Get the free 2024 Florida Profit Corporation Annual Report

Get, Create, Make and Sign 2024 florida profit corporation

Editing 2024 florida profit corporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida profit corporation

How to fill out 2024 florida profit corporation

Who needs 2024 florida profit corporation?

2024 Florida Profit Corporation Form: A Comprehensive Guide

Understanding Florida profit corporations

A Florida profit corporation is a legal entity organized to conduct business operations with the primary goal of generating profit for its shareholders. Unlike non-profit corporations, which focus on social, charitable, or religious objectives, profit corporations operate under the intent to create financial returns from their activities. Forming a profit corporation is crucial for businesses aiming to provide limited liability protection to their owners and investors, allowing them to separate personal assets from business liabilities.

When compared to other business structures, such as Limited Liability Companies (LLCs) and partnerships, profit corporations offer distinct advantages and challenges. Corporations can raise capital through the sale of stock, pure legal existence separate from its owners provides more security, and they may enjoy certain tax benefits. However, this structure also comes with more regulatory obligations and paperwork.

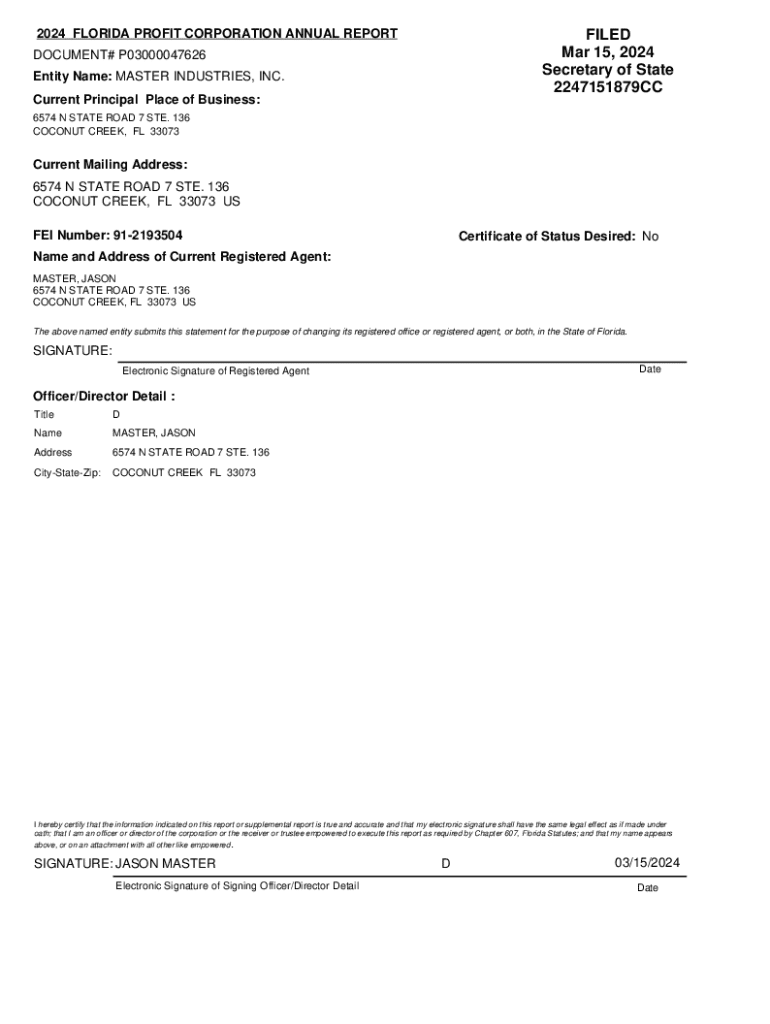

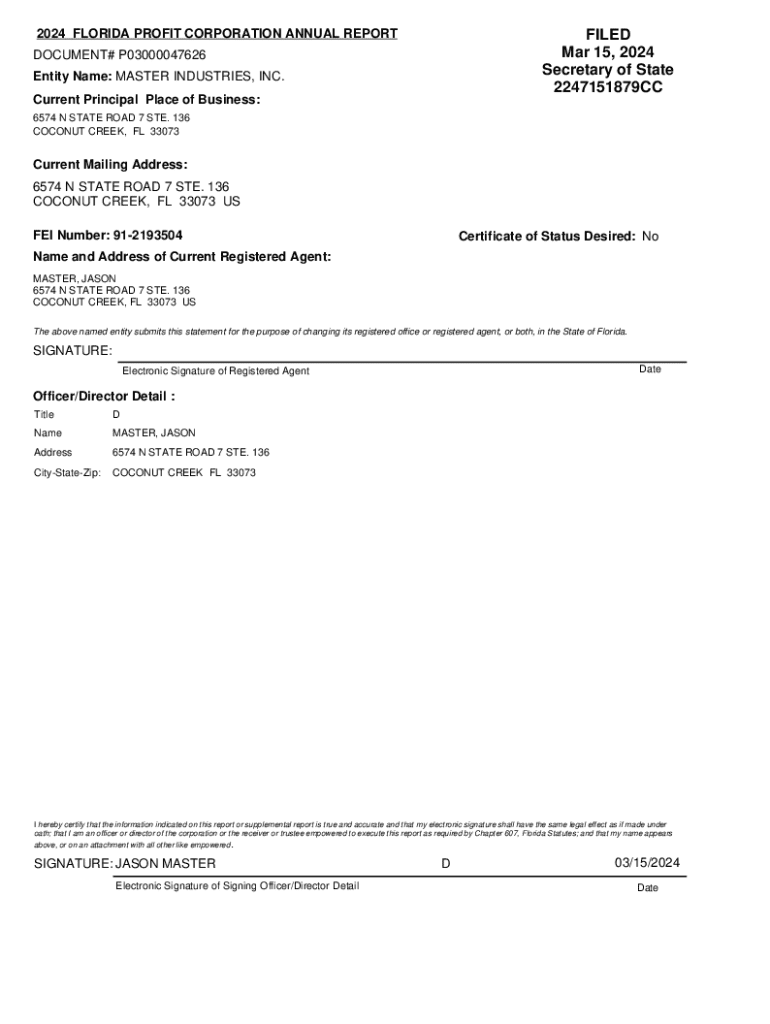

Key filing information for Florida profit corporations

To establish a profit corporation in Florida, filing Articles of Incorporation with the Florida Department of State is imperative. This fundamental document outlines the essential details of the corporation, including its name, address, purpose, and information about the registered agent responsible for receiving legal documents on behalf of the corporation.

