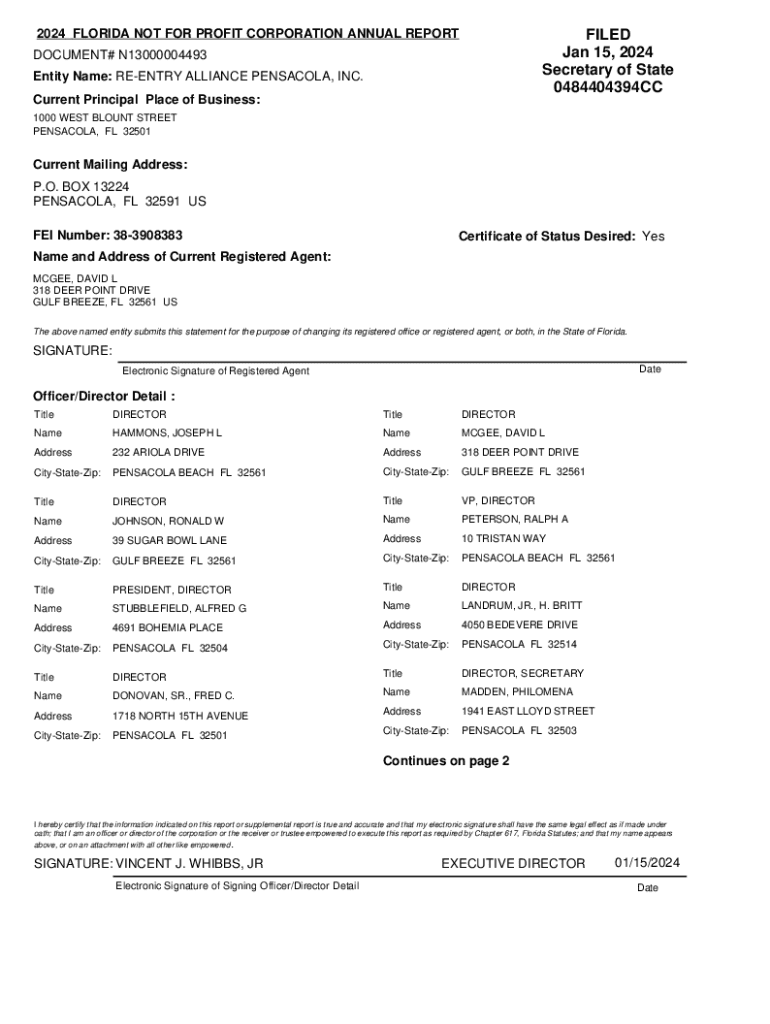

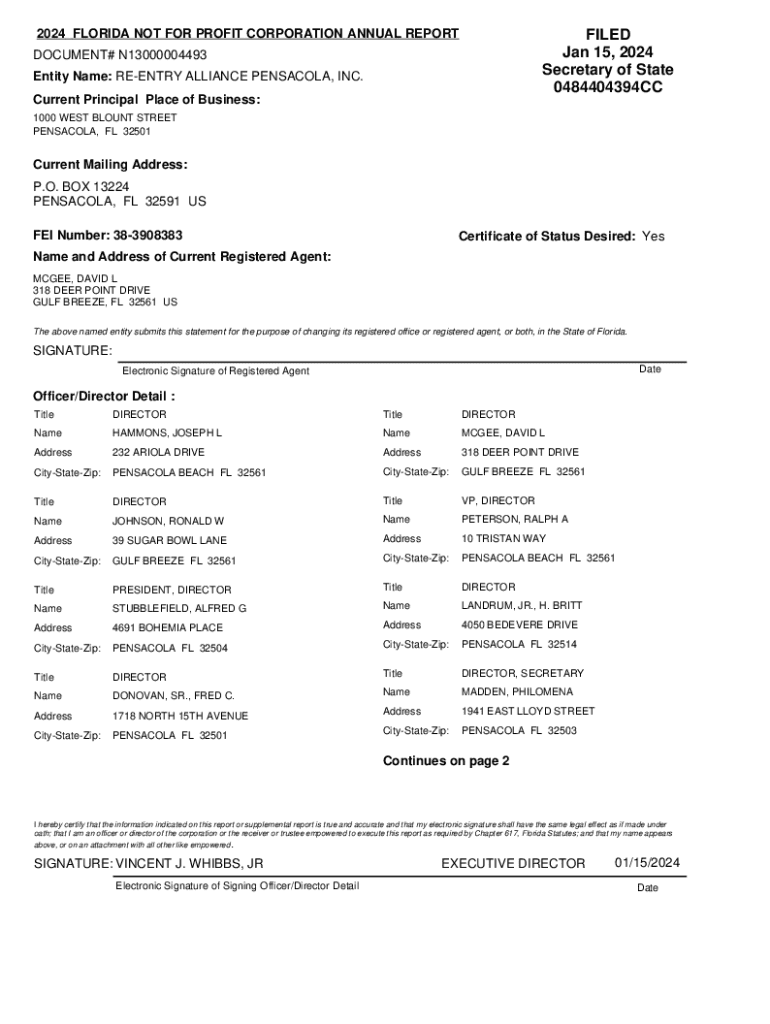

Get the free 2024 Florida Not for Profit Corporation Annual Report

Get, Create, Make and Sign 2024 florida not for

Editing 2024 florida not for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 florida not for

How to fill out 2024 florida not for

Who needs 2024 florida not for?

