Get the free 2021 Florida Limited Liability Company Annual Report

Get, Create, Make and Sign 2021 florida limited liability

Editing 2021 florida limited liability online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2021 florida limited liability

How to fill out 2021 florida limited liability

Who needs 2021 florida limited liability?

Your guide to the 2021 Florida limited liability form

Understanding limited liability companies (LLCs) in Florida

A Limited Liability Company, or LLC, is a distinct business structure that combines the liability protection of a corporation with the operational flexibility of a partnership. In Florida, forming an LLC provides business owners a shield against personal liability for business debts and obligations, allowing them to engage in business activities with confidence.

Several key benefits make forming an LLC in Florida particularly appealing. Firstly, liability protection ensures that personal assets, such as homes and savings, remain safeguarded against business-related lawsuits or debts. Secondly, LLCs afford significant tax advantages, as they are typically taxed as pass-through entities, meaning profits are only taxed at the individual level, thus eliminating the possibility of double taxation. Lastly, operational flexibility allows LLCs to choose their management structure, whether member-managed or manager-managed, which can simplify decision-making processes.

Popular types of businesses suited for the LLC structure in Florida include professional services, real estate investments, and small retail businesses. Because of their diverse uses, more entrepreneurs are recognizing the practicality of LLCs as a vehicle for business growth in the state.

The importance of the 2021 Florida limited liability form

Filing the 2021 Florida limited liability form is an essential step in establishing your LLC. This form officially registers your business with the state, ensuring that it complies with local laws and operates legally. Without submitting this form, your business cannot attain the recognition it needs to function effectively or protect its members' assets.

Non-compliance can lead to serious repercussions, including fines, legal challenges, or complete dissolution of the LLC. Timely filing can prevent unnecessary hassles, allowing you to focus on growing your business. Additionally, failing to file by specific deadlines can result in late fees or other penalties, further complicating matters for new business owners.

Keep in mind that key deadlines exist for filing the 2021 Florida limited liability form. Typically, these are tied to the date of formation, making it imperative to be vigilant about when to submit your paperwork. Understanding the timeline not only keeps your business compliant but also sets a solid foundation for future operations.

Step-by-step guide to completing the 2021 Florida limited liability form

Completing the 2021 Florida limited liability form requires careful attention to detail. To navigate this process smoothly, follow these steps:

Each step requires diligence. Members should diligently check the form for accuracy; incomplete or incorrect submissions may compromise the registration. Using tools like pdfFiller can streamline this process, allowing for easier edits and quicker checks.

Enhancing your submission process

Choosing the right submission method for the 2021 Florida limited liability form can significantly impact the efficiency of your filing. There are generally two options: online and paper filing. Online submission typically offers faster processing times and instant confirmation of receipt, which enhances peace of mind for busy entrepreneurs.

Utilizing platforms like pdfFiller for online filing can lead to an altogether more streamlined experience. This tool not only facilitates easy document filling but also allows you to eSign and share crucial forms across teams effortlessly. Additionally, it often enhances accuracy, ensuring the details you enter are correctly submitted.

Moreover, remember to factor in the fees associated with filing the Florida Limited Liability Form, which can vary depending on the filing method and additional services chosen. Understanding the costs upfront can help you prepare your budget accordingly.

Interacting with state agencies

When filing your 2021 Florida limited liability form, you'll interact primarily with the Florida Department of State: Division of Corporations. This state agency oversees the registration of businesses and ensures compliance with regulations. Should you need assistance at any point during the process, this agency provides resources and contact information on their website.

After submission, expect to receive a confirmation of your filing, a crucial document that serves as proof of your LLC's legal existence. Keep in mind that processing times may vary, so it's wise to plan accordingly and maintain communication with the Division of Corporations.

Managing your Florida after filing

Establishing your LLC is just the first step; managing it effectively is crucial for ongoing success. Florida LLCs have annual reporting requirements that demand timely submissions to maintain good standing. Missing these deadlines can result in penalties or administrative dissolution, compromising the business's operations.

Maintaining good standing is paramount. Always monitor for timely filings, to avoid pitfalls that often arise from neglect. Additional forms and updates may also be required, especially if there are changes in management structure or member composition. Continually educating yourself about ongoing compliance necessities ensures your LLC remains operational without interruption.

Overcoming challenges in forming your

Navigating the LLC formation process can be challenging. Common pitfalls include incomplete applications, failure to comply with state requirements, and misinterpretation of submission guidelines. Such missteps can lead to costly delays or rejections.

Fortunately, tools like pdfFiller simplify documentation, with user-friendly interfaces guiding you through the form-filling process seamlessly. Additionally, real user testimonials showcase how pdfFiller has assisted entrepreneurs in overcoming initial barriers to successful LLC formation, emphasizing that with the right tools, the process is manageable.

Frequently asked questions (FAQs)

When delving into the realm of LLC formation, questions are natural. Let's address some common ones:

Interactive tools and resources offered by pdfFiller

pdfFiller isn't just a tool for filling out forms; it’s a comprehensive platform designed to empower users in document management. With robust document editing features, users can easily make changes to PDFs and other files. eSigning capabilities facilitate faster contract agreements, while collaboration tools enable team members to work together seamlessly.

Moreover, pdfFiller provides templates and guides for additional forms, making it easier to handle various documentation needs during the LLC lifecycle. This comprehensive suite of resources positions pdfFiller as an invaluable asset for anyone navigating the complexities of LLC management.

Need more help?

Should you require additional support while navigating the formation of your LLC or completing the 2021 Florida limited liability form, pdfFiller is here to assist. Contact their support for personalized help and explore comprehensive guides on related forms to empower your business journey.

