Get the free 2024 Foreign Profit Corporation Annual Report

Get, Create, Make and Sign 2024 foreign profit corporation

Editing 2024 foreign profit corporation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 foreign profit corporation

How to fill out 2024 foreign profit corporation

Who needs 2024 foreign profit corporation?

2024 Foreign Profit Corporation Form: A Comprehensive Guide to Registration and Compliance

Understanding foreign profit corporations

A foreign profit corporation is a legal entity formed in one state or country but operates in another. The primary purpose of registering as a foreign profit corporation is to legally conduct business in states outside the entity's original formation jurisdiction. The registration ensures compliance with local business laws and regulations, protecting the corporate entity and its officers from legal penalties.

Registering as a foreign entity carries significant importance. Failure to do so can result in hefty fines and potential prohibitions on business operations. To navigate this complex landscape, understanding essential terminology such as 'registered agent,' 'certificate of authority,' and 'good standing' is critical for business owners.

Preparing to file the 2024 foreign profit corporation form

Before filing the 2024 foreign profit corporation form, it’s imperative to establish eligibility requirements. Typically, your corporation must be in good standing in its home state and must follow local law guidelines for foreign entities. Understanding these requirements can save time and prevent complications during the filing process.

Considerations extending beyond eligibility include local business laws that may differ from your home state. For instance, some states may impose additional taxes or fees that affect your decision to operate there. It's crucial to assess your business operations in the host state, ensuring that your business model aligns with local market regulations.

