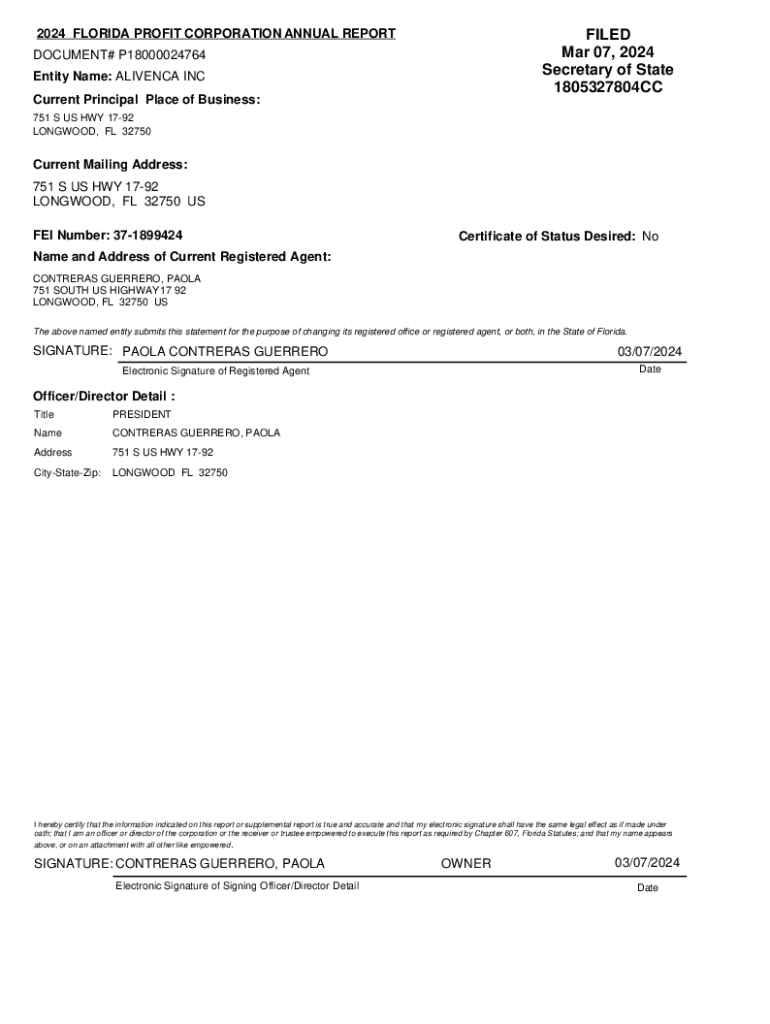

Get the free florida profit corporation annual report

Get, Create, Make and Sign florida profit corporation annual

How to edit florida profit corporation annual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out florida profit corporation annual

How to fill out 2024 florida profit corporation

Who needs 2024 florida profit corporation?

Comprehensive Guide to the 2024 Florida Profit Corporation Form

Understanding the Florida Profit Corporation

In Florida, a profit corporation is established to generate income for its shareholders. This type of corporation distinguishes itself by offering limited liability, where the personal assets of shareholders are protected from business debts and liabilities. Forming a profit corporation is a strategic move for many entrepreneurs aiming to enhance their business credibility and operational structure.

The benefits of forming a profit corporation in Florida include perpetual existence, various tax advantages, and ease in raising capital through stock sales. Additionally, a profit corporation can establish a strong brand identity, making it easier to attract customers and investors alike. Some key terms relevant to this structure are ‘Articles of Incorporation,’ which is the foundational document filed, and ‘Registered Agent,’ who acts as the point of contact for legal documents.

Preparing to file the 2024 Florida profit corporation form

Before filing the 2024 Florida profit corporation form, you need to gather the necessary documentation and information essential for a smooth application process. The primary document required is the Articles of Incorporation, which outlines the fundamental structure of your business.

You must also confirm the availability of your desired corporate name, ensuring it adheres to state guidelines and templates. It's crucial to check the Florida Division of Corporations’ database for name availability, and be aware of any restrictions, such as prohibitive terms or those already in use by existing entities.

Step-by-step filing process

Filing the 2024 Florida profit corporation form is simplified through an online portal. Here’s a step-by-step guide to ensure your filing is successful.

Start by accessing the Florida Online Filing Portal. If you do not have an account, create one by providing your email and a password. Once logged in, navigate to the section for filing Articles of Incorporation. Completing the online form requires attention to various fields.

Avoid common pitfalls by thoroughly reviewing each section before submitting. Always double-check for typos or incorrect information.

After completing the form, utilize eSignature functionalities to sign electronically using pdfFiller, streamlining the submission process.

Finally, submit the form along with the required filing fee, choosing from various payment methods such as credit card or electronic transfer.

Post-filing information

Once you have submitted your filing, you can check its status through the Florida Division of Corporations website. Typically, processing time can vary, but you can expect confirmation of your Articles of Incorporation within a few days. After approval, you will receive a confirmation detailing the status of your filing.

Understanding the Articles of Incorporation document is vital. This document serves as proof of your corporation's legal existence and can be obtained directly from the state website or through your online account.

Handling filing issues

Situations sometimes arise where filing documents can be rejected. Common reasons include incorrect information, improper formatting, or missing signatures. If your filing is rejected, the state will provide feedback to help you amend your submission.

To correct mistakes, you’ll need to follow the amendment procedures outlined by the Florida Division of Corporations. This usually involves submitting a form detailing the corrections and may require additional fees.

Fees and financial considerations

As of 2024, the filing fee for the Articles of Incorporation for Florida profit corporations stands at approximately $70. Payment can be made via credit card or electronic funds transfer directly through the filing portal.

In addition to the filing fees, consider other potential costs associated with forming a corporation, such as registered agent fees or legal consulting if needed. It's wise to budget for these costs upfront to avoid surprises.

Reporting requirements after filing

Once your Florida profit corporation is established, you will have specific reporting requirements. Annual reports are mandatory, and they must be filed by May 1st each year. Failure to comply with these deadlines could result in penalties or potential dissolution of your corporation.

Staying organized with these reporting requirements ensures your business remains in good standing with the state. Remember that compliance with state and federal taxes is equally crucial, and keeping abreast of updates in regulations will aid in maintaining your corporation's operational status.

Important considerations for new corporations

As you establish your Florida profit corporation, it's important to understand the requirements for corporate governance. This includes maintaining accurate records, having regular board meetings, and adhering to bylaws. Florida law mandates certain corporate formalities, and failing to meet these can expose members to personal liability.

Tax obligations also play a significant role in the operations of profit corporations. All corporations must file a Florida corporate income tax return, which varies based on the corporation's revenue. Familiarize yourself with potential tax incentives and deductions available to corporations to leverage any financial benefits.

Expert tips for using pdfFiller

pdfFiller is an exceptional tool that streamlines the filing process for the 2024 Florida profit corporation form. It offers an array of features that simplify document management, such as form completion, electronic signatures, and collaborative capabilities for team members.

Utilizing the interactive tools provided by pdfFiller helps ensure your forms are error-free. By collaborating with team members, you can enhance accountability in the document management process, ensuring that all necessary information is complete before submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my florida profit corporation annual directly from Gmail?

How do I edit florida profit corporation annual online?

How can I fill out florida profit corporation annual on an iOS device?

What is 2024 florida profit corporation?

Who is required to file 2024 florida profit corporation?

How to fill out 2024 florida profit corporation?

What is the purpose of 2024 florida profit corporation?

What information must be reported on 2024 florida profit corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.