Get the free Buy to Let Mortgage Application

Get, Create, Make and Sign buy to let mortgage

How to edit buy to let mortgage online

Uncompromising security for your PDF editing and eSignature needs

How to fill out buy to let mortgage

How to fill out buy to let mortgage

Who needs buy to let mortgage?

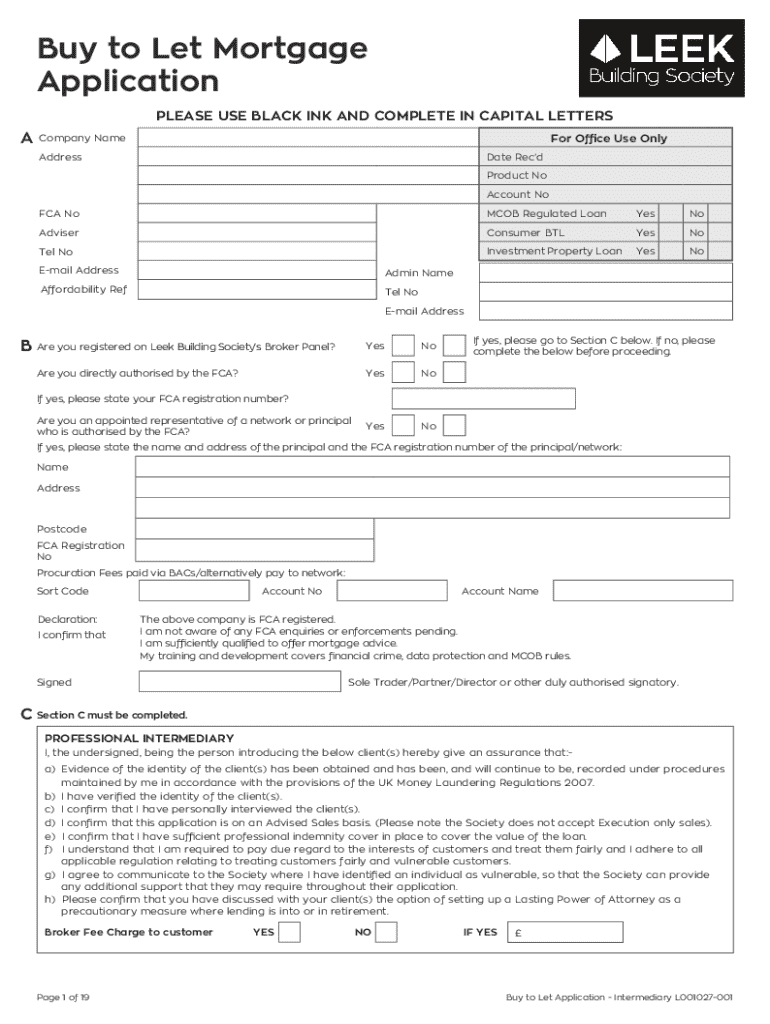

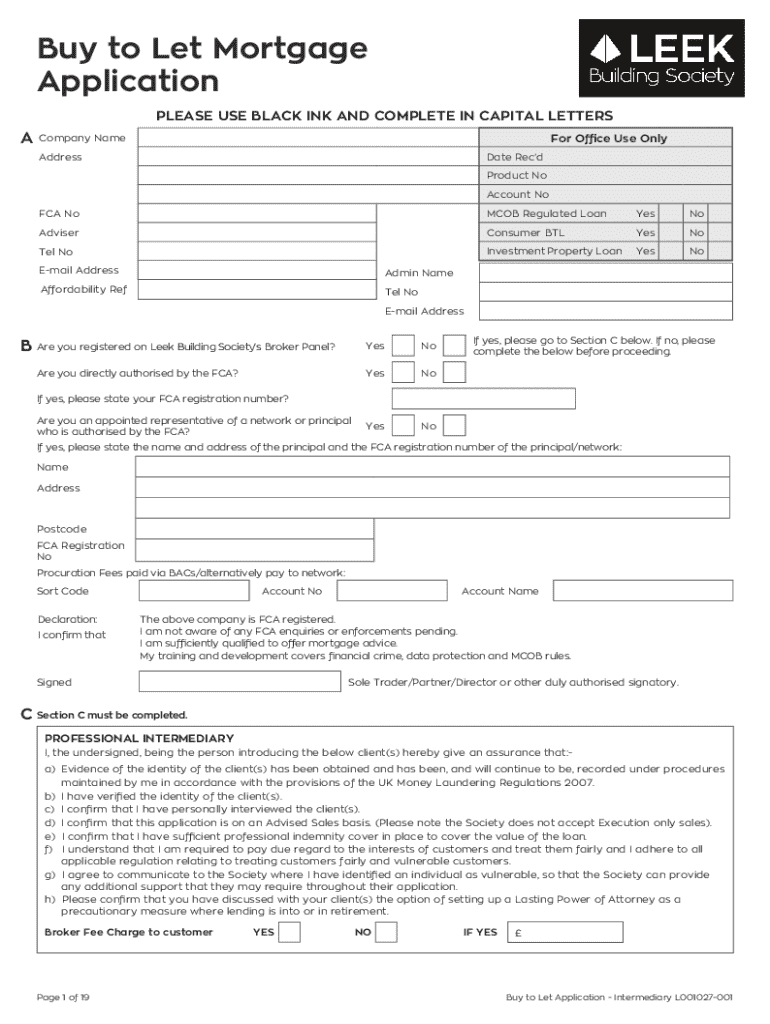

A comprehensive guide to the buy to let mortgage form

Understanding buy to let mortgages

Buy to let mortgages are specialized financing options designed for individuals who wish to purchase property as an investment rather than as a primary residence. This type of mortgage allows landlords to borrow funds specifically for the purpose of buying residential properties to rent out to tenants, thereby generating rental income. Unlike standard residential mortgages, buy to let mortgages take into account the expected rental income as a key factor in the approval process.