Professional services offered by pdfFiller for LLC management can also provide peace of mind, ensuring that you remain compliant and positioned for success in the Florida business landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2021 florida limited liability directly from Gmail?

How do I make changes in 2021 florida limited liability?

How do I fill out the 2021 florida limited liability form on my smartphone?

What is 2021 florida limited liability?

Who is required to file 2021 florida limited liability?

How to fill out 2021 florida limited liability?

What is the purpose of 2021 florida limited liability?

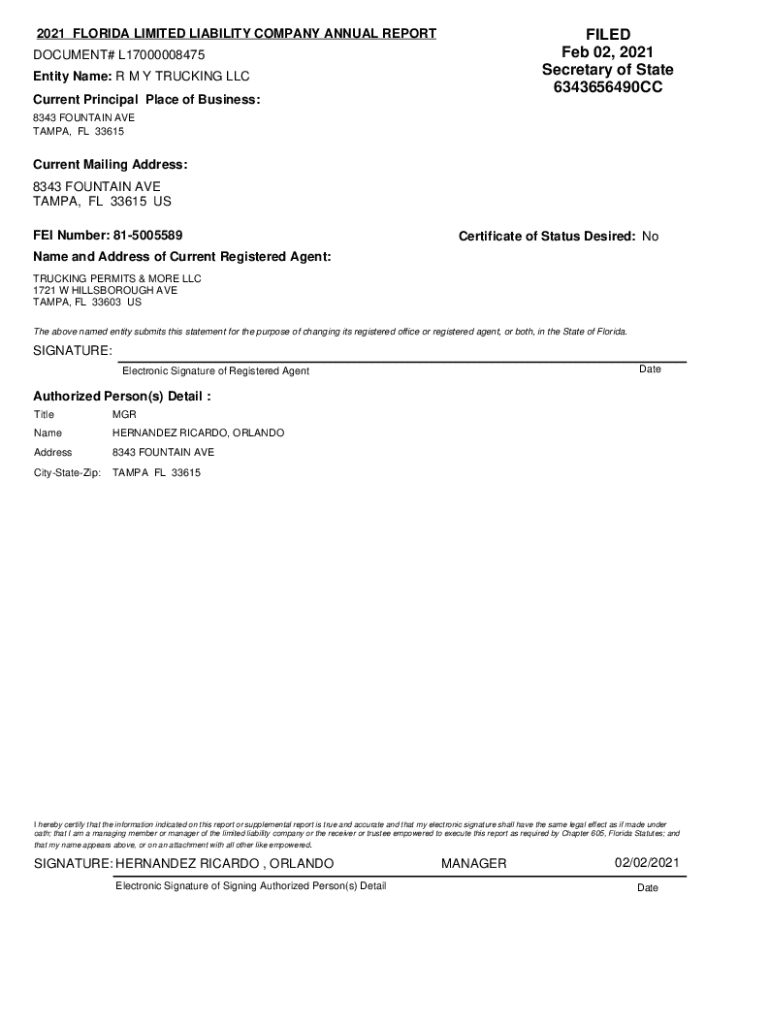

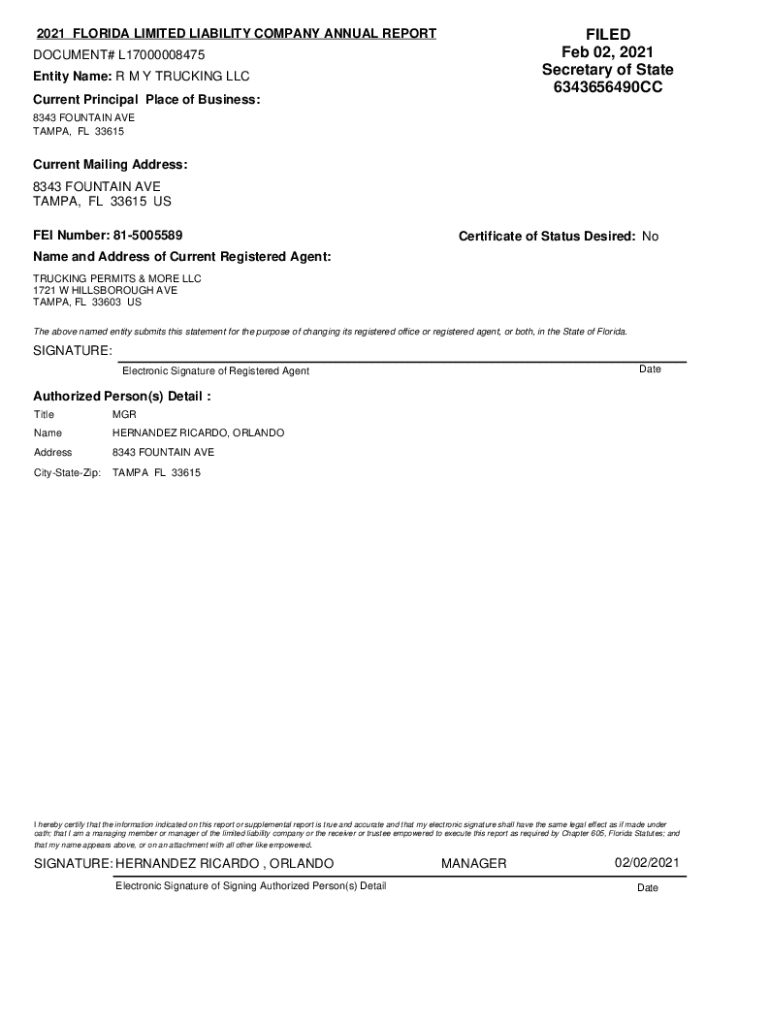

What information must be reported on 2021 florida limited liability?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.