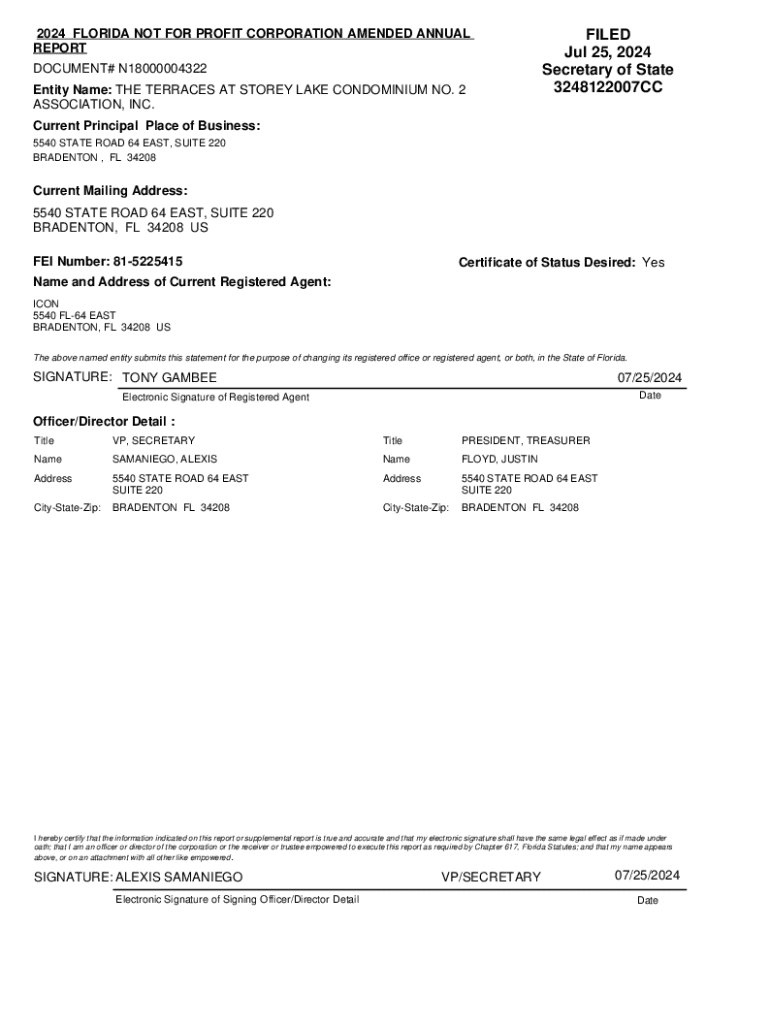

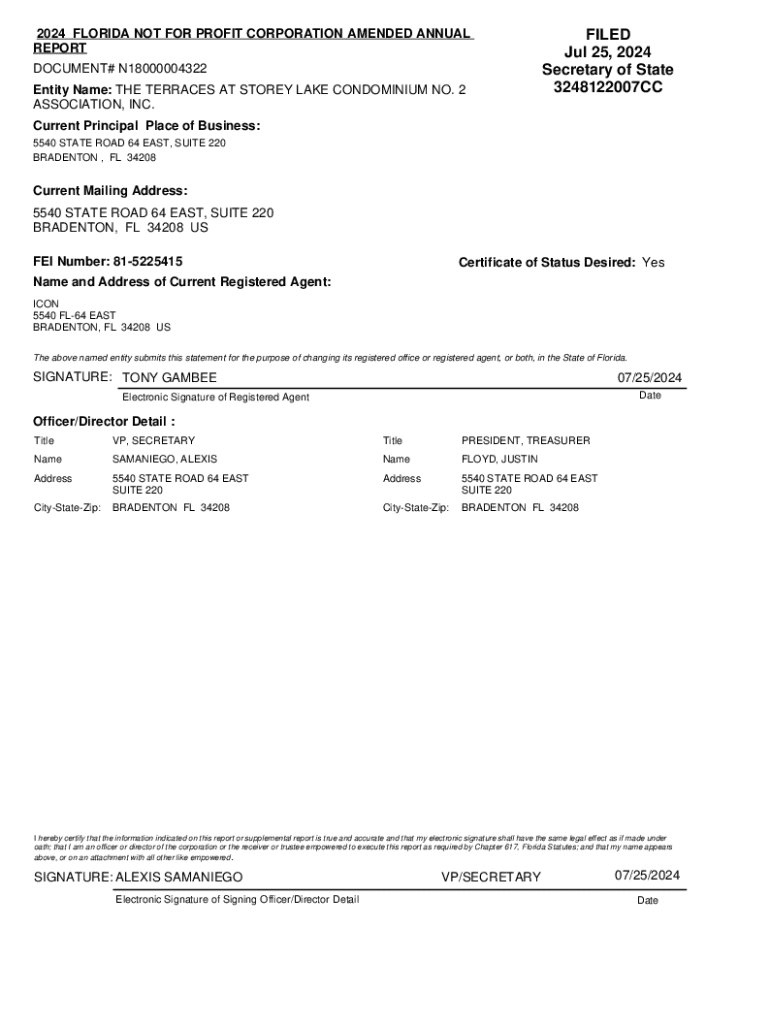

Get the free 2024 Florida Not for Profit Corporation Amended Annual Report

Get, Create, Make and Sign 2024 florida not for

How to edit 2024 florida not for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida not for

How to fill out 2024 florida not for

Who needs 2024 florida not for?

