Get the free 2024 Florida Profit Corporation Annual Report

Get, Create, Make and Sign 2024 florida profit corporation

How to edit 2024 florida profit corporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida profit corporation

How to fill out 2024 florida profit corporation

Who needs 2024 florida profit corporation?

2024 Florida Profit Corporation Form: A Comprehensive Guide

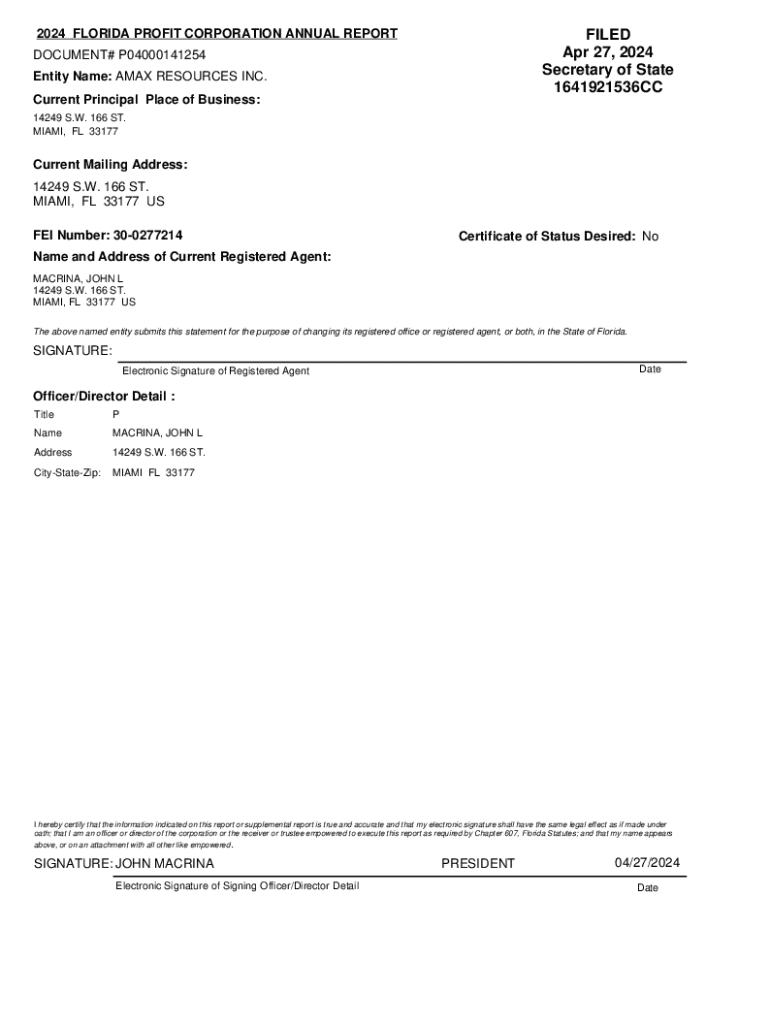

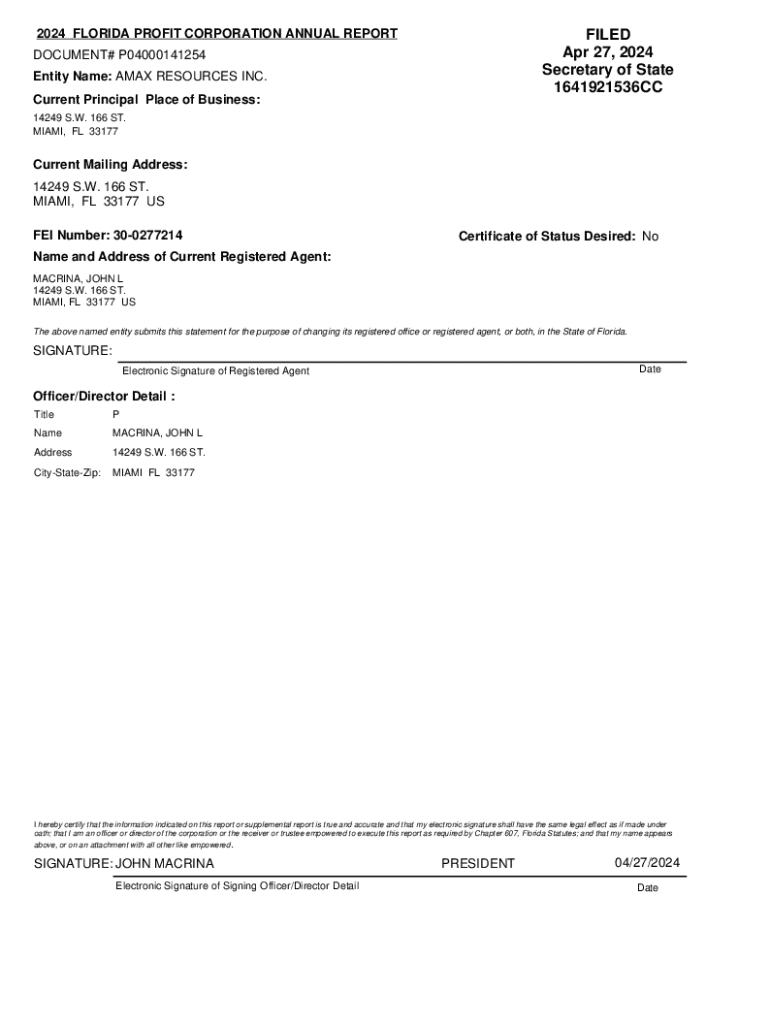

Overview of the Florida Profit Corporation Form

The 2024 Florida Profit Corporation Form is a critical document for entrepreneurs looking to establish a corporation in the Sunshine State. This form serves to officially register a business entity, providing a legal framework for operations and limiting personal liability for its owners. By filing this form, business owners ensure that their corporation is recognized by the state, which is essential for legal and tax purposes.

Forming a corporation in Florida in 2024 is significant as it allows businesses to take advantage of the state’s favorable tax climate, asset protection laws, and a robust business ecosystem. Moreover, leveraging tools like pdfFiller can simplify form management and streamline the document creation process. pdfFiller offers a user-friendly platform that enhances the efficiency of filing, making it easier for businesses to focus on growth.

Key aspects of the Florida Profit Corporation Form

When completing the Florida Profit Corporation Form, several essential elements must be included. These elements ensure that the form meets legal requirements and that the corporation is correctly registered. Key aspects include the corporation's name, the principal office address, registered agent details, and information about the directors. Understanding these components is vital to prevent delays in processing your application.