The Articles of Incorporation comprise several key components, such as the corporation’s name, which must be unique and not deceptively similar to existing corporations, the principal office address, and the names and addresses of the incorporators. Understanding these components is essential to ensure a smooth filing process.

Step-by-step guide to filing the 2024 Florida profit corporation form

Filing the 2024 Florida profit corporation form can be a straightforward process if approached methodically. Here’s a step-by-step breakdown:

E-filing your Florida profit corporation form

The online filing process for Florida profit corporations is efficient and user-friendly. Start by accessing the Florida Department of State's e-filing portal. The interface will guide you step-by-step through the requirements for completing the Articles of Incorporation.

When e-filing, it’s crucial to use supported web browsers, ensuring optimal performance. Google Chrome and Mozilla Firefox are recommended for their compatibility and speed. Prioritize connectivity to reduce the risk of interruptions during the submission process.

Payment options when filing online

When filing your 2024 Florida profit corporation form online, you’ll need to choose a payment method for the associated filing fees. Acceptable payment options typically include major credit and debit cards, as well as eChecks.

The cost of filing Articles of Incorporation varies; however, it’s important to ensure that payment is secure and that you receive a confirmation of your transaction. Keep records of all transactions to maintain an accurate account of your filing expenses.

Confirming the availability of your corporation name

Before submitting your Articles of Incorporation, you need to verify that your desired corporation name is not already in use. You can perform a name availability search through the Florida Division of Corporations' online database.

