ME REW-2 2014 free printable template

Show details

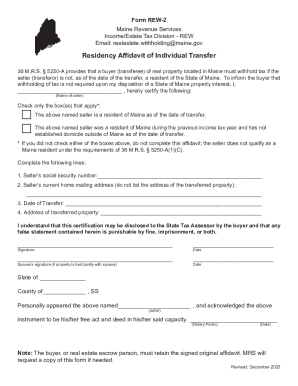

FORM REW-2 MAINE REVENUE SERVICES Income/Estate Tax Division NEW P.O. Box 1064 Augusta, ME 04332-1064 Tel. 207-626-8473 Fax 207-624-5062 RESIDENCY AFFIDAVIT, INDIVIDUAL TRANSFEROR, MAINE EXCEPTION

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign rew 2

Edit your rew 2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rew 2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rew 2 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit rew 2. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ME REW-2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out rew 2

How to fill out ME REW-2

01

Obtain the ME REW-2 form from the appropriate source, such as your local tax office or website.

02

Fill in your personal information, including your name, address, and Social Security Number.

03

Indicate the tax year for which you are filing the form.

04

Complete the income section by entering your total income for the year.

05

Enter applicable deductions and credits in their designated sections.

06

Calculate your total tax liability based on the information provided.

07

Review the form for any errors or omissions before submission.

08

Sign and date the form before submitting it to the relevant tax authority.

Who needs ME REW-2?

01

Individuals who are required to report their income and deductions for tax purposes.

02

Taxpayers who need to claim certain deductions or credits.

03

Anyone filing a state tax return in jurisdictions that utilize the ME REW-2 form.

Fill

form

: Try Risk Free

People Also Ask about

How much is capital gains tax on real estate in Maine?

State Capital Gains Tax Rates RankStateRates 20219Wisconsin *7.65%10Hawaii *7.25%11Maine7.15%12South Carolina *7.00%47 more rows

Does Maine have a capital gains tax on real estate?

Most homesellers in Maine, like all homesellers across the country, do not need to report the sale of their property. However, if you have capital gains of more than $250,000 or $500,000 as a couple filing a joint return, then the IRS will tax you on some of the gain.

Can you avoid the Maine state tax when you sell your home?

A request for exemption or reduction in real estate withholding (Form REW-5) should be filed as soon as the seller and buyer have reached an agreement to transfer property. Sellers should allow 5 business days for Maine Revenue Services to respond to a Form REW-5 request.

Do I have to pay taxes when I sell my house in Maine?

Note: Regardless of residency status, all individuals and entities are subject to Maine income tax on gains realized from the sale of real estate in Maine.

How do I avoid capital gains tax on sale of house?

Live in the house for at least two years The two years don't need to be consecutive, but house-flippers should beware. If you sell a house that you didn't live in for at least two years, the gains can be taxable.

Do seniors pay property tax in Maine?

Maine Property Tax Deferral Program In 2021, the Maine Legislature reinstated this property tax deferral program to help seniors and the fully disabled stay in their homes and age in place. For qualified and approved applicants, the State of Maine will pay the property taxes each year.

Is there a capital gains tax in Maine?

Maine taxes both long- and short-term capital gains at the full income tax rates described in the income tax section above. This means that income from capital gains can face a state rate of up to 7.15% in Maine.

What is the capital gains tax on real estate in Maine?

Additional State Capital Gains Tax Information for Maine The Combined Rate accounts for Federal, State, and Local tax rate on capital gains income, the 3.8 percent Surtax on capital gains and the marginal effect of Pease Limitations (which results in a tax rate increase of 1.18 percent).

Do you have to pay capital gains when you sell your house in Maine?

Most homesellers in Maine, like all homesellers across the country, do not need to report the sale of their property. However, if you have capital gains of more than $250,000 or $500,000 as a couple filing a joint return, then the IRS will tax you on some of the gain.

How do I avoid New Jersey exit tax?

New Jersey exit tax exemptions If you remain a New Jersey resident, you'll need to file a GIT/REP-3 form (due at closing), which will exempt you from paying estimated taxes on the sale of your home. Instead, any applicable taxes on sales gains are reported on your New Jersey Gross Income Tax Return.

What is the capital gains tax rate for 2022 on real estate?

If you have a long-term capital gain – meaning you held the asset for more than a year – you'll owe either 0 percent, 15 percent or 20 percent in the 2022 or 2023 tax year.

How are property taxes figured in Maine?

Maine laws dictate that residential property be assessed at 70% of its market value. If, for instance, your property has a market value of $100,000, the assessed value would add up to (0.7 x $100,000) $70,000. Maine property tax rates are applied to that amount to calculate your annual tax bill.

How do I calculate capital gains on sale of property?

Capital gains tax is the amount of tax owed on the profit (aka the capital gain) you make on an investment or asset when you sell it. It is calculated by subtracting the asset's original cost or purchase price (the “tax basis”), plus any expenses incurred, from the final sale price.

What are real estate taxes in Maine?

Maine Property Tax Rates CountyMedian Home ValueAverage Effective Property Tax RateKennebec County$155,0001.37%Knox County$206,8001.32%Lincoln County$213,3001.08%Oxford County$142,2001.33%12 more rows

How can I avoid paying tax on the sale of my house?

Home sales can be tax free as long as the condition of the sale meets certain criteria: The seller must have owned the home and used it as their principal residence for two out of the last five years (up to the date of closing). The two years do not have to be consecutive to qualify.

What age do you stop paying property taxes in Maine?

To be eligible for the program, you must be at least 65 years old or unable to work due to a disability.

At what age do you stop paying property taxes in Maine?

The State Property Tax Deferral Program is a lifeline loan program that can cover the annual property tax bills of Maine people who are ages 65 and older or are permanently disabled and who cannot afford to pay them on their own.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my rew 2 directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your rew 2 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit rew 2 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your rew 2 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I edit rew 2 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share rew 2 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is ME REW-2?

ME REW-2 is a state-specific wage reporting form used in Maine to report employee wages and tax-related information to the Maine Revenue Services.

Who is required to file ME REW-2?

Employers in Maine who have paid wages to employees during the tax year are required to file the ME REW-2.

How to fill out ME REW-2?

To fill out ME REW-2, employers need to provide detailed information such as the employee's name, social security number, total wages earned, and taxes withheld using the form's specified format.

What is the purpose of ME REW-2?

The purpose of ME REW-2 is to ensure accurate reporting of income and tax withholdings to the state, facilitating proper tax collection and compliance.

What information must be reported on ME REW-2?

The ME REW-2 must report employee details including their name, social security number, total wages, and the amount of state taxes withheld.

Fill out your rew 2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rew 2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.