Common terminology associated with this filing includes terms like 'Articles of Incorporation,' which refer to the document that formally creates your corporation. Additionally, terms such as 'shareholders' and 'bylaws' define the structure and governing rules of the corporation. Understanding these terms will help you navigate the filing process more effectively, allowing you to manage legal implications associated with running a corporation.

Preparing to file the Florida Profit Corporation Form

Before diving into the actual filing process, gathering all necessary information is crucial to ensure a smooth experience. Required details include the corporate name, which must be unique and adhere to Florida naming regulations, along with the principal office address. You will also need to select a registered agent—an individual or business entity designated to receive legal documents on behalf of the corporation—and provide information regarding the board of directors.

Choosing the right business structure is equally important. A profit corporation typically serves individuals aiming for business growth and profit generation through the sale of goods or services. The decision surrounding your business entity type can impact legal liabilities and tax responsibilities, making it crucial to understand these considerations before completing the form.

Step-by-step guide to completing the form online

To effectively complete the 2024 Florida Profit Corporation Form, start by accessing pdfFiller’s platform, which is compatible with various web browsers like Chrome, Firefox, and Safari for optimum user experience. The steps to fill out the form online are straightforward. After logging in to your pdfFiller account, locate the Florida Profit Corporation Form from their template library.

1. **Complete the required sections:** Each section of the form must be filled out accurately. Pay close attention to provide the correct corporate name and ensure all details are up to date. 2. **Use pdfFiller's editing tools:** Utilize the software features allowing you to easily input information, add notes, and collaborate with team members. 3. **Double-check for accuracy:** Before submission, review all entries to prevent errors or omissions that could lead to rejection or delays in processing.