If your chosen name is taken, you may need to modify it or reserve a different name. Name reservations can be executed online by submitting a specific application, ensuring legal protection for your preferred name until your corporation is formally established.

Alternatives to online filing

If you prefer a traditional approach, you can print and mail your Articles of Incorporation instead of filing online. Completing this offline submission involves filling out the form manually and sending it to the correct address for processing.

Make sure to include a check for the filing fee along with your form. Keep in mind that mailing times may delay the processing of your application, so plan accordingly to avoid unnecessary waiting.

Confirmation of filing status

Once you submit your Articles of Incorporation, you'll receive a confirmation notice when your application is accepted by the Florida Department of State. This confirmation proves that your corporation is legally recognized.

During processing, you can track your application status through the e-filing portal or contact the Division of Corporations for updates if necessary.

Processing times for Articles of Incorporation

The standard processing time for Articles of Incorporation in Florida can vary based on several factors. Generally, you can expect processing to take between 3 to 7 business days when filed online.

However, if additional information is needed or there are discrepancies in your application, processing may take longer. Be mindful of external factors, such as peak filing periods, which can also impact the speed of your application’s approval.

Signing the online form

Electronic signatures are a vital part of the online filing process. Florida law recognizes electronic signatures as valid, but certain requirements must be met to ensure legal compliance.

The individual signing the Articles of Incorporation must be an incorporator or authorized representative of the corporation. Make sure that you follow the guidelines specified on the filing platform to avoid complications.

Retrieving your corporation's Articles of Incorporation

After your corporation is successfully formed, obtaining a copy of your filed Articles of Incorporation is essential for record-keeping and future reference. You can access your documents online through the Florida Division of Corporations site.

Additionally, if you require certified copies for legal or business purposes, consider the option to order them for a nominal fee. This can often be done online for convenience.

Dealing with rejection of filing

Not all filings are accepted at first submission. Common reasons for rejection include improper form completion, issues with the corporation name, and missing payment details. If your Articles of Incorporation are denied, you will receive a notification detailing the reasons.

Addressing the issues highlighted in the rejection notice and resubmitting the corrected form is crucial. Be thorough with your revisions to increase the chances of a successful filing on the next attempt.

Adjusting to new fees for Florida profit corporations

In 2024, there are updated fees for filing Articles of Incorporation for Florida profit corporations. Staying informed on these changes is vital for budgeting and ensuring compliance. Generally, filing fees can range, and any amendments or additional filings may incur extra costs.

Administrative fees related to ongoing compliance and renewal should also be considered, as these can add up significantly over time. Familiarizing yourself with the full fee schedule helps in effective planning.

Reporting requirements for beneficial ownership information

As part of the incorporation process, Florida requires profit corporations to report beneficial ownership information. This requirement is to enhance transparency and accountability in corporate structures.

When filling out your Articles of Incorporation, ensure you gather the relevant details concerning the individuals or entities with significant control over the corporation. These details may need to be reported alongside your initial filing or in separate documents.

Overview of forms & fees related to Florida corporations

In addition to the Articles of Incorporation, there are several other forms and fees associated with maintaining corporate status in Florida. Key forms include annual report filings, business licenses, and specific amendments as business activities evolve over time.

Understanding the necessary documentation and associated fees can prevent compliance issues. Staying proactive in filing renewals and reports is essential for sustaining good standing with the Florida Department of State and avoiding penalties.

Diverse business structures in Florida

Florida offers various business structures, each with unique features and implications. Here’s a brief overview of key options available:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2024 florida profit corporation without leaving Google Drive?

How can I get 2024 florida profit corporation?

How do I complete 2024 florida profit corporation on an Android device?

What is 2024 Florida profit corporation?

Who is required to file 2024 Florida profit corporation?

How to fill out 2024 Florida profit corporation?

What is the purpose of 2024 Florida profit corporation?

What information must be reported on 2024 Florida profit corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.