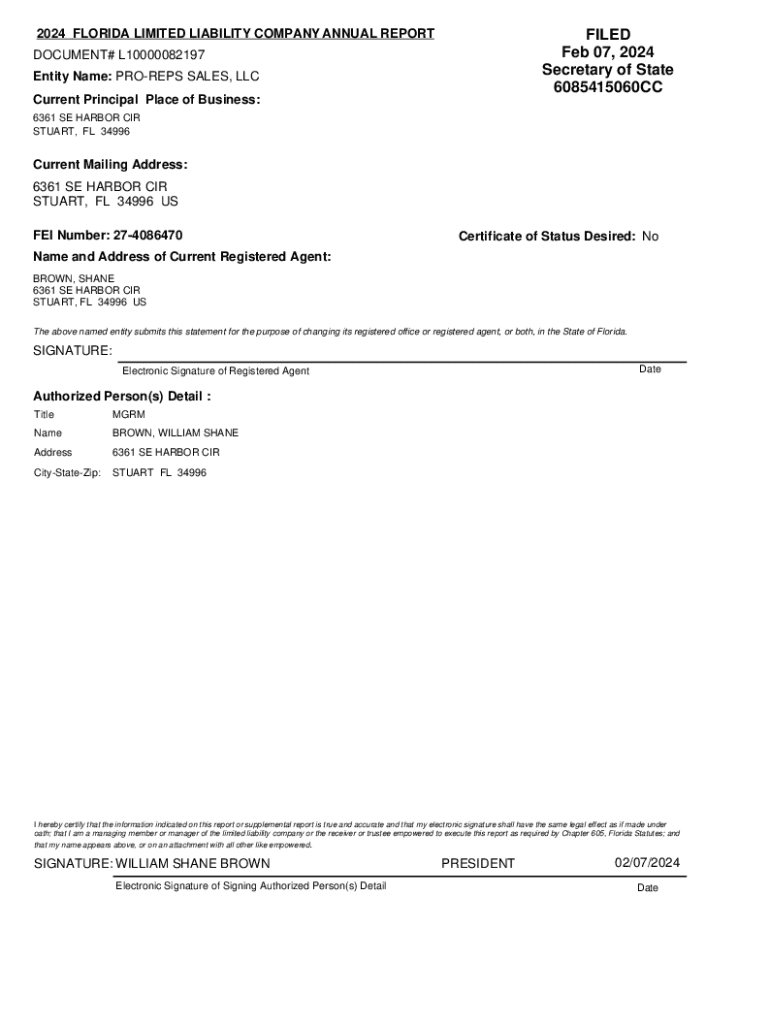

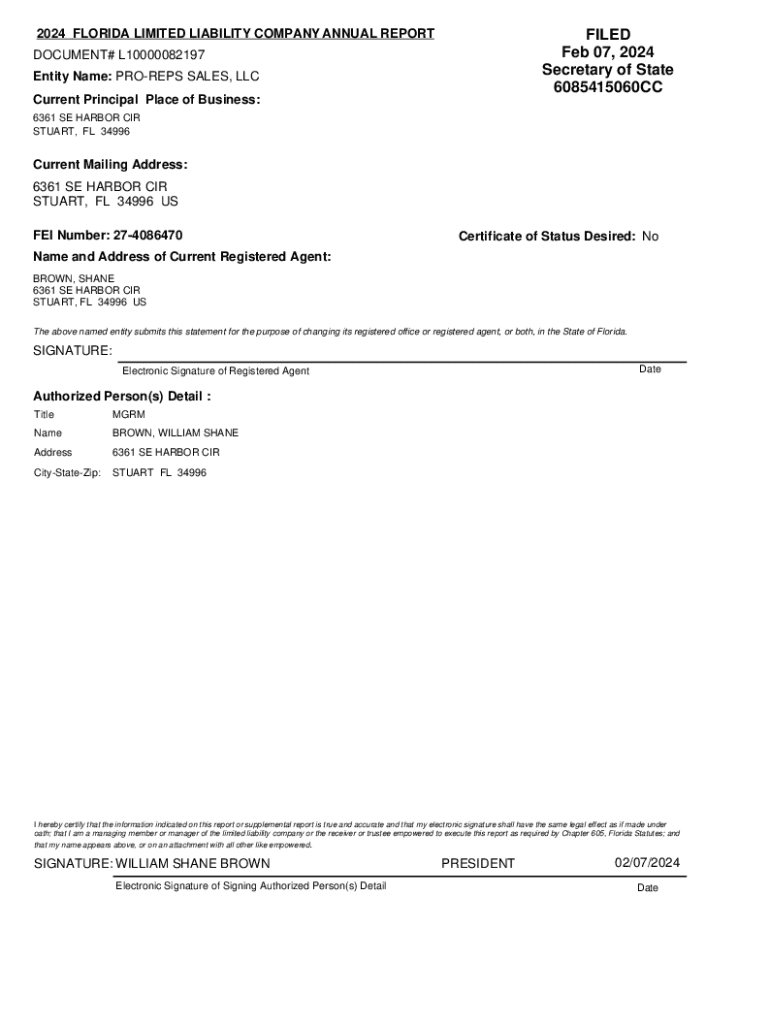

Overview of the 2024 Florida Limited Liability Form

The 2024 Florida Limited Liability Form is essential for anyone looking to establish an LLC in the state. This official document formalizes the creation of the LLC, providing necessary information about the business and its members. Understanding this form is a critical step in the business formation process.

Among the **key changes in the 2024 form**, the state has streamlined sections for clarity and included prompts to help users avoid common mistakes. Additionally, it reflects updated statutory requirements, ensuring compliance with the latest business laws.

If you’re planning to start a small business, it’s crucial to determine if you need to file this form based on your business structure and goals.

Step-by-step guide to filling out the 2024 Florida Limited Liability Form

Filling out the 2024 Florida Limited Liability Form involves several critical steps, beginning with gathering the right information. The form asks for specific details that you need to prepare in advance for successful submission.

Start the process by considering **business name requirements**; your name must be unique and not infringe on existing trademarks. Next, choose a **registered agent**, a person or business designated to receive legal documents on behalf of the LLC. Lastly, determine the **management structure**—will it be member-managed, where all members participate, or manager-managed, where appointed managers handle operations?

Now, let's delve into the detailed sections of the form. Here’s what to provide:

Common mistakes to avoid include failing to double-check the business name against state records, neglecting to include required signatures, or omitting necessary information about the management structure.

Filing options: How to submit your 2024 Florida Limited Liability Form

Once the LLC form is completed, the next step is submission. Florida provides two primary options for filing: e-filing and paper filing.

**E-filing** is highly recommended due to its efficiency. To file electronically, navigate to the Florida Division of Corporations’ e-filing portal, create an account if needed, and follow the instructions to submit your form. Points to remember include ensuring payment for filing fees is processed during the submission.

If you prefer to **mail your application**, download the paper form from the Florida Division of Corporations’ website. Complete the form thoroughly and include payment for the filing fees. Mail your application to the provided address in the form, ensuring you keep copies for your records.