2024 Florida Not for Profit Form: A Comprehensive Guide

Understanding the Florida Not for Profit Form

The Florida Not for Profit Form, crucial for organizations operating on a non-profit basis within the state, serves as a declaration of your organization's intent and activities. It is a formal documentation required for compliance with state regulations, ensuring that not-for-profits are operating transparently and within the boundaries of the law. As of 2024, the filing of this form is more vital than ever due to recent regulatory changes and increased accountability measures.

Key deadlines to be aware of include the submission date typically set for May 1st, allowing organizations sufficient time to prepare and gather necessary documentation. Failing to file on time may result in penalties or even loss of status.

Types of organizations required to file

In Florida, not-for-profit organizations are primarily defined under Section 501(c)(3) of the IRS code, which includes charities, educational institutions, and religious entities. Understanding the scope of what constitutes a not-for-profit is essential for compliance with state and federal laws.

However, not all organizations are required to file. For instance, certain faith-based entities that qualify under specific exemptions may not need to submit the form. It’s vital to assess your organization’s status based on the regulations laid out by the Florida Division of Corporations.

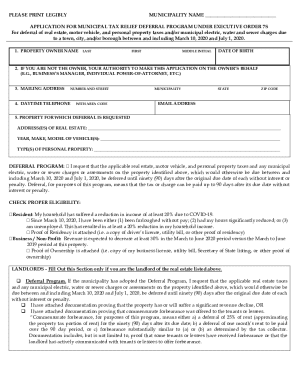

Preparing to file your 2024 Florida Not for Profit Form

Before diving into filling out the form, preparation is key. Gather all necessary documents and information that reflect your organization’s structure and financial health. This involves compiling organizational bylaws, articles of incorporation, and recent financial statements and accounting records.

Understanding financial reporting requirements is vital, as many not-for-profits only qualify for simpler reporting standards if they meet specific revenue thresholds. Preparing these documents in advance can streamline the filing process significantly.

Step-by-step instructions for filling out the form

Filling out the Florida Not for Profit Form requires meticulous attention to detail. Ensure you carefully complete each section, as errors could delay your submission. Here’s a breakdown of the main sections:

Make a note of common pitfalls, such as incorrect financial projections or missing signatures. Each section must be completed fully to avoid delays; consider utilizing a checklist to ensure completion.

Editing and reviewing your form

Once your form is filled out, reviewing for accuracy is crucial. Implementing a review process can save your organization from unnecessary errors that could lead to complications. Tools like pdfFiller facilitate easy editing and reviewing by allowing multiple users to collaborate on the same document.

Best practices suggest conducting a peer review within your organization before final submission to minimize the risk of oversight.

E-signing and finalizing your submission

Once you've finalized the document, next comes the e-signing stage. Electronic signatures are not just convenient; they align with Florida's legal requirements for document submission. With pdfFiller, signing your Florida Not for Profit Form becomes a straightforward process.

This digital approach not only saves time but also enhances the security and integrity of your document.

Managing and tracking your submission

After submission, it’s essential to monitor the status of your Florida Not for Profit Form. Submitting online is typically the fastest method, and you can expect a confirmation of receipt. If you do not receive this confirmation within a reasonable timeframe, contact the relevant authorities.

Proactive management of your submission timeline guarantees compliance and peace of mind.

Post-submission actions

Once your organization has successfully filed the form, maintain a copy of the submission for your records. Set reminders for important dates such as renewals or amendments to ensure your organization remains in good standing with state regulations.

Staying organized with this information provides the framework to manage your not-for-profit effectively.

Frequently asked questions (FAQ)

Anticipating questions surrounding the Florida Not for Profit Form can enhance your organizational readiness. Below are commonly posed inquiries that can clarify the process:

Being well-versed in these questions can help streamline your organization’s preparations.

Resources for further assistance

For any further assistance, the Florida Division of Corporations is your go-to resource. They offer robust support for non-profits navigating the filing process. Utilize their resources to gain deeper insights into compliance and operational standards.

Leveraging these resources can empower your organization to thrive and maintain compliance effectively.

Benefits of using pdfFiller for your Not for Profit documentation

When navigating the complexities of not-for-profit documentation, utilizing pdfFiller can significantly enhance your efficiency. This platform offers a range of features that simplify the document creation and management process. For instance, the editing capabilities allow users to seamlessly modify documents and ensure accuracy before submission.

Testimonials showcase that organizations experiencing pdfFiller find their paperwork management process streamlined, allowing them to focus more on fulfilling their nonprofit missions.

Navigating potential challenges

Running a not-for-profit organization comes with its share of challenges, ranging from financial accountability to regulatory compliance. Understanding common obstacles encountered during the filing process can help mitigate issues before they arise. Not all organizations are equipped with the resources for extensive documentation, making knowledge of the requirements paramount.

Incorporating these strategies can lead to enhanced compliance, reducing frustration and promoting sustainability for not-for-profit organizations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2024 florida not for without leaving Google Drive?

How do I edit 2024 florida not for in Chrome?

Can I create an electronic signature for signing my 2024 florida not for in Gmail?

What is 2024 florida not for?

Who is required to file 2024 florida not for?

How to fill out 2024 florida not for?

What is the purpose of 2024 florida not for?

What information must be reported on 2024 florida not for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.