Payment options for filing the Florida Profit Corporation Form

Filing the Florida Profit Corporation Form entails specific payment structures that need to be adhered to. Acceptable payment methods include online transactions through credit cards like Visa, MasterCard, and American Express, as well as electronic payment options via authorized platforms. It's important to check the latest filing fees, as these can vary and may be updated in 2024.

Here are the payment options you'll likely encounter: - **Online payment portals:** Most filings can be completed directly through state websites or pdfFiller's platform for convenience. - **Payment processing fees:** Be aware that additional processing fees may apply for certain payment methods.

Submission process for the Florida Profit Corporation Form

Once you have completed the Florida Profit Corporation Form, the submission process through pdfFiller is straightforward. After reviewing all your entries for accuracy, click on the 'Submit' button to file directly with the designated state office. Upon submission, you can expect to receive a confirmation email that your application has been successfully filed.

Timing is essential here; processing times for corporation filings can vary based on volume and time of year. Typically, you might expect processing to take anywhere from a few days to several weeks. Keeping track of this timeline is important to avoid operational delays.

Troubleshooting common issues

Despite thorough preparation, form rejections can occur. Common reasons for rejection often include inaccuracies in the corporate name, providing incorrect information about the registered agent, or omitting necessary signatures. Understanding these pitfalls will enhance your chances of a successful application.

If your filing is rejected, promptly check the feedback provided by the state’s office. Corrections may require refiling, so acting quickly is essential to minimize delays.

Post-filing information

After filing the Florida Profit Corporation Form, obtaining a copy of the corporation’s Articles of Incorporation is often advised. This document serves as proof of your corporation's existence and is necessary for various operations, including opening a business bank account and securing loans. To request a copy, you can visit the state's corporate filing office or their website.

Beyond acquiring your Articles of Incorporation, it’s crucial to maintain compliance with ongoing corporate obligations. This includes timely reporting of beneficial ownership information and adherence to annual meeting requirements, which are vital for sustaining your corporate status and avoiding penalties.

Additional forms and fees related to Florida corporations

In addition to the Florida Profit Corporation Form, there are various related filings that new businesses may need to consider. For instance, limited liability companies (LLCs) and partnerships each possess distinct forms with their respective filing requirements.

Understanding these different forms and their relevant fees is crucial for business owners planning to diversify their entities. - **LLC filings** typically involve distinct fees and definitions, focusing on protecting personal assets while offering operational flexibility. - **Miscellaneous forms** might include amendments to existing corporation documents, additional business licenses, or permits, all of which also incur associated costs.

Utilizing pdfFiller's features for document management

pdfFiller isn’t just a tool for filling out forms; it offers a comprehensive platform for document management. Features include options for electronic signatures, which allow you to sign documents securely and efficiently from anywhere, facilitating faster transactions. This capability is especially important when collaborating with remote team members or stakeholders.

Moreover, pdfFiller ensures the security of your documents by employing robust encryption measures. This not only protects sensitive information but also allows users to access their documents from virtually any device, boosting flexibility and operational efficiency.

FAQs about the Florida Profit Corporation Form

Navigating the filing process may lead to several questions. Many individuals ask if it’s possible to print and mail their application rather than filing online. Yes, Florida allows this option; however, online submission is typically faster and more efficient.

Additionally, checking whether your corporation name is already in use can be done through Florida's official business name search feature, ensuring you avoid conflicts. Following up on your application status can also be done through the same state office, where they provide insights into processing times and any outstanding requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 2024 florida profit corporation?

How do I make edits in 2024 florida profit corporation without leaving Chrome?

How do I complete 2024 florida profit corporation on an iOS device?

What is 2024 florida profit corporation?

Who is required to file 2024 florida profit corporation?

How to fill out 2024 florida profit corporation?

What is the purpose of 2024 florida profit corporation?

What information must be reported on 2024 florida profit corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.