Get the free Notice of Delinquent Taxes and Sale of Real Property

Get, Create, Make and Sign notice of delinquent taxes

Editing notice of delinquent taxes online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of delinquent taxes

How to fill out notice of delinquent taxes

Who needs notice of delinquent taxes?

Notice of Delinquent Taxes Form - How-to Guide

Understanding the notice of delinquent taxes

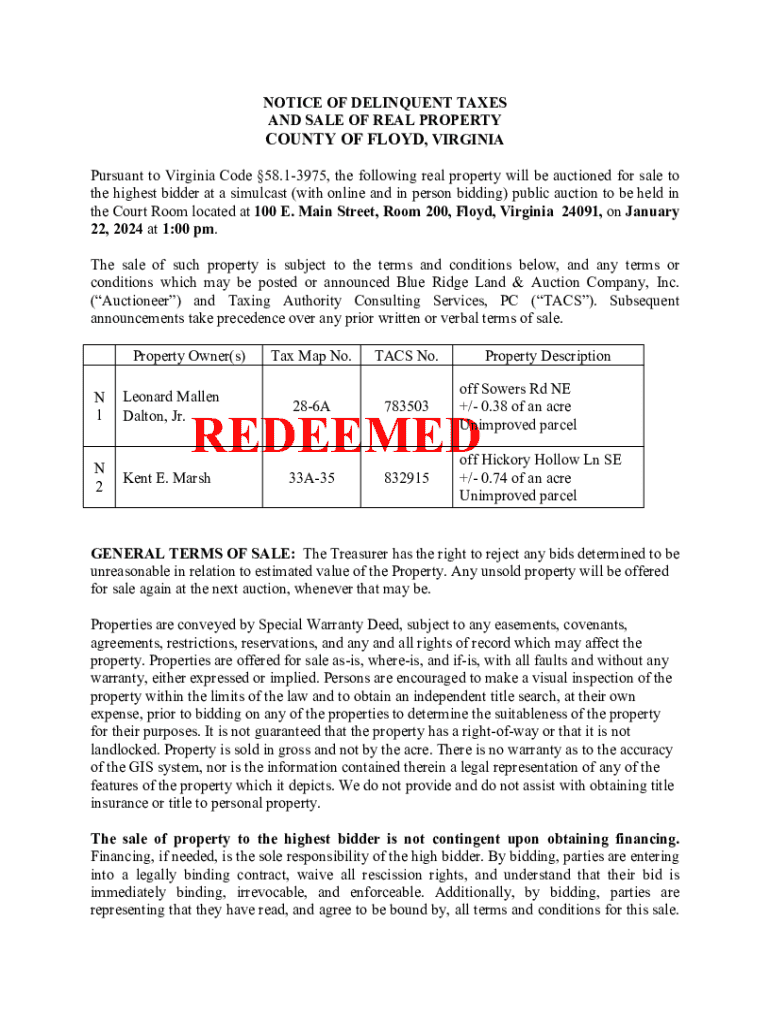

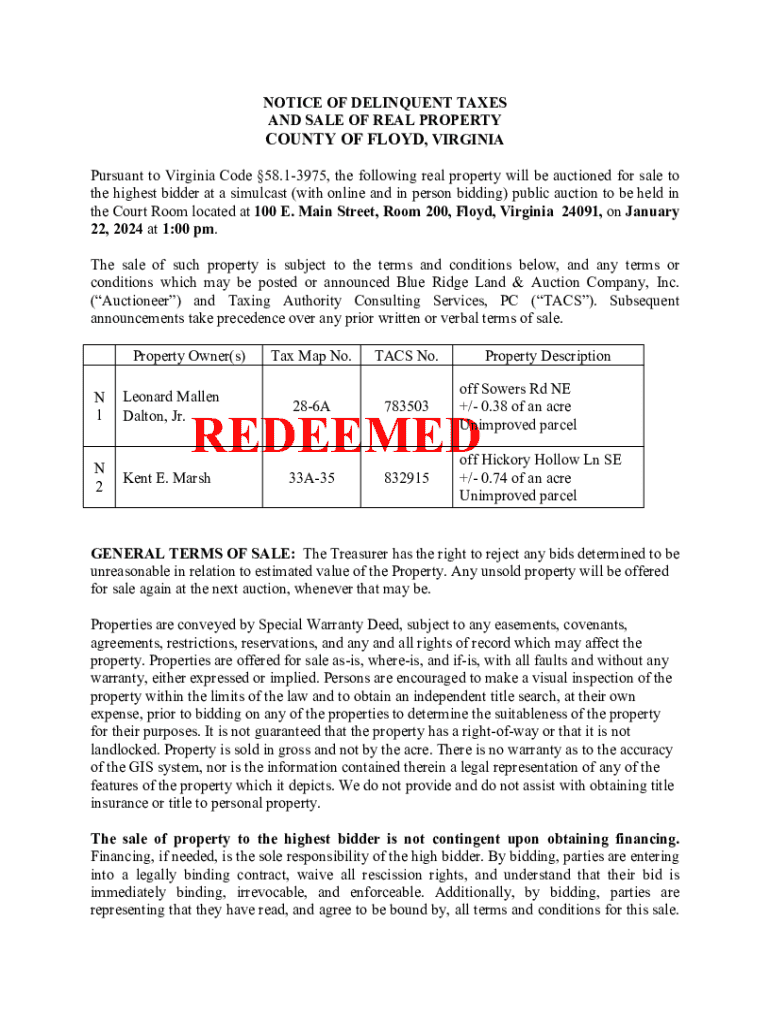

A Notice of Delinquent Taxes is an official communication from a local tax authority indicating that property taxes have not been paid by their due date. This notice serves as a crucial reminder for taxpayers, emphasizing the importance of taking immediate action to avoid further penalties. Ignoring such notices can lead to severe financial consequences, including interest accrual and potential liens against the property.

Recognizing and addressing a Notice of Delinquent Taxes promptly is vital; failure to do so can escalate into more complicated situations, such as tax foreclosure. Being proactive not only helps in maintaining ownership of your property but also mitigates financial stress.

Common causes leading to delinquent taxes

Key information contained in the form

Understanding the contents of the Notice of Delinquent Taxes form is essential for taxpayers. The form typically includes critical information that helps you determine your obligations and next steps. At the very least, it will inform you about the amount due, penalties accrued, and deadlines.

A breakdown of essential sections of the form includes:

Additional notices and requirements

Beyond the essential sections, the notice will often include deadlines for action and instructions on how to contest the notice or dispute errors within it. For anyone receiving such a notice, it is crucial to pay close attention to all provided details as they outline necessary steps toward resolution.

Steps to fill out the notice of delinquent taxes form

Completing a Notice of Delinquent Taxes form involves several important steps. First, you need to prepare by gathering essential documents, including previous tax returns, property records, and any prior correspondence with tax authorities.

Next, follow this detailed walkthrough for each section of the form:

To ensure clarity and accuracy, utilize tools available on platforms like pdfFiller to edit and fill in the form effectively. Always review for potential errors before finalizing any submission.

Editing and managing the notice of delinquent taxes form

Utilizing pdfFiller enhances your document management experience for the Notice of Delinquent Taxes. Begin by uploading your form to the platform where you can easily edit any necessary fields. This eliminates the hassle of re-printing or re-filling forms manually.