Considering a buy to let mortgage can be highly beneficial for investors looking to enter the property market, diversify their investment portfolio, or generate a steady income stream. The increasing demand for rental properties makes this avenue particularly appealing amidst fluctuating housing prices. However, potential investors must be aware of the associated risks and ensure they meet the eligibility criteria set by lenders.

The importance of the buy to let mortgage form

The buy to let mortgage form is paramount to the application process, serving as the official document through which prospective landlords detail their financial situation, property plans, and the specific property they wish to purchase. Filling out this form accurately can significantly influence the application's success or failure. A well-completed form provides lenders with essential information to assess risk and determine eligibility.

Common misconceptions surround the buy to let mortgage form, such as the belief that it’s merely a formality. In reality, inaccuracies or incomplete sections can lead to delays or outright denials. Therefore, it’s crucial to approach it with thorough attention, accurately reflecting your financial standing and expectations.

Step-by-step guide to filling out the buy to let mortgage form

Filling out the buy to let mortgage form can seem daunting, but breaking it down into manageable steps simplifies the process. The first step is gathering preliminary information, which includes collecting necessary documentation. This data will typically encompass your financial records, personal identification, and current landlord credentials if applicable.

Step one is critical, as lenders will rely heavily on this data when assessing your application. Ensure you have updated credit reports, recent bank statements, and proof of income ready for review. Next, move on to property details, where you’ll need to provide the full address and should estimate potential rental income based on current market rates.

Key sections of the buy to let mortgage form explained

While each lender may have variations, the buy to let mortgage form typically includes several key sections. The first is borrower information, which records personal details such as your name, address, and contact information. This section sets the foundation for your entire application. Next comes property information, where full details about the property you intend to purchase are crucial. This entails specifying the type of property, its address, and any current rental agreements if applicable.

Finally, the financial assessment segment is pivotal in your overall application. This part evaluates your financial health, requiring comprehensive insight into your income, existing debts, and overall asset worth. The accuracy within this section is paramount, as lenders utilize this information to determine your mortgage eligibility.

Interactive tools for buy to let mortgages

Navigating the world of buy to let mortgages can be effectively managed with the help of several interactive tools. A rental calculator can help potential landlords estimate their expected rental income based on local market trends and comparable properties. This gives a clearer picture of the viability of the investment right from the onset.

Moreover, online form completion tools provided by platforms like pdfFiller streamline the process, allowing users to fill out, edit, and manage forms effortlessly. Enhanced document management services enable you to eSign, store, and collaborate on essential documents without the hassle of physical paperwork.

Managing your buy to let mortgage application

Once you’ve submitted your buy to let mortgage form, it's important to understand the steps that follow. Typically, the lender will review your application, assessing the provided information against their underwriting guidelines. This process may take anywhere from a few days to a couple of weeks, depending on the lender’s workload and the completeness of your application.

Follow-up is crucial, so keep an eye on your application status and maintain communication with your lender. If additional information or clarification is needed, be prompt in your responses. Timely communication can smooth the process and demonstrate your commitment to maintaining a good relationship with your lender.

Collaboration and support for mortgagors

Collaboration can significantly enhance the mortgage application process. Platforms like pdfFiller provide features that facilitate teamwork among individuals and teams, allowing multiple stakeholders to review, edit, and finalize the necessary documents. For first-time landlords, valuable resources are available to clarify expectations and processes associated with buy to let mortgages, including connections to professional advisors and mortgage agents who can provide personalized guidance.

Networking with experienced landlords or joining property investment groups can also offer insights into successful renting strategies and managing properties effectively. Engaging with community resources strengthens your understanding and boosts confidence as you navigate this investment journey.

Help & support for buyers

Accessing customer support while navigating the buy to let mortgage form is essential for a seamless experience. Most platforms like pdfFiller offer dedicated customer service channels, including live chat support and comprehensive FAQs to provide immediate answers to common queries. Engaging in community forums where other users share their experiences can also yield valuable insights and reassurance as you embark on this financial venture.

By proactively utilizing these support systems, first-time buyers can gain clarity, reduce anxiety, and ensure they have the right resources at their fingertips. Whether it's technical help with document submission or advice on compliance issues, various support avenues are available to enhance your confidence throughout the process.

User experiences and success stories

Hearing from users who successfully navigated the buy to let mortgage process can provide both inspiration and practical insights. Testimonials from satisfied borrowers illustrate the transformative potential of securing a mortgage and expanding one’s investment portfolio through rental properties. Additionally, case studies can reveal the steps taken from filling out the initial form to ultimately obtaining approval and making their first rental purchases.

These narratives not only highlight the benefits associated with buy to let mortgages but also emphasize the importance of diligent preparation, a well-completed application form, and understanding market dynamics. In sharing experiences, prospective buyers can derive real-world insights that serve to enhance their own journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete buy to let mortgage online?

How do I make changes in buy to let mortgage?

Can I sign the buy to let mortgage electronically in Chrome?

What is buy to let mortgage?

Who is required to file buy to let mortgage?

How to fill out buy to let mortgage?

What is the purpose of buy to let mortgage?

What information must be reported on buy to let mortgage?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.