After filing: What to expect next

After submitting your 2024 Florida Limited Liability Form, the next steps revolve around verification and compliance. You will receive a confirmation of your filing via email or postal service, depending on your filing method.

**Verification of your filing** is simple; check for a confirmation number or an official approval letter, which indicates your LLC has been successfully registered. Processing times can vary, but in many cases, approvals happen within a week.

Frequently asked questions about Florida limited liability forms

Navigating LLC formation can raise various questions, particularly concerning challenges that might arise during the process.

Alternative forms and resources related to Florida LLCs

In addition to the standard LLC formation form, there are alternative forms available based on your business needs, such as forms for mergers or conversions. Familiarizing yourself with these alternatives can be beneficial.

Interactive tools and solutions by pdfFiller

At pdfFiller, users gain access to an array of interactive tools specifically designed to enhance the form-filling process for the 2024 Florida Limited Liability Form. Our platform empowers individuals and teams to easily edit PDFs, eSign documents, and collaborate seamlessly.

Accessing pdfFiller tools during your LLC formation journey can significantly streamline the process, providing a user-friendly interface and ensuring compliance with state requirements.

Importance of legal compliance for LLCs in Florida

Once your LLC is formed, understanding the **ongoing compliance requirements** becomes paramount. Florida mandates that all LLCs file annual reports to maintain good standing. Failure to do so could result in penalties or dissolution of the LLC.

Resources for remaining compliant include the Florida Division of Corporations’ website and local chambers of commerce, which often provide valuable insights into updates on laws and regulations affecting LLCs in Florida.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2024 florida limited liability directly from Gmail?

How do I complete 2024 florida limited liability online?

How do I edit 2024 florida limited liability online?

What is 2024 florida limited liability?

Who is required to file 2024 florida limited liability?

How to fill out 2024 florida limited liability?

What is the purpose of 2024 florida limited liability?

What information must be reported on 2024 florida limited liability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.