Collaboration is simplified too—team members or advisors can access the form, provide input, or highlight areas that need attention. Moreover, pdfFiller offers several interactive features to streamline usability.

Signing and submitting the notice of delinquent taxes form

After completing the form, it’s time for signing and submission. The option for electronic signing is available through pdfFiller, streamlining the entire process and saving time.

Here’s how to eSign using pdfFiller:

Tracking your submission status is essential to ensure that your Notice of Delinquent Taxes is received and processed correctly. Be sure to request confirmation when submitting.

Handling potential consequences of delinquent taxes

Receiving a Notice of Delinquent Taxes can come with anxiety about potential legal consequences. Depending on your jurisdiction, failure to address these delinquent taxes may lead to fines, accrued fees, and possibly even a lien on your property.

Mitigating these risks is crucial. Consider the following strategies:

Frequently asked questions about delinquent taxes forms

Taxpayers often have questions about how to manage a Notice of Delinquent Taxes effectively. Here are some common queries:

Case studies and real-life examples

Understanding how others have successfully navigated their delinquencies can offer valuable insights. Numerous individuals have faced Notices of Delinquent Taxes but turned their situations around with effective strategies.

For example, Jane, a homeowner in Texas, received such a notice due to an oversight in payment following her husband’s passing. She promptly contacted the local tax office, explained her situation, and negotiated a payment plan that allowed her to retain ownership of her home while managing her budget.

Through community resources and professional help, Jane’s case exemplifies how proactive behavior can lead to positive outcomes from potentially dire situations.

Accessing further support and resources

If you're still uncertain about dealing with a Notice of Delinquent Taxes, know that support is available. Local tax offices often have designated hours and staff available to help you comprehend your options.

You can easily find contact information for your area’s tax office online or inquire at local government websites.

Additionally, pdfFiller’s customer support is ready to assist you in navigating the platform and ensuring you have the resources needed to effectively manage tax forms and other legal documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit notice of delinquent taxes in Chrome?

How do I edit notice of delinquent taxes straight from my smartphone?

How do I fill out notice of delinquent taxes on an Android device?

What is notice of delinquent taxes?

Who is required to file notice of delinquent taxes?

How to fill out notice of delinquent taxes?

What is the purpose of notice of delinquent taxes?

What information must be reported on notice of delinquent taxes?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.