Step-by-step guide to completing the 2024 foreign profit corporation form

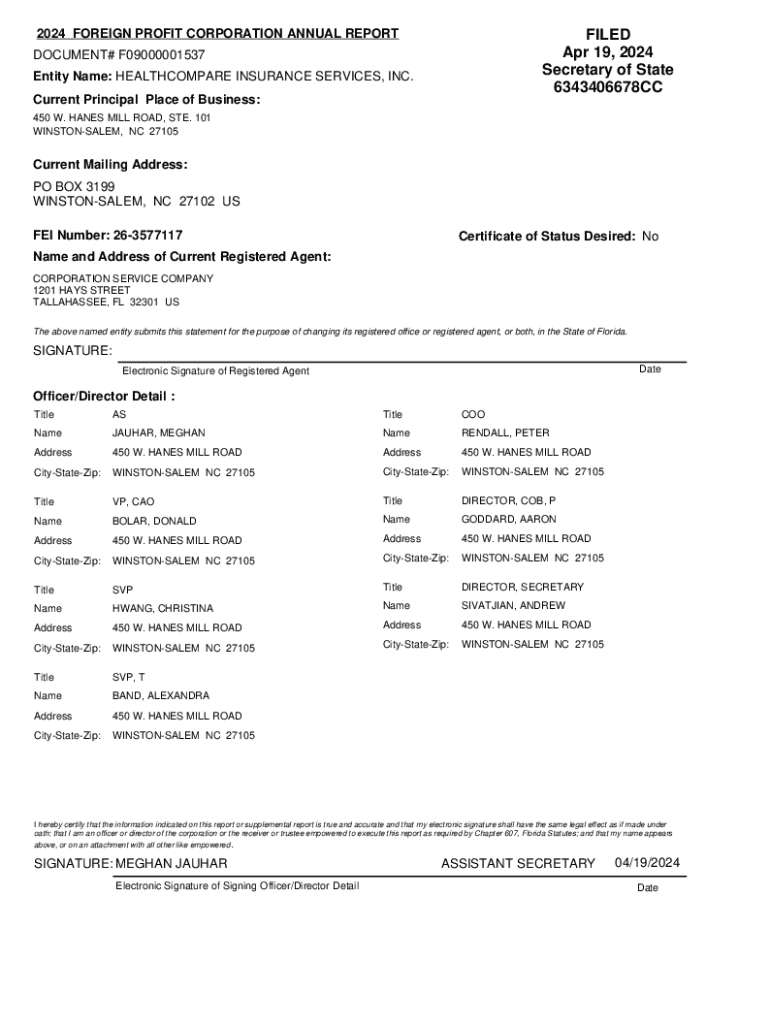

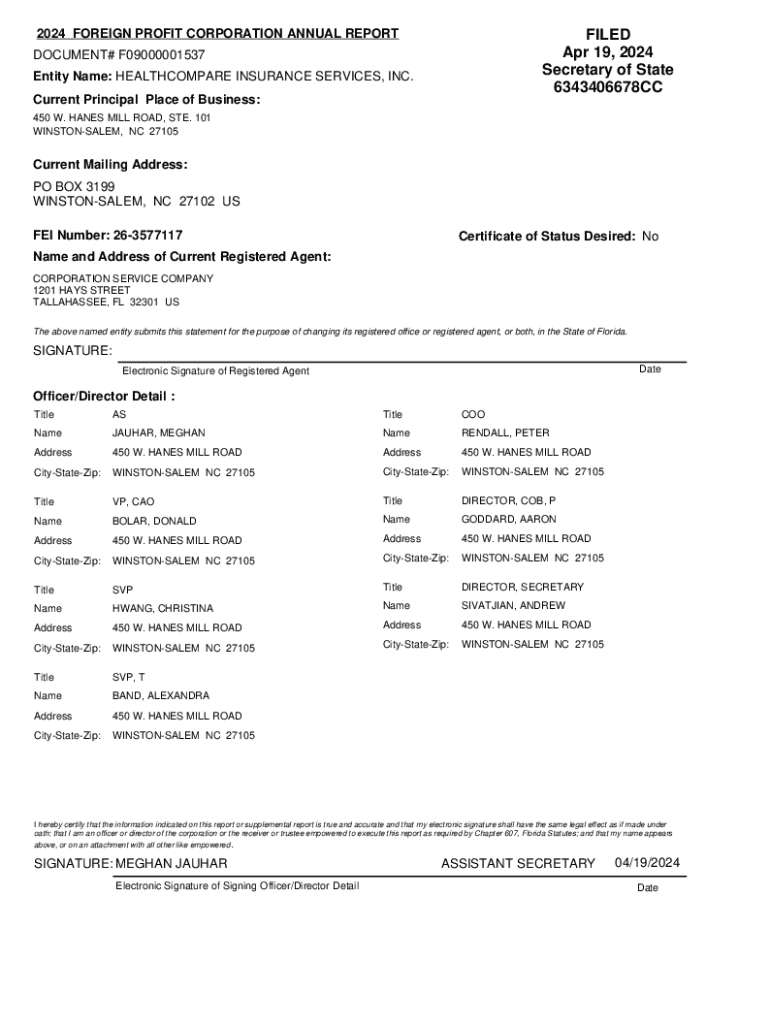

Completing the 2024 foreign profit corporation form is critical for legal recognition. The first section requires basic corporate information, including the name of the corporation, the principal office address, and the registered agent's information. The name must reflect your corporation’s identity and comply with state naming conventions, ensuring it's not already in use.

Next, the corporate structure details section invites you to outline your ownership and management framework. This could include information about shareholders, directors, and officers, alongside a brief description of the purpose for incorporation. Clarity at this stage lays the groundwork for future corporate governance.

Providing your accounting information also requires care. You'll need to select a fiscal year, which could either align with the calendar year or adopt a different timeline based on your business’s financial cycles. Finally, ensure all individuals designated to sign the form understand their responsibilities, as certification often requires specific verifications.

Filing options for the 2024 foreign profit corporation form

Filing the 2024 foreign profit corporation form can be done through various methods. Online filing via platforms like pdfFiller offers an intuitive and efficient process. This method facilitates easy completion, saving time and reducing the potential for errors. For those preferring traditional methods, forms can be filed by mail or delivered in person to the appropriate state office.

Once your submission is completed, you may wish to check its status. This can typically be done through either the state’s business registry website or directly through the submission portal if available.

Common mistakes to avoid when filing

Avoiding mistakes during the filing process is essential for a smooth registration. Incomplete information or skipping necessary attachments can lead to significant delays. Understanding the precise legal terminologies involved is also vital to ensure compliance. For instance, misinterpreting the role of the registered agent could lead to failure in receiving essential legal documents, resulting in legal repercussions.

Moreover, adhering to deadlines is another crucial aspect. Every state has specific submission dates for various registration requirements, and failing to meet these can lead to fines or loss of good standing.

Post-filing steps for foreign profit corporations

After filing the 2024 foreign profit corporation form, it’s essential to understand the approval processes and timeline. Typically, the duration can range from a few days to several weeks, depending on the state. During this period, the Secretary of State or equivalent office will assess your application, verifying your adherence to local regulations.

Once approved, you will receive a certificate of authority, which legitimizes your corporation's operating status in the hosting state. This certificate is not just a formality; it's a crucial document required for opening bank accounts, signing contracts, and conducting other business transactions.

Annual reporting requirements for foreign corporations

Once established, foreign profit corporations have ongoing compliance obligations that extend beyond initial filing. Most states require annual reports to maintain active status. These reports usually include updated corporate information and confirmation that the corporation remains in good standing in its home state.

It's crucial to be aware of deadlines for these filings since failure to comply can lead to fines or potential dissolution of the corporation. By keeping organized records and setting reminders for each year, businesses can avoid the repercussions of non-compliance.

Managing your foreign profit corporation with pdfFiller

Utilizing pdfFiller offers powerful features that streamline the management of your foreign profit corporation documents. This cloud-based platform enables users to create, edit, and manage forms efficiently—eliminating the hassle of traditional paperwork. The interactive tools allow for seamless collaboration among team members, which is particularly beneficial for businesses with multiple stakeholders.

In addition to document management, pdfFiller offers eSigning capabilities that facilitate faster turnaround times for approvals. Users can securely store and access all their corporation-related forms in one central location, ensuring easy retrieval whenever necessary. This comprehensive approach significantly simplifies the complexities associated with corporate management.

Key resources and contacts

Access to the right resources is crucial when navigating the complexities of foreign corporation registration. Each state has specific business registration contact points, ensuring your inquiries are addressed efficiently. Familiarizing yourself with state-specific resources can enhance your awareness of local regulations.

Frequently asked questions about foreign profit corporations can also provide valuable insights into common challenges faced by new registrants. Links to relevant state and federal forms and policies are integral for compliance and should be bookmarked for easy access.

Troubleshooting and support

In the event of filing issues, effective customer support is invaluable. pdfFiller offers dedicated assistance for users navigating complex filing processes. Timely responses can help you solve problems quickly, whether it's updating your corporation's information or clarifying compliance requirements.

Handling disputes or legal issues related to foreign corporations requires proactive measures to mitigate risks. Understanding the processes in place for dispute resolution prepares you to address challenges efficiently, ensuring your corporation’s operations proceed smoothly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 2024 foreign profit corporation?

How do I complete 2024 foreign profit corporation online?

How do I make changes in 2024 foreign profit corporation?

What is 2024 foreign profit corporation?

Who is required to file 2024 foreign profit corporation?

How to fill out 2024 foreign profit corporation?

What is the purpose of 2024 foreign profit corporation?

What information must be reported on 2024 foreign profit corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.