Comprehensive Guide to the 2024 Florida Not for Form

Understanding the 2024 Florida Not for Form

The 2024 Florida Not for Form is a crucial document for individuals and organizations in Florida, primarily used for reporting purposes regarding specific transactions or changes in status. This form serves to provide vital information to the state, ensuring compliance with state laws and regulations. In 2024, the importance of filing this document becomes even more pronounced as new regulations may have been introduced, making it essential for stakeholders to stay informed.

Filing the 2024 Florida Not for Form accurately and on time helps avoid penalties and ensures that all changes and updates are officially recognized by the state. Effectively, this form acts as a bridge between citizens and government entities, facilitating smooth communication and compliance.

Eligibility criteria

Not everyone is required to file the 2024 Florida Not for Form. Understanding who needs to complete this form is critical for compliance. Generally, the primary candidates include individuals who have undergone a significant change in their financial or legal status, such as filings for bankruptcy, changes in asset ownership, or modifications in business registration.

Key qualifications for this form typically involve having a direct relationship with the state or being part of specific regulated sectors. It’s also vital to consider exceptions - certain low-income individuals or those receiving specific forms of state support may be exempt from filing.

Step-by-step guide to completing the 2024 Florida Not for Form

Completing the 2024 Florida Not for Form can seem daunting, but by breaking it down into manageable steps, it becomes straightforward. First, prepare by gathering relevant information and documentation that demonstrates the legitimacy of your claims. The structure of the document is designed to capture specific data points, so familiarity with its layout is advantageous.

Step 1: Gathering necessary information

Compile all necessary documents, including identification proofs, prior tax returns, and any records related to changes you are reporting. This foundational step is vital for completeness and accuracy.

Step 2: Filling out the form

When filling out the form, ensure to follow instructions for each section closely. Each field demands specific information, so take your time to avoid common pitfalls such as missing signatures or incorrect data.

Step 3: Reviewing your submission

Before submitting, review your completed form meticulously. Checking for accuracy and completeness can prevent delays or issues down the line. Use checklists to confirm all required information is filled in.

Step 4: Submitting the form

Finally, submit the form through the chosen method: online, via mail, or in person. Make note of important deadlines to ensure timely submission and avoid penalties.

Common FAQs: Navigating the 2024 Florida Not for Form

Many questions arise regarding the 2024 Florida Not for Form, especially about deadlines and post-filing actions. If you miss the filing deadline, you may incur penalties or late fees, which can complicate matters further. It's best to reach out directly to state departments for guidance in such situations.

Amending information after filing is permissible, provided you follow the specified procedures. Tracking the status of your form can typically be done through online portals set up by the state, allowing you to ensure your submission is processed.

Tools and resources for assistance

To streamline the process of completing the 2024 Florida Not for Form, various tools and resources are available. Online services, such as pdfFiller, provide interactive guides and checklists that can guide users through each step of the process, ensuring nothing is overlooked.

For additional assistance, having contact information for state support offices can be invaluable. Make use of these resources to prepare adequately and understand all requirements before submission.

Special cases: When and how to seek help

There are instances where professional assistance may be necessary for dealing with the 2024 Florida Not for Form. Individuals with complex financial situations or those who have encountered issues with previous filings may benefit from consulting a tax advisor or legal expert.

Local resources such as Florida Bar Association or local law clinics can provide valuable guidance. If there are issues with form acceptance, be proactive and reach out to the office where you submitted your form to resolve the situation effectively.

Related forms and documentation

Filing the 2024 Florida Not for Form may not be the only documentation required depending on your situation. Other related forms could include tax returns, state-specific declarations, or additional registration forms. It’s important to understand these related documents to ensure comprehensive compliance.

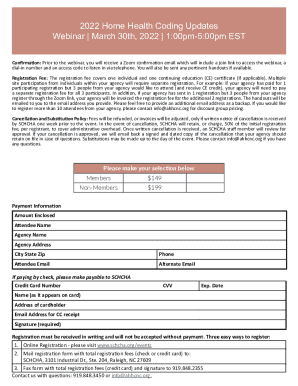

Payment information

When submitting the 2024 Florida Not for Form, certain fees may accompany the process. Understanding these charges is crucial to avoid any surprises. Payment methods accepted typically include credit cards, electronic checks, or money orders.

Late payment of any associated fees could result in further penalties, so staying informed and completing payments promptly is advised.

Importance of compliance and record keeping

Maintaining accurate records of your submission of the 2024 Florida Not for Form is essential. It not only serves as proof of compliance but also helps if there are queries or audits from the state.

Storing copies securely, both digitally and physically, will allow easy access when necessary. It’s advisable to set a routine for document management to prevent future complications during subsequent filings.

Best practices for filling out forms using pdfFiller

Utilizing pdfFiller enhances the form-filling experience significantly. The platform allows for easy editing, eSigning, and collaboration, directly addressing the common concerns users face when submitting forms.

Specific features, such as real-time document sharing, can facilitate collaboration between team members, ensuring everyone is on the same page. To manage and edit documents thoroughly, pdfFiller’s cloud-based tools create an efficient workspace for users.

Important updates for 2024

With each year comes new legislative changes that could affect the filing process for the 2024 Florida Not for Form. Keeping abreast of these updates is vital for compliance. This year, particular attention should be given to any amendments in fees or reporting criteria that could impact your filing responsibilities.

Understanding these changes not only prepares individuals and organizations for the current filing year but also sets a precedent for subsequent years, helping to build a proactive compliance strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2024 florida not for online?

How do I edit 2024 florida not for in Chrome?

Can I create an eSignature for the 2024 florida not for in Gmail?

What is 2024 florida not for?

Who is required to file 2024 florida not for?

How to fill out 2024 florida not for?

What is the purpose of 2024 florida not for?

What information must be reported on 2024 